Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-15-2022, 10:19 AM #1

US Retail Sales Unexpectedly Tumble In May

US Retail Sales Unexpectedly Tumble In May

by Tyler Durden

Wednesday, Jun 15, 2022 - 07:35 AM

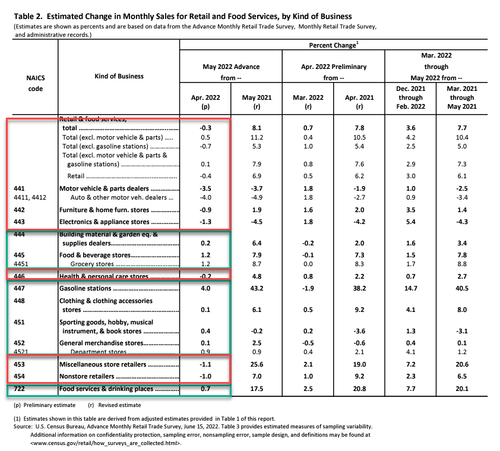

Amid record low consumer sentiment, crashing asset markets, and tumbling savings rates, it is no surprise that May retail sales were a disappointment but the 0.3% plunge was remarkable relative to a 0.1% expected rise and downwardly revised 0.7% MoM rise in April.

That is the first negative print since Dec 2021.

Source: Bloomberg

Auto sales dropped 3.5% in May, reinforcing data from Ward’s Automotive Group that showed sales dropped the most since August in the month. Meantime, spending at gas stations rose 4%, likely reflecting higher fuel pricesin the month. Excluding those categories, retail sales rose 0.1%, the smallest gain in five months.

Remember, retail sales data is nominal - and so an inflationary impulse is actually 'helping' put some lipstick on this headline pig. Whiule adjusting retail sales by CPI directly is somewhat oranges to apples (due to different weightings tec), it gives some general sense of the state of 'real' retail sales. May was the third straight month of declines for real retail sales...

The Control Group - used in the GDP calculation - printed a blank (0.0% MoM). Additionally the Control Group retail sales data from April was revised dramatically lower from +1.0% MoM to +0.5% MoM suggesting Q2 GDP could be heading into contraction and the dreaded 'technical' recession looms.

Finally, as a reminder, the myth of the 'strong consumer' is dead as Americans are surviving by eating into their savings and piling up credit card debt as inflation sends the cost of living to the moon...

Source: Bloomberg

All of which is Putin's fault of course.

https://www.zerohedge.com/personal-f...dly-tumble-maySupport our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

Similar Threads

-

Cyber Monday retail sales may hit record

By JohnDoe2 in forum Other Topics News and IssuesReplies: 6Last Post: 11-28-2011, 06:45 PM -

Retail sales up for third month; economy keeps lid on prices

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 10-15-2010, 04:45 PM -

Home sales tumble: December largest drop in 40 years

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 1Last Post: 01-26-2010, 10:16 AM -

U.S. Economy: Sales Unexpectedly Fall on Job Losses (Update2

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 08-13-2009, 06:24 PM -

U.S. Retail Sales Unexpectedly Drop as Jobs Evaporate

By Dixie in forum Other Topics News and IssuesReplies: 8Last Post: 04-14-2009, 02:24 PM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Listen to William Gheen on Rense Apr 17, 2024 talking NEW Tool...

04-18-2024, 06:17 PM in ALIPAC In The News