Results 1 to 5 of 5

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-11-2022, 10:33 AM #1

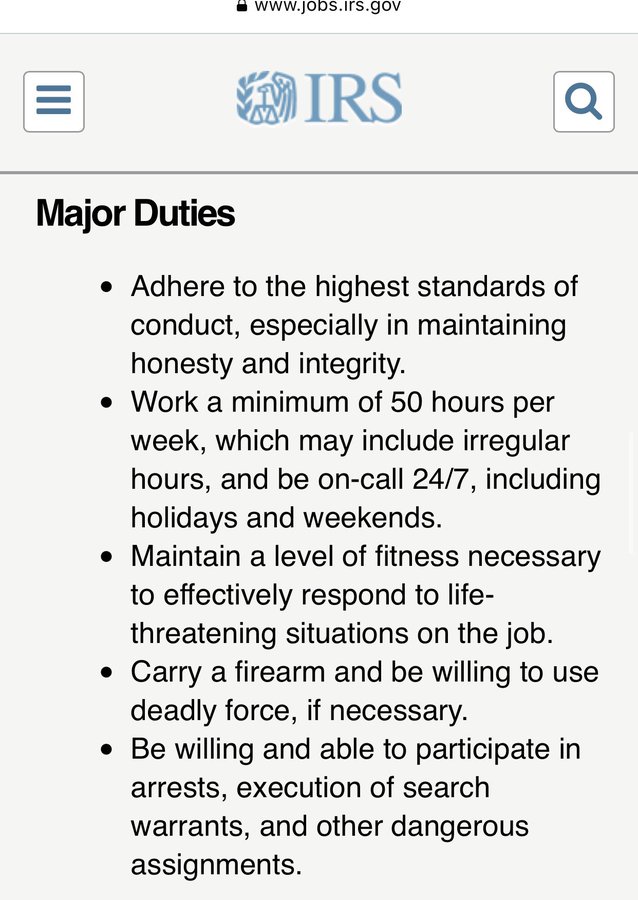

The IRS is hiring 87,000 special agents, must be able to carry guns!

.

Requirements include working min “50 hours per week, which may include irregular hours, and be on-call 24/7, including holidays and weekends” and “Carry a firearm and be willing to use deadly force, if necessary.”

.

.

Have we not yet learned that the experiment allowing Congress to lay and collect a tax calculated from “incomes” has proven to be an alluring tool which invites and encourages some of the most evil actors on earth to want to administer its use for notoriously evil ends?

Just look at what we have brought upon ourselves with a tax calculated from profits, gains, sales, interest, salaries, wages, tips, inheritances and other lawfully realized money. It is now used by those administering it to attack and harass targeted political opponents, while creating privileged classes exempt from its reach. It is also used by its administrators to fatten their own fortunes by enticing a swarm of lobbyists to engage in quid pro quo offerings, uniquely beneficial to themselves. And let us not forget how this particular tax is used as a carrot and stick to implement educational techniques into our public-school systems to pervert and indoctrinate the minds of innocent and impressionable children. Indeed, we the people are responsible for introducing a poisonous tax into our system which is now destroying our country from within.

The question is, will the American people rise to the occasion and withdraw from the hands of Congress this patently evil a tax - which has proven to invite a lethal corruption into their system - or will they remain docile and victims of their own doing?

Is it not time to withdraw Congress' power to calculate a tax from "incomes" and adopt the Fair Share Balanced Budget Amendment?

JWK

“We often give enemies the means of our own destruction.” -- AesopLast edited by johnwk; 08-11-2022 at 11:04 AM.

-

08-11-2022, 11:27 AM #2

Will they be going after the MILLIONS of illegal aliens who work under the table and send $50 BILLION dollars back over the border and the Employers who hire them?

Not on your life!ILLEGAL ALIENS HAVE "BROKEN" OUR IMMIGRATION SYSTEM

DO NOT REWARD THEM - DEPORT THEM ALL

-

08-11-2022, 11:56 AM #3

The Fair Share Balanced Budget Amendment . . . a real solution!

Didn't you know, illegal aliens may be who they are hiring!

Aside from that, the American people need to work on a solution, and that solution is found in The Fair Share Balanced Budget Amendment which would end all taxes calculated from legally realized "incomes".

The Fair Share Balanced Budget Amendment would do that.

“SECTION 1. The Sixteenth Amendment is hereby repealed and Congress is henceforth forbidden to lay any tax or burden calculated from profits, gains, sales, interest, salaries, wages, tips, inheritances or any other lawfully realized money.

NOTE: these words would return us to our founding father’s original tax plan as they intended it to operate! They would also end the experiment with allowing Congress to lay and collect taxes calculated from lawfully earned “incomes” which now oppresses America‘s economic engine and robs the bread which working people have earned when selling the property each has in their own labor, not to mention they would end federal taxation being used as a political weapon to harass and attack political opponents!

