Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-02-2012, 11:46 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Middle class dysphoria What does the new American Dream look like? compressed wages

Middle class dysphoria What does the new American Dream look like? Inflated college tuition, lower home ownership rates, and compressed wages.

mybudget360 in banks, debt, government, income, median net worth, middle class, recession

The American Dream was always tied to economic prosperity. The ability to work and save for a respectable retirement seemed cornerstones to this vision of middle class success. The idea that future generations would have it better seemed to also be part of this vision of economic prosperity. The last two decades have seen a dramatic shift to this vision. The struggle to stay in the middle class is getting more difficult since more are being pushed into the poor or working poor categories. The recovery has been largely an odd accounting function courtesy of bailouts to the banks and massive government spending. Today, we have the largest number of Americans on food stamps. Those seeking to follow their desire to get a better education are saddled with a minefield of student debt and subpar institutions that simply look to steal their money and give them a piece of paper that is hardly recognized in any professional context. The home ownership rate, the symbolism of the American Dream is drifting further into the shadows.

The consequences of the housing bubble

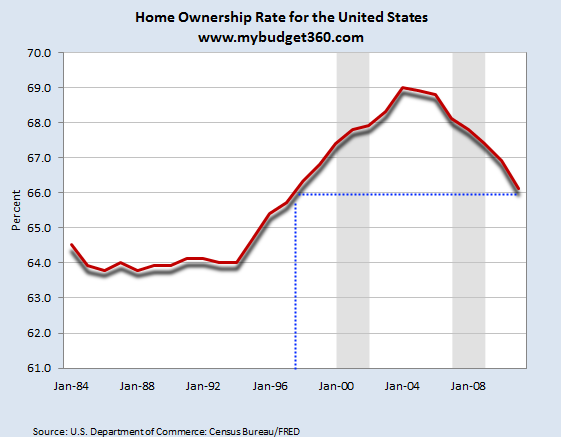

The current home ownership rate across the country is now back to levels last seen in 1996:

What does this mean for the middle class that once relied on housing as the cornerstone for the American Dream? At the core, it has shaken the faith of many because housing was supposed to be a sure bet. Every year, your home value would go up and you subtly built equity. That assurance has been wiped away in the current aftermath of the housing bubble. The housing market had been a steady investment for many decades providing this bedrock of stability. This all changed of course