Results 5,491 to 5,500 of 7393

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-17-2012, 10:26 PM #5491Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

HOW DO Empires Die? by Martin Armstrong - Highly Recommended

Posted by Charleston Voice, 06.17.12

A very remarkable read. Added value for its placing empires and their state monies in historical context. It was a reminder to me to keep whatever is used as money for exchange in a relative value reference to commodities and services. Meaning, if gold goes to $50,000 or whatever price, why is that important if both dollar and gold are hoarded?

Realize wrapping our minds around Armstrong's view may be awkward for some of us, but work at it. You could bring about a 'V8-slap-on-the-forehead' moment upon yourself if you don't!

HOW DO Empires Die?

by Martin Armstrong

I began writing what I thought would be a report. Toward the final chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt asking why anyone considered it to be quality since all government defaulted on their debts and never paid them off. I assumed the list wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely made that statement with no reference to such defaults, the more I was left in a state of devastating shock. When it comes to research, those that know me understand that I leave no stone unturned. I allow the research to carry me along a journey of exploration. I never PRESUME anything and try to LEARN myself to round out my knowledge.

It is almost finished. I am publishing for the first time the Table of Contents. There just seems to be such profound conviction that everyone will flee to gold, gold will save the world, and there is always an alternative for capital to flee. The emails from the Goldbugs just refuse to understand that there is also DEFLATION. Here is the latest:

“You assume two things here, sadly both are wrong. You assume firstly that the US dollar will always be more stable than (for example) the yuan, the Brazilian Real, the Euro. A dangerous and flawed assumption, one perhaps made by a dying Roman empire, and the British Empire too. Nope, always something new out there to step in. Your other assumption, even more flawed, and currently being proven wrong as I type the world over, is that capital will flee to another fiat. Nope, much of it will flee to (or try to flee to) solid physical gold. Because that is what the world has always done. ‘Giant’ money is already there, the US’s strategic enemies are already there, and adding gold reserves every month, rather than soaking up the ever-growing flow of US dollar debts.”

It is just astonishing. I am interested in discovery what makes the world tick. I am not like Marx who tried to dictate to the world this is how I say you must function to fit some preconceived idea. If the dollar is the CORE RESERVE CURRENCY and the reserves around the world are really in US government bonds, just how does anyone assume you can flee to the yuan, Brazil or better still to the Euro that will create their desperate vision of hyperinflation? There is not enough assets in those countries combined to absorb the cash in US bonds. Only about 18% of the German DAX freely floats since the rest is tied up in cross-holdings. Only the dollar can absorb that amount of cash. Brazil? Come on! China has its own bubble. Buildings are vacant in ghost cities and the quality of new construction has been extremely poor. Like all emerging markets, it is over-extended.

When municipals went bankrupt in the 1930s like the city of Detroit, capital was able to distinguish a muni from the feds and not all munis defaulted. However, had the feds defaulted, then they take down ALL the munis at once. There is a HUGE difference between a fringe and a core economy. The assumption is other countries reserves will somehow survive a US hyperinflation? Brazil and China combined could NOT absorb all the cash from the US and Europe. Their economies are not that big. To arbitrarily say “giant” money is already in gold – where? How? When? Why is it still fleeing to the dollar sending 10-year rates to record lows?

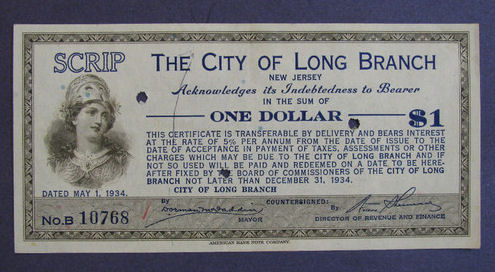

Another best kept secret of the Great Depression I have included in the upcoming book on the Great Depression & the Sovereign Debt Crisis of 1931, is the fact that there were vast amounts of private currency being issued at that time because of hoarding and bank failures. There was NO money to even circulate. Of course the socialists did not want to write about that as well because it reflected the collapse in government’s ability to manage the economy.

