Results 1 to 7 of 7

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-26-2022, 11:06 AM #1

China After The Party Congress: What Now? Tyler Durden's Photo BY TYLER DURDEN MONDAY

It sounds like there was an attempted Coup

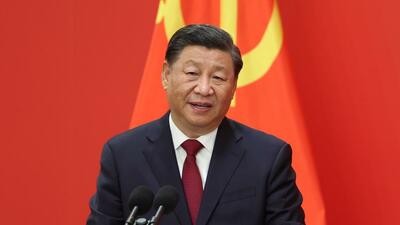

When Xi Jinping’s predecessor as leader of China and its Communist Party, Hu Jintao, was removed from the closing session of the Party Congress on Oct. 22 in full view of the 2,300 delegates, it was a demonstration to the world that Xi had swept aside all rivals and is now the undisputed ruler of the nation.

China After The Party Congress: What Now?

MONDAY, OCT 24, 2022 - 11:40 PM

Authored by Roger Garside via The Epoch Times,

When Xi Jinping’s predecessor as leader of China and its Communist Party, Hu Jintao, was removed from the closing session of the Party Congress on Oct. 22 in full view of the 2,300 delegates, it was a demonstration to the world that Xi had swept aside all rivals and is now the undisputed ruler of the nation.

Yet, in his political report to the Congress, Xi listed an array of deep-seated problems, which his victory does nothing to resolve because they are the product of the political system he is determined to defend. Indeed, his victory will exacerbate these problems because in choosing subordinates, he has given priority to loyalty to him over experience and competence in government.

More importantly, the problems have essentially been caused by the very political system that Xi and his supporters are ever more determined to defend. They include economic problems like the debt mountain, an ecological catastrophe, a “zero-COVID” strategy that has led to isolation and perpetual lockdown, and the increasing hostility of the United States and its allies.

China’s body politic is terminally sick. It is like a person suffering from an advanced stage of uremia who can only be saved by a kidney transplant. China requires a political transplant: a democratic revolution.

Instead of systemic change, Xi has chosen a trajectory that has intensified China’s problems. He has replaced the “reform and opening” of Deng Xiaoping with regression and closure. He prioritizes state-owned enterprises over the private sector that produces the wealth. To rule, he relies upon techno-totalitarianism, not trust. His premature strategic challenge to the United States and its allies has turned their benign partnership into hostility and distrust. In all this, he is alienating 500 million Chinese who produce wealth, and enjoyed the newfound freedoms to create businesses, and travel and study abroad that Deng’s strategy brought them.

As unsolved problems give birth to crises - the debt mountain led first to the collapse of the property sector, and now to a slow-motion financial crisis - Xi will intensify confrontation with the United States and its allies, to mobilize nationalist sentiment behind him, exploiting the chauvinism long nurtured by the regime. This will be very dangerous for the world. Xi will be surrounded by yes-men who will not dare to restrain him.

We cannot sit back and wait for China’s autocracy to implode. We must be proactive.

We have great assets to mobilize, such as the world’s major reserve currencies, capital markets, pools of investment finance, and centers of scientific and technological creativity. After a slow start, the United States is taking decisive action; its allies must follow suit.

We cannot dictate how China is governed, but we can enable those Chinese who want systemic change to achieve it. Occasions such as the 20th Congress give a false picture. This is a regime that is outwardly strong and inwardly weak. If Xi were truly strong, he would not need to have his predecessor dragged out of the Congress. If the Party were truly confident, it would submit itself to the judgment of the people in free elections in place of this charade of strength and unity.

China After The Party Congress: What Now? | ZeroHedge

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-26-2022, 11:18 AM #2

"One Wonders Who The Real Morons Are"

A good winnowing mechanism of knowing if you are dealing with an IYI is if, given a free choice, they focus first on the Sunak story, and not on what happened in China over the weekend.

"One Wonders Who The Real Morons Are"

MONDAY, OCT 24, 2022 - 11:05 AM

By Michael Every of Rabobank

Hu's who and what's what

For some, today’s big news is former British PM BoJo dropping put of the Tory leadership contest, marking the coronation of former Chancellor Sunak as the next national leader. There will be chatter of what this means for the UK’s “moron risk premium”. Yet given markets, central banks, and actors like Sunak built a global system that is not only not failsafe, but which is de facto designed to fail in terms of healthcare, supply chains, inflation, energy security, financial stability, the environment, and even national defence, one wonders who the real morons are. As Taleb might put it, those talking about MRP hold their own Intellectual Yet Idiot (IYI) risk premium, which ironically they aren’t pricing correctly, e.g., Friday already saw a spike in key bond yields and collapse in JPY, requiring central-bank interventions that won’t resolve things at all.

A good winnowing mechanism of knowing if you are dealing with an IYI is if, given a free choice, they focus first on the Sunak story, and not on what happened in China over the weekend.

