Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

12-27-2016, 11:15 AM #1

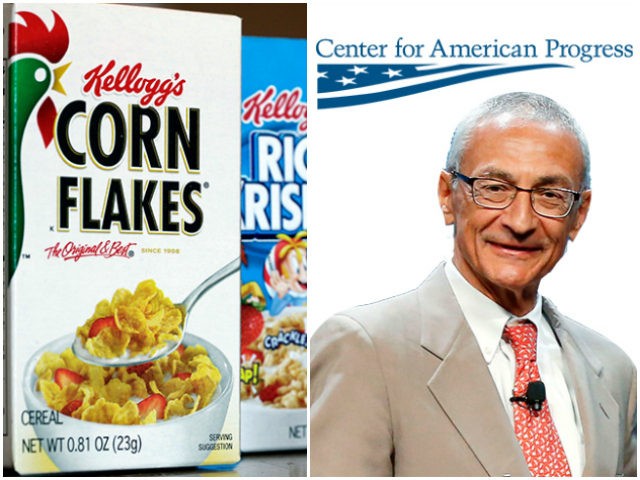

Kellogg Foundation Made Huge Grants to John Podesta’s Center for American Progress

Kellogg Foundation Made Huge Grants to John Podesta’s Center for American Progress

Getty Images, BNN Edit

Getty Images, BNN Edit

by LEE STRANAHAN

27 Dec 2016

The W.K. Kellogg Foundation gave nearly two million dollars to the John Podesta-founded Center for American Progress and a closely affiliated organization called Washington Center for Equitable Growth that also lists John Podesta as a founder.

The W.K. Kellogg Foundation is the namesake nonprofit arm of the Kellogg Company, which weeks ago pulled advertising from Breitbart News, declaring in an official statement that Breitbart is not “aligned with our values as a company.”

The Foundation describes itself as being “founded in 1930 as an independent, private foundation by breakfast cereal pioneer Will Keith Kellogg” and “among the largest philanthropic foundations in the United States.”

Although the Foundation states that its mission is to “create conditions for vulnerable children so they can realize their full potential in school, work and life,” the donations to John Podesta’s Center for American Progress—which Politico described as “the leading progressive think tank in Washington”—is part of W.K. Kellogg Foundation’s pattern of giving to partisan, far left-wing political organizations such as Black Lives Matter, George Soros’ Open Societies Institute, and the Tides Foundation.

The Center for American Progress (aka CAP) was started in 2003 by its then-President and Chief Executive Officer John Podesta, the former Chief of Staff for President Bill Clinton who led Barack Obama’s presidential transition team after the 2008 election and went on to be the campaign manager of Hillary Clinton’s 2016 presidential campaign. Podesta’s relationship with Bill Clinton goes back to 1970.

According to their website, the W.K. Kellogg Foundation gave at least three grants directly to the Center for American Progress. The Foundation contributed one grant for half a million dollars scheduled to fund from May 1, 2015 – April 30, 2017 to develop “work-family policy solutions.” Another grant to CAP for $500,000 for the same period of May 1, 2015 – April 30, 2017 was given to:

Contribute economic data and research that will allow policymakers to make evidence-based policy decisions that simultaneously stimulate economic growth for the country and improve economic security for families

A third grant to CAP for the period of May 1, 2014 – Dec. 31, 2015 for $300,000 was for the stated purpose of:

Improve achievement in elementary school by increasing the development of aligned preschool-third grade programs with sustained funding

Aside from these three direct grants to Center for American Progress, the W.K. Kellogg Foundation also gave a grant to another CAP-connected group called the Washington Center for Equitable Growth for the period of May 1, 2016 – Oct. 31, 2017 for $395,625. The stated purpose was openly to impact public policy and said the money would be used to:

Facilitate evidence-based policy decisions that simultaneously stimulate economic growth for the country and improve economic security for families by contributing economic data and research to the family financial stability discourse

When Wikileaks began publishing the hacked emails of John Podesta during the run-up to the 2016 presidential election, it revealed an interesting relationship between the Center for American Progress and the Washington Center for Equitable Growth, in what appears a clear attempt to hide the relationship from the two groups as much as possible, even though both were founded and directly connected to John Podesta and one another.

