Results 21 to 30 of 38

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-02-2016, 02:46 PM #21

Carlos Slim and the New York Times are doing their best to defeat Trump. Slim wants to stop Trump from putting a kink in his own interests, his own power and wealth in Mexico and the United States.

From 2015, "Carlos Slim, the New York Times Sugar Daddy", written by Ann Coulter.

the world’s richest man, Carlos Slim Helu, saved the Times from bankruptcy. When that guy saves your company, you dance to his tune. So it’s worth mentioning that Slim’s fortune depends on tens of millions of Mexicans living in the United States, preferably illegally.http://townhall.com/columnists/annco...daddy-n2005713Carlos Slim: The New York Times’ Sugar Daddy

Ann Coulter|

Posted: Jun 01, 2015 12:01 AM

Editor's note: The following is an excerpt from Ann Coulter's new book, "¡Adios, America! The Left’s Plan to Turn Our Country into a Third World Hellhole"

CAN WE TRUST ANYTHING THE NEW YORK TIMES SAYS ABOUT IMMIGRATION?

In 2008, the world’s richest man, Carlos Slim Helu, saved the Times from bankruptcy. When that guy saves your company, you dance to his tune. So it’s worth mentioning that Slim’s fortune depends on tens of millions of Mexicans living in the United States, preferably illegally.

That is, unless the Times is some bizarre exception to the normal pattern of corruption—which you can read about at this very minute in the Times. If a tobacco company owned Fox News, would we believe their reports on the dangers of smoking? (Guess what else Slim owns? A tobacco company!) The Times impugns David and Charles Koch for funneling “secret cash” into a “right-wing political zeppelin.”1 The Kochs’ funding of Americans for Prosperity is hardly “secret.” What most people think of as “secret cash” is more like Carlos Slim’s purchase of favorable editorial opinion in the Newspaper of Record.

It would be fun to have a “Sugar Daddy–Off” with the New York Times:

Whose Sugar Daddy Is More Loathsome? The Koch Brothers? The Olin Foundation? Monsanto? Halliburton? Every time, Carlos Slim would win by a landslide. Normally, Slim is the kind of businessman the Times—along with every other sentient human being—would find repugnant.

Frequently listed as the richest man in the world, Slim acquired his fortune through a corrupt inside deal giving him a monopoly on telecommunications services in Mexico. But in order to make money from his monopoly, Slim needs lots of Mexicans living in the United States, sending money to their relatives back in Oaxaca. Otherwise, Mexicans couldn’t pay him—and they wouldn’t have much need for phone service, either—other than to call in ransom demands.

Back in 2004—before the Times became Slim’s pimp—a Times article stated: “Clearly . . . the nation’s southern border is under siege.”2 But that was before Carlos Slim saved the Times from bankruptcy. Ten years later, with a border crisis even worse than in 2004, and Latin Americans pouring across the border, the Times indignantly demanded that Obama “go big” on immigration and give “millions of immigrants permission to stay.” What a difference one thieving Mexican billionaire makes!

True, it’s not unusual for the Times to root for the destruction of the United States. Maybe, in this particular instance, the Times agrees with every single thing Slim says. Perhaps there was a secret meeting with Slim: You may have saved us, Carlos Slim, but this newspaper will be in no way cognizant of your financial interest in continued illegal immigration. You’re just very lucky that we happen to agree with you. However, if you get into offshore drilling, we will take a VERY strong position against you.On the other hand, there’s no question but that the Times has become exceptionally shrill on immigration since Slim saved the company from bankruptcy.

HOW “THE RICHEST MAN IN THE WORLD” MAKES MONEY ON ILLEGAL IMMIGRATION

One of the ways Slim makes money off of illegal immigration in the United States is by overcharging Mexicans to call home, especially during World Cup soccer season. Slim takes a percentage of all cell phone calls into Mexico—and Telmex’s “interconnection rates” are astronomical. International roaming rates are 37 percent higher in Mexico than the average of all OECD countries.

