Results 1 to 4 of 4

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-17-2011, 01:24 AM #1

Taxpayer ID theft serious problem for U.S.

Taxpayer ID theft serious problem for U.S.

June 15, 2011

Jim Kouri

Identity theft is a serious and growing problem in the United States and it has been linked to criminals accessing citizens' tax records, according to a recent report submitted to the U.S. Congress and law enforcement organizations this week.

Taxpayers are harmed when identity thieves file fraudulent tax documents using stolen names and Social Security numbers. In 2010 alone, the Internal Revenue Service (IRS) identified over 245,000 identity theft incidents that affected the tax system.

The hundreds of thousands of taxpayers with tax problems caused by identity theft represent a small percentage of the more than 140 million individual returns filed, but for those affected, the problems can be quite serious.

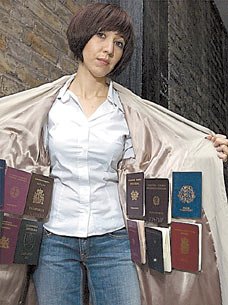

Identity theft is not typically a stand-alone crime; rather identity theft is usually a component of one or more white-collar or financial crimes. According to U.S. immigration officials, the use of fraudulent documents by illegal aliens is extensive, with immigration enforcement agents and Border Patrol agents intercepting tens of thousands of fraudulent documents at ports of entry in each of the last few years.

These documents were presented by aliens attempting to enter the United States to seek employment or obtain naturalization or permanent residency status. Federal investigations have shown that some aliens use fraudulent documents in connection with more serious illegal activities, such as narcotics trafficking and terrorism.

Efforts to combat identity fraud in its many forms likely will command continued attention for policymakers and law enforcement to include investigating and prosecuting perpetrators, as well as focusing on prevention measures to make key identification documents and information less susceptible to being counterfeited or otherwise used fraudulently.

Congress requested official at the Government Accountability Office to describe, among other things, at what point does the IRS detect identity theft based refund and employment fraud, what steps IRS has taken to resolve, detect, and prevent innocent taxpayers' identity theft related problems, and what are the constraints that hinder IRS's ability to address these issues.

GAO's report is based on its previous investigations of identity theft incidents. GAO simply updated its analysis by examining data on recently detected identity theft cases and interviewing IRS officials.

www.examiner.comSupport our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

06-17-2011, 07:47 AM #2

Sellers of fake immigration documents dismiss call for new IDs

http://www.alipac.us/ftopict-29944-.html

LOS ANGELES - Luis Hernandez {a criminal cockroach who needs to be arrested} is laughing as he sells fake drivers licenses and Social Security cards to illegal immigrants near a park known for shady deals.

Now documents are made with illegal software on laptop computers. That mobility makes them harder to bust.

"With a computer and a printer, you are in business," Jeffery said.

Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

-

06-17-2011, 08:02 AM #3

Re: Taxpayer ID theft serious problem for U.S.

===================================== Originally Posted by jean

Originally Posted by jean

ABSOLUTE HOGWASH, and the IRS and Justice Department know it.

So do MILLIONS OF ILLEGAL ALIENS!

Justice Breyer Is Among Victims in Data Breach Caused by File Sharing (Exposed to ID Theft)

http://www.washingtonpost.com/wp-dyn/co ... 97_pf.html

2 Supervisors Are Arrested After Sweep at Meat Plant - Stolen SSNs Sold Right at The Meat Plant!

http://biz.yahoo.com/nytimes/080705/119 ... html?.v=19

Vehicles get phony IDs in Mexico for sale in U.S.

http://www.signonsandiego.com/uniontrib ... theft.htmlJoin our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

-

06-17-2011, 09:08 AM #4

Keep in mind that the Social Security Administration does not inform the legal owner of the SSN of its illegal use. Only when additional taxes are claimed due, do SSN holders find out about identity theft.

"A Nation of sheep will beget a government of Wolves" -Edward R. Murrow

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

We must push through early Thurs at this critical moment

04-24-2024, 10:44 PM in illegal immigration Announcements