Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-29-2010, 09:38 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Greece Financial / Economic Collapse Sinking Euro Zone Econ

Greece Financial Markets and Economic Collapse Sinking Euro Zone Economy

Economics / Global Debt Crisis Apr 29, 2010 - 01:26 AM

By: John_Mauldin

This is a special Outside the Box. I got this letter from my good friend Greg Weldon last night and got permission to pass it on to you. I think it illustrates the problems that the world is facing from the sovereign debt crisis that is building in Europe.

There are no good solutions here, only very difficult ones. In order to get financing, Greece must willingly put itself into a multi-year depression. And borrowing more money when it cannot afford to pay back what it has will not solve the problem. 61% of Greeks now favor leaving the euro. How has Greece responded? By banning short selling on its stock market for the next two months. That should make things better. Greeks are responding by rioting and going on strike. But you truly know when a country is dysfunctional when its AIR FORCE goes on strike. Yesterday Reuters reported that hundreds of Greek pilots called in sick in protest. The response from government? The Minister of Defense said he was "profoundly disappointed." Now that had to make the pilots feel bad.

Money is flying from Greek banks, which makes sense, as how can a bankrupt Greek government guarantee Greek bank deposits? I know that Greek bankers may have a different view, but Greek depositors are voting with their feet. And Greg shows us it is not just Greece. It is fast becoming Portugal. And Spain is not far behind in my opinion.

I can well imagine there are private meetings among Greek government officials, banks and other leaders as to what must now be done. Those meetings I am sure can be tense. These things matter, as European banks hold a lot of Greek debt, as well as Portuguese and Spanish debt. European banks have not come close to dealing with their problems and are seriously over-leveraged. There is the potential for yet another banking and credit crisis stemming from European banks. Will world banks see their trust for each other (and especially European banks with large amounts of Club Med bonds) devolve as it did on August of 2008? It is something we must think about. It is possible, in my opinion. I sincerely hope it does not happen, but we must think about it. (Note, this is not something that will happen for awhile, but we should be aware of the problem.)

I want to thank Greg for letting me send this on to you. His website is www.weldononline.com. This letter is typical of his work â thorough and detailed and full of charts. He is the best slicer and dicer of data that I know.

John Mauldin, Editor

Outside the Box

MACRO-EUROPE: The Titanic is SINKING

WELDON'S MONEY MONITOR

We rewind to our February 15th Money Monitor entitled "Three Card Monty", with its focus on the 'early stages' of the now full-blown Greek debt-deficit-debacle, and we replay the quotes we spotlighted at the time ...

Greek Finance Minister George Papaconstantinou ...

... "We are basically trying to change the course of the Titanic. People think we are in a terrible mess. And we are.

We note comments from Jean-Claude Juncker, speaking on behalf of European Finance Ministers following a meeting of top EU officialdom in Brussels this afternoon ...

... "Greece is responsible for the consolidation of its public finances. It is first a Greek problem, and an internal Greek problem."

From European Central Bank President Jean-Claude Trichet ...

... "Everyone needs to respect their commitments. We have a particular Greek problem, but the other countries have their programs and they must be implemented. It is important that all of the heads of state and governments do what is necessary to guarantee the stability of the euro zone."

And from German Chancellor Angela Merkel ...

... "Germans should not pay for the consciously flawed fiscal and budgetary policies of others."

We stated, in our conclusion to that Money Monitor ...

Thinking that the problems of Greece, let alone two dozen other European debt-deficit 'offenders', will be 'solved', without PAIN, quickly ... or that they will be easily and quietly 'papered-over' ... is like playing Three Card Monty with the hustlers of Eighth Avenue in Manhattan.

It is ALWAYS a LOSING proposition.

Now, over two months later ... the Titanic is SINKING ... amid today's credit rating downgrade announced by Standard and Poor's, as it relates to Greece's sovereign debt.

Moreover, in our March 3rd Money Monitor, "It's All Over Now, NOT !!!", we stated the following ...

In short, it is NOT, at all ... "all over now", in Europe.

And, in our April 12th Monitor, "Three Blind Mice" ... published in the wake of the announcement of the (alleged) solution via a loan to Greece, from EU member nations, and the IMF ... we said the following ...

What happens when Italy needs a bailout, or Portugal, or Spain ...

... bailouts-that-are-not-a-bailout that would be significantly LARGER than the 45 billion EUR offered to Greece ... what then ????