“SECTION 2. Congress ought not raise money by borrowing, but when the money arising from imposts duties and excise taxes are insufficient to meet the public exigencies, and Congress has raised money by borrowing during the course of a fiscal year, Congress shall then lay a direct tax at the beginning of the next fiscal year for an amount sufficient to extinguish the preceding fiscal year’s deficit, and apply the revenue so raised to extinguishing said deficit.”

NOTE: Congress is to raise its primary revenue from imposts and duties, [taxes at our water’s edge], and may also lay miscellaneous internal excise taxes on specifically chosen articles of consumption. But if Congress borrows and spends more than is brought in from imposts, duties and miscellaneous excise taxes during the course of a fiscal year, then, and only then, is the direct apportioned tax to be laid in order to balance the budget on an annual basis.

“SECTION 3. When Congress is required to lay a direct tax in accordance with Section 1 of this Article, the Secretary of the United States Treasury shall, in a timely manner, calculate each State’s apportioned share of the total sum being raised by dividing its total population size by the total population of the united states and multiplying that figure by the total being raised by Congress, and then provide the various State Congressional Delegations with a Bill notifying their State’s Executive and Legislature of its share of the total tax being collected and a final date by which said tax shall be paid into the United States Treasury.”

In reference to the above Section see: FIRST DIRECT TAX LAID BY CONGRESS, 1798

NOTE: our founder’s fair share formula to extinguish an annual deficit would be:

States’ population

---------------------------- X SUM TO BE RAISED = STATE’S FAIR SHARE

Total U.S. Population

The above formula, as intended by our founding fathers, is to ensure that each state’s share towards extinguishing an annual deficit is proportionately equal to its representation in Congress, i.e., representation with a proportional financial obligation! And if the tax is laid directly upon the people by Congress, then everybody taxpayer across the United States pays the exact same amount!

Note also that each State’s number or Representatives, under our Constitution is determined by the rule of apportionment:

State`s Pop.

------------------- X House size (435) = State`s No. of Representatives

U.S. Pop.

“SECTION 4. Each State shall be free to assume and pay its quota of the direct tax into the United States Treasury by a final date set by Congress, but if any State shall refuse or neglect to pay its quota, then Congress shall send forth its officers to assess and levy such State’s proportion against the real property within the State with interest thereon at the rate of ((?)) per cent per annum, and against the individual owners of the taxable property. Provision shall be made for a 15% discount for those States paying their share by ((?))of the fiscal year in which the tax is laid, and a 10% discount for States paying by the final date set by Congress, such discount being to defray the States’ cost of collection.”

NOTE: This section respects the Tenth Amendment and allows each state to raise its share in its own chosen way in a time period set by Congress, but also allows the federal government to enter a state and collect the tax if a state is delinquent in meeting its obligation.

"SECTION 5. This Amendment to the Constitution, when ratified by the required number of States, shall take effect no later than (?) years after the required number of States have ratified it.

Last edited by johnwk; 08-11-2022 at 02:57 PM.

-

08-12-2022, 12:31 PM #4

.

Which Americans Are Most Likely to be Audited by IRS Under ‘Inflation Reduction Act’?

.

In a press release, Brady used IRS data to estimate that the Democrats’ bill, if passed as is, would amount to 1.2 million new audits of taxpayers per year. Over 710,000 of these audits would fall on Americans who earn $75,000 a year or less, the Texas Republican said.

Just imagine the relief which American citizens and businesses would experience if the Fair Share Balanced Budget Amendment was added to our Constitution.

JWK

-

08-16-2022, 09:27 AM #5

.

With 87,000 IRS Agents being hired, and all the misery they will rain down on American citizens and their businesses, I'm absolutely disappointed there is no talk about real tax reform.

JWK

We are here today and gone tomorrow, but what is most important is what we do in-between and is what our children will inherit and remember us by.

Similar Threads

-

Border Wall Contractors Request Right to Carry Guns

By Jean in forum illegal immigration News Stories & ReportsReplies: 3Last Post: 04-06-2017, 12:52 PM -

TSA Posts 24 Million Round Ammo Bid Solitictiation – Most TSA Agents Don’t Carry Guns

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 05-22-2014, 03:44 AM -

Protestors can carry guns at rally In New Mexico Saturday

By topsecret10 in forum Other Topics News and IssuesReplies: 1Last Post: 12-31-2009, 02:47 PM -

TX-More carry guns in El Paso

By American-ized in forum Other Topics News and IssuesReplies: 1Last Post: 08-03-2009, 12:57 PM -

NYPD could carry guns fitted with cameras

By jimpasz in forum Other Topics News and IssuesReplies: 0Last Post: 05-13-2008, 10:30 AM

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Oklahoma House passes bill making illegal immigration a state...

04-19-2024, 05:14 AM in illegal immigration News Stories & Reports