Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

03-29-2019, 06:33 PM #1

"Desperate" Illinois Ponders Taxing Internet Streaming Services And Hiking Gas Tax

Dirt Broke Socialist State; you voted for the Psychos, keep your backside there and prepare to ride that Progressive Socialist monkey and the Illegal Aliens they rode in on

"Desperate" Illinois Ponders Taxing Internet Streaming Services And Hiking Gas Tax

"...get the hell out!"

Fri, 03/29/2019 - 13:45

149 SHARES

Authored by Mike Shedlock via MishTalk,

Illinois seems desperate to drive away every able body citizen who can possibly leave.

Illinois is considering several bills that will without a doubt drive more businesses and individuals out of the state. One of them is likely illegal.

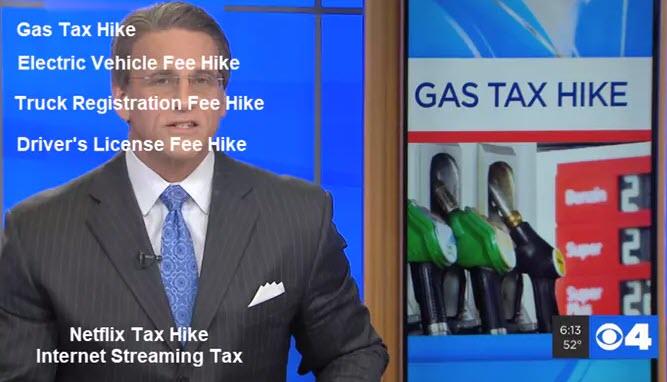

Gas Tax Hikes

Please consider Bill Seeks to Increase Illinois' Gas Tax to Fund Road Repair.Illinois lawmakers are considering raising the state's gas tax by 19 cents a gallon and hiking vehicle fees to pay for transportation infrastructure repairs.Where Would the Money Go (Part 1)

Legislation introduced last week proposes the state's first gas tax increase since 1990 and could raise an additional $2 billion in revenue each year, the Chicago Tribune reported. But it also would hike the electric-vehicle fee from $17.50 to $148, and increase truck registration fees by $100.

The fees for driver's licenses would double under the proposal, from $30 to $60, while passenger vehicle registration would increase from $98 to $148.

"Doubling the state gas tax would bring Illinois to the second-highest overall gas tax burden in the nation, notes the Illinois Policy Institute.

Supposedly these tax hikes would go for road repairs. Perhaps about 10% would. The rest would go to bail out bankrupt Illinois' pension plans.

Netflix Tax

Next, please consider ILLINOIS BILL WOULD EXPAND CHICAGO’S ‘NETFLIX TAX’ STATEWIDE.House Bill 3359 would create the “Video Service Tax Modernization Act” and “Entertainment Tax Fairness Act,” which would impose new taxes on satellite and video streaming service providers and subscribers. Users of those services would pay a 1 percent tax “for the privilege to witness, view, or otherwise enjoy the entertainment,” while companies would pay a 5 percent tax on their gross revenues.Where Would the Money Go (Part 2)

Chicago currently stretches the definition of its 9 percent citywide “amusement tax” to include online streaming services such as Netflix and Spotify, as well as Playstation rentals.

The legality of Chicago’s “Netflix tax” is dubious. The Liberty Justice Center, the Illinois Policy Institute’s litigation partner, sued the city on behalf of streaming service customers in 2015, after the expansion of the tax to online services went into effect. The city tax was previously applied only to ticketed live entertainment performances and events.

The Center argued expanding the tax to online services violates the 1998 Internet Tax Freedom Act, a federal law. The Act prohibits taxes that discriminate against electronic commerce levied by any government body, including state governments, suggesting Illinois could expose itself to similar legal risks should HB 3359 become law.

This tax hike is even easier to state. No matter what anyone says, 100% of this money would be diverted to bail out bankrupt Illinois' pension plans.

Constitutional Amendment

These hikes are on top of a major Constitutional Amendment change to make the Illinois state income tax "Progressive". Rest assured it will dramatically increase taxes on the middle class no matter what these parasites say.

Get the Hell Out

I repeat my caution of last week: An Illinois' Demographic Collapse Is on the Horizon.

Get Out As Soon As You Can!

Yes, we live in Illinois. I expect to be out of this hell hole within 18 months. Plans are underway.

https://www.zerohedge.com/news/2019-...hiking-gas-taxIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

03-30-2019, 01:08 AM #2

Who In Their Right Mind Would Lend Money To Chicago?

Why would such obviously crappy paper be such an easy sell?

