Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-07-2010, 09:21 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Weekly Claims Drop to 445,000, 4-Week Ave at 455,750

Thursday, October 07, 2010

Weekly Claims Drop to 445,000, 4-Week Moving Average at 455,750; Where to From Here?

Weekly Claims fell this week to 445,000 but that number is still consistent with an economy losing jobs.

Please consider the Unemployment Weekly Claims Report for October 7, 2010. http://www.dol.gov/opa/media/press/eta/ui/current.htm

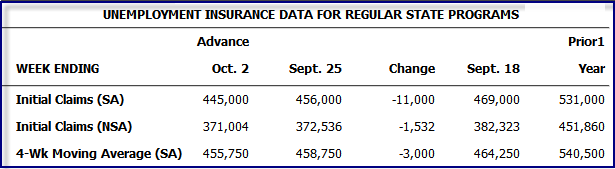

In the week ending Oct. 2, the advance figure for seasonally adjusted initial claims was 445,000, a decrease of 11,000 from the previous week's revised figure of 456,000. The 4-week moving average was 455,750, a decrease of 3,000 from the previous week's revised average of 458,750.

Unemployment Claims

The weekly claims numbers are volatile so it's best to focus on the trend in the 4-week moving average.

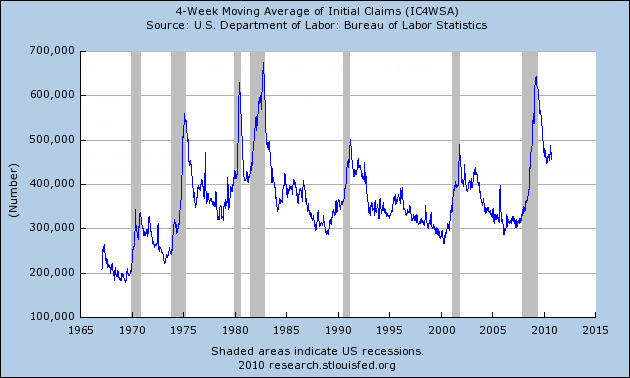

4-Week Moving Average of Initial Claims

The 4-week moving average is still near the peak results of the last two recessions. It's important to note those are raw numbers, not population adjusted. Nonetheless, the numbers do indicate broad, persistent weakness.

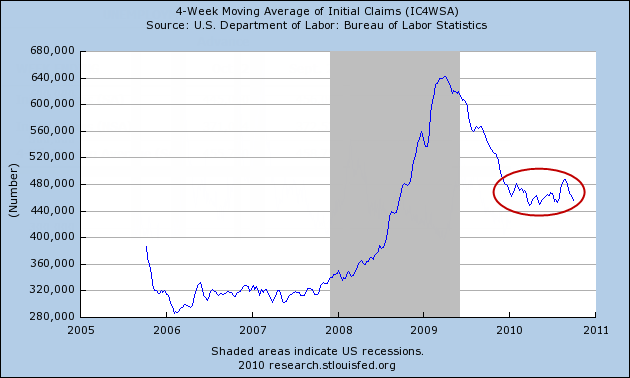

4-Week Moving Average of Initial Claims Since 2007

No Lasting Improvement for 10 Months

There has been no lasting improvement for nearly 10 months.

To be consistent with an economy adding jobs coming out of a recession, the number of claims needs to fall to the 400,000 level.

At some point employers will be as lean as they can get (and still stay in business). Yet, that does not mean businesses are about to go on a big hiring boom. Indeed, unless consumer spending picks up, they won't.

Questions on the Weekly Claims vs. the Unemployment Rate

A question keeps popping up in emails: "How can we lose 400,000+ jobs a week and yet have the unemployment rate stay flat and the monthly jobs report show gains?"

The answer is the economy is very dynamic. People change jobs all the time. Note that from 1975 forward, the number of claims was generally above 300,000 a week, yet some months the economy added well over 250,000 jobs.

Also note that the monthly published unemployment rate is from a household survey, not a survey of payroll data from businesses. That is why the monthly "establishment survey" (a sampling of actual payroll data) is not always in alignment with changes in the unemployment rate. At economic turns the discrepancy can be wide.

With census effects nearly played out, It may be quite some time before we weekly claims drop to 400,000 or net hiring that exceeds +250,000.

