Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-19-2016, 05:29 PM #1

Here's Your Share of State Pension Shortfalls

JAN 19 2016, 3:53 PM ET

Seeing Red: Here's Your Share of State Pension Shortfalls

by JOHN W. SCHOEN, CNBC

Despite the ongoing economic recovery, state governments are still struggling to keep up with the payments to their pension funds needed to take care of current and future retirees.

And the shortfalls vary widely from one state to another, according to the latest data from Moody's, which assigns credit ratings for state governments.

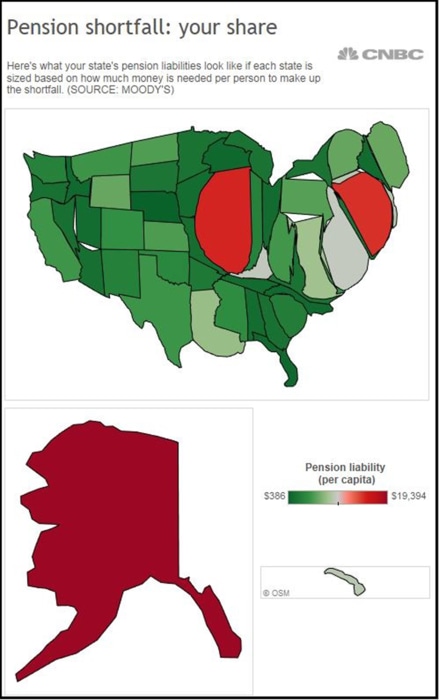

In Nebraska, for example, the pension liability amounts to about $386 per person, the lowest in the nation. That compares with Alaska ($19,394 per person: the highest in the country), Illinois ($15,158 per person) and Connecticut ($14,769). The average pension shortfall in 2014 amounted to $4,383.

One way to show how your state's pension shortfall is to resize the states on a map based on their pension liability instead of their land area. When sized that way, here's what state pension liabilities look like.

Map shows states sized according to their pension liability instead of land area. CNBC

Overall, funding levels improved slightly last year, thanks to the rising stock market that helped lift pension fund portfolios.

That progress could be reversed if the recent market plunge extends further.

Since the Great Recession ended, most states have seen gains in tax revenues as more people returned to work and consumer spending and the housing market recovered. Despite those gains, pension fund shortfalls widened between 2010 and 2014 in all but eight states. In Wisconsin, the state's public pension liability nearly tripled during that period. Only New Hampshire, Maine, Oklahoma, Alabama, Rhode Island and Delaware saw their overall liability fall.

Public Pension Cuts? Not for Convicted Lawmakers

One reason: Some states have failed to keep up with the annual payments they need to make to keep their pension funds on a sound footing. Last year, Kentucky, New York and Texas paid only two-thirds of the payments needed to fully fund future benefits. California paid less than half of what's needed. New Jersey paid just 19 percent.

Making up for years of underfunding is now costing some states a rising share of revenues, which is crowding out other services and putting upward pressure on tax rates.

Illinois, Connecticut, Louisiana, New Jersey, Maryland, Kentucky, New Mexico, West Virginia, California and Hawaii now need to spend 5 percent or more of their revenues to keep up with pension fund payments.

In Illinois, which is halfway through the current fiscal year without an approved budget, the funding required to meet pension obligations accounts for 12 cents of every dollar of state revenues. Last year, the state made only 88 percent of that payment.

http://www.nbcnews.com/business/taxe...tfalls-n499766

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

Similar Threads

-

Arizona's convicted officials still get pension from state

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 11-19-2010, 03:02 PM -

Toxic Pension and Municipal Bonds; State and Local Borrowing

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 06-16-2010, 03:07 PM -

Seven State Pension Plans Out of Money by 2020

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 06-12-2010, 04:30 AM -

Fed to Steal State Pension Funds

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 08-25-2009, 04:23 PM -

Convicted ex-congressman has state pension tapped for fine

By FedUpinFarmersBranch in forum Other Topics News and IssuesReplies: 1Last Post: 06-05-2008, 12:30 PM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Number of American teens being arrested for HUMAN SMUGGLING on...

04-19-2024, 10:20 PM in General Discussion