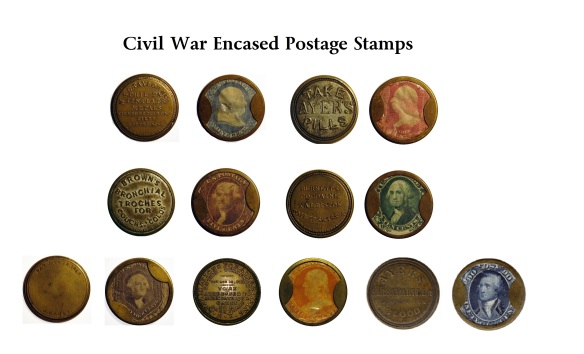

It seems axiomatic that whenever a government fails to provide an adequate supply of currency or coin to maintain commercial trade, the people will step in and provide their own to fill the vacuum. This is something the Goldbugs fail to grasp. Money will become whatever the people accept as the medium of exchange and when government fails to provide that medium, they create their own fiat system. Thus, the use of scrip during the 1930’s was not a new idea in the United States. During other earlier financial crises such as the Panic of 1837, the Civil War years, and the Panics of 1873, 1893 and especially 1907, many different kinds of private emergency fiat currency had been issued.

During the worst periods of the Great Depression, many communities were temporarily deprived of normal monetary supplies and functions because of bank failures, hoarding of money, and inability to collect taxes. People simply had no money to spend. To counteract this situation, various forms emergency currency or scrip were issued. The first of these appeared as early as 1931, though it was not until a year later that it was being issued in any appreciable quantities. By February of 1933, according to a Bureau of Foreign and Domestic Affairs estimate, there were over 400 communities using some form of emergency fiat currency – and this was before the official “bank holiday” and the resulting flood of scrip across the country. Gold was hoarded – not used as money.

Clearly, people will create money if the state fails to provide it. Roman coins exist in quantity today solely due to the very same human trends that appear in every crisis – hoarding. This reduces the VELOCITY of money creating DEFLATION.

I have stated numerous times that the purchasing power of the Roman denarius collapsed to the point it purchased 1/50th of its previous worth. The German Hyperinflation was 170 marks to the dollar at the beginning to 87 trillion. To compare this with the fall of Rome with money dropping to 1/50th of its former value, that is only 170 to 8500. Rome did not do the way of hyperinflation. It was the CORE economy and it collapse at 170 to 8500 level not 170 to 87,000,000,000.

Sorry, but you can die in a desert from extreme heat or freeze to death in Antarctica from extreme cold. To survive, we need a temperate client to live within. DEFLATION or INFLATION can kill an economy. Empires do not die by HYPERINFLATION – that is reserved for the fringe. When an empire dies, it historically has ALWAYS been by DEFLATION. How? Real wealth is driven from the ABOVEGROUND economy into the UNDERGROUND economy where it is hoarded and tucked away. This is why we find hoards of Roman coins. This reduces the VELOCITY of money and commerce is reduced. This is ALWAYS AND WITHOUT EXCEPTION how empires die. This is why there was scrip issued in the United States during the Great Depression. The VELOCITY of money came to a halt. Continue reading @Armstrong Economics

Read more: Charleston Voice: HOW DO Empires Die? by Martin Armstrong - Highly RecommendedJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-17-2012, 10:41 PM #5492Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

4409 - Is this America? Nazi Checkpoint = CIA drug trafficking

Submitted by 4409 on Sun, 06/17/2012 - 17:33

Don't forget to push the share button and help spread the word. Use the tweet button

Don't know how to embed a video so here is the link

No arrest for us this time...this is America...stand your ground. This footage was shot with multiple cameras that had to be saved.

To pretend this is not happening is to ignore reality.

These are Inland checkpoints that are nowhere near a border.

They are there to confiscate the NON-CIA backed cartels drugs that made it pass the actual border and allow the CIA-backed cartels to run their trucks cart-Blanche.

They are NOT there to catch illegals. You don't catch illegals with drug dogs....they can't sniff that you're Mexican or Canadian.

In as much, the dogs are just a clever way to get into anyone's vehicles....drug dogs are a complete fraud.

They just claim the dog alerted and poof they are in your car....its a complete sham.

See you all at Porcfest...

~4409

4409 - Is this America? Nazi Checkpoint = CIA drug trafficking | Peace . Gold . Liberty | Ron Paul 2012

Last edited by AirborneSapper7; 06-17-2012 at 10:54 PM.

