Results 181 to 190 of 443

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

07-01-2019, 07:50 AM #181

Trump needs to CUT OFF THE FUNDING for all these organizations now!

Shut them down.ILLEGAL ALIENS HAVE "BROKEN" OUR IMMIGRATION SYSTEM

DO NOT REWARD THEM - DEPORT THEM ALL

-

07-01-2019, 12:55 PM #182If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-02-2019, 01:28 PM #183Perform a flagrant act of politics - ask your Dem supporter friends which of the candidates will be addressing this in their presidential "platform" (after all the FREE promises they are making)

Illegal Aliens are in HUD Housing; these are AMERICANS Dying in the Streets

usnews.com

The Homeless Are Dying in Record Numbers on the Streets of Los Angeles

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-02-2019, 06:20 PM #184New Chicago Mayor Wants State Taxpayer Bailout Of Chicago Pension Debts

"We cannot keep asking taxpayers to give us more revenue without the structural reforms that are fundamentally necessary to make our city and our state run better..."

Mon, 07/01/2019 - 19:55

2 SHARES

Submitted by Ted Dabrowski and John Klingner of Wirepoints

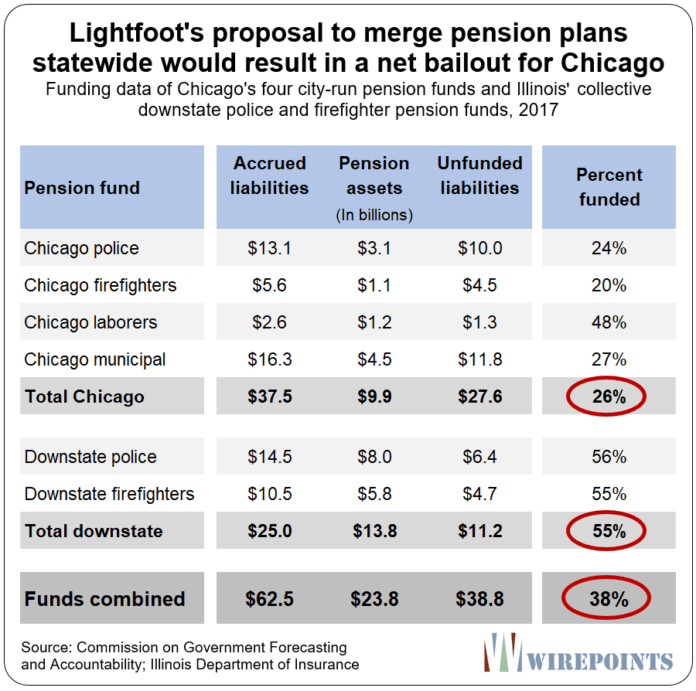

It didn’t take long for new Chicago Mayor Lori Lightfoot to propose a plan that would wash her hands of Chicago’s pension crisis altogether. According to a recent report in Crain’s, Lightfoot wants the state to take over Chicago’s pension debts and merge them with the other pension plans throughout the state. The move would make all state taxpayers responsible for paying down the city’s debts.

Chicago Mayor Lori Lightfoot The plan to shift city debts to the state would bail out the mayor from having to raise about $1 billion in additional taxes to pay for increasing pension costs by 2023. A massive tax hike is something she’s desperate to avoid.

Chicago Mayor Lori Lightfoot The plan to shift city debts to the state would bail out the mayor from having to raise about $1 billion in additional taxes to pay for increasing pension costs by 2023. A massive tax hike is something she’s desperate to avoid.

But while Lightfoot may think the cost-shift is a solution, it will only make things worse for Illinois. She should expect significant pushback from many sides.

Start with downstate and suburban residents. Sure, their public safety pension funds would get consolidated under the state, too, but it’s the Chicago funds that are some of the biggest and worst-funded in the state. The four city-run funds are collectively funded at just 27 percent and face an official shortfall of $28 billion.

In contrast, the 650 downstate pension plans are 58 percent funded and have a shortfall of nearly $10 billion. The end result of any statewide pooling of pension funds will be a net bailout for Chicago.

Non-Chicagoans aren’t going to just accept yet another bailout of the city. Downstaters’ most recent bailout of Chicago came when the state’s new education funding formula locked in special subsidies for Chicago Public Schools. That included hundreds of millions in hold-harmless funding as well as $200 million-plus annually to pay for the district’s pension costs.