Again, as we have stated repeatedly since the 4Q of last year ... Europe's fiscal debt-deficit crisis is FAR from 'over'.

Again, as we have repeatedly stated ... it will not be over, until draconian fiscal austerity measures are implemented ACROSS the region.

It will not be over ... for years to come.

Fast forward to the present ... and the announcement by Standard and Poor's wherein the credit ratings agency cut Greece's sovereign debt rating to JUNK status ... and we shine the spotlight on commentary from today's S+P 'statement' ...

... "We believe that the government's policy options are narrowing because of Greece's weakening economic growth prospects, at a time when pressures for stronger fiscal adjustment measures are rising. Moreover, in our view, medium-term financing risks related to the government's high debt burden are growing, despite the government's already sizable fiscal consolidation plans."

... "Our updated assumptions about Greece's economic and fiscal prospects lead us to conclude that the sovereign credit rating is no longer compatible with an investment grade rating."

Also ...

... "The government's multi-year fiscal consolidation program is likely to be tightened further under the new EMU-IMF agreement. This is likely to further depress Greece's medium-term economic growth."

And ...

... "The government's resolve is likely to be tested repeatedly by trade unions and other powerful domestic constituencies that will be adversely affected by the government's policy."

Adding insult to injury, Standard and Poor's also put Greece's credit 'outlook' on 'negative watch', opening the door for FURTHER downgrades ...

... "The negative outlook reflects the possibility of a further downgrade if the Greek government's ability to implement its fiscal and structural reform program materially weakens, undermined by domestic political opposition at home, or by even weaker economic conditions than we currently assume."

Indeed, the ICEBERG is HUGE ... and the unsinkable ship is sinking !!!

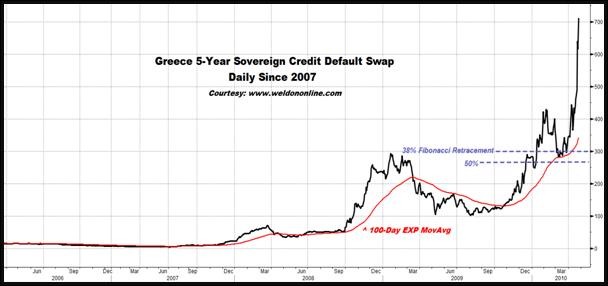

Evidence the rising water levels in the engine room, as represented by the 'price' of default 'protection', evidenced in the chart below plotting Greece's 5-Year Credit Default Swap Rate ... which has SOARED today, easily reaching a NEW ALL-TIME HIGH ... by FAR !!!

In fact, in our March 22nd Money Monitor entitled "Three Card Monty, Revisited", we offered a chart perspective on the 5-Year Greek CDS. We spotlighted the downside correction that took the CDS to the med-term trend defining 100-Day EXP-MA, in line with a text-book Fibonacci retracement (between the 38% and 50% retracement levels) ... suggesting that the downside correction provided a 'buying' opportunity.

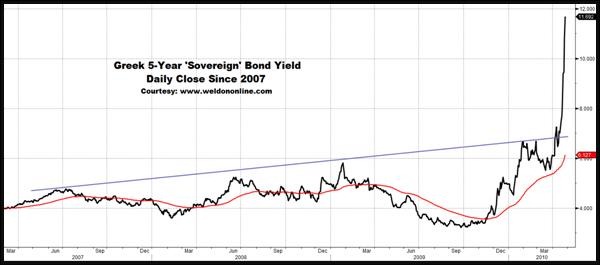

We also 'warned' about the potential for higher interest rates to significantly impact the entire fiscal environment in Greece. Thus we note additional commentary from within the Standard and Poor's statement ...

... "Pressures for more aggressive and wide-ranging fiscal retrenchment are growing, in part because of recent increases in market interest rates."

After today's parabolic rise in the 5-Year Greek Bond yield, as noted below, the word 'increases' becomes a substantial understatement.