Xi Jinping was reappointed Secretary General of the Chinese Communist Party for another, unprecedented five-year term: as age-limit rules were broken, and the party constitution rewritten to place Xi’s philosophy at its core, while making it the duty of CCP members to protect it and Xi, most China experts say there could be more terms to follow. This extension of power was also a centralisation. The Politburo and key positions were stacked with Xi supporters: ‘Ideology czar’ Wang Huning stepped up; former Shanghai boss Li Qiang is the new Premier; ‘market-favourites’ Li Keqiang and Liu He stepped down. Moreover, despite the CCP’s media stewardship of its Congress, Xi’s predecessor Hu Jintao was forcibly ejected in front of cameras. The official excuse was that he was feeling ill: the CCP are aware the images struck many analysts as deliberate.

Bloomberg says, ‘Chinese Markets Tumble as Xi’s Tightening Grip Alarms Investors.’ Weren’t some there saying now was the time to buy just days ago? Won’t they be doing so again in hours?

China data were just released after a Congress-driven lag, and they were much better than expected: was someone busy the last few days? Growth was 3.9% q-o-q vs. 2.8% foreseen, and in y-o-y 3.9% vs. 3.3%, though year-to-date (ytd) still 3.0% as projected, suggesting backwards revisions. Elsewhere, industrial production was 6.3% y-o-y ytd vs. 4.8% expected even as local and global demand withers; retail sales were 0.7% y-o-y ytd, less than consensus; fixed asset investment was 5.9% y-o-y ytd vs. 6.0% expected; property investment was -8.0% y-o-y ytd, worse than the -7.5% expected; new home prices fell -0.3% m-o-m; and residential property sales -28.6% y-o-y, slightly better than -30.3% last month. I am not sure how much sense the GDP headline makes in the total context, or how much time we should spend worrying about it going forwards.

The balance of data show a litany of problems depressingly familiar to the West: too much private debt - Chinese consumers run higher debt-to-income ratios than Americans; too much public debt - local government revenue to expenditure ratios are just over 50%, and consolidated public sector deficits already sit at war-time levels; over-priced, over-supplied housing markets; massive income and wealth inequality; structural deflation – as the West had until 2021; a demographic collapse – the Chinese population could be close to that of the US by 2100; declining global demand for all goods, including Chinese (as export growth just slipped to 5.7% y-o-y while import growth stayed at 0.3%), as the US has clearly shifted demand to other producers since the Trump; and a Cold War, where the US is deliberately blocking access to technology.

How do you think China will resolve these structural problems? To clarify for IYIs, how will it resolve them in line with Marxist-Leninist-Maoist-Xi Jinping Thought? Does it mean more cheap stuff for the West, low inflation, and free hugs? Sadly, the potential disruption to such Western “because markets” analysis is enormous.

To put this in context, a recent global public opinion survey already showed pro-China sentiment collapsing in many nations while positive opinion of US has rebounded. The Financial Times carries an op-ed from former Australian PM and China-dove-turned-hawk Rudd, who even before the final Politburo line-up was clear and the Hu incident was arguing, ‘Xi’s congress report lays bare an aggressive and statist worldview’.

Businesses are not unresponsive – but naturally conflicted.

The Asia Nikkei says ‘Japanese companies explore how to go 'zero-China' amid tensions’, and claims Honda has been pursuing a plan to cut China from its supply-chain – and finding out this is going to be fiendishly expensive/inflationary.

Germany’s Chancellor Scholz, busily backsliding on pledges to rearm “because inflation” (to paraphrase Blair, “If you think defence is expensive, try a lack of it.”), is insisting trade with China must continue, and China can buy a stake in Hamburg port despite the idea being shot down by all other stakeholders. Then again, as Eastern Europeans currently quip, Germany is a trade association pretending to be a state.

Perhaps summarizing the United States’ view, The Hill runs a pull-no-punches op-ed by a former China writer for The Economist Intelligence Unit titled, ‘Ten years ago, we got Xi Jinping wrong. On his coronation, we should reflect on why.’ It opens that pro-China Western experts “to a man, […] got it wrong.” It underlines, “In my time in China, I have met some fascinating characters who are essentially selling out American interests but are completely oblivious to their own role, or the collective role of the business community.” It concludes, ”People in my network express alarm that just as they are waking up to the threat from Xi’s China, they are becoming increasingly powerless to effect change within their own organizations. Perhaps this sensational week in Beijing will help to reverse that trend. But I wouldn’t bet on it.”

