Results 1 to 5 of 5

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-10-2017, 07:22 PM #1

Lower-wage workers likely to lose in Social Security reform

Lower-wage workers likely to lose in Social Security reform

By Scott Burns

Published 4:22 pm, Tuesday, January 10, 2017

Photo: OZIER MUHAMMAD

Dan Ros-tenkowski, shown in 1998, once ran afoul of senior citizens over legislation he pushed in the late 1980s as chairman of the House Ways and Means Committee.

I have some advice for our new Republican leadership: Remember Dan Rostenkowski. He was the chairman of the House Ways and Means Committee in 1989. Angry senior citizens surrounded and nearly attacked the Democratic congressman from Chicago for the Catastrophic Coverage Act.

After massive protests by seniors, the law was soon repealed. Rostenkowski died in 2010.

A far larger issue than the Catastrophic Coverage Act is at hand for 2017, which promises to be a watershed year for the American middle class. Rep. Sam Johnson, R-Plano, introduced the Social Security Reform Act of 2016. The bill foreshadowed this year's biggest debate.

The reintroduction of that bill will test the reading and listening skills of all Americans. It makes a huge promise. It offers to make Social Security solvent for the next 75 years without increasing taxes. It would do this by cutting $11.6 trillion in promised benefits.

Don't expect the politicians to discuss what they are doing as benefit cuts. Instead, they will call it "reforming" and "modernizing." But the actual event will be to cut $11.6 trillion of benefits that future retirees expect. This, they say, will bring the system into "balance."

Workers with average and higher earnings can expect big cuts. The benefits lower-wage workers can expect appear to be higher. The bill redistributes the benefits workers with earnings of $49,121 to $118,500 will lose to workers with wages under $49,121 a year.

But the operative word here is "appear."

According to an analysis from the office of the chief actuary for Social Security, the reduction in benefits for workers with average and above wages can be severe. And the bite will get worse year by year.

Consider these examples. A worker who is 52 this year with earnings of $78,594 would retire at 65 in 2030. She would lose 19.9 percent of benefits to start. The loss would deepen year by year, until 26.6 percent of benefits were lost at age 95.

A worker who is 32 this year would retire at 65 in 2050. He would lose 33.2 percent of expected benefits to start, growing to 69.1 percent by age 95.

But both workers would continue to pay the same level of employment taxes. So the benefit changes function as a sly graduated tax on younger workers.

On the surface, lower-than-average-wage workers get a better deal. A worker earning $22,105 this year and retiring in 2030 at 65 could expect to have a 4.5 percent boost in benefits. A younger worker retiring at 65 in 2050 could expect a 10.1 percent boost in benefits.

So there's still a "social safety net" for those who earn less, right? Sorry. The reality is that lower-wage workers are more likely to retire and claim benefits well before age 65.

This isn't irrational or self-destructive. Many claim benefits early because their job has disappeared, or they are no longer capable of doing the hard physical work many low-wage jobs require. Workers lose about 8 per-cent in benefits for each year of early claiming. So it's not difficult to see that having a 4.5 to 10.1 percent benefit boost is possible on paper - but unlikely in practice.

Another factor is life expectancy. Those in the top half of the wage distribution tend to live five years longer than those in the bottom half.

The politicians will be talking about Social Security benefits as "entitlements." It will sound like a form of welfare. They will tell us that those entitlements have grown out of hand.

But here's something I've learned from reader letters. Real people don't like the word "entitlement." They are the millions who depend on Social Security, who don't have congressional pensions. The word offends them. It angers them. They've paid employment taxes year after year. In their view, Social Security isn't an entitlement; it is something they earned.