One memo revealed an email to Steve Daetz—whose LinkedIn profile lists him currently as “Executive VP at Sandler Foundation—from Heather Boushey, the Executive Director of Washington Center for Equitable Growth.

The August 1, 2014 email subject line reads “A marriage of equals: Equitable Growth’s hopes and dreams for our relationship with the Center for American Progress”and outlines how Boushey wants to have support from CAP with “no fingerprints.” The memo also shows Boushey suggesting, “Please burn this email after you read it!”

While we believe there is much to be gained from our affiliation with CAP, we also believe that for us to be successful—and to do the most to support the work of CAP and other progressive organizations—requires that CAP’s support “leaves no fingerprints.” (Please burn this email after you read it!)

Boushey goes on in the same email to make specific suggestions about how to leave “no fingerprints”:

…to maintain our “fierce independence,” we need:

• Phone lines that show up as “Equitable Growth,” not “Center for American Progress.”

• Job openings posted on our site, not CAP’s

• Our staff listed on our own website, not CAP’s

• The ability to sign contracts with academics and researchers saying only “Equitable Growth,” not “Center for American Progress.”

Another memo attached to an email written by Boushey and released by Wikileaks makes it clear that Podesta is directly involved with the group at a senior level by requesting a private office for him:8 private offices with natural light, one of which needs to be suitable for Podesta and a second must be large enough for Heather to have a small table to meet with staff and guests.

The same memo also mentions the planned request for funding from the W.K. Kellogg Foundation:Kellogg Foundation. We will ask for 500,000 for 2015 to conduct joint grantmaking to academics, and to support our communications work to elevate how equitable growth can inform policymaking.

The memo also says it planned to seek funding from such major institutional left funders as the Ford Foundation, the MacArthur Foundation, and the Wyss Foundation.

Another one of Wikileaks’ published emails shows the Washington Center for Equitable Growth’s excitement about getting a $500,000 grant from the W.K. Kellogg Foundation. Under the subject “W.K. Kellogg Foundation Grant P3032271 Notification of Approval,” Heather Boushey writes to John Podesta:

More good news this week!

1. Kellogg giving us a 2-year, $500k grant – some of which will support our grant making.

2. Herb called me to say Larry Kramer will give us “$1 million/year for three years” but I don’t have paper on that yet.

Best,

Heather

Another note forwarded in the same email chain from Bridget Ansel—Equitable Growth’s Assistant Editor for Publications and Development—is effusive:

As some of you already know…we got kellogg!! woo-hoo!!!

Following the Kellogg Company’s decision to pull advertising from Breitbart News because Breitbart with its 45 million monthly readers doesn’t “aligned” with Kellogg’s “values as a company,” Breitbart News Editor-in-Chief Alexander Marlow issued a statement urging a continuing boycott of Kellogg’s products, saying, “For an American brand like Kellogg’s to blacklist Breitbart News in order to placate left-wing totalitarians is a disgraceful act of cowardice.”

http://www.breitbart.com/big-governm...ican-progress/

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

12-27-2016, 11:23 AM #2

If they lost their tax exempt status for partisan political activity, I wonder how much they would owe in back taxes.

How to Lose Your 501(c)(3) Tax Exempt Status (Without Really Trying)

It’s easy for a nonprofit organization to maintain its tax exempt status—and can be just as easy to lose it.

Each year, the IRS revokes the tax-exempt status of more than 100 501(c)(3) organizations. Organizations recognized as exempt from federal income tax under this section of the Internal Revenue Code include private foundations as well as churches, educational institutions, hospitals, and many other types of public charities.

But these organizations can maintain their tax-exempt status if they heed the rules in six areas:

- Private benefit/inurement

- Lobbying

- Political campaign activity

- Unrelated business income (UBI)

- Annual reporting obligation

- Operation in accord with stated exempt purpose(s)

(Note: The following subjects are described briefly. If you want more information about each area, visit the Tax-Exempt Status Virtual Workshop on the IRS educational micro-site, www.stayexempt.irs.gov.

1. PRIVATE BENEFIT/INUREMENT

Private benefit: “A 501(c)(3) organization’s activities should be directed exclusively toward some exempt purpose,” said Richard Crom, Staff Assistant for IRS Exempt Organizations Customer Education and Outreach office. “Its activities should not serve the private interests, or private benefit, of any individual or organization (other than the 501(c)(3) organization) more than insubstantially. The intent of a 501(c) (3) organization is to ensure it serves a public interest, not a private one.”