Not betting on business as usual is historian Niall Ferguson, who has a doughty op-ed on Bloomberg, and a doughtier academic paper to back it up, which underline to IYIs why this matters. It is titled, ‘How Cold War II Could Turn Into World War III: History shows that nothing causes fiscal and monetary instability quite like multiple big, long conflicts.’ The key points are:“Great conflicts were the dominant phenomena of the 20th century, transforming economic, social and political life almost everywhere. But in recent times, their importance has somewhat faded in most minds. It would not be too much to say that during the interwar era of 1991 to 2018 --in other words, the period between Cold War I and Cold War II-- many economists and policymakers lost interest in war.In short, money-supply growth is higher; productivity is worse; demographics are worse – more elderly people means higher inflation, not higher asset prices “because retirees”; fiscal positions are far worse; financial markets are more fragile; so is the environment.

Because the wars of the interwar era were relatively small (Bosnia, Afghanistan, Iraq), more closely resembling colonial policing operations, we forgot that war is history’s most consistent driver of inflation, debt defaults - even famines. Large-scale war is simultaneously destructive of productive capacity, disruptive of trade, and destabilizing of fiscal and monetary policies. Economists tend to treat wars as “exogenous shocks,” generally omitting them from their models. From the historian’s standpoint, however, war is not exogenous, but the endogenous prime mover of the historical process - “the father of all things,” as Heraclitus said.

First, wars have played a very noticeable role in the history of inflation expectations… Second, wars have often been responsible for discontinuities in the history of interest rates.”

Ferguson underlines Covid engendered both war-scale fiscal responses and a war-style shut down of productive capacity: and here we are today; and war is still with us.

“It goes without saying that the return of great-power conflict has made the life of policymakers difficult, just as it did in 1973. I recently heard it said that the 2020s are not likely to be as inflationary as the 1970s because labour is less organized, so the risk of a wage-price spiral is lower. But I would draw your attention to a number of important differences that make our contemporary circumstances more worrisome than the situation in the 1970s.”

Ferguson concludes:“We may get lucky. We may get away with just re-running the 1970s - though judging by recent events in the UK, we may do it at a rather higher speed: from the inflationary Barber budget (1972) to the Winter of Discontent (1978-9) in a matter of weeks rather than years. Yet there is a much worse scenario, in which we get something closer to the 1940s, with regional conflicts coalescing into something like World War III - albeit with smaller armies, many unmanned weapons systems, and far more powerful and accurate bombs.”He decries both the US National Security Strategy and China. He worries that if we pursue Cold War II, we risk stumbling into World War III. Yet he does not suggest any off-ramp from the ramping up now evident on both sides.

Meanwhile, IYIs talk about Moron Risk Premiums, not the bigger picture risks that they “don’t do”.

Indeed, neoliberalism is so deeply entrenched in some minds that Adam Tooze shares the argument from the Centre for Economic Policy Research that Ukraine, in a total war against Russia, should embrace radical economic reforms that wither the size of its state to improve its fighting efficiency, rather than continue with the statist (Western-backed) mechanisms every economy has used throughout history. Ukrainians might suggest those authors try the front lines and see how they feel about the superiority of free markets vs. centralized authority.

"One Wonders Who The Real Morons Are" | ZeroHedgeIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-26-2022, 11:20 AM #3

China Stocks Crash As Xi Tightens Grip On Power

"While Chinese politics have long been opaque, this sharp consolidation of power is adding to investor unease"

China Stocks Crash As Xi Tightens Grip On Power

MONDAY, OCT 24, 2022 - 10:01 AM

Shares in Chinese companies crashed Monday morning as traders were spooked by the consolidation of power by President Xi Jinping. After a weeklong Party Congress, Xi was confirmed for a third presidential term on Saturday.

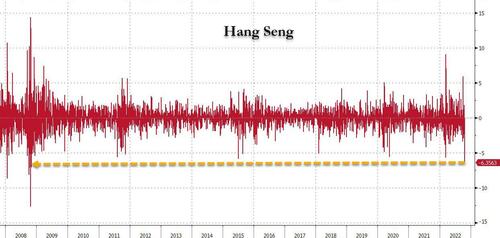

Traders fear more stringent regulations on technology companies pushing these stocks very deep into the red. The Hang Seng Index plunged to a 13-year low, dropping more than 1,000 points before closing around 15,180. The index saw a 6.4% drop, the most significant one-day drop since 2008.

The Hang Seng Tech Index dropped as much as 9%. The index is down more than 74% since peaking in 1Q21.

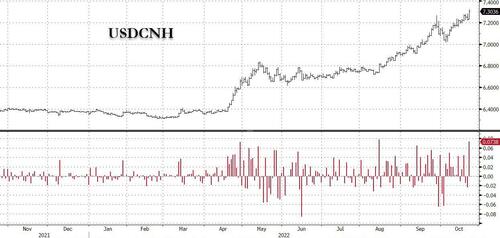

The offshore yen resumed its decline, tumbling by 1.3% - the biggest one-day slide since August 2019, to a record of 7.31.