Next week: Social Security is the battleground of the next 15 years.

http://www.chron.com/business/burns/...l-10848532.php

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

01-11-2017, 01:24 AM #2

Squeezed by congressional skinflints, Social Security axes more services

The Social Security Administration's main campus outside Baltimore. Congress has been cutting its staff, but is the SSA itself partially to blame? (Patrick Semansky / Associated Press)

Michael Hiltzik Contact Reporter

Social Security is much beloved by Americans — that’s why it’s often called the “third rail of American politics” — but its enemies on Capitol Hill never rest in trying to make it less beloved. We’re not talking about the level of benefits, which has resisted conservatives’ determined slash-and-burn campaigns (so far), but the level of its public outreach, which has suffered grievously in recent years.

One key service now looks to be ready for hospice care, according to an announcement Monday by the Social Security Administration: the annual mailing of Social Security statements to the millions of Americans who make payroll contributions to the system. These paper statements have been required by federal law since 1989, thanks to a bill by the late Sen. Daniel P. Moynihan (D-N.Y.). That hasn’t stopped Social Security from putting their existence on a roller coaster — cutting them back, then restoring them somewhat.

On Monday, Deputy Commissioner Doug Walker disclosed that the agency would cease mailing paper statements to most workers. Only people ages 60 or older who are not receiving benefits and who haven’t opened a MySocialSecurity online account will still get them.

Congress continues its stealth assault on Social Security's customer service

Are the Democrats allowing Social Security to twist in the wind?

This is a ridiculously shortsighted policy that feeds the goals of political leaders most hostile to the program. Social Security has traditionally been known for its ability to communicate with workers and retirees; ending the mailings will silence the program’s outreach to clients most in need of it.

We raised these very points in 2012, the first time the agency cut back on the mailings. The points we raised then are still germane today. So is the budgetary context: Social Security’s administrative budget has been systematically hollowed out by congressional action for years. The agency, as Walker observed in a blog post, is making do with a budget “10% lower than it was in 2010, after adjusting for inflation.”

Meanwhile, the number of beneficiaries on the rolls has risen 13%, to 60 million retirees and their dependents; survivors of deceased workers; and disabled workers and their dependents.

The agency instituted a hiring freeze last year that will reduce staff to its lowest level since 2013 and also cut back on overtime. “So, we have fewer resources to serve more people,” Walker writes.

Mindful that its administrative costs come out of worker contributions, the agency has always been careful about spending. Its administrative budget has typically come to about 0.9% of its overall spending. Congressional budget legislation, however, has slashed that to about 0.7%. (The agency spent $6.3 billion on administrative expenses in 2015, out of total spending of $897.1 billion.) It’s proper to ask whether the Social Security Administration has been too docile about letting this happen without raising a public stink.

The consequences of the cutbacks are plain to anyone who seeks help, guidance, or answers from Social Security staff. The Center on Budget and Policy Priorities observed in June that the cuts had hampered the agency’s ability to perform services “such as determining eligibility in a timely manner for retirement, survivor, and disability benefits, paying benefits accurately and on time, responding to questions from the public, and updating benefits promptly when circumstances change.”

As the workload grows at Social Security, the workforce shrinks. (Council on Budget and Policy Priorities)

Average wait times on the agency’s 800 number and the percentage of calls getting a busy signal both rose through 2014, when a slight budget increase allowed staff to expand. Since then, however, both measures have been back on the rise.

Meanwhile, the number of field and mobile offices, their hours and their staffing have been cut back, sharply reducing their availability for face-to-face consultations with members of the public, who often have needs that can’t adequately be handled over the phone. Most applicants now must wait more than three weeks for an appointment, and many have to travel long distances to reach an office. Because of a hearing backlog, roughly 1.1 million disability applicants were still awaiting rulings on their eligibility at the end of 2016.

Sadly, that wasn’t the first time the Center on Budget and Policy Priorities or other Social Security advocates had to raise the alarm — and it won’t be the last. All these steps eat away at public confidence in the Social Security system, which may well be the goal of the budget cutters on Capitol Hill — it just softens the system up for the kill.

But the decision to end the mailing of paper statements to most workers may be the most harmful budget saving initiative of all.