Inurement: The concept of inurement states that no part of an organization’s net earnings may inure to the benefit of a private shareholder or individual who, because of the person’s relationship to the organization, has an opportunity to control or influence its activities.

“A 501(c)(3) organization is prohibited from allowing its income or assets to benefit insiders (people with a personal or private interest in the activities of the organization),” said Crom. “Insiders are typically board members, officers, directors, and important employees.” He added that prohibited inurement includes the payment of dividends, the payment of unreasonable compensation to insiders, and the transfer of property to insiders for less than fair market value.

If a 501(c)(3) organization engages in inurement or substantial private benefit, the organization risks losing its exemption. Additionally, insiders guilty of inurement may be subject to excise tax.

2. LOBBYING

When an organization contacts, or urges the public to contact, members or employees of a legislative body for the purpose of proposing, supporting, or opposing legislation, or when the organization advocates the adoption or rejection of legislation, it is lobbying. “501(c)(3) organizations are allowed to do some lobbying,” said Melaney Partner, acting director for the IRS Exempt Organizations Customer Education and Outreach office. “However, if lobbying activities are substantial an organization risks losing its tax exempt status.” She added that an organization can elect to have its lobbying activities measured by an “expenditure test” to determine whether or not the activities are substantial. This is known as a 501(h) election, so-named for the section of the Internal Revenue Code where the rules for the expenditure test are spelled out.

“By making this election, an organization agrees to not spend more than a certain percentage of its total expenses on lobbying activities,” Partner said. “The other way to measure lobbying activity is to determine whether, based on all of the pertinent facts and circumstances, an organization’s lobbying comprises a substantial part of its overall activities. This substantial part test is a more subjective method compared to the more mathematical, objective expenditure test.”

Organizations must file Form 5768, Election/Revocation of Election by an Eligible Sec. 501(c)(3) Organization to Make Expenditures to Influence Legislation, in advance to be subject to the expenditure test.

3. POLITICAL ACTIVITY

All section 501(c)(3) organizations are prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate running for public office. The prohibition applies to all campaigns (federal, state and local level). “Political campaign intervention includes any and all activities that favor or oppose one or more candidates for public office,” said Crom, who speaks to non-profit organizations on a regular basis about tax-compliance issues. “The prohibition extends beyond candidate endorsements.”

Contributions to political campaign funds or public statements of position (verbal or written) made by or on behalf of an organization in favor of, or in opposition to, any candidate for public office clearly violate the prohibition on political campaign intervention.

Section 501(c)(3) organizations may engage in some activities to promote voter registration, encourage voter participation, and provide voter education, but they can’t engage in activities that favor or oppose any candidate for public office. Whether an activity is political campaign intervention depends on all the facts and circumstances.

“The political campaign intervention prohibition is not intended to restrict free expression on political matters by leaders of organizations speaking for themselves as individuals,” said Crom. “Nor are leaders prohibited from speaking about important issues of public policy. However, for their organizations to remain tax exempt under section 501(c)(3), leaders cannot make partisan comments in official organization publications or at official functions of the organization.”

4. UNRELATED BUSINESS INCOME (UBI)

Another activity that can potentially jeopardize an organization’s 501(c)(3) tax-exempt status is having too much income generated from activities that are unrelated to the exempt function of the organization. This income comes from a regularly-carried-on trade or business that is not substantially related to the organization’s exempt purpose. “An organization that produces unrelated business income as a result of its unrelated trade or business may have to pay taxes on that income,” said Partner. “Income-producing activity must meet three conditions before the income is potentially taxable.”

First, the activity must be a trade or business. Second, the trade or business must be regularly carried on. Third, the business activity is not substantially related to an organization’s exempt purpose. In other words, the activity itself does not contribute importantly to accomplishing the exempt purpose, other than through the production of funds.

Some of the most common UBI generating activities include: the sale of advertising space in weekly bulletins, magazines, journals or on the organization’s website; the sale of merchandise and publications when those items being sold do not have a substantial relationship to the exempt purpose of the organization; provision of management or other similar services to other organizations; and, even some types of fundraising activities. Generally, organizations that generate unrelated business income should file Form 990-T, Exempt Organization Business Income Tax Return, and pay tax on the income.

