Results 1 to 1 of 1

Thread: Gold & Geopolitics

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-02-2022, 08:45 AM #1

Gold & Geopolitics

Gold & Geopolitics

SUNDAY, OCT 02, 2022 - 08:10 AM

Gold and silver dumped and pumped this week - after a week of consolidation - against a background of a rising dollar on the foreign exchanges.

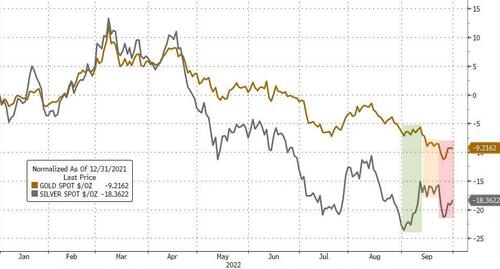

As the chart below shows, silver is up around 6% since 1 September, while gold is down around 3%...

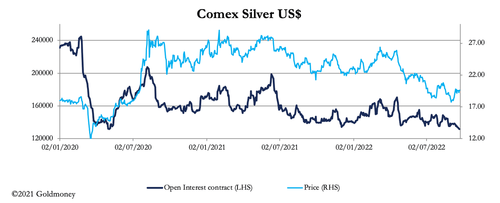

But as GoldMoney.com's Alasdair Macleod details below, Silver is extremely oversold in illiquid conditions, illustrated by our next chart.

The level of open interest is probably the best indicator of market sentiment.

At under 132,000 contracts it is as oversold as it was in early May 2020, just before the price rocketed higher from under $15, doubling in only three months.

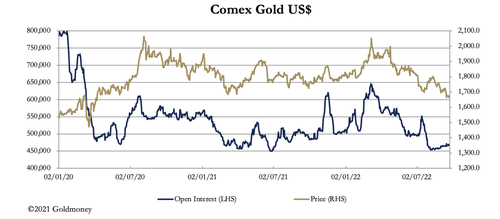

Being a far larger and more liquid market, the position in gold is less obviously oversold, as our next chart suggests.

Nevertheless, we can see that open interest refuses to fall below the 450,000-contract level, which suggests that a rally from here is a high probability, potentially taking out all-time highs.

This price resilience is in the face of severe weakness in the yen, euro, pound, and yuan. It is reflected in the dollarís trade weighted index, which continues to power ahead.

Undoubtedly, there are very good reasons to get out of the other currencies and into dollars. But the dollarís overbought condition must be extreme, exposing it to sudden and sharp bear squeezes.

Together with the deeply oversold position for gold and silver, undoubtedly mirrored in a raft of commodities and energy contracts, we can see how traders might become very badly wrong-footed.

There are other developments worthy of attention - this time in Russia. Following the referenda in Ukraine, Russiaís border marches westwards, and in the absence of a ceasefire, the Ukrainians supported by NATO will be attacking Russia directly. It would be an escalation into a direct conflict between Russia and NATO.

Putin probably expects an uneasy ceasefire to follow.

Meanwhile, his attention appears to be already turning to monetary and financial matters, centred on gold.

Together with the Russian Central Bankís reserves, Russiaís state fund and its National Wealth Fund are believed to hold about 12,000 tonnes of gold.

Steps have been taken to ďmobiliseĒ the non-reserve gold.

This is not for emergency war funding as some commentators think, but more likely to be so that they can be included in central bank reserves.

Russia could then declare the largest monetary gold reserves in the world.

Together with the recently announced Moscow gold standard and plans for a new trade settlement currency to replace the dollar, enhanced gold reserves will provide support a new gold standard for cross-border trade.

It would replace payments to Russia for energy in weak Asian currencies, and probably force China to declare its true gold reserves as well.

If this is Putinís plan, the consequences for Western fiat currencies are likely to be devastating - suffering the financial equivalent of a nuclear attack.

Gold & Geopolitics | ZeroHedge

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

M Chossudovsky: Geopolitics and the World's Gold Holdings

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 04-25-2011, 09:06 PM -

The Geopolitics Behind The Phony US War In Afghanistan

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 10-21-2009, 03:46 PM -

The Geopolitics of the US-North Korea Standoff

By carolinamtnwoman in forum Other Topics News and IssuesReplies: 0Last Post: 06-29-2009, 03:13 PM -

Pipeline Geopolitics and the New Cold War: The Real Truth

By carolinamtnwoman in forum Other Topics News and IssuesReplies: 2Last Post: 08-26-2008, 02:17 AM -

The Geopolitics of Dope

By zeezil in forum illegal immigration News Stories & ReportsReplies: 3Last Post: 02-01-2008, 01:48 AM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

We must push through early Thurs at this critical moment

04-24-2024, 10:44 PM in illegal immigration Announcements