The backlog of disability decisions has reached about 1.1 million cases. (Council on Budget and Policy Priorities)

That’s because the annual statements were the only proactive outreach the agency made to its clientele. The statements, as one might remember from the period when they arrived in the mailbox once a year, listed estimated retirement benefits already earned, as well as potential disability and survivor benefits. It was a real-time readout of how Social Security would protect workers and their families in the event of retirement, disability or untimely death.

The idea, I was told in 2012 by Webster Phillips, a former associate Social Security commissioner who worked with Moynihan to craft the mandate, was to strengthen the bond between workers and the Social Security program by showing that the money they paid in, week in and week out, would yield tangible benefits. If Congress tried to take them away or cut them down, the consequences would show up in every worker's mailbox.

The statements also displayed the worker’s earnings record year by year. This allowed recipients to pinpoint errors — the statements provided an 800 number and instructed recipients to “Call us right away” to report inaccuracies.

Can these features be replicated by the MySocialSecurity online account? Obviously not. Leaving aside that many people are still uncomfortable about opening online accounts or are unable to do so, or don’t have Internet access, the best feature of the paper statements is that they came unbidden.

No one had to go hunting for the website. No one had to manage a password (or change it every six months, as the system requires). This was a case of government reaching out to let citizens know how it was working for them. This is not a light that should be hidden under a bushel.

The Social Security Administration says it will save $11.3 million a year by cutting out most of the mailings. That comes to about two-tenths of 1% of its administrative budget, and a bit more than one-thousandth of 1% of its total spending. But it’s giving up much more in public access.

Rather than make clear the drawbacks of this step, the agency is wringing its hands as though it’s inevitable. “We know that our cutbacks will affect many of you, but we have no choice,” Walker wrote in a blog post announcing the cut in mailed statements. Instead of pointing the finger at shortsighted congressional action, he added simply that congressional cheeseparing means “there may be more bumps in our journey together. We’ll do our best to get through them.”

That’s not good enough. The Social Security Administration represents the public in this sort of battle, and it shouldn’t be rolling over. The annual statements were mandated by Congress nearly 30 years ago, and they’re still needed. Social Security and its advocates should be fighting for them, and for all the other services that bind the system to its beneficiaries, tooth and nail.

http://www.latimes.com/business/hilt...110-story.html

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

01-12-2017, 12:58 PM #3

Because of the increasing wages over the years and inflation many seniors find that a Social Security income can be insufficient in today's economy. The COLA's have been too few and far between to actually make an impact.

Further, the addition to payments being made through SSI and other programs FUNDED by Social Security to people that have never contributed, in my opinion, rob from the Social Security Fund.

Under Executive Action, Immigrants Are Entitled To Social Security Benefits

December 3, 20142

EYDER PERALTA

We're a little late to this news, but we're pointing it out to set the record straight: The White House says immigrants protected under President Obama's executive action will be eligible for Social Security benefits.

When Obama made a Nov. 20 announcement that he was shielding from deportation some 4 million immigrants here illegally, a White House official told reporters during a briefing that those immigrants would not receive Social Security benefits. We reported that in several blog posts.

The White House is now saying otherwise.

During a briefing earlier this week, White House Press Secretary Josh Earnest said it was his understanding that if immigrants paid taxes, they would be eligible for Social Security and Medicare. Earnest said:

"The goal of the executive — one of the goals of the executive action program or executive action that the President announced, as it relates to immigration, about 10 days ago, was related to bringing those individuals who have been in this country for some time out of the shadows, giving them a work permit ... and under the books, and giving them a Social Security number and making them taxpayers. And that does mean that they're going to be filing their taxes on a regular basis and that does mean that if they qualify for the child tax credit, for example, as a taxpayer that would be something that they would benefit from. But we released this study from the Council of Economic Advisers who talked about the significant economic benefits for the country associated with bringing these individuals out of the shadows so they're not getting paid in cash under the table but actually sort of part of the broader economy."Katherine Vargas, a White House spokeswoman, told us in an email that once immigrants register under deferred action, they become taxpayers, contributing their "fair share into Social Security and Medicare."