But the main way illegal immigrants benefit Slim is through their remissions. Monopolistic pricing is of little value in a poor country. A monopoly on air in Burundi would not produce the world’s richest man. Luckily for Slim, Mexico is located right next to one of the wealthiest nations in the world. The OECD estimates that Slim’s suffocating telecommunications monopoly costs Mexican consumers $26 billion a year, with more than half of that coming from Slim gouging his customers. They would have $20 billion less to spend without 40 million Mexicans living in the United States.

According to the World Bank and the International Monetary Fund, Mexican immigrants or those of Mexican descent send at least $20 billion out of America back to their relatives in Mexico each year.29 No wonder immigrants are so reliant on welfare—they’re sending so much of it out of the country! Twenty billion dollars is significantly more—about a quarter more—than the amount of money the United States sends to Mexico in direct foreign aid. The $20 billion being sent to immigrants’ grandmothers in Chiapas is forever eliminated from the American economy—unavailable for investment in American companies, the purchase of American products, or hiring American workers. That’s a cost of immigration that Americans are never told about.

These billions of dollars being drained out of the U.S. economy every year would be bad enough if the money were coming exclusively from cheap-labor employers like Sheldon Adelson. But it’s worse than that. It comes from American taxpayers. Not only do taxpayers have to support Americans who lose their jobs to low-wage immigrant laborers, taxpayers support the immigrants, too. Seventy-five percent of immigrant families from Mexico are on government assistance.

Then they turn around and give the money to Carlos Slim. The majority of the money sent by immigrants to Mexico is used for “consumption”— i.e., to buy Carlos Slim’s telephone service, shop at Carlos Slim’s department stores, and eat in Carlos Slim’s restaurants. Slim’s businesses account for 40 percent of all publicly traded companies on Mexico’s main stock market index.

That’s why, in 2014, Slim was exhorting Mexican youth to cross illegally into the United States for jobs. The stated purpose of Obama’s open defiance of American immigration laws was to avoid punishing “children” who were brought to the United States by their parents. Slim didn’t care about that. (Then again, neither did Obama.) He just wanted more Mexicans working in America and sending dollars back to him. As the CEO of the “Carlos Slim Foundation” explained, “[O]ur goal is to reduce the access barriers for them to reach this potential . . . to build not just them but their families, so they’re able to contribute to the economy”—i.e., the Mexican economy owned by Carlos Slim.

THE TIMES CHANGES ITS TUNE

The Times has become noticeably hysterical about illegal immigration since Carlos Slim came on board. In 1997—the pre-Slim days—the Times had editorialized: “Fighting illegal immigration is a difficult and important job. But Congress should do it in a way that will deter illegal entry at the border.”39 Another editorial that year complained that the Immigration and Naturalization Service had “done a poor job of keeping out illegal aliens, deporting criminals [and] processing requests for asylum.” This wasn’t even Bush-bashing—Clinton was president!

Post-Slim, the Times tends more toward deranged hectoring in favor of illegal immigration. In the Times’ 2014 “Go Big” editorial—the one insisting that Obama grant permanent residence to illegal immigrants streaming across the border—the Timessniped: “Republicans will howl over Mr. Obama’s solo actions. Let them.”

The Times should never stop hearing about Carlos Slim. By all the rules of the Left, you’re not supposed to trust someone beholden to a rich man, especially one with a specific interest in public policy. If Slim had saved any company in the world other than the New York Times, his sleazy insider deals and business model based on mass illegal immigration to the United States would absolutely be a problem. But you forgot something—we’re the New York Times! We’re the good guys. You’re not factoring that in.Last edited by Newmexican; 10-02-2016 at 03:39 PM. Reason: Inserted complete article

Matthew 19:26

But Jesus beheld them, and said unto them, With men this is impossible; but with God all things are possible.