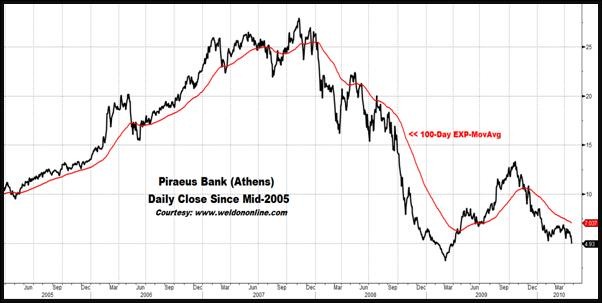

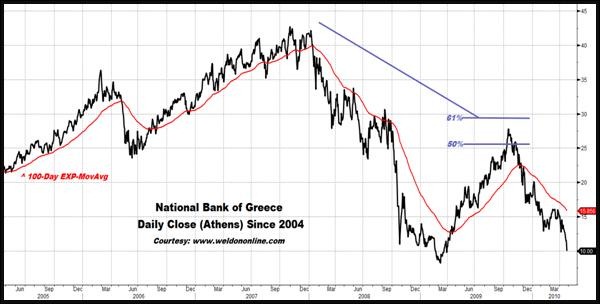

As if this was not enough turbulence, we also note that in line with the downgrade of the Greek government credit rating, Standard and Poor's also marked down the 'rating' on the nation's largest banks ... stating that ...

... "We find that Greece's fiscal challenges are increasing pressure on the banking and corporate sectors. In particular we see continuing fiscal risks from contingent liabilities in the banking sector, which, could, in our view, total at least 5%-6% of GDP in 2010-2011."

Standard and Poor's downgraded the 'long-term counterparty credit ratings on National Bank, Eurobank, Alpha Bank, and Piraeus Bank ... causing share prices to plummet. Evidence the pair of charts on display below in which we plot Piraeus Bank ...

... and, the National Bank of Greece, both of which are breaking down technically, following a rally that mapped out another 'text-book' Fibonacci retracement correction.

Hence we turn the spotlight on the Greek stock market as a whole, represented within the chart below in which we plot the Greek ASE stock index. Indeed, we note another Fibonacci retracement, to the 33% target, followed by this week's renewed technical breakdown.

The ship ... is going DOWN.

We have been bearish on the Eurocurrency since October-November of last year, and after suffering because we were 'early' to this thematic-trade, we have been rewarded for our patience and perseverance ... as evidenced in the longer-term daily chart on display below, revealing today's decline in the EUR to a new move LOW.

Further, we spotlight the bearish technical dynamic, as defined by the negative action in the moving averages, and the slide into bearish territory by the long-term 200-Day Rate-of-Change.

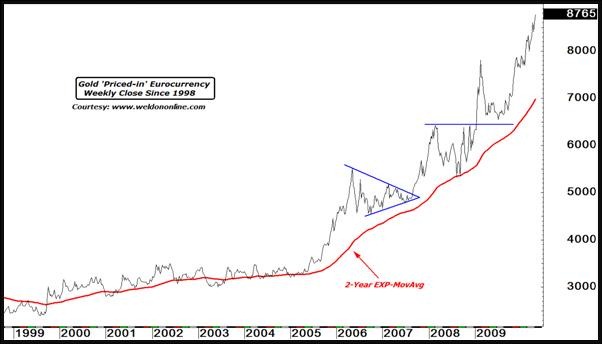

While the Titanic (also known as the Eurocurrency) SINKS ... the price of Gold denominated in the Euro is SOARING, reaching a NEW ALL-TIME HIGH today, in excess of EUR 875 per ounce ...

... as observed in the long-term weekly chart seen below.

We are now watching for a 'confirming' upside breakout in the spot (USD based) price of Gold. Noting the daily chart on display below we focus on the most recent re-acceleration to the upside in the med-term trend defining 100-Day EXP-MA.

An upside violation of the April 12th high of $1169 would constitute a full-blown med-term upside breakout.

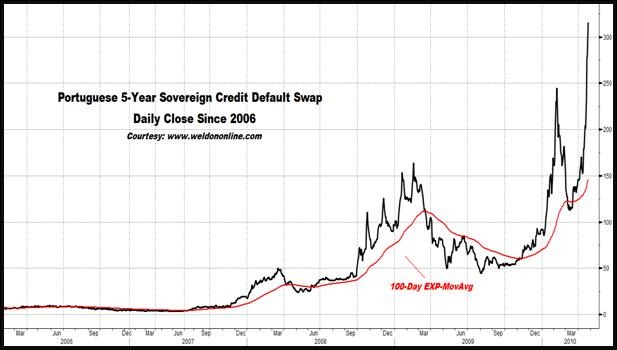

All 'passengers' are going down with the ship ... with a downgrade to Portugal's sovereign credit rating also announced today, as Standard and Poor's marked down Portugal's rating by two notches, from A+ to A-, while placing the country on a negative outlook watch, portending more downgrades in the future.