"And only after they've paid taxes for over a decade will they become eligible for Social Security," Vargas wrote. "As taxpayers, deferred action recipients will pay into these systems and receive the same benefits on these issues as other taxpayers."

(It's worth pointing out that all taxpayers have to work for at least a decade to receive benefits.)

Vargas added that immigrants protected under Obama's plan will not receive other federal benefits such as welfare, food stamps, Medicaid or benefits under the Affordable Care Act.

The Washington Post reports that Republicans were surprised by all this. The paper quotes Republican National Committee spokeswoman Kirsten Kukowski saying:"First with Obamacare we were told we should pass it and then read it to find out what was in it. Now Obama overreached and acted unilaterally on immigration, which should have been vetted and authorized by Congress, and we're finding out there's more to the story than Obama and the Democrats originally told Americans."Stephen Miller, a spokesman for Sen. Jeff Sessions, a Republican from Alabama, told Fox News that this new eligibility is "an attack on working families."

"The amnestied illegal immigrants are largely older, lower-wage and lower-skilled and will draw billions more in benefits than they will pay in," he said.

It's also worth noting that Obama's executive actions could be quickly erased by the next president.

We've asked the White House to explain why their official announcement first said immigrants were not eligible for Social Security. We have yet to hear back.

Update at 11:17 a.m. ET. On Dec. 4: Misspoke:

A White House official says the official who originally said immigrants would not receive Social Security benefits misspoke. The official mistakenly lumped in Social Security with other benefits — like subsidies under the Affordable Care Act — that immigrants will not be entitled to.

http://www.npr.org/sections/thetwo-w...urity-benefits

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

01-12-2017, 12:59 PM #4

From Social Security.gov

SPOTLIGHT ON SSI BENEFITS FOR ALIENS -- 2016 Edition

Links to SSI Spotlights Home / Spotlight on SSI Benefits for Aliens

UNDER WHAT CIRCUMSTANCES MAY A NON-CITIZEN BE ELIGIBLE FOR SSI?

A non-citizen (also called an "alien" for immigration purposes) may be eligible for Supplemental Security Income (SSI) if he or she meets the requirements of the laws for non–citizens that went into effect on August 22, 1996. In general, beginning August 22, 1996, most non-citizens must meet two requirements to be potentially eligible for SSI:

be in a qualified alien category; and

be in a qualified alien category; and

meet a condition that allows qualified aliens to get SSI.

meet a condition that allows qualified aliens to get SSI.

IMPORTANT: A non-citizen must also meet all of the other rules for SSI eligibility, including the limits on income and resources, etc.

WHO IS A QUALIFIED ALIEN?

There are seven categories of qualified aliens. You are a qualified alien if the Department of Homeland Security (DHS) says you are in one of these categories:

Lawfully Admitted for Permanent Residence (LAPR) in the U.S., which includes"Amerasian immigrant" as defined in P.L. 100-202, with a class of admission AM-1 through AM-8;

Lawfully Admitted for Permanent Residence (LAPR) in the U.S., which includes"Amerasian immigrant" as defined in P.L. 100-202, with a class of admission AM-1 through AM-8; Granted conditional entry under Section 203(a)(7) of the Immigration and Nationality Act (INA) as in effect before April 1, 1980;

Granted conditional entry under Section 203(a)(7) of the Immigration and Nationality Act (INA) as in effect before April 1, 1980; Paroled into the U.S. under Section 212(d)(5) of the INA for a period of at least one year;

Paroled into the U.S. under Section 212(d)(5) of the INA for a period of at least one year; Refugee admitted to the U.S. under Section 207 of the INA;

Refugee admitted to the U.S. under Section 207 of the INA; Granted asylum under Section 208 of the INA;

Granted asylum under Section 208 of the INA; Deportation is being withheld under Section 243(h) of the INA, as in effect before April 1, 1997; or removal is being withheld under Section 241(b)(3) of the INA;

Deportation is being withheld under Section 243(h) of the INA, as in effect before April 1, 1997; or removal is being withheld under Section 241(b)(3) of the INA;- A

"Cuban and Haitian entrant" as defined in Section 501(e) of the Refugee Education Assistance Act of 1980 or in a status that is to be treated as a "Cuban/ Haitian entrant" for SSI purposes.