____________________

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-02-2016, 03:14 PM #22

I think the New York Times and Carlos Slim should release their US federal income tax returns.

A Nation Without Borders Is Not A Nation - Ronald Reagan

Save America, Deport Congress! - Judy

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

10-02-2016, 03:47 PM #23Senior Member

- Join Date

- Jan 2012

- Posts

- 4,815

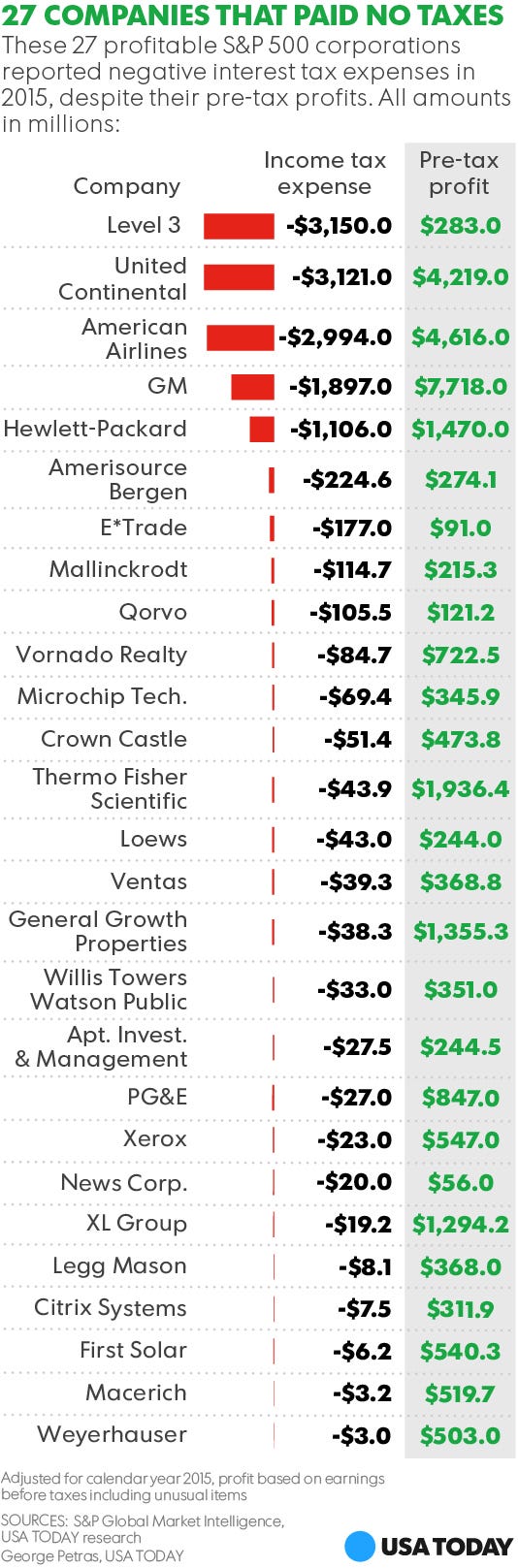

27 giant profitable companies paid no taxes

Matt Krantz, USA TODAY 5:59 p.m. EST March 7, 2016

Matt Krantz, USA TODAY 5:59 p.m. EST March 7, 2016

Death and taxes are supposed to be two certainties of life. But a few companies have at least escaped the taxes part.

There are 27 companies in the Standard & Poor's 500, including telecom firm Level 3 Communications (LVLT), airline United Continental (UAL) and automaker General Motors (GM), that reported paying no income tax expense in 2015 despite reporting pre-tax profits, according to a USA TODAY analysis of data from S&P Global Market Intelligence.

Only profitable firms were included in the analysis since firms that lost money - like many energy companies - wouldn't be expected to pay taxes.

Escaping the taxman, so far, hasn't been an advantage at least in the eyes of

investors. Shares of the companies that paid no taxes are down 11% on average over the past 12 months, which is more than twice the 4.8% decline by the S&P 500 during the same period.