Subsequently, Portugal's 5-Year Credit Default Swap is SOARING, as noted in the chart below, spiking to a NEW ALL-TIME HIGH ... today.

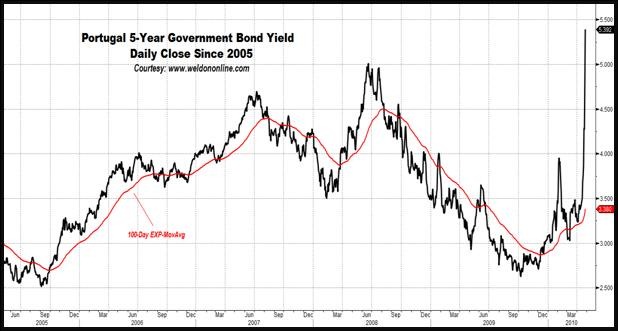

Similarly, Portugal's 5-Year Government Bond yield SOARED to a NEW HIGH, jumping by + 60 basis points today alone, capping a monstrous +215 basis point rise in the month of April, easily violating the February high of 3.95% ... as evidenced in the chart below.

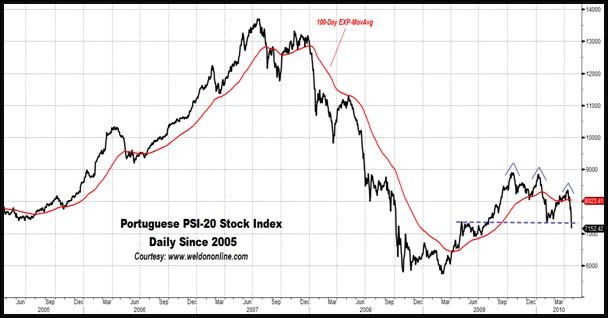

Like the Titanic ... the Portuguese stock market is also ... sinking ...

... as evidenced in the daily chart on display below, replete with technical breakdown, head-and-shoulders pattern, violation of the med-term trend defining 100-Day EXP-MA ... and ... the downside reversal by the moving average itself, directionally speaking.

And finally, we have been focused on the downside price action and severe underperformance exhibited by the Spanish stock market (specifically spotlighted as recently as last Friday's ETF Playbook) ...

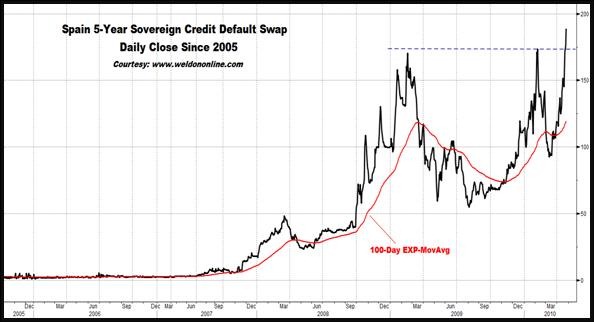

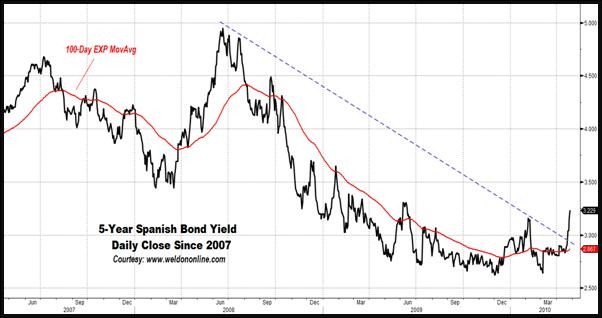

... and thus we note the chart on display below as Spain begins to unravel too, with the 5-Year Credit Default Swap SOARING to a NEW ALL-TIME HIGH, slicing through the (previous) double-top formed as defined by the February 17th, 2009 high at 170 basis points, and the February 8th, 2010 high at 173 basis points, reaching towards 200 basis points.

And, we shine the spotlight on the chart below plotting Spain's 5-Year Bond yield, which is breaking out to the upside, today, and doing so 'from' historically low levels below 2.75%, violating the February 5th high of 3.13%.

The Titanic is sinking, and ultimately, ALL passengers will go down with the ship, including Portugal, Spain, Greece, and several other Maastricht Treaty debt-deficit offenders.

We have been anticipating this event for months.

Thus, we remain bearish on the European currencies ....

... and bullish on Gold priced in EUR.

Gregory T. Weldon ---

Subscription Information ... eileen@weldononline.com

Or Visit www.Weldononline.com for a free trial.