The mayor can expect pushback from the rating agencies, too. Illinois already has what Moody’s Investors Service calculates as a $234 billion state pension shortfall, while the state’s retiree health insurance fund has another gaping $73 billion hole.

Adding $42 billion more – what Moody’s reports as Chicago’s true pension debt – may push the state’s credit rating into junk category. That’s significant since no state in modern times has been rated junk.

Lightfoot’s pension proposal might come as a surprise to some given her comments last week to the Chicago Sun-Times. According to the paper, “Mayor Lori Lightfoot said Friday she’s willing to tackle Chicago’s ‘mounting, looming, all-consuming’ pension debt once and for all, even if it means risking her political future.”

“We cannot keep asking taxpayers to give us more revenue without the structural reforms that are fundamentally necessary to make our city and our state run better. Now is the time to act,” she said.

Lightfoot has obviously given up on structural reforms. Her proposal does nothing to actually reduce the overwhelming debts of the city’s pension funds. Instead, it appears her only goal is to socialize the costs across all state residents.

That’s not “risking her political future.” Making everyone else pay for the city’s debts, if she can make it happen, is the easy way out.

Few options

Lightfoot the candidate knew what a mess the city’s finances were in. The city was already rated junk by Moody’s when she took over, while CPS was five notches deep into junk – worse than even Detroit.

But Lightfoot never signaled a plan for pension reform during her campaign. Her only commitment was that she would protect pensions: ”First, we must start from the firm position that pensions are a promise – and that protecting the retirement security of our public employees is imperative to maintaining a stable middle class and, thereby, our local economy.”

Now she’s found that, in the absence of reforms, the city is running out of options.

Reamortizations – kicking debt payments further into the future – are getting pushback from both rating agencies and public sector unions alike.

Pension obligation bonds, another kind of can kick that Rahm Emanuel pursued, have also run into opposition. Rating agencies, pension funds and actuarial associations are calling POBs what they really are: a gamble with taxpayer dollars.

City tax hikes aren’t a solution either. Chicagoans are tapped out. City residents have been hit by an avalanche of state and local tax increases over the past several years, including the state’s 2017 income tax increase and the biggest property tax hike in the city’s history. Increasing taxes yet again to get the $1 billion needed for pensions could result in severe backlash against the mayor.

Fixing things

Lightfoot’s words to the Sun-Times are all the more disappointing considering the reforms she could have called for: a constitutional amendment to the pension protection clause, changes to how the city doles out retirement benefits going forward, and tough cuts in upcoming contract negotiations with CPS and other labor unions.

Instead, her desperate plan abrogates any responsibility for the city’s largely self-inflicted retirement crisis. And more importantly, it leaves nobody better off. Despite all the tricks, Illinoisans, including Chicagoans, would still be under the same mountain of debt.

Reforms, not can kicks, are the solution to the state’s pension woes. If not, expect more and more Illinoisans to cut their share of retirement debt down to zero by leaving.

https://www.zerohedge.com/news/2019-...-pension-debtsIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-02-2019, 07:41 PM #185

GO TO BLAZES YOU DEMONRATS!ILLEGAL ALIENS HAVE "BROKEN" OUR IMMIGRATION SYSTEM

DO NOT REWARD THEM - DEPORT THEM ALL

-

07-02-2019, 09:19 PM #186

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-02-2019, 10:22 PM #187

Subpar Home-Price Appreciation Has Cost Illinoisans A Quarter-Trillion Dollars Over Ten Years

For many Illinois homeowners, it’s much worse than a matter of limited appreciation. It’s about depreciation that has made their homes worth less than their mortgage balance...