The underperformance might come as a bit of a surprise given how much time and effort some companies have put into lowering their tax bills.

"Income tax issues, while important, are not as important as how well as company is doing or how well an industry is performing," says Bill Selesky, investment analyst at Argus Research. "It gets to be an issue that I would put at the bottom of the list."

Yet, investors have paid closer attention to the tax rates companies pay as profit growth continues to stall along with revenue growth.

Companies must find any way possible to boost their bottom line, which for some involves looking for ways to reduce their tax liabilities.

Some have taken advantage of lower overseas tax rates, a practice that has drawn criticism. Drugmaker Pfizer (PFE) last year, for instance, drew fire last year for a plan to merge with rival Allergan (AGN) and move its headquarters to Ireland.

And on Sunday night, Presidential candidate Hillary Clinton took aim Johnson Controls (JCI), which is planning to merge with Tyco (TYC) and move its headquarters to

Ireland.

"I am also going to go after companies like Johnson Controls in Wisconsin," Clinton said. "They came and got part of the bailout because they were an auto parts supplier. Now they want to move headquarters to Europe. They are going to have to pay an exit fee. We are going to stop this kind of job exporting and we are going to start importing and growing jobs again in our country."

Three of the 27 companies that paid no income tax in 2015 are based outside the U.S. including healthcare firm Mallinckrodt (MNK), financial firm Willis Towers Watson (WLTW) and insurer XL Group (XL). Several are real-estate investment trusts (REITs). Their unique “pass-through” accounting, which shifts the tax burden to shareholders rather than the company itself, has become a more popular structure as companies look to convert to REITs.

There are a number of reasons why a profitable company may not pay taxes. For instance, years of deep losses can affect a tax bill.

Take United Continental, which reported a $3.2 billion income tax credit in 2015 despite reporting earnings before taxes of $4.2 billion. Accounting rules allow the airline to offset taxes due with valuation allowances resulting from losses in past years. During 2015, these allowances amounted to $4.7 billion which erased the company's $1.5 billion tax bill based on its normal corporate tax rate.

It was a similar situation at Level 3. The company booked a tax credit of $3.2 billion in 2015 despite recording a pre-tax profit of $283 million in the same year. The tax gain was the result of credits associated with losses in previous years in addition to losses at Colorado-based TW Telecom, which Level 3 bought in 2014.

Not all companies breakdown in detail where they paid taxes, be it in the U.S. or elsewhere. But the location can be important to the overall taxes companies pay.

In 2015, General Motors saw a tax credit of of $1.9 billion, even though its earnings before taxes hit $7.7 billion. Uncle Sam got his due, as the company reported a U.S.

federal income tax expense of more than $1 billion. Yet the company's global tax bill was a credit thanks mostly to a tax break connected with General Motors Europe.

Investors, though, should know many of these tax breaks and credits will likely eventually run out. United's 2015 annual regulatory filing warns investors as much: "The Company anticipates its effective tax rate will be approximately 37%, which reflects a more normalized rate after the release of the tax valuation allowance in 2015 and is based on the Company’s relative mix of domestic, foreign and state income tax expense."

And at GM, "this benefit will slowly dissipate over the 2016 and 2017 time frame," says Argus' Selesky says. He doesn't think it will be a problem, though.

"Assuming a decent global economy and a good mix of international revenue versus domestic U.S. revenue, GM should not have a problem counteracting that tax credit with better sales performance in some other part of the world," he says.

But when these companies' credits run out - the taxman will be waiting for his due.