China tech companies such as Alibaba and Tencent plummeted more than 11% in Asia. Internet search company Baidu closed down 12% while Meituan plunged 14%. BABA shares listed in the US are down more than 11%, trading at 2016 lows.

Nasdaq Golden Dragon China Index slumped 12%.

Downward press in Chinese stocks comes at the end of the 20th Chinese Communist Party Congress, which has solidified Xi's third term, surpassing the historical precedent of a two-term limit and is now the longest leader since Mao Zedong. This has undoubtedly alarmed investors with more political uncertainty and regulatory headwinds."While Chinese politics have long been opaque, this sharp consolidation of power is adding to investor unease. Equity valuations, already near a 10-year trough, will likely face more pressure if international investors demand a higher risk premium," Mark Haefele, CIO at UBS Global Wealth Management, said.Xi's consolidation of power also suggests an end to zero-Covid restrictions seemed less likely, while the latest economic data shows a weak recovery.

"Now that the new Politburo standing committee is packed with Xi's own picks and those in rival factions ... were all out, it becomes clear that no other political elite dares to challenge his policy mistakes or even deviate however slightly from his preferred policy agenda, which of course over the past few years has focused on favoring the state sector at the expense of the private one," Xin Sun, senior lecturer in Chinese and East Asian business, at King's College London, told CNBC via email.Marvin Chen, a strategist at Bloomberg Intelligence, said after the leadership transition is finalized, traders will "focus on the economy and mending the property sector." He said the property market is a fragile sector of the economy, adding, "still, these may take time. We may not see much change to Covid policies in the near term."

The selloff in Chinese stocks is appealing to some investors though they said an inflection point of when to buy is still unknown. This was explained by Xiadong Bao, fund manager at Edmond de Rothschild Asset Management in Paris:"A lot of bad news have been baked in and the market correction is clearly overshooting, but we're still looking for an inflection point which is unclear for now."Besides leadership fears and a souring economic outlook, traders avoid Chinese stocks. One reason is because of the Biden administration's economic war on Beijing. Then the Federal Reserve's aggressive monetary tightening made emerging market equities unappealing.

"Foreigners are selling out of tech now," said Hao Hong, partner and chief economist at Grow Investment Group. "Right now, except the historical precedents and cheap valuation, there is nothing working for Chinese tech."So with China stocks set for the most significant drop since the global financial crisis -- traders and asset managers continue to shun these stocks as there are too many overhangs and not enough positive upside catalysts in the near term.

China Stocks Crash As Xi Tightens Grip On Power | ZeroHedgeIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-26-2022, 11:53 AM #4

China Congress Ends As "Dictator For LIfe" Xi Stacks Inner Circle With Loyalists; Equity Market Implications

"The appointments of Xi's associates to the highest positions of power in China indicates that Xi's vision for China will be rigidly executed in the next decade"

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-26-2022, 12:01 PM #5

It sounds to me like it was attempted Coup and the plotters are being rounded up

Former China President Abruptly Escorted From Party Congress

The incident has gone unmentioned in Chinese state media coverage of the event...

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-27-2022, 10:42 AM #6

China arrested a senior globalist after uncovering an assassination attempt on Ji Jinping

Thread: Situation Update: Russia Holds Nuclear Drills As Nuclear WW3 Looms! Kiev Regime's Dir

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-29-2022, 12:19 AM #7

Russia gave intel to President Xi that a Western backed Coup was being activated to take him out

Thread: Juan O' Savin: "Where Was The Trump Arrest?" (Video) Friday, October 28, 2022 22:11

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

National Security Threat: China's Eyes In America Tyler Durden's Photo BY TYLER DURDE

By Airbornesapper07 in forum Other Topics News and IssuesReplies: 0Last Post: 09-15-2022, 02:22 AM -

Have We Entered The New Dark Ages? Tyler Durden's Photo

By Airbornesapper07 in forum Other Topics News and IssuesReplies: 0Last Post: 09-03-2022, 01:54 PM -

Victor Davis Hanson: Why The Left Will Cut Biden Loose Tyler Durden's Photo BY TYLER

By Airbornesapper07 in forum Other Topics News and IssuesReplies: 1Last Post: 06-25-2022, 06:41 AM -

Greenwald: The Neoliberal War On Dissent In The West Tyler Durden's Photo BY TYLER DU

By Airbornesapper07 in forum Other Topics News and IssuesReplies: 0Last Post: 02-22-2022, 07:51 AM -

The Consequences Of System Failure Profile picture for user Tyler Durden by Tyler Du

By Airbornesapper07 in forum Other Topics News and IssuesReplies: 0Last Post: 10-30-2018, 09:09 AM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Californians now ARMING themselves after Border Patrol dumps...

04-18-2024, 05:14 PM in General Discussion