Tue, 07/02/2019 - 19:40

2SHARES

https://www.zerohedge.com/news/2019-...n-dollars-over

Authored by Mark Glennon and John Klingner via WirePoints.org,

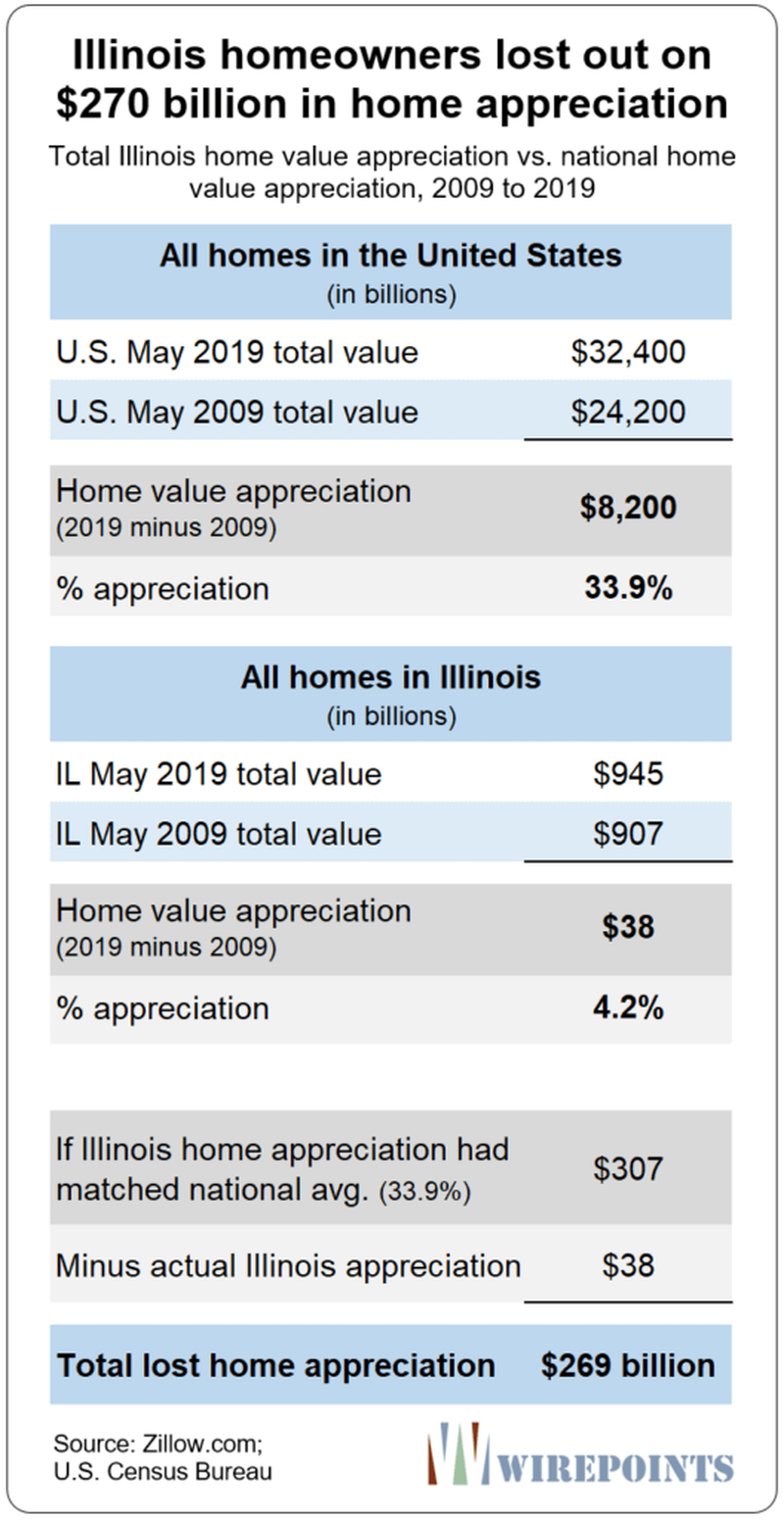

How much wealthier would Illinois homeowners be, in total, if homes here had appreciated at the national average?

With help from the Research Group at Zillow, Wirepoints got the answer:

With help from the Research Group at Zillow, Wirepoints got the answer:

Illinois homeowners would be a stunning $269 billion wealthier if home appreciation here had just kept pace with the national average over the last ten years.Here are the details: According to Zillow, the total value of all homes in the United States in May 2009 was $24.2 trillion. That increased to $32.4 trillion in May 2019, which is an increase of 33.9%. Over that same period, Illinois’ total home value increased from $907 billion to $945 billion, just 4.2%. Had Illinois homes appreciated at that national rate, they would be worth $1.21 trillion, which is $269 billion more than actual. Illinois homeowners lost out on over a quarter trillion dollars of appreciation.

The numbers are summarized below.

Zillow provided these numbers to us using a constant-stock methodology, meaning they looked at the same homes in each time period. So, none of the gain in total value over those ten years was due simply to more or fewer houses having been built in Illinois compared to the rest of the nation.