“An organization must be careful generating money in activities that do not further its specific exempt purposes,” said Partner. “In addition to the taxability of income from unrelated activities, if those activities are substantial in relation to your exempt purpose activities, you may be putting your exempt status in jeopardy.”

5. ANNUAL REPORTING OBLIGATION

While 501(c)(3) public charities are exempt from Federal income tax, most of these organizations have information reporting obligations under the Internal Revenue Code to ensure they continue to be recognized as tax-exempt. In addition, they may also be liable for unrelated business income tax as described above, employment tax, excise taxes, and certain state and local taxes.

Public charities generally file either Form 990, Return of Organization Exempt from Income Tax, Form 990- EZ, Short Form Return of Organization Exempt from Income Tax, or submit online Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations not Required To File Form 990 or 990-EZ.

“The type of form or notice required is generally determined by the public charity’s gross receipts and the value of its assets,” said Crom. For tax years ending on or after December 31, 2010, an organization may file Form 990-EZ if its gross receipts are normally less than $200,000, and if its total assets are less than $500,000 at the end of the year. If the organization’s gross receipts are $200,000 or greater, or if its assets at the end of the tax year are $500,000 or more, the organization generally must file Form 990. If the organization’s annual gross receipts are generally $50,000 or less, the organization may in lieu of Form 990 or 990-EZ submit online new Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations not Required to File Form 990 or 990-EZ.

There are some public charities that are not required to file Forms 990 or 990-EZ, including churches and certain church-affiliated organizations. Organizations can learn about filing and new requirements applicable to supporting organizations at the IRS Nonprofits and Charities website.

“The IRS will remove many organizations previously recognized as tax-exempt from its Master File due to provisions of the Pension Protection Act of 2006,” said Crom. “The act requires that all tax-exempt organizations—except churches and church-related organizations—must file an annual return with the IRS. And if they don’t do so for three consecutive years, they automatically lose their exempt status.”

The IRS conducted an extensive outreach effort over the past several years to remind tax-exempt organizations about this new legal requirement — and to file on time. “There were many organizations that we still did not hear from and we will post a list of those revoked organizations on the IRS website in February 2011,” said Crom.

If an organization finds that its exempt status has been automatically revoked due to non-filing and it wants its tax-exempt status reinstated, it will need to reapply and pay the appropriate user fee. For more information on that process, visit the Charities and Non- Profits pages on the IRS website.

6. OPERATION IN ACCORD WITH STATED EXEMPT PURPOSE(S)

“If you stop doing all or a significant amount of the exempt activities you told the IRS you were going to do in your original application for exemption—you could lose your exemption,” said Crom. “If your organization’s direction has changed, let us know. It could prevent future problems.” He added that organizations must adhere to the guidelines inherent in these six areas. “If they do this, they will maintain their tax-exempt status and continue enjoying the benefits associated with it,” said Crom.

To receive periodic updates on current Exempt Organization issues of interest, visit www.irs.gov and sign up to receive the EO Update by e-mail.

https://www.nonprofitrisk.org/librar...t_Status.shtmlSupport our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

Similar Threads

-

Center for American Progress Helped Craft EPA Press Strategy

By Newmexican in forum Other Topics News and IssuesReplies: 0Last Post: 07-06-2015, 11:23 AM -

Center for American Progress — or corporate donors’ progress?

By Newmexican in forum Other Topics News and IssuesReplies: 0Last Post: 02-03-2014, 05:04 PM -

Report: Kellogg Foundation, SEIU funded attacks on voter ID laws

By Newmexican in forum General DiscussionReplies: 1Last Post: 12-03-2012, 08:07 PM -

March on America - Center on American Progress

By GeorgiaPeach in forum Videos about Illegal Immigration, refugee programs, globalism, & socialismReplies: 1Last Post: 03-23-2010, 10:09 PM -

Center for American Progress on C-Span

By Skippy in forum General DiscussionReplies: 0Last Post: 07-07-2006, 01:29 PM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Watch: Paul, Hawley Torch Mayorkas To His Face On Laken Riley's...

04-19-2024, 02:32 PM in illegal immigration News Stories & Reports