Results 1 to 6 of 6

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-17-2013, 02:55 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Chase Bank Prepares For Bank Runs – Updated! Limits Cash Withdrawals, Bans Internatio

Chase Bank Prepares For Bank Runs – Updated! Limits Cash Withdrawals, Bans International Wire Transfers

Wednesday, October 16, 2013 8:47

(Before It's News)

Update: Christopher Greene has just put out the following video report on this unfolding story. The original story, including a copy of the letter from Chase Bank, is down below this video.

Chase Bank has made the move to limit cash withdrawals as shared in this story from Infowars . Is this but the latest sign of an economy and society ready to totally collapse? This latest signal is but the most recent one in a series that spell out a much bigger picture. A video report about the rapidly crumbling US economy is also below.

Chase Bank has moved to limit cash withdrawals while banning business customers from sending international wire transfers from November 17 onwards, prompting speculation that the bank is preparing for a looming financial crisis in the United States.

Numerous business customers with Chase BusinessSelect Checking and Chase BusinessClassic accounts have received letters over the past week informing them that cash activity (both deposits and withdrawals) will be limited to a $50,000 total per statement cycle from November 17 onwards.

http://beforeitsnews.com/economy/201...s-2561750.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-17-2013, 03:51 AM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Confirmed: Chase bank drops the hammer on capital controls; no money allowed to transfer out of USA starting Nov. 17th

Mike Adams

Natural News

October 16, 2013

(NaturalNews) I admit that when I saw today’s breaking news on InfoWars.com about Chase Bank limiting cash withdrawals and banning international wire transfers, I was skeptical. Many readers didn’t believe it, either. So just to check it out, I called my own accounting team to ask if we had received a similar letter from Chase, announcing that no international wire transfers would be allowed after Nov. 17th.

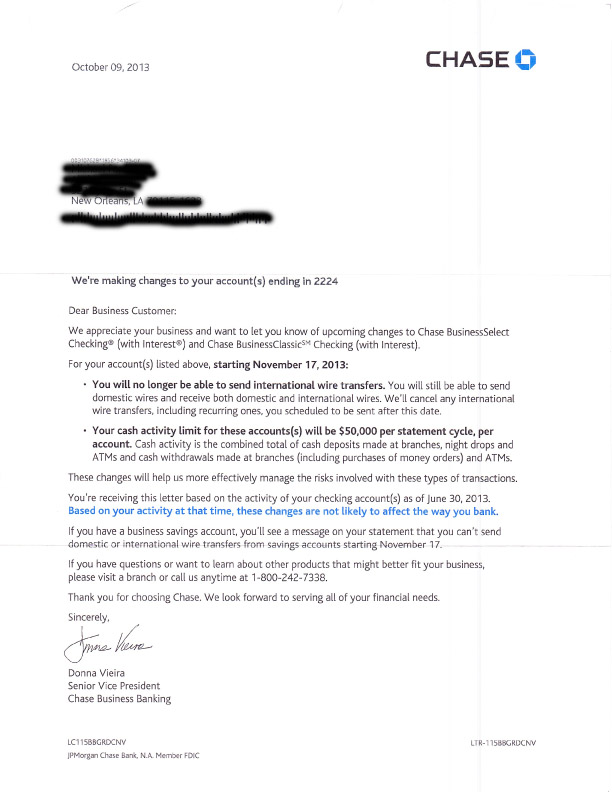

Sure enough, we were sent the same letter! I’ve posted a JPG image of the letter below so you can read it for yourself.

Or Click here to see the hi-res scan of this letter. This is the letter that we received directly from Chase. This is not secondhand information.

The letter clearly states that beginning November 17:

• All international wire transfers will be disallowed.

• All cash activity, including cash withdrawals and deposits, will be halted at “$50,000 per statement cycle.” How are businesses who deal with a lot of cash (such as restaurants) supposed to function under such restrictions?

Chase Bank representatives told Natural News “everything is fine”

We called and spoke with Chase Bank to ask why these capital controls were being implemented on November 17th.

Their response was that these changes were being implemented “to better serve our customers.” They did not explain how blocking all international wire transfers would “better serve” their customers, however.

Chase Bank specifically denied any knowledge of problems with cash on hand, or government debt or any such issue. They basically downplayed the entire issue and had no answers for why capital controls were suddenly being put into place.

Dropping the hammer on capital controls

This is the beginning of the capital controls we’ve been warning about for years. Throughout history, when governments are on the brink of financial default, they begin limiting capital controls in exactly the way we are seeing here.

Following that, governments typically seize government pension funds, meaning the outright theft of pensions for cops, government workers, etc., is probably just around the corner.

Finally, the last act of desperation by governments facing financial default is to seize private funds from banks, Cyprus-style. The precedent for this has already been set in Cyprus, and when that happened, I was among many who openly predicted it would spread to the United States.

This is happening, folks! The capital controls begin on November 17th. The bank runs may follow soon thereafter. Chase Bank is now admitting that you cannot use your own money that you’ve deposited there.

This is clearly stemming from a government policy that is requiring banks to prevent cash from leaving the United States. Such policies are only put into place when a huge financial default event is expected.