The numbers are for single family homes and condominiums; commercial real estate is not included.

That $269 billion is $1.3 million for every mile from here to the Moon. It’s $22,000 for every person in Illinois. It comes out to about $66,000 per house in Illinois.

That quarter-trillion dollars of missed appreciation is for the past ten years only. However, tens of billions more were probably missed in earlier years beginning around 2004. It was then that Chicago area home values began to diverge from the rest of the nation, according to Standard & Poor’s Case-Shiller index. The same trend probably emerged at the same time in the rest of Illinois.

For many Illinois homeowners, it’s much worse than a matter of limited appreciation. It’s about depreciation that has made their homes worth less than their mortgage balance. According to Attom Data Solutions, 16% of Illinois homes are “seriously underwater,” meaning that the mortgage balance is more than 25% above the estimated home value. Only four states have a higher percentage of seriously underwater homes.

The impact of these numbers go beyond the staggering direct impact on homeowners. First, is what’s called the “wealth effect.” Consumer spending increases as wealth accrues even on unrealized gains in stocks and real estate. Restaurant owners will tell you that business perks up when the stock market is soaring, and the stock market is where the wealth effect is usually discussed. The negative wealth effect works in reverse, too.

Home values have the same effect, and perhaps more quickly. According to research by the Joint Center for Housing Studies Harvard University, housing wealth effects are more immediate. Consumers spend about 5 1/2 cents out of every dollar increase in housing wealth or in stock wealth in the long run. It takes only about one year for spending from housing wealth to reach four-fifths of this long-run effect compared with several years for stock wealth, according to that research. If true, that would mean Illinois’ subpar home appreciation cut consumer spending by about $15 billion in the state over ten years.

Reduced home appreciation also makes the often-discussed retirement crisis more challenging. Home equity is the largest store of savings for most households and, according to the Center for Retirement Research, households entering retirement will increasingly need to tap home equity to maintain their living standards.

What happened?

The reasons why Illinois home values have underperformed are extensive and some are debatable – matters we’ve written about often on this site. However, property taxes surely top the list. Home values and mortgage qualification are driven primarily by affordability, measured by mortgage payments, insurance and property taxes. High property taxes directly reduce values. They average 2.2% in Illinois, about twice the national average and roughly tied with New Jersey for the highest. Many Illinois communities average over 3% or 4%. Chicago’s south suburbs average over 5%.

Those property taxes have effectively confiscated home equity. They represent a seizure of what is the primary store of wealth for most families, particularly working class families.

A quarter trillion dollars over ten years.

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-03-2019, 02:45 PM #188

With Pension Advice Like This, Chicago And Illinois Are Doomed

There is no solution to the woefully underfunded pensions in Chicago and in Illinois that does not involve benefit cuts subsequent to a 2020 constitutional amendment or municipal bankruptcy...

Wed, 07/03/2019 - 12:50

2 SHARES

Authored by Mark Glennon via WirePoints.org,

The latest op-ed on pensions that has us scratching our heads is from a new face on the scene.

That’s Amanda Kass, writing in Crain’s. Her advice:The best course of action for the near term is for both Illinois and Chicago to make the payments required under current law. Only after the downward trend in the pension systems’ finances has been reversed should lawmakers even consider extending the repayment schedules and/or lowering the funding targets.

That may seem harmless, but hold on. What would it mean to continue making payments required under current law until pensions get to treadwater status – when “the downward trend in our pensions reverses?

Let’s take Chicago’s pensions first. That won’t happen until 2033, even assuming Chicago can somehow figure out how to fund the up-ramp in taxpayer contributions required under current law, By then, annual taxpayer contributions for unfunded pension liabilities will have doubled to $2.6 billion from this year’s $1.3 billion and the unfunded pension liability will have increased another $4 billion.

Let’s take Chicago’s pensions first. That won’t happen until 2033, even assuming Chicago can somehow figure out how to fund the up-ramp in taxpayer contributions required under current law, By then, annual taxpayer contributions for unfunded pension liabilities will have doubled to $2.6 billion from this year’s $1.3 billion and the unfunded pension liability will have increased another $4 billion.

