Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-19-2010, 04:43 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Disappointing US Jobs Number Sees Stocks and Dollar Fall Whi

Disappointing US Jobs Number Sees Stocks and Dollar Fall While Gold Rises

Commodities / Gold and Silver 2010

Aug 19, 2010 - 10:48 AM

Gold rose to new 6 week highs at $1,237/oz after the disappointing US jobs number heightened concerns about the health of the US economic recovery. The rise follows yesterday's recovery from initial falls and marginal higher close as safe haven buying trumped an initial bout of profit taking.

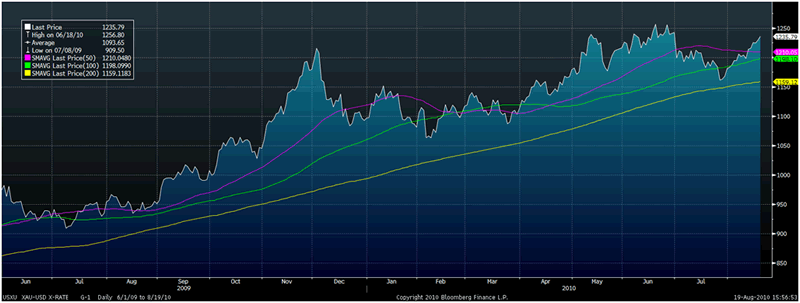

There is no technical resistance between this price level and the record highs (nominal) seen in June at $1,265/oz and the fundamentals continue to remain sound with safe haven demand remaining quite high - especially for this time of year.

Gold in USD Since June 2009 - Showing Summer Weakness and Autumn Strength

Gold may also be being supported by the deteriorating budget deficit figures in the US. The budget deficit will hit $1.342 trillion this year, the Congressional Budget Office forecast today. CBO, the Congress's nonpartisan budget analyst, also forecast a $1.066 trillion deficit for fiscal year 2011, which begins on October 1, up from the March estimate of $996 billion.

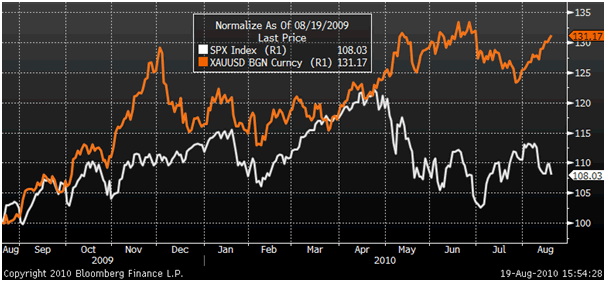

These very large benefits could lead to the dollar declining in value in the coming years versus other currencies - but especially versus gold. While the markets have ignored these real fiscal challenges to the US, it seems only a matter of time before they become a real issue leading to falling US bond prices and a falling dollar - both of which would benefit gold.

Gold and the S&P500 - 1 Year (Daily)

Gold is currently trading at $1,234.53/oz, â¬959.17/oz and £789.09/oz.

Silver

Silver is currently trading at $18.35/oz, â¬14.26/oz and £11.72/oz.

Platinum Group Metals

Platinum is trading at $1,521.50/oz, palladium is at $486/oz and rhodium is at $2,050/oz.

This update can be found on the GoldCore blog here. http://www.goldcore.com/goldcore_blog/

Mark O'Byrne

http://www.marketoracle.co.uk/Article22029.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Ukraine-Israel Bill Secretly Funds Biden's invasion!

04-24-2024, 12:01 PM in illegal immigration Announcements