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-17-2012, 11:53 PM #5493Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Ron Paul: The Coming Fed Bailout of Europe Must Be Stopped! by Ron Paul

Originally posted December 26, 2011

By Ron Paul

posted by EPJ

The economic establishment in this country has come to the conclusion that it is not a matter of "if" the United States must intervene in the bailout of the euro, but simply a question of "when" and "how". Newspaper articles and editorials are full of assertions that the breakup of the euro would result in a worldwide depression, and that economic assistance to Europe is the only way to stave off this calamity. These assertions are yet again more scare-mongering, just as we witnessed during the depths of the 2008 financial crisis. After just a decade of the euro, people have forgotten that Europe functioned for centuries without a common currency.

The real cause of economic depression is loose monetary policy: the creation of money and credit out of thin air and the monetization of government debt by a central bank. This inflationary monetary policy is the cause of every boom and bust, yet it is precisely what political and economic elites both in Europe and the United States are prescribing as a resolution for the present crisis. The drastic next step being discussed is a multi-trillion dollar bailout of Europe by the European Central Bank, aided by the IMF and the Federal Reserve

.

The euro was built on an unstable foundation. Its creators attempted to establish a dollar-like currency for Europe, while forgetting that it took nearly two centuries for the dollar to devolve from a defined unit of silver to a completely unbacked fiat currency note. The euro had no such history and from the outset was a purely fiat system, thus it is not surprising to followers of Austrian economics that it barely survived a decade and is now completely collapsing. Europe's economic depression is the result of the euro's very structure, a fiat money system that allowed member governments to spend themselves into oblivion and expect that someone else would pick up the tab.

A bailout of European banks by the European Central Bank and the Federal Reserve will exacerbate the crisis rather than alleviate it. What is needed is for bad debts to be liquidated. Banks that invested in sovereign debt need to take their losses rather than socializing those losses and prolonging the process of adjusting their balance sheets to reflect reality. If this was done, the correction would be painful, but quick, like tearing off a large band-aid, but this is necessary to get back on solid economic footing. Until the correction takes place there can be no recovery. Bailing out profligate European governments will only ensure that no correction will take place.

A multi-trillion dollar European aid package cannot be undertaken by Europe alone, and will require IMF and Federal Reserve involvement. The Federal Reserve already has pumped trillions of dollars into the US economy with nothing to show for it. Just considering Fed involvement in Europe is ludicrous. The US economy is in horrible shape precisely because of too much government debt and too much money creation and the European economy is destined to flounder for the same reasons. We have an unsustainable amount of debt here at home; it is hardly fair to US taxpayers to take on Europe's debt as well. That will only ensure an accelerated erosion of the dollar and a lower standard of living for all Americans.

Read more: Charleston Voice: Ron Paul: The Coming Fed Bailout of Europe Must Be Stopped! by Ron PaulLast edited by AirborneSapper7; 06-17-2012 at 11:55 PM.

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-18-2012, 12:03 AM #5494Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Will the US Fed Bailout Europe Without US Voter Approval?

Posted by Charleston Voice, 06.13.12

Reads to me like Americans are being postured for their own private central bank cartel, the US Federal Reserve, to bailout Europe.

It really doesn't matter what wealth and liberties will be surrendered, or what voters think. The banking cartel and its government enforcement arm will do whatever it takes (from you) to safeguard their own wealth and safety.

Analysis: Endless QE? $6 trillion and counting

4:03am EDT

By Mike Dolan

LONDON (Reuters) - Many more years of money printing from the world's big four central banks now looks destined to add to the $6 trillion already created since 2008 and may transform the relationship between the once fiercely-independent banks and governments.

As rich economies sink deeper into a slough of debt after yet another wave of euro financial and banking stress and U.S. hiring hesitancy, everyone is looking back to the U.S. Federal Reserve, European Central Bank, Bank of England and Bank of Japan to stabilize the situation once more.

What's for sure is that quantitative easing, whereby the "Big Four" central banks have for four years effectively created new money by expanding their balance sheets and buying mostly government bonds from their banks, is back on the agenda for all their upcoming policy meetings.

Government credit cards are all but maxed out and commercial banks' persistent instability, existential fears and reluctance to lend means the explosion of newly minted cash has yet to spark the broad money supply growth needed to generate more goods and services.

In other words, electronic money creation to date - whether directly through bond buying in the United States or Britain or in a more oblique form of cheap long-term lending by the ECB - is not even replacing what commercial banks are removing by shoring up their own balance sheets and winding down loan books.