Those are the city’s own numbers for its four pensions combined, contained in its most recent Annual Financial Analysis. That means the numbers are overly optimistic, built on the usual phony assumptions and accounting, which invariably prove wrong resulting in never-ending downward adjustments. And the numbers don’t include Chicago’s other overlapping pensions for the school district, water reclamation district, Cook County and Forest Preserve, which are in the same boat.

Mayor Lightfoot is already floundering for solutions to meet near-term scheduled contributions, first asking for a state bailout and now perhaps a sales tax on services. The unfunded liability is already nearly $30 billion. Yet Chicago should just pay more and more into the pensions even as the hole deepens?

It’s a similar story for the state’s pensions. Under current law, the state says its pensions wouldn’t get to treadwater status until 2028. By then, taxpayer contributions will have had to jump by another $2.4 billion and unfunded liabilities will be up another $6 billion. Current state contributions of $9.2 billion already consume almost a quarter of the budget, driving out spending for other purposes. Unfunded pension liabilities already have the state’s credit rated near junk.

And what about the state’s pensioner healthcare costs, which Kass doesn’t mention? Today, it’s a staggering $73 billion, which increases the true pension hole by about 50%. It’s entirely unfunded so it just grows and grows. It will never reach the reversal Kass wants to see before changing course.

How does Kass propose we pay for the increased pension contributions needed to get to treadwater status? She doesn’t say.

What’s the reasoning behind her proposed course of action? Well, it’s not something that should be called a “crisis,” she says, and that’s “because pension systems’ finances are in constant flux, and unfunded liabilities represent a long-term form of debt. As such their financial condition is not something to be ‘solved.’”

Got that? Long-term debt is nothing to worry about. You don’t “solve” it. It’s been “in flux,” which apparently helps make it OK. Never mind that it’s in flux only in the sense of worsening every year.

And what does Kass suggest we do when the pensions get to treadwater status, assuming we could do it? Then, it would be alright for lawmakers to “consider extending the repayment schedules and/or lowering the funding targets.” In other words, kick the can again! There’s no mention of any other pension reform in the article. Nor have I seen her elsewhere propose any material pension reform other than putting more money into them sooner.

Kass’s article is a short version of an academic paper she published recently along with two co-authors, Robert Bruno and David Merriman. Aggressively pro-union, they are regular authors of research papers purporting to back up standard talking points of Illinois public unions. Read through that paper’s academic jargon if you want, but it says little more than Kass’s Crain’s article.

Amanda Kass

Amanda Kass

Kass is the new go-to source for folks who defend the current pension system and deny the severity of the crisis. Columnist Rich Miller, for example, wrote “If Amanda Kass is part of a study, you know it’s good,” referring to that aforesaid paper.

Formerly with the Center for Tax and Budget Accountability, Kass is now with the Government Finance Research Center at the University of Illinois at Chicago’s College of Urban Planning & Public Affairs. Those two co-authors are also with taxpayer-supported Illinois universities. Aren’t you happy to know what your tax dollars are supporting?

A pension actuary writing in Forbes this week said succinctly exactly how we see things:I can only repeat again and again: There is no solution to the woefully underfunded pensions in Chicago and in Illinois that does not involve benefit cuts subsequent to a 2020 constitutional amendment or municipal bankruptcy. And the sooner Pritzker and Lightfoot figure that out, the better off we’ll all be.They haven’t had to figure that out because voters haven’t figured that out, thanks, in part, to what they’re reading in op-eds by authors who haven’t figured that out.

https://www.zerohedge.com/news/2019-...ois-are-doomedIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-03-2019, 02:57 PM #189

Austin city council votes to allow homeless camping on sidewalks...except in front of city hall

Today's prize for lack of self-awareness goes to the Austin, Texas city council.

July 3, 2019

By Thomas Lifson

Today's prize for lack of self-awareness goes to the Austin, Texas city council. While it is fine and dandy for homeless people to camp out in front of people's homes and businesses, with all the problems of human waste, panhandling, mental illness, and open drug use that we in the Bay Area see whenever we venture to take a walk in San Francisco, the wise councilors exempted their own place of business from the such concerns.

Elizabeth Findell of the Austin Statesman writes:

After emotional testimony last week regarding homelessness in Austin, City Council members rescinded prohibitions on camping on public property. Starting Monday, so long as they are not presenting a hazard or danger, people will be able to sleep, lie and set up tents on city-owned sidewalks, plazas and vacant non-park space.