"Cuban and Haitian entrant" as defined in Section 501(e) of the Refugee Education Assistance Act of 1980 or in a status that is to be treated as a "Cuban/ Haitian entrant" for SSI purposes.

In addition, you can be a “deemed qualified alien” if, under certain circumstances, you, your child or parent were subjected to battery or extreme cruelty by a family member while in the United States.UNDER WHAT CONDITIONS MAY A "QUALIFIED ALIEN" BE ELIGIBLE FOR SSI BENEFITS?

If you are in one of the seven "qualified alien" categories listed above, you may be eligible for SSI if you also meet one of the following conditions:

- You were receiving SSI and lawfully residing in the U.S. on August 22, 1996.

- You are LAPR with 40 qualifying quarters of work.

Work done by your spouse or parent may also count toward the 40 quarters of work, but only for getting SSI.

Work done by your spouse or parent may also count toward the 40 quarters of work, but only for getting SSI.

Quarters of work earned after December 31, 1996, cannot be counted if you, your spouse, or parent who worked, received certain benefits from the United States government, based on limited income and resources during that period.

Quarters of work earned after December 31, 1996, cannot be counted if you, your spouse, or parent who worked, received certain benefits from the United States government, based on limited income and resources during that period.

IMPORTANT: If you entered the United States on or after August 22, 1996, then you may not be eligible for SSI for the first five years as an LAPR even if you have 40 qualifying quarters of coverage. - You are currently on active duty in the U.S. Armed Forces or you are an honorably discharged veteran and your discharge is not because you are an alien. This condition may also apply if you are the spouse, widow(er), or dependent child of certain U.S. military personnel.

- You were lawfully residing in the U.S. on August 22, 1996 andyou are blind or disabled.

- You may receive SSI for a maximum of seven years from the date DHS granted you immigration status in one of the following categories, and the status was granted within seven years of filing for SSI:

Refugee under Section 207 of the INA;

Refugee under Section 207 of the INA;

Asylee under Section 208 of the INA;

Asylee under Section 208 of the INA;

Alien whose deportation was withheld under Section 243(h) of the INA or whose removal is withheld under Section 241(b)(3) of the INA;

Alien whose deportation was withheld under Section 243(h) of the INA or whose removal is withheld under Section 241(b)(3) of the INA;

"Cuban or Haitian entrant" under Section 501(e) of the Refugee Education Assistance Act of 1980 or in a status that is to be treated as a "Cuban/ Haitian entrant" for SSI purposes; or

"Cuban or Haitian entrant" under Section 501(e) of the Refugee Education Assistance Act of 1980 or in a status that is to be treated as a "Cuban/ Haitian entrant" for SSI purposes; or

"Amerasian immigrant" pursuant to P.L. 100-202, with a class of admission of AM-1 through AM-8.

"Amerasian immigrant" pursuant to P.L. 100-202, with a class of admission of AM-1 through AM-8.

For purposes of SSI eligibility, individuals are not considered qualified aliens if they were admitted to the U.S. under the provisions of the Victims of Trafficking and Violence Protection Act of 2000. Their eligibility is subject to the proper certification in such status by the U.S. Department of Health and Human Services and possession of a valid "T" non-immigrant visa. Once the alien obtains proper certification and is in possession of a "T" non-immigrant visa, he or she becomes potentially eligible for SSI. EXEMPTION

FROM THE AUGUST 22, 1996 LAWS FOR CERTAIN NON-CITIZEN INDIANS

Certain categories of non–citizens may be eligible for SSI and are not subject to the August 26, 1996 law. These categories include:

American Indians born in Canada who were admitted to the U.S. under Section 289 of the Immigration and Nationality Act; or

American Indians born in Canada who were admitted to the U.S. under Section 289 of the Immigration and Nationality Act; or

non–citizen members of a federally recognized Indian tribe under Section 4(e) of the Indian Self–Determination and Education Assistance Act.

non–citizen members of a federally recognized Indian tribe under Section 4(e) of the Indian Self–Determination and Education Assistance Act.