More updates to follow. Stay tuned to Natural News for intelligent analysis of why this is happening. We are already receiving word that this may have something to do with the “Dodd-Frank Wall Street Reform and Consumer Protection Act” and we are looking into it further.

Here’s the letter we received:

Learn more: http://www.naturalnews.com/042529_Ch...#ixzz2hvOVVTj7

This article was posted: Wednesday, October 16, 2013 at 5:01 pm

Tags: economics, financial

Related Articles

- Chase Bank Limits Cash Withdrawals, Bans International Wire Transfers

- Cyprus Bank Deposits Plunge By Most Ever During “Capital Controls” Month

- It’s Official — America Now Enforces Capital Controls

- Obama Already Placed ‘Soviet-Style’ Capital Controls on Americans Two Years Ago

- Chase Employees Admit Orders from Top to Limit Cash for ‘Unknown Reasons’

http://www.infowars.com/confirmed-ch...ting-nov-17th/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-17-2013, 03:54 AM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Chase Employees Admit Orders from Top to Limit Cash for ‘Unknown Reasons’

Chase information center employees admit ‘orders from the top’ were issued to limit finances for reasons that even they do not know

Anthony Gucciardi

Infowars.com

October 16, 2013

Following the documented reports that Chase bank had been limiting overall cash withdraws from various accounts and freezing wire transfers, I decided to get to the bottom of the issue and call the nationwide Chase information line. What I found is that not only did every business account owner receive a document detailing strange measures to limit their overall account usage to a $50,000 maximum and the complete restriction of wire transfers, but that even the Chase employees themselves had no idea why the measures had been instituted.

Instead, they simply told me that the orders ‘came from the top’ and that not even the highest level managers at the information center knew why they had been instituted. But what’s more, I was also told that these ‘regulations’ may also hit other banks around the country.

When speaking to the supervising manager on the account caps and transfer restrictions, I was told that the entire thing could be the result of ‘regulation’, which may have actually stemmed from government higher ups.

The supervising manager even went on to answer my question as to why Chase customers are not allowed to access their own finances, telling me that it is possible for customers to ‘pay a fee’ to withdraw their funds after ‘upgrading to a platinum account’ for an unspecified amount of upgrade costs. Now remember, this entire lockdown was initiated over ‘risks’ and the continued ‘safety’ of the bank’s finances. So what are they so afraid of when it comes to giving customers their own finances?

The reality is that banks are gearing up for a Cyprus-style scenario, where even your own finances are held captive by the mega banks through either regulation or orders from the top. Specifically, the mega banks absolutely hate cash payments and deposits, because they deal only in debt-based digital numbers on a screen.

I would encourage everyone to immediately transfer their finances out of Chase bank, but don’t expect a lengthy delay in this policy when it comes to infiltrating the other mega banking establishments.

—-

Anthony Gucciardi is a writer, analyst, and Founder of Storyleak.com whose articles are routinely featured on top sites like Drudge Report and regularly appears on national and international television media.

This article was posted: Wednesday, October 16, 2013 at 7:49 pm

Tags: cash limits, chase, chase bank, employees

Related Articles

- Chase Bank Limits Cash Withdrawals, Bans International Wire Transfers

- Confirmed: Chase bank drops the hammer on capital controls; no money allowed to transfer out of USA starting Nov. 17th

- US Banks Stuffing ATMs With 20-30% More Cash In Case Of Panicked Withdrawals

- Cleveland police suspend 63 officers over deadly chase

- TSA Workers Admit To Stealing Huge Amounts Of Cash From Passengers

http://www.infowars.com/chase-employ...known-reasons/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-17-2013, 04:13 AM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Avoiding Cyprus; Chase Bank Implements Cash Transaction Limits, Bans Transfers

Posted by: Sam Wright Posted date: October 16, 2013

In: Economics, News

Quite possibly just taking a forewarning from the crisis in Cyprus, Chase bank has sent out letters to various customers informing them of their new policies regarding cash transactions and international transfers. After the banking industry witnessed international bank gouging, it seems that Chase has decided to err on the side of caution with its implementation of a $50,000 monthly transaction limit to cash activity, and bans on international transfers. While the limit may not seem all too excessive to some, the damper it proposes to small businesses could be a bit restrictive.

Speculation is being made that Chase is anticipating a collapse of the U.S. economy, and subsequently the dollar. Such fears might now be unwarranted after the announcement of Republicans to cave on the government shutdown, and re-open with funding to bills that include Obamacare through January. Chase has already been under heavy eye from the banking community after recent events when customers went to withdraw cash, only to find that their account balances had been zeroed out.

Whatever the motivation for the new policies, it is safe to say that Chase is protecting its own interests above that of the U.S. consumer first.

http://freepatriot.org/2013/10/16/av...b_source=pubv1Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-17-2013, 08:41 AM #5Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Chase Bank Chases Away Customers

http://www.youtube.com/watch?feature...&v=OvHgwLoiBU0Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-17-2013, 09:39 AM #6Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

"YOU WILL FOOT THE BILL FOR ILLEGAL IMMIGRANTS!" GOVERNOR HOCHUL...

04-23-2024, 05:46 AM in Videos about Illegal Immigration, refugee programs, globalism, & socialism