John Mauldin

Editor, Outside the Box

http://www.marketoracle.co.uk/Article19029.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

04-29-2010, 09:48 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Greece's Bill Is Now Due - And Others Will Be Next, Debt Denial and the Five Stages of Greece

Economics / Global Debt Crisis Apr 28, 2010 - 03:39 PM

By: Justice_Litle

The phenomenon of "debt denial" has gripped not only Greece and the eurozone, but the entire roster of rich Western nations. When the smoke finally clears, you'll want to own gold coins...

The eurozone is slowly but surely imploding under an unsustainable debt load. Greece is still center stage, but the woes will soon spread. Ultimately, Greece is the first domino in a long chain of looming debt defaults... and at the end of that chain lies the United States.

You'll want to be paid up on "printing press insurance" before the final domino falls - and gold coins might fit the bill nicely in that regard. More on that at the end of today's piece...

Q: What's the difference between Greece and the rest of the OECD countries? A: Greece is small enough to be bailed out.

Ha ha. Funny stuff, right? Or maybe not. That sobering riddle is posed by Dylan Grice of Societe Generale. (OECD, which stands for "Organization for Economic Cooperation and Development," is simply shorthand for rich Western nations with democratic governments.)

As Grice writes to his SocGen clients (emphasis mine), "Back in January, when Greece's debt problems first surfaced, I thought it would be the first in a series of fiscally driven market seizures... I still think Greece is the beginning of a wave of government funding crises, not the end."

Your humble editor agrees. What's happening in Greece is a prelude to far larger troubles.

For months now, the Greek soap opera has played itself out on the world stage. During all this, the euro has lurched up and down - but mostly down - in concert with investor moods.

Chart: The optimist fight in a losing euro battle

The optimists have put up a truly impressive fight. Over and over we have heard that "the situation will be solved"... that "Greece will not be allowed to fail"... that "a solution is just around the corner" and "Greece will be bailed out."

Yet every time, the supposed "solution" has been little more than hot air. Political fantasy keeps running aground on the hard shoals of reality. European pols have trashed their credibility so many times now, it's hard to keep count.

Fiscal Crisis and the Kübler-Ross Model

The Greek debt situation could ultimately prove fatal - not just for Greece, but for the entire eurozone. In their extended display of denial, one could thus argue investors are passing through the "five stages of grief."

(Or in this case, the five stages of Greece. Get it? Gallows humor, I know...)

The five stages of grief are central to the Kübler-Ross model, as first described by Dr. Elisabeth Kübler-Ross in her book On Death and Dying in 1969. Per Wikipedia, the stages look like this:

1. Denial. "I feel fine... this can't be happening to me."

2. Anger. "Why me? It's not fair! How can this happen to me?"

3. Bargaining. "I'll do anything for a few more years..."

4. Depression. "Oh, what's the point... why even bother going on?"

5. Acceptance. "I can't fight it. I may as well prepare."

We can see all these stages at work with Greece. At first, outright denial was the order of the day. Then came the anger... and the hopeful bargaining... and now, as the euro nears a fresh test of 12-month lows, we are edging our way into the depression stage, in which reality can no longer be denied.

Not Just Greece

But again, as SocGen analyst Dylan Grice points out, denial ain't just a river in Egypt... and the sovereign debt problem is not just confined to Greece.

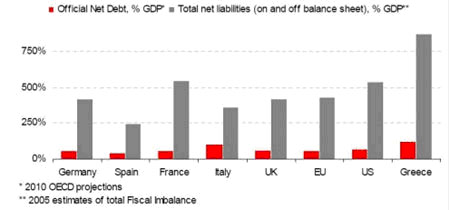

2010 OECD projections - official net dept vs total net liabilities

The above chart shows official net debt and total net liabilities for various OECD countries. The gray bar shows net liabilities - the total obligations both "on" and "off" the balance sheet - for each country shown.

When it comes to net liabilities, Greece is the runaway leader of the pack (the tall gray bar on the far right). From a whole country perspective, Greece's obligations are more than 750% of annual income (GDP), a truly staggering amount.

But Grice's key point is that "Greece isn't that different" from the other, bigger nations. The net liabilities of the United States - the gray bar next to Greece - are now more than 500% of GDP. The U.K., France, the EU as a whole, and even Germany are right in there too.

This next chart (also from Grice) is the real kicker...