Global investors appear convinced more QE is in the pipe.

"It is almost as if investors are saying QE will happen no matter what," said Bank of America Merrill Lynch's Gary Baker.

BoA Merrill's latest monthly survey of 260 fund managers showed nearly three in four expect the ECB to proceed with another liquidity operation by October. Almost half expected the Fed to return to the pumps over the same period.

The BoJ has already upped asset purchases yet again this year and Bank of England policy dove Adam Posen said on Monday the BoE should not only buy more government bonds but target small business loans too.

SO FAR, SO SO

But aside from investor hopes of a market-based call and response, is there any evidence that QE actually helps the underlying problem and what are the risks from all this?

The "counterfactual", to use an economics wonk's term, is the most powerful argument in QE's favor - what would have happened if they didn't print at all and broad money supply collapsed?

But after four years in which, according to HSBC, the balance sheets of the Big Four have collectively more than tripled to $9 trillion and still not generated self-sustaining recoveries, the question is how long this can keep going on without creating bigger problems for the future.

For a start, there is no quick solution to the problem of mountainous indebtedness.

Recapitalizing banks; stabilizing housing and mortgage markets responsible for deteriorating loan quality; further deep integration of euro fiscal links to support the shared currency; and capping government debt piles in the United States, Japan and Britain will - even for optimists - take many years.

On top of that the rich economies face gale force headwinds over the next decade from ageing and retiring populations... Finish reading @Source Reuters

Read more: Charleston Voice: Will the US Fed Bailout Europe Without US Voter Approval?Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-18-2012, 12:28 AM #5495Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Ron Paul Exposes Neo Conservatives A.K.A. NEOCONS (2003) - When Character Doesn't Matter

Last edited by AirborneSapper7; 06-18-2012 at 12:31 AM.

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-18-2012, 12:47 AM #5496Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

SBSS 37. Blood On The Street

By Silver Shield, on June 13th, 2012

A look at how the Anglo American banking dynasties are preparing for the collapse of the dollar paradigm.

SBSS 37. Blood On The Street | Don't Tread On MeJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-18-2012, 02:44 AM #5497Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Council on Foreign Relations

By Dean Henderson

theintelhub.com

June 17, 2012

(Excerpted from Big Oil & Their Bankers: Chapter 3: The House of Saud & JP Morgan)

In 1919 Rothschild’s Business Roundtable launched the Royal Institute of International Affairs (RIIA) in London. The RIIA soon spawned sister organizations around the globe, including the US Council on Foreign Relations (CFR), the Asian Institute of Pacific Relations, the Canadian Institute of International Affairs, the Brussels-based Institute des Relations Internationales, the Danish Foreign Policy Society, the Indian Council of World Affairs and the Australian Institute of International Affairs. [1] Other affiliates popped up in France, Turkey, Italy, Yugoslavia and Greece.

The RIIA is a registered charity of the Queen and, according to its annual reports, is funded largely by the oil oligopoly which I have dubbed the Four Horsemen – Exxon Mobil, Chevron Texaco Phillips, BP Amoco ARCO and Royal Dutch/Shell Pennzoil.

Former British Foreign Secretary and Kissinger Associates co-founder Lord Carrington is President of both the RIIA and the Bilderbergers. [2]

The inner circle at RIIA is dominated by Knights of St. John Jerusalem, Knights of Malta, Knights Templar and 33rd Degree Scottish Rite Freemasons.

The Knights of St. John were founded in 1070 and answer directly to the British House of Windsor. The Catholic Knights of Malta, who answer to the Vatican, retreated to Malta after their bruising Crusades defeat and turned that Mediterranean island into a nexus for drugs/guns/oil smuggling.

The Knights Templar invented insurance, the bond market and the concept of credit cards as they shuttled pilgrims to and fro’ the Middle East during the Crusades. They founded Temple Bar in the center of the City of London, which serves as global administer of British Maritime Law – very quietly the law of the land in many nations, including the US, where if you take an oath in a courtroom adorned with gold fringed American flag, you are bound not by the US Constitution, but by British Maritime Law.

Freemasons are largely unaware underling agents of the British Empire, who sponsor children’s hospitals, put on circuses and appear in all parades. They serve as a ruse for the City of London’s global domination of the “colonies”.