ADDITIONAL ELIGIBLE ALIEN CATEGORIES

Victims of Severe Forms of Human trafficking: You may be eligible for SSI under certain circumstances if the Department of Health and Human Services’ Office of Refugee Resettlement (http://www.acf.hhs.gov/programs/orr/) and the Department of Homeland Security determines that you meet the requirements of the Trafficking Victims Protection Act of 2000.

Special eligibility for nationals of Iraq or Afghanistan: If you are an Iraqi or Afghan national who was admitted to the U.S. as a special immigrant, you may qualify for seven years of SSI benefits if you served as a translator/interpreter for the U.S. Armed Forces in Iraq or Afghanistan or if you worked for the U.S. government in Iraq.WE NEED PROOF OF YOUR IMMIGRATION STATUS

If you apply for SSI benefits, you must give us proof of your immigration status, such as a current DHS admission/departure Form I-94, Form I-551 or an order from an immigration judge showing withholding of removal or granting asylum.

If you have served in the U.S. Armed Forces, you may also need to give us proof of military service such as U.S. military discharge papers (DD Form 214) showing an honorable discharge.

Your local Social Security office can tell you what other types of evidence you can submit to prove your alien status.WHAT IF YOU HAVE A SPONSOR?

When you entered the U.S., you may have had someone sign an agreement with DHS to provide support for you. We call this agreement an affidavit of support, and we call the person who signs it your sponsor. If you have a sponsor, we generally will count his or her (and his or her spouse's) income and resources as your income and resources. Your local Social Security office can give you more information about these rules and how they apply in your case.BECOMING A U.S. CITIZEN

You can get more information about becoming a U.S. citizen by writing or visiting the U.S. Citizenship and Immigration Services website at www.uscis.gov or calling 1-800-870-3676 to get an application package for naturalization (DHS Form N-400).