Want to know why some businesses aren't hiring? Please consider Creating Jobs Carries a Punishing Price http://globaleconomicanalysis.blogspot. ... price.html

Where To From Here?

The 4-week moving average has ticked down for a few weeks but the number is nothing to crow about. Moreover, claims have been generally in 450,000 range for 10 straight months of sideways movement so we can easily see more of the same. I am still expecting lots of state cutbacks so that could have an impact. Finally, the holiday shopping season is now just around the corner. It will be interesting to see what that portends.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot. ... -week.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-07-2010, 09:24 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Thursday, October 07, 2010

Gallup Survey Shows Unemployment Jumps From 9.4% to 10.1%

As economists up their forecasts for tomorrow's jobs report, I am lowering mine.

First, the recent ADP report suggests private nonfarm employment dropped by 39,000 with expectations of a gain. Second, Gallup Finds U.S. Unemployment at 10.1% in September http://www.gallup.com/poll/143426/Gallu ... ember.aspx

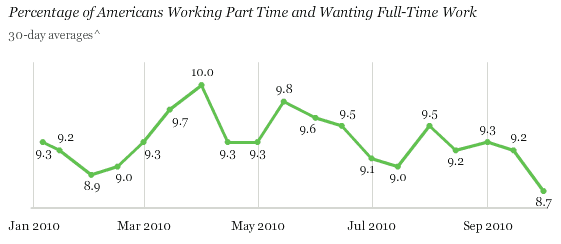

Unemployment, as measured by Gallup without seasonal adjustment, increased to 10.1% in September -- up sharply from 9.3% in August and 8.9% in July. Much of this increase came during the second half of the month -- the unemployment rate was 9.4% in mid-September -- and therefore is unlikely to be picked up in the government's unemployment report on Friday.

The increase in the unemployment rate component of Gallup's underemployment measure is partially offset by fewer part-time workers, 8.7%, now wanting full-time work, down from 9.3% in August and 9.5% at the end of July.

Friday's Unemployment Rate Report Likely to Understate

The government's final unemployment report before the midterm elections is based on job market conditions around mid-September. Gallup's modeling of the unemployment rate is consistent with Tuesday's ADP report of a decline of 39,000 private-sector jobs, and indicates that the government's national unemployment rate in September will be in the 9.6% to 9.8% range. This is based on Gallup's mid-September measurements and the continuing decline Gallup is seeing in the U.S. workforce during 2010.

However, Gallup's monitoring of job market conditions suggests that there was a sharp increase in the unemployment rate during the last couple of weeks of September. It could be that the anticipated slowdown of the overall economy has potential employers even more cautious about hiring. Some of the increase could also be seasonal or temporary.

Further, Gallup's underemployment measure suggests that the percentage of workers employed part time but looking for full-time work is declining as the unemployment rate increases. To some degree, this may reflect a reduced company demand for new part-time employees. For example, employers may be converting some existing part-time workers to full time when they are needed as replacements, but may not in turn be hiring replacement part-time workers. Another explanation may relate to the shrinkage of the workforce, as some employees who have taken part-time work in hopes of getting full-time jobs get discouraged and drop out of the workforce completely -- going back to school to enhance their education, for example, instead of doing part-time work. It is even possible that some workers may find unemployment insurance a better alternative than part-time work with little prospect of going full time.

Regardless, the sharp increase in the unemployment rate during late September does not bode well for the economy during the fourth quarter, or for holiday sales. In this regard, it is essential that the Federal Reserve and other policymakers not be misled by Friday's jobs numbers. The jobs picture could be deteriorating more rapidly than the government's job release suggests.

Crapshoot

Gaming the monthly job report estimates is something akin to a crapshoot. Nonetheless, I sense a degree of optimism that is both high and unwarranted.

Did the Fed manage to up expectations with its Quantitative Easing shenanigans? It seems that way to me.

However, if the Gallup survey is to be believed, the sharp increase in the unemployment rate will not occur until the October data (next month's report). Tomorrow we find out.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot. ... jumps.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

As Sen. Cortez Masto Scuttles Mayorkas' Impeachment, Illegal...

04-18-2024, 06:27 AM in Americans Killed By illegal immigrants / illegals