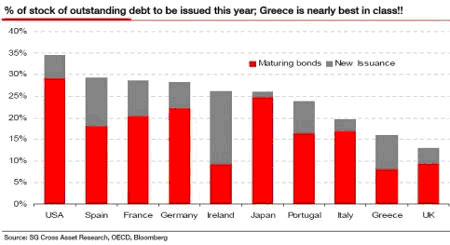

Percentage of outstanding debt to be issued this year, Greece is nearly best in class!

In case it's hard to see, the print at the top reads: "% of stock of outstanding debt to be issued this year; Greece is nearly best in class!"

The red portion of each bar represents maturing bonds - debt that will need to be "rolled over" soon. The gray portion is new issuance. And who is the big kahuna by this measure? That would be the USA (the tall bar on the far left).

It is still an open question as to who will supply Uncle Sam with the many trillions he needs to borrow, just to keep the whole scheme afloat.

A Borrowed Recovery

This goes back to a central problem of the "economic recovery" narrative. We have managed to "buy" a broad perception of recovery in the same manner that a gambler in a casino buys a little more time at the tables by drawing down his line of credit.

With a fat enough pipeline of credit, any businessman can look like a genius - for a little while at least. All one has to do is borrow hand over fist... invest the borrowed dollars in at least a semi-sensible way... and then proudly point to the profits accrued, without bothering to mention the ballooning debt side of the ledger.

Like the classic credit card "kiting" scheme, in which one credit card is used to pay off another, this modus operandi can work for a long time... until the revolving credit lines max out or the lender finally balks, at which point the music suddenly stops.

Greece's Bill Is Now Due - And Others Will Be Next

In fact, the credit card analogy may be the simplest means of understanding what's happening in Greece.

Monetary union in the eurozone was the equivalent of a joint-issued credit card for all 16 countries that signed up. With its ability to borrow in euros - and the implied promise of eurozone solidarity - Greece was given the ability to tap Germany's credit rating.

Over the course of a decade or so, Greece used this newfound line of credit irresponsibly. The country borrowed much more, at a much lower rate of interest, than it ever could have done without the eurozone imprimatur. Now the bill is coming due... and Greece can't pay.

Market jitters suggest that Portugal is up next. "Portuguese bonds fell," Bloomberg recently reported, "pushing yields to the highest relative to German bunds in 13 months, on mounting concern that governments in the euro region will struggle to control their budget deficits."

First Greece, then Portugal. (Latvia has already imploded, but it is too small to register - no offense intended to Latvian readers.) After Portugal, the small countries start to get bigger. Who will be next in line? Italy? Spain?

In debt crisis terms, we are looking at a chain of dominoes here. That chain starts with Greece... wends its way around the eurozone... stops off in Asia at the doorstep of Japan... and ends with the United States.

Gold Coins as Printing Press Insurance

Few things in life are guaranteed, other than death and taxes. One thing we can say with certainty, though, is that human nature does not change. The average politician, if not the average man in the street, is in love with the easy solution - the painless path, the quick fix.

Politicians do not manage for the long term. They manage for the next election cycle. And that means borrowing in ever-greater amounts to keep perceptions of recovery intact. When that strategy fails, the "five stages of Greece" will be writ large. And the printing press will be the final answer to the West's looming "debt denial" problem.

In other words, when all other measures fail - and they will - the West will inflate and debase its way out. The playbook is centuries old, millennia old even. It is nature's inevitable way, just as rivers run to the sea.

The above is why you should consider gold coins for a portion of your investment portfolio (if you haven't done so already). The final act of this tragicomic play will be big... it will be ugly... and it will be all encompassing. Fiat currencies across the board could be reduced to confetti.

That is the type of environment where a stash of coins - gold you can keep in your possession, rather than own at arm's length through a trading account - might come in handy.

I bring up this final point because my publisher, Sandy Franks, tells me that $5 Gold Eagles (a popular coin issued by the U.S. Mint) are, quite literally, disappearing. They are flying off the shelves, and the Mint can't meet demand. Given the long-term troubles we face - and the reality of Greece as prelude to something bigger - this doesn't surprise me one bit.

You can find out more about Gold Eagles by clicking on this link.

Source: http://www.taipanpublishinggroup.com/ta ... 42310.html

By Justice Litle

http://www.taipanpublishinggroup.com/

http://www.marketoracle.co.uk/Article19021.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Mike Johnson betrays border security for more foreign aid

04-18-2024, 10:31 PM in illegal immigration News Stories & Reports