Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-08-2012, 05:43 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Is College Worth The Money And Debt? The cost of college increased by 11x since 1980

Is college worth the money and debt? The cost of college has increased by 11x since 1980 while inflation overall has increased by 3x. Diluting education with for-profits. and saddling millions with debt.

- Posted by mybudget360

- 3 Comment

Is a college degree worth it? Since the debt bubble burst spectacularly in 2007 many more prospective students are questioning the worth of a college degree. For so many decades it was simply taken at face value that getting a college degree, any college degree would be worth it. Slowly this perception has morphed when annual tuition is running at $20,000 or more at for-profit institutions and $50,000 for private institutions. More to the point, most of the recent educational growth has been financed with large wallet crushing student loans. This financing of the college dream is turning out story after gut-wrenching story of college education nightmares. When a college education becomes this expensive it is important that potential students become savvy consumers. The financial sector certainly isn’t going to offer any advice on navigating the minefield of higher education since they largely have their greedy hands on this sector of the economy as well.

The soaring cost of college

In hindsight everyone seems to now agree that the housing bubble was rather obvious to spot since it far outstripped every measure of inflation and even rose while incomes fell. You would think this lesson would be learned but the cost of a college education is much deeper into bubble territory even beyond the metrics of the housing market at its peak:

Source: Cluster Stock

While housing at the peak rose by a factor of 4 (400 on the chart) college tuition has soared by a factor of 10 (it hasn’t stopped going up so it is now likely up in the 11x or 12x range). It is a downright startling figure especially when the incomes of recent college graduates has gone in the complete opposite direction:

Source: BusinessWeek

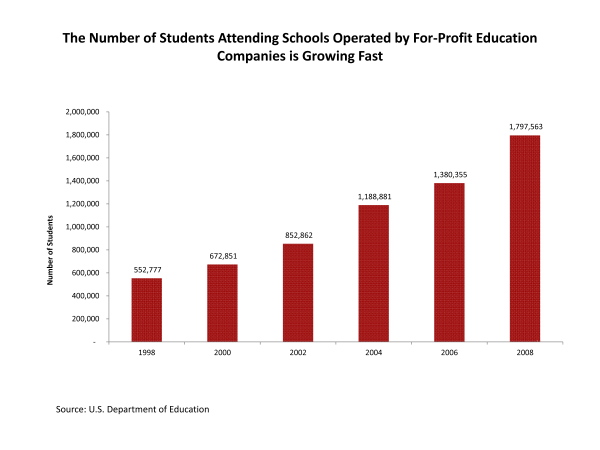

Since 2000 real earnings for college graduates has fallen while tuition costs continue to soar and put students into further student loan debt. I was hearing a few stories about states with record applicants to public universities yet with state budgets hurting, these schools are unable to meet the demand. So students are left with the option of $50,000 a year for private institutions or going to for-profits that are a step above paper mills. For this reason we have seen a giant increase in for-profit enrollments:

Source: Senator Harkin

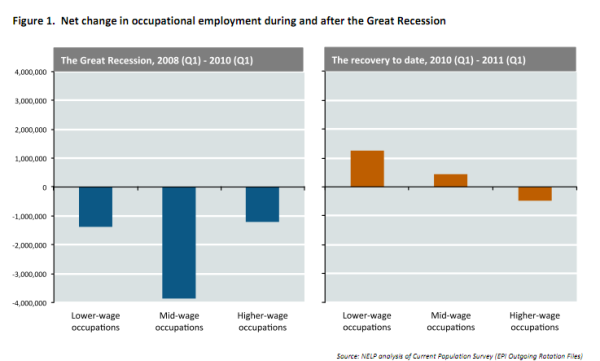

For-profits have tripled their growth since 2000 which I also believe has diluted the earnings potential of the overall college pool and has also saddled many students with incredible amounts of debt. We are set to surpass the $1 trillion mark in student debt in 2012. The recent recovery has been a low-wage employment recovery so many recent graduates are coming out with heavy debt burdens and finding employment opportunities that pay much less:

Source: NLEP

We have lost a stunning 5,000,000+ mid-wage to high-wage jobs and have only added 1,000,000 since the recovery started way back in the summer of 2009. Yet the pool of graduates continues to grow. Another startling fact is many state schools are seeing peek applications even though high school graduation trends show a smaller cohort. Why? You have many people going back to school trying to retool especially after losing a job. Yet going to a for-profit school for gaming, art, or some other career path may prove to be a very expensive realization that not all college degrees are created equal. In many instances students would be better set if they went to a 2-year college or a trade school to pick-up the education they require.

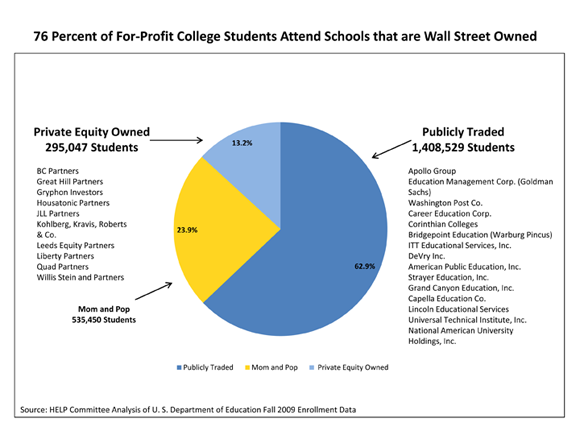

“The difference of course is that state schools do not market to you. You have to go to them. The for-profits spend more money on marketing than they do on instruction. That should tell you where their priorities sit.”Most of the for-profits are owned by large financial institutions that had their hand in this economic meltdown we are living through:

So a lot of the dilution in educational quality has come at the hands of these institutions. However, you also have private institutions outside of the top-tier that are heavily marketing and recruiting to pull students into their expensive four year traps. There are a few rules you should follow if you are not sure how much debt you should take on when pursuing a college education:

-First, your maximum student loan debt should not pass your expected annual salary after college.The net worth gap between younger and older Americans is already large enough and doesn’t need to be bigger with the saddling of student debt:

-Second, you should do your own market analysis of the field you are going into. Many of these schools promise unrealistic placement data.

-Third, if unsure, look at 2-year state schools and transferring to a state 4-year institution. Because of budget constraints and the above factors, state schools have gotten more competitive because people realize the other options are either too expensive or simply not worth it.

-Finally, If you really want to go to a private institution, consider a state school first and transferring into a graduate degree later.

Source: CNN Money

To expect a 17 or 18 year old to understand this is hard to see but parents need to step it up but with the average per worker salary being $25,000 it is doubtful many parents have the resources to run an in-depth market analysis when it comes to choosing the right school or program. As usual do your own due diligence and don’t be fooled by the notion that all colleges are created equal and that college is priceless. At these cost levels, you better believe that there is a significant price.

http://www.mybudget360.com/is-colleg...fit-education/

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-08-2012, 12:40 PM #2

At one time I believe a college degree was worth the money and effort however in today's climate of super poor colleges plus high cost many would be better served by a trade, electrical,welding, etc but so many look down on working with your hands most won't consider:

Prior to my retirement we hired many young people with 2-4 years of college, math skills and simply common sense of daily work life was beyond them basically it was much like training a 9 year old in the 50's, scary stuff the fact they are put in charge of this country in any manner: Our education system has failed if we want to move forward need to admit that before anything can be done.I'm old with many opinions few solutions.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Ukraine-Israel Bill Secretly Funds Biden's invasion!

04-24-2024, 12:01 PM in illegal immigration Announcements