https://www.ssa.gov/ssi/spotlights/s...n-citizens.htm

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

01-12-2017, 04:58 PM #5

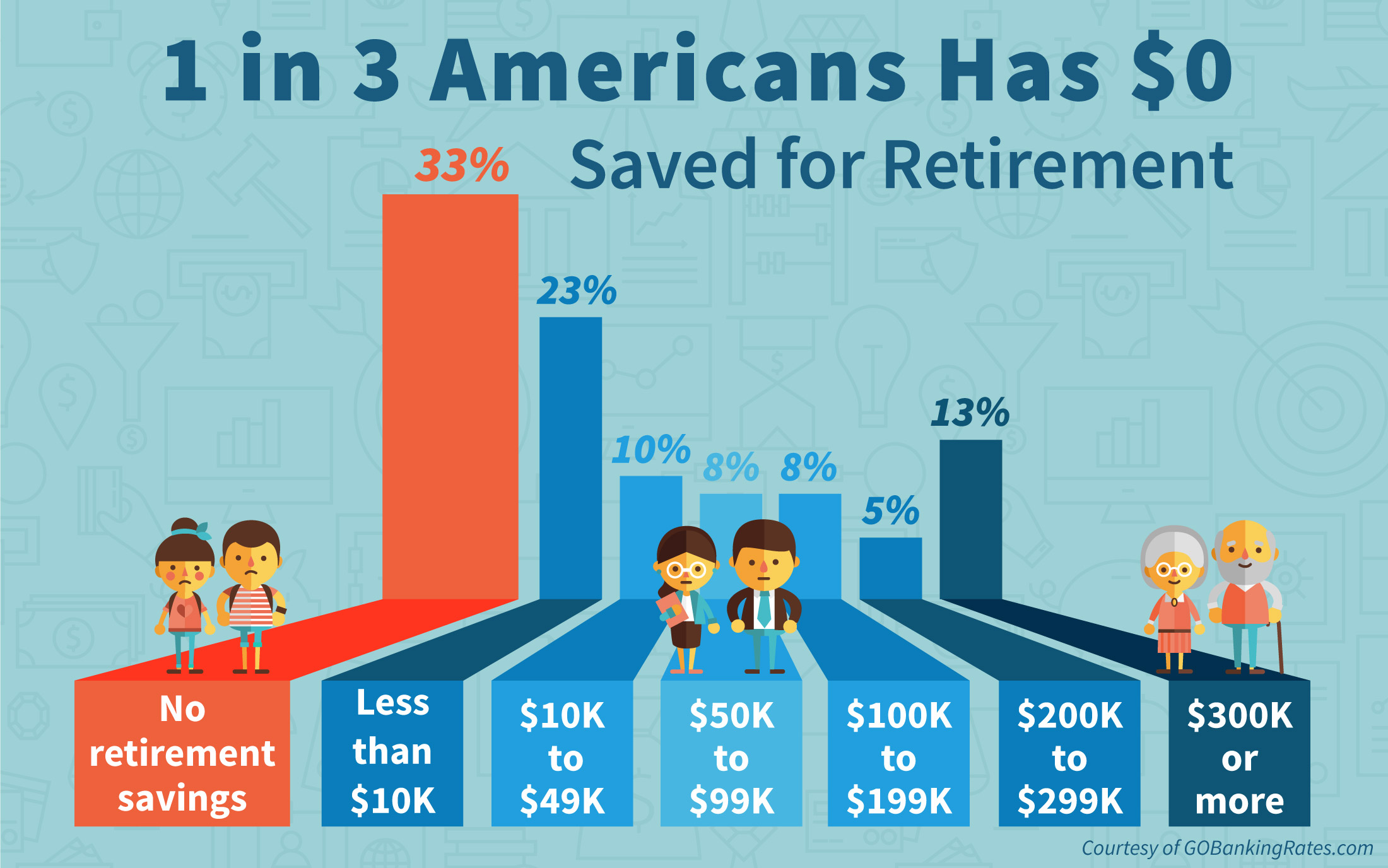

Social Security was never meant to be anyone's retirement funding.

It was meant to supplement the money you saved during your lifetime for your retirement.

This lack of savings indicates that just getting started on retirement planning is a significant obstacle for many people. This difficulty can be due to a lack of education on the importance of retirement savings, said Kristen Bonner, the GoBankingRates research lead for this survey. “Americans might also be feeling as though their employer match ― or lack of ― is not enough to make it worth it to open an account, as well the growing trend of changing jobs every couple years and not wanting to deal with rolling over funds from one account to another.”

http://time.com/money/4258451/retire...avings-survey/NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

Similar Threads

-

SHARING THEIR SOCIAL SECURITY WITH FOREIGN WORKERS

By Lone_Patriot in forum General DiscussionReplies: 9Last Post: 03-08-2007, 10:18 AM -

Social Security Reform

By houston in forum General DiscussionReplies: 1Last Post: 07-12-2006, 11:48 PM -

Social Security uncovers illegal workers

By Brian503a in forum illegal immigration News Stories & ReportsReplies: 5Last Post: 07-11-2006, 03:38 PM -

Social Security Adm protects Illegal Workers

By xanadu in forum General DiscussionReplies: 0Last Post: 07-10-2006, 09:49 AM -

Undocumented Workers Add Small Windfall to Social Security

By Brian503a in forum illegal immigration News Stories & ReportsReplies: 0Last Post: 12-09-2005, 08:25 PM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

We must push through early Thurs at this critical moment

04-24-2024, 10:44 PM in illegal immigration Announcements