Contributing: Ed Brackett

http://www.usatoday.com/story/money/...axes/81399094/

-

10-02-2016, 03:57 PM #24

No business or person should pay income taxes. Under our Constitution, income taxes were illegal and unconstitutional. Our Constitution had to be modified, amended, to create this disaster. The income tax violates the freedom of Americans and American Businesses, it violates ones privacy, it complicates the daily tasks of life, both for individuals and businesses. No decision should be centered on income tax "implications". The income tax is a socialist communist idea, derived from the feudal lord system of Kings, Queens and Monarchs.

Why any American would have anything to do with them, except under the force of a law, is a query that should be answered. Some will claim "to pay for government". No, you do not need an income tax to pay for government, tariffs and sales taxes, which are voluntary, easy, simple, and that don't invade one's decision-making process or privacy, can pay for government. Some will say, to tax the rich. No, you are not taxing the rich with income taxes, you are taxing yourselves TWICE. Income taxes are embedded in the cost of business, the source of income for the rich, so when you buy products and services, YOU are paying their income taxes for them, and still paying your own at the SAME TIME on your own earnings. So you are paying TWICE. You're paying your own taxes and the taxes of the rich.

The income tax was illegal from 1789 until 1913. No good has come from the income tax. Only debt, globalism and misery.

GET RID OF IT!

Support the FairTax Act. HR 25 in the US House of Representatives and S 155 in the US Senate.A Nation Without Borders Is Not A Nation - Ronald Reagan

Save America, Deport Congress! - Judy

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

10-02-2016, 04:01 PM #25Senior Member

- Join Date

- Jan 2012

- Posts

- 4,815

The New York Times Paid No Taxes in 2014

Dan Flynn by Joel B. Pollak2 Oct 2016

Dan Flynn by Joel B. Pollak2 Oct 2016

The New York Times has excited the Clinton campaign and the rest of the media with a revelation that Republican nominee Donald Trump declared a $916 million loss in 1995 that might have resulted in him not paying taxes in some subsequent years.

The implication, reinforced by CNN’s Jake Tapper on State of the Union on Sunday morning, is that Trump “avoided” paying taxes, when in fact his tax liability was zero.

But the Times itself has “avoided” paying taxes — in 2014, for example.

As Forbes noted at the time:

… for tax year 2014, The New York Times paid no taxes and got an income tax refund of $3.5 million even though they had a pre-tax profit of $29.9 million in 2014. In other words, their post-tax profit was higher than their pre-tax profit. The explanation in their 2014 annual report is, “The effective tax rate for 2014 was favorably affected by approximately $21.1 million for the reversal of reserves for uncertain tax positions due to the lapse of applicable statutes of limitations.” If you don’t think it took fancy accountants and tax lawyers to make that happen, read the statement again.New York Mayor Rudy Giuliani defended Trump on Sunday, telling NBC News’ Meet the Press that Trump was a “genius” in business who was simply doing what the tax code allows every American to do by counting losses against tax liabilities, and bouncing back from failure to success.

That would include the New York Times — which, however, is still struggling.

As Jazz Shaw of HotAir.com notes, the Times — or whoever was its source — likely obtained Trump’s tax document illegally.

The ongoing IRS scandal, in which the federal government targeted conservative organizations, involved several cases in which the agency illegally shared taxpayer information with other branches of government, and in one case leaked taxpayer information to a conservative organization’s political opponents.

In 2008, the confidential tax information of Joe “the Plumber” Wurzelbacher, who emerged as a critic of then-Sen. Barack Obama, was leaked illegally by an Ohio state official.

http://www.breitbart.com/big-journalism/2016/10/02/new-york-times-paid-no-taxes-2014/

-

10-02-2016, 04:17 PM #26

LOL!!! LOL!!! Oh that is good to know, artist!! Thank you so much for the research that exposes these hypocrites for what they are: SCUM BAGS!!

What about the Washington Post. Trump thinks they're in some financial trouble, too!

Here's an article from last December when Trump had 5 million followers on Twitter. Today Trump has 12 million followers.