On this side of the pond, the City’s domination over US foreign policy and the State Department is exerted via the Council on Foreign Relations.

Bechtel/Chevron board member and former Reagan Defense Secretary George Pratt Schultz was a long-time current director at the Council on Foreign Relations (CFR).

The CFR was created in 1922 and is headquartered in Harold Pratt House in New York City. The building was donated by Pratt’s widow, whose husband made his fortune as a partner in John D. Rockefeller’s Standard Oil Company.

Schulz is a relative of Mrs. Harold Pratt and replaced CFR member Alexander Haig to become Reagan’s Secretary of State. The CFR is the US affiliate of the Royal Institute for International Affairs (RIIA) in London. Both foreign policy think tanks are loaded with powerful leaders of industry, academia and government.

They hold an enormous amount of sway over US and British foreign policies, providing the glue for the so-called “special relationship” between the US and Britain, whereby the Hessianized US mercenary colony pays for and fights the wars which the City of London both desires and profits from.

CFR publishes Foreign Affairs, a bi-monthly journal on the global political landscape, which is considered by many in the State Department as a kind of “how-to” guide for conducting foreign policy.

Founding members of CFR included brothers John Foster and Allen Dulles, columnist Walter Lippman, former Secretary of State Elihu Root and Colonel Edward Mandell House, who as adviser to President Woodrow Wilson pushed through the Federal Reserve Act, creating a private US central bank owned by a few wealthy banking families.

In 1912, one year before the Federal Reserve was created, House wrote Philip Dru: Administrator. The book describes a conspiracy within the United States bent on establishing a central bank, a graduated income tax and control of both political parties.

Past funding for CFR has come from international financiers David Rockefeller, J.P. Morgan, Bernard Baruch, Jacob Schiff, Otto Kahn and Paul Warburg. International banks Kuhn Loeb, Lazard Freres, Lehman Brothers and Goldman Sachs – whose directorates interlock and whose families have interbred – heavily influence CFR proceedings. [3]

CFR members are sworn to secrecy regarding goals and operations. But Admiral Chester Ward, a longtime CFR member, let slip that the goal of the group is, “to bring about the surrender of the sovereignty and the national independence of the United States…Primarily, they want a world banking monopoly from whatever power ends up in the control of global government.”

CFR members have dominated every Administration since FDR and most Presidential candidates come from its ranks. Adlai Stevenson, Dwight Eisenhower, Richard Nixon, John F. Kennedy, Lyndon Johnson, Hubert Humphrey, George McGovern, Walter Mondale, Jimmy Carter, George Bush Sr. and Al Gore are all CFR alumni.

David Rockefeller served as CFR Chairman for some time, giving way to fellow Chase Manhattan chairman/ARAMCO attorney John McCloy.

Nearly every CIA Director since Allen Dulles has been a CFR member. These include Richard Helms, William Colby, George Bush Sr., Bill Casey, William Webster, James Woolsey, John Deutsch and Robert Gates. Interestingly, current Obama Administration CIA Director Leon Panetta is not a CFR member.

CFR’s Foreign Affairs consistently advocates US military intervention and is the most widely read periodical at the US State Department. According to both former Deputy Director of the CIA Victor Marchetti and former State Department analyst John Marks, the CFR is the principal constituency of the CIA, since the elite who run the CFR are the ones who own the overseas assets which the CIA and the US military work to guard. [4]

It is through the CFR that the international bankers and the global intelligence community mingle. The bankers and the spooks share a common goal of keeping the world safe for global monopoly capitalism and often intelligence operatives are recruited from the banking houses where their loyalties to the banking elite have been thoroughly tested. OSS founding father William “Wild Bill” Donovan had been an agent for JP Morgan.

The revolving door between banking and intelligence swings the other way as well. The very best CIA, Mossad and MI6 agents are recruited to become better paid private spooks for multinational corporate and banking empires as documented in Jim Hougan’s Spooks: The Haunting of America – Private Use of Secret Agents. As author Donald Gibson wrote, “By the early 1960’s the CFR, Morgan and Rockefeller interests, and the intelligence community were so extensively inbred as to be virtually one entity.”[5]

The CFR is also the primary incubator for Presidential cabinet positions. The Nixon Administration had 115 CFR members, while the Clinton Administration included over 100 CFR alumni. They included CFR President Peter Tarnoff, National Security Adviser Anthony Lake, Vice-President Al Gore, Secretary of State Warren Christopher, Secretary of Defense Les Aspin and his successor William Cohen, Secretary of Treasury Lloyd Bentsen, CIA Director James Woolsey, Colin Powell, Tim Wirth, Winston Lord, Laura Tyson, George Stephenopoulos and Samuel Lewis.

