Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

02-25-2012, 12:56 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

25 million adults live at home W/parents because they’re unemployed, underemployed

The compression of generations – 25 million adults live at home with parents because they’re unemployed or underemployed. The crushing cost of a college education today.

- Posted by mybudget360 in college, debt, economy, education, middle class, psychology

- 0 Comments

Where have the young adults gone?

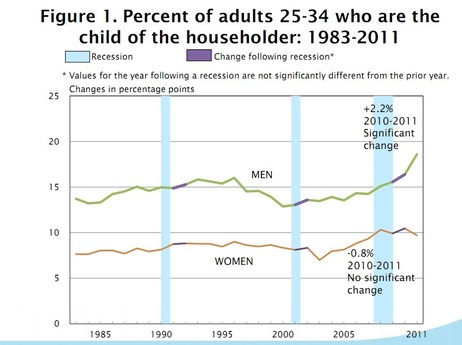

Without a doubt many young adults, those between the ages of 25 to 34 have moved back home (or never left home) because of the recession:

Source: Census

Part of the trend is unmistakable in that much of the growth has come from men. This is likely due to industries like construction taking a brutal hit once the housing market went bust. However the trend has also occurred with females if we go back to the early 2000s. There are a variety of reasons for this compression of generations. This is common in other parts of the world but certainly is a new phenomenon here in the US. In Italy it is common for men to live at home well into (and beyond) young adulthood but how well will this go in the US?

It doesn’t seem like much of this is by voluntary choice:

“(TIME) Nearly 25 million adults live at home with their parents because they’re unemployed or underemployed, they’re trying to pay off student loans or save money to buy a place, or for any number of other reasons. While calling mom and dad your “roommates” may be a smart financial move, it’s the kiss of death for a healthy dating life. Trulia’s survey found that only 5% of unmarried adults would be open to dating someone who lived with their parents.”This might also explain a massive slowdown in the first time homebuyer market since many purchase their first home between the ages of 25 to 34. It is tricky to purchase a home when people are working low-wage jobs or simply not working at all. The massive amount of student debt also hangs above many from moving into another major debt purchase. As the above data highlights living with your parents might be good for your pocketbook but it might be difficult to woo a potential partner when living at home for many reasons. Yet this also delays the need for a home since there is little need for larger spaces when you are single.

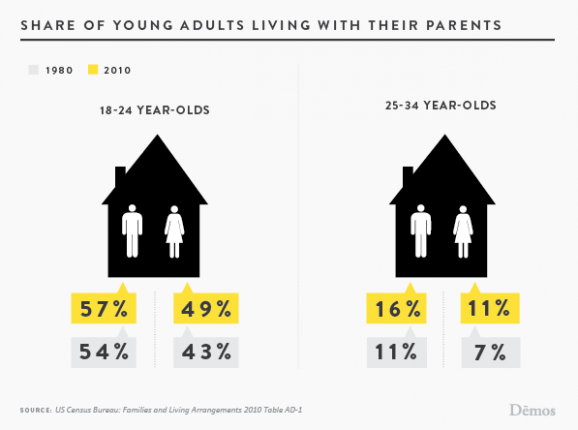

Without a doubt the trend of young adults living at home has increased:

The markets might be crying out at a recovery but for young adults, the recession is still in season. A large part of this problem stems from the wicked maze that has become our higher education system. Make a mistake today and you can be saddled with tens of thousands of dollars in debt for life with a paper mill degree. Even two decades ago this was not possible. Today with the financialization of college for-profits saddle students with enormous levels of debt but with a degree that yields very little in the marketplace.

The crushing blow of college debt

In 1997-98 for-profits enrolled 3 percent of all undergraduates.

Today they are up to 9 percent. What is more troubling is the disproportionate amount of federal aid these institutions draw:

Source: Chronicle of Higher Education

For-profits, although 9 percent of all undergraduate enrollments eat up 22 percent of all unsubsidized Stafford Loans and 21 percent of all Pell Grants. With for-profits now enrolling close to 2,000,000 students you have a large number of young adults with degrees that will not likely yield a solid return on their investment (if any at all aside from a large debt load).

If students from competitive schools are having a hard time finding suitable employment what of those that went to these schools? It seems like many are catching on but not before nationally student loan debt races to the $1 trillion mark.

The trend for automation

Self-checkout stands, self-serve kiosks, and other items of automation are part of our modern day economy. But you can rest assured that they are not creating much in the way of jobs:

“(TIME) It’ll be interesting to see what Coinstar and other businesses try to sell via vending machines during the test stage. Sneakers? Jewelry? A home mortgage? An entire dinner in a pill, like something out of “The Jetsons”? Who knows.This is a trend that seems unstoppable. For those with few skills the manual labor positions are being automated out. Think of Redbox for example. This is a boom sector for Coinstar but each one of the 28,000 kiosks does very little in adding a job. Today there are 28,000 Redbox locations with revenues of $774 million. Not bad but will these add many jobs? That seems to be the conundrum of our modern economy.

Here’s one thing we can be pretty sure of, though: The spread of vending machines is unlikely to do much in the way of creating jobs.”

The current economy and the recent recession have been particularly rough on young adults. Many are moving back home with parents and this trend seems to be holding strong. With the cost of college soaring and stagnant wages, the money will have to come from somewhere.

The compression of generations

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Oklahoma House passes bill making illegal immigration a state...

04-19-2024, 05:14 AM in illegal immigration News Stories & Reports