__________________

Jeff Bezos’s Ownership of the Washington Post, Explained for Donald Trump

By Benjamin Freed on December 7, 2015

Republican presidential candidate and noted Twitter monster Donald Trump is on a tear this morning against the Washington Post. In a string of tweets, the bumptious developer states his belief that the Post is nothing more than a front for its owner Jeff Bezos in which Bezos can uses the paper’s financial losses as a tax write-off to alleviate the sting at his much more famous company, Amazon.

Amazon, like many huge global corporations, has an extremely complicated corporate tax structure and has struggled for most of its history to actually turn a profit. But for Trump to think that Bezos can write off potential losses at the Post to blunt Amazon’s balance sheet sounds like yet another one of his exaggerations. So, explained in terms Trump might understand, here’s a quick primer on how Bezos’s ownership of the Post works:

What did the Post do this time?

The Post literally cannot stop writing about Donald Trump, who leads in every poll. A Nexis search just over the last seven days turns up 228 articles from the Post that mention Trump. But who knows what set Trump off this morning? A spokesperson for Trump did not answer when Washingtonian—a real classy joint, by the way—asked if there was any article in particular to which he was reacting.

How does Bezos own the Post?

Unlike Amazon, a publicly traded company, the Post became a subsidiary of Nash Holdings, Bezos’s personal investment firm, when he bought the paper in August 2013. Bezos paid $250 million for one of the great US newspapers—one of the truly most stunning deals in the history of publishing, I have to tell you. But even under Bezos, the Post and Amazon are completely separate. Bezos owns 18 percent of Amazon, making him its largest shareholder by far, while he owns the Post outright as a private investor.

So how much money is the Post losing now?

Unclear. As the Post is privately held, its profits and losses are no longer disclosed to the public. It could be a huge loser. Who knows? Bezos doesn’t have to say. But at least as a publication, the Post‘s readership has never been more huge. In October, the Post finally topped the New York Times—which is also failing, according to Trump—in online readership, with 66.9 million unique visitors. That’s a terrific number.

But how does that minimize the losses at no-profit Amazon?

It doesn’t! The Post and Amazon are distinct companies that operate independently of each other. For most of its history, Amazon was a dummy loser company that never made any real money. But for the previous two quarters, the Seattle-based giant has posted profits, driven largely by the phenomenal, really huge success of Amazon Web Services, its cloud-computing division, which posted $2.1 billion in sales in the third quarter of 2015. Amazon reported $79 million in net income in the three months ending September 30, according to documents filed with the Securities and Exchange Commission. However, that figure is smaller than Amazon’s second-quarter profit of $92 million, so maybe it’s just going back to being low-energy.

Then how does the Post measure up?

Because the Post is now privately held, we have no way of knowing how those jabronis are doing today. But consider the earnings report filed from the public corporation Graham Holdings in the second quarter of 2013, when it was still known as the Washington Post Company. The newspaper division lost $14.8 million in that three-month span, or 0.7 percent of what Amazon Web Services just raked in during third-quarter 2015.

How is Amazon screwing the public on its tax bill?

Rather than using a relatively puny—and independently owned and operated—newspaper company to mitigate losses, Amazon, like many huge tech companies, uses a web of foreign subsidiaries to keep its international revenues from being subject to the United States’ 35 percent corporate income tax, and some other nations’ taxes. But earlier this year, Amazon actually relented a bit when it announced it would stop sending all of its European revenue through a Luxembourg subsidiary and begin paying taxes in individual European countries. Amazon still keeps plenty of money outside the United States, but it is hardly alone in this practice.

What about Trump’s tax bill?

Trump has said he plans to release his tax statements, but so far, his only disclosure has been a photo of him signing a pile of documents he described on Twitter as his tax return.

But while the paper stack is huge, the final sum Trump owes might not match up. “I fight like hell to pay as little as possible for two reasons,” he told CBS News in August. “Number one, I’m a businessman. And that’s the way you’re supposed to do it.”