Except, not in front of City Hall itself.

Austin's mayor engaged in some epic double-talk trying to explain his way out of the obvious hypocrisy:Mayor Steve Adler said Friday that he does not think the City Hall camping ban should be immediately rescinded. He said it should be reviewed as staffers seek to identify, by August, the places where people should and shouldn't be allowed to camp in Austin. Adler acknowledged that some business owners objected to the ordinance changes out of concern about the impact people camping in front of their businesses could have, but he said they shouldn't consider the City Hall ban to be hypocritical.Whole sidewalks everywhere but city hall are open to people appropriating public property for their own use. The madness does not extend everywhere:

"I think the businesses in our community want staff to focus on the broader question in our community regarding where people can and can't camp," he said. "I'm sure included in that discussion will be city properties, properties along Congress and elsewhere in the city. We can't do everything all at once."

Adler would not say whether he thinks the City Hall plaza and amphitheater are appropriate for camping.

"You could come up with a list of 20 different locations and we could go through the list," he said. "The appropriateness of any locations really need to be understood in the context of all the locations."

Other areas where camping remains banned include any city park space, under Austin Parks and Recreation rules. That includes downtown green spaces as well as trails and greenbelts such as along Barton Creek.People who are unable to provide housing for themselves deserve our compassion and assistance, but they do not deserve to take for their own use whatever public spaces they desire. I have long believed that campsites in rural locations, fenced in and featuring tents and basic food such as rice and beans, ought to be available to anyone who declares himself a pauper, indigent, and incapable of self-sufficiency. Basic needs and nothing else are to be provided. Nothing else, for there should be no incentive to let go of personal responsibility and depend on taking the product of others' hard work to live a life of leisure.

This would not be prison, even though there would be walls. Leaving the camp would simply require a declaration of personal autonomy, meaning no need to depend on others for provision of life's necessities.

With that basic safety net in place, camping out on public property can then be banned.

Photo credit: Delwin Steve Campbell.

Follow us: @AmericanThinker on Twitter | AmericanThinker on Facebook

https://www.americanthinker.com/blog...city_hall.htmlIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-03-2019, 03:04 PM #190House Democrat wants to prosecute people who make fun of members of Congress online

"We're going to shut them down," she promises. She's a moron. Come and get me...

July 3, 2019

By Thomas Lifson

"We're going to shut them down," promises Representative Frederica Wilson, the Florida Democrat who does not understand the First Amendment. She not only wants to silence criticism, but wants to prosecute it, though she has no idea what law could be used to do that...because there isn't one. In other words, she is a moron.Those people who are online making fun of members of Congress are a disgrace, and there is no need for anyone to think that is unacceptable. We're going to shut them down and whoever it is, to shut them down and they should be prosecuted. You cannot intimidate members of Congress, threaten members of Congress, it is against the law, and it's a shame in this United States of America.

Watch her flaunt her ignorance and her totalitarian inclinations:

Video at the page link

Wilson is best known for her collection of hundreds of hats. She is a clown.

Come and get me, Rep. Wilson. I am mocking you, as is my right. You should have remained an elementary school principal, where your level of sophistication was consistent with that of your clients.

Meanwhile, the Left continues to beclown itself, calling President Trump a Nazi, while one of its own behaves just like a totalitarian.

Graphic credit: Grabien screen grab.

Follow us: @AmericanThinker on Twitter | AmericanThinker on Facebook

https://www.americanthinker.com/blog...ss_online.htmlIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

Study: 42 of the 50 Most Violent Peacetime Cities in the World Are in Latin America

By lorrie in forum illegal immigration News Stories & ReportsReplies: 3Last Post: 03-10-2018, 11:06 AM -

Paul Craig Roberts: The Collapsing US Economy and the End of the World

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 07-08-2012, 07:12 PM -

US Airways is hiring in 3 cities, including Phoenix & NV

By Newmexican in forum Other Topics News and IssuesReplies: 0Last Post: 11-02-2011, 06:49 PM -

Williams: Obama/Cong Plan America Down 3rd World Status

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 10-28-2010, 01:39 AM -

AMERICA REDUCED TO THIRD WORLD STATUS

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 3Last Post: 09-22-2008, 10:25 AM

280Likes

280Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Congressman Eli Crane says Biden administration is stonewalling...

04-24-2024, 05:07 AM in illegal immigration News Stories & Reports