In the fall of 1998 as impeachment loomed over Clinton, the President rushed to New York to try and muster support from his CFR “handlers”. As publisher John F. McManus stated, “Bill Clinton knows well that he serves as President because the members of the ‘secret society’ to which he belongs chose him and expect him to carry out its plans.”

Current co-chairs at CFR are Carla Hills – Bush Sr. trade representative who was the chief negotiator of NATFA and other key WTO machinations – and Robert Rubin – former Clinton Treasury Secretary and Citigroup chairman.

Other current board members include Madeline Albright, Tom Brokaw, General John Abizaid, Fareed Zakaria, Hyatt heiress Penny Pritzker, Blackstone Group insider J. Tomlinson Hill, Caterpillar chair James W. Owens and Carlyle Group co-founder David Rubenstein. [6]

[1] Fourth Reich of the Rich. Des Griffin. Emissary Publications. Pasadena, CA. 1978. p.77

[2] The Robot’s Rebellion: The Story of the Spiritual Renaissance. David Icke. Gateway Books. Bath, UK. 1994. p.195

[3] The Rockefeller File. Gary Allen. ’76 Press. Seal Beach, CA. 1977. p.75

[4] Rule by Secrecy: The Hidden History that Connects the Trilateral Commission, the Freemasons and the Great Pyramids. Jim Marrs. Harper-Collins Publishers. New York. 2000. p.36

[5] Battling Wall Street: The Kennedy Presidency. Donald Gibson. Sheridan Square Press. New York. 1994. p.133

[6] Members of the Council on Foreign Relations - Wikipedia, the free encyclopedia

Dean Henderson is the author of Big Oil & Their Bankers in the Persian Gulf: Four Horsemen, Eight Families & Their Global Intelligence, Narcotics & Terror Network, The Grateful Unrich: Revolution in 50 Countries and Das Kartell der Federal Reserve. Subscribe to his Left Hook weekly column FREE at www.deanhenderson.wordpress.com

The Council on Foreign Relations :

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-18-2012, 03:38 AM #5498Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Mike Maloney on Credit-Based Money, Feudalism, and Financial Enslavement Only Ron Paul Speaks About This

Submitted by ronpaul_d_1 on Mon, 06/18/2012 - 01:11

Economy

Video - Mike Maloney on Credit-Based Money, Feudalism, and Financial Enslavement Only Ron Paul Speaks About This | Peace . Gold . Liberty | Ron Paul 2012

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-18-2012, 04:07 AM #5499Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-18-2012, 05:15 PM #5500Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Obama vs Romney

Last Updated: 6/18

State Pollster Poll Date Obama Romney National Rasmussen Reports 6/15-6/17 44% 47% National Gallup Tracking 6/11-6/17 46% 46% Maine WBUR/MassINC 6/13-6/14 48% 34% Michigan Baydoun/Foster 6/12-6/12 56% 33% National Reuters Ipsos 6/7-6/11 45% 44% Nevada PPP 6/7-6/10 48% 42% North-Carolina PPP 6/7-6/10 46% 48% Pennsylvania Quinnipiac 6/5-6/10 46% 40% National IBD CSM TIPP 6/1-6/8 46% 42% Wisconsin WeAskAmerica 6/6-6/6 48% 43% North-Dakota Mason Dixon 6/4-6/6 39% 52% National Monmouth/SurveyUSA/Braun 6/4-6/6 47% 46% New-York Siena 6/3-6/6 59% 35% National Fox 6/3-6/5 43% 43% Michigan EPIC MRA 6/2-6/5 45% 46%

More Obama vs Romney »

Rasmussen Tracking »

Gallup Tracking »

Battleground States: Florida, Ohio, Pennsylvania.

General Election? Read the Karl Rove Playbook

http://www.nationalpolls.com/

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

19Likes

19Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Listen to Frosty Wooldridge on Rense Apr 23, 2024 talking...

04-24-2024, 05:17 PM in illegal immigration News Stories & Reports