So if and when Trump’s tax return ever becomes public and he has a shockingly low effective tax rate, remember that’s how it’s supposed to be, because business. And don’t forget the $40 million break his company got for turning the Old Post Office into a luxury hotel.

So, what kind of scam is Jeff Bezos running then?

Look, Trump tells you what’s on his mind, all the time. He’s got 5.11 million followers on Twitter, the most of any presidential candidate—Republican or Democrat. Bezos? He’s only got 47,000. What a joke. But there’s something they may agree on–neither billionaire follows Post Executive Editor Marty Baron. Sad!

https://www.washingtonian.com/2015/1...-donald-trump/A Nation Without Borders Is Not A Nation - Ronald Reagan

Save America, Deport Congress! - Judy

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

10-02-2016, 04:20 PM #27

HA!! HA!! Jeff Bezos apparently got rich making no money at all. He makes no money from Amazon and loses money from the Washington Post!! Yet he's a Rich Democrat. GO FIGURE!!

Hilarious.A Nation Without Borders Is Not A Nation - Ronald Reagan

Save America, Deport Congress! - Judy

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

10-02-2016, 04:28 PM #28

I hope Mr. Trump makes public the long list of companies, corporations, individuals, who paid no taxes or very little. This seems like it could blow up and expose a great number of people. A Pandora's box.

If Mike Pence is asked about this in the VP Debate on Tuesday, he should be ready as well to list names. Expose some Clinton/Obama "friends" using tax laws to avoid taxes where appropriate.Last edited by GeorgiaPeach; 10-02-2016 at 04:32 PM.

Matthew 19:26

But Jesus beheld them, and said unto them, With men this is impossible; but with God all things are possible.

____________________

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-02-2016, 04:49 PM #29

When you lose money, it's called a net operating loss, so to determine net income, you have to deduct the losses, or you're taxing on gross profits or gross revenues instead of actual net income. There is no other way to deal with profit and loss. And the CORRUPT MEDIA spin that claims this is just for "wealthy billionaires" is a lie. These tax laws on losses apply to every business and every person, regardless of size and wealth.

Income tax rates may change with larger, richer, etc., but this loss carry forward applies to all businesses and persons who own them and are required to declare net income on their personal return depending on how they set up their business, corporation or partnership or limited liability company, the latter two require business income and loss reported on the owners' personal tax return. Losses have to be carried forward, back or both. Otherwise the government isn't taxing net income, it's taxing gross, and that's illegal.Last edited by Judy; 10-02-2016 at 04:51 PM.

A Nation Without Borders Is Not A Nation - Ronald Reagan

Save America, Deport Congress! - Judy

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

10-02-2016, 05:26 PM #30

Who gives a crap!

We want to see Hillary Clintons Neaurological test, Speech transcripts, clintons personal bank records and the 30,000 + emails she deleted to cover up the criminal

Clinton Enterprise and numerous bogus foundation slush fund accounts!

Similar Threads

-

DHS Records Reveal TOP OFFICIALS WERE EXEMPTED FROM STRICT BAN PLACED ON WEB-BASED PE

By lorrie in forum General DiscussionReplies: 1Last Post: 06-17-2016, 09:51 PM -

Ancient Records Reveal Scary Sea-Level Scenarios

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 09-25-2014, 12:36 PM -

How 21,000 Wealthy Americans Avoided Paying Income Tax

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 06-01-2012, 01:59 PM -

Records reveal 'Co-President Hillary'

By Jean in forum illegal immigration News Stories & ReportsReplies: 0Last Post: 03-20-2008, 02:30 AM -

SPP Records Reveal Proposal For Funded Grants for Mexico

By avenger in forum Other Topics News and IssuesReplies: 3Last Post: 08-20-2007, 07:30 AM

34Likes

34Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Listen to William Gheen on Rense Apr 24, 2024 talking Invasion...

04-25-2024, 02:03 PM in ALIPAC In The News