Fri, 03/29/2019 - 21:25

70 SHARES

Authored by John Rubino via DollarCollapse.com,

When you see that Italy’s debt is rising, the logical question is, who the hell is dumping good money after bad into such an obviously failed state? The answer is that by lending money to Italy (or Greece, Portugal, Spain, or France) you’re really lending money to Germany, since the latter will have to bail those other countries out shortly.

Keep that in mind as you read this, from yesterday’s Wall Street Journal:

Cash-Strapped Illinois, Chicago Seek Billions From InvestorsHere’s the key passage that ties Illinois/Chicago back to Italy:

Illinois and its biggest city kick off hundreds of millions of dollars in borrowings this week, a test of investors’ willingness to lend to stressed governments prone to spending more money than they bring in.

The state launched borrowings with about a $440 million bond deal on Tuesday, followed by a sale topping $700 million by Chicago. Analysts expect what could be billions more especially from the state, as it puts together funds to do everything from paying retirees’ pensions to launching capital projects.

Before buying bonds from the nation’s lowest-rated state and its biggest city, investors have to assess their continuing mismatches between expenses and revenues along with pension burdens, which are slated to eat up a growing share of both budgets in coming years. Municipalities nationwide are grappling with how to pay bondholders while also meeting the rising costs of retirement benefits, but few are as financially strained as the nation’s third-largest city and the state.

Illinois leaders have floated borrowing at least $4.5 billion more through next year, according to its financials. Rather than using most funds to build bridges or improve infrastructure, the Prairie State plans to use many of its bonds to pay off outstanding debts or put money toward pension benefits that have already been earned. For example, a proposed $1.5 billion borrowing tentatively scheduled for June would help pay for a pile of unpaid bills the state still owes. Lawmakers failed to pass a budget for two years under the former governor, worsening this backlog.

Rahm Emanuel’s last bond deal as Chicago’s mayor will be used to pay off previous short-term borrowing alongside projects including sidewalk improvements and traffic signal installation. He considered selling $10 billion of debt to fund pensions, but it will be up to his successor—elected this April—to decide whether to move forward.

Illinois’s rating sits just above junk level. Chicago holds a speculative grade from Moody’s Corp. and investment-grade scores from S&P Global Inc. and other firms. Chicago didn’t hire Moody’s for its latest bond deal.

Despite their precarious finances, the city and state’s leaders have turned to the bond market at what some analysts say is an opportune time. Investors have poured money into municipal bonds in recent weeks, vying for a relatively limited supply of debt, analysts say, and lifting prices while pushing down the yields of even some existing Illinois and Chicago bonds.

That background helps ensure demand for the new bonds, analysts said, in the latest example of how investors’ voracious appetite for debt can help governments find willing lenders despite fiscal stress.

“Despite their precarious finances, the city and state’s leaders have turned to the bond market at what some analysts say is an opportune time. Investors have poured money into municipal bonds in recent weeks, vying for a relatively limited supply of debt, analysts say, and lifting prices while pushing down the yields of even some existing Illinois and Chicago bonds.”Why would such obviously crappy paper be such an easy sell? Because investors are looking ahead to the next Great Reflation, in which the Fed and other major central banks are forced to unleash a tidal wave of new credit to bail out the bad debts incurred in the previous round of monetary experimentation.

If the express goal is to keep bad debts from blowing up the global financial system, then by definition Illinois/Chicago will be bailed out, since they personify the concept of “bad debt”. So today’s junk munis are tomorrow’s Fed balance sheet assets. Which is another way of saying they’re taxpayers’ responsibility, not Chicago’s.

https://www.zerohedge.com/news/2019-...-money-chicagoIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

Australia plans to record all Internet activity "Conferring with Internet industry"

By kathyet2 in forum Other Topics News and IssuesReplies: 0Last Post: 08-04-2014, 09:54 AM -

Taxing the "rich"? No, ruining America!

By kathyet in forum Other Topics News and IssuesReplies: 1Last Post: 12-08-2010, 10:39 AM -

Roubini Ponders the "L-Shaped Recession"

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 07-18-2010, 04:22 PM -

Streaming Live Right Now! "Stand with Arizona" ra

By Melissa in forum General DiscussionReplies: 2Last Post: 05-29-2010, 10:11 PM -

Live Streaming from Nationwide "End the Fed" Prote

By chloe24 in forum Other Topics News and IssuesReplies: 2Last Post: 11-26-2008, 05:20 PM

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Listen to William Gheen on Rense Apr 17, 2024 talking NEW Tool...

04-18-2024, 06:17 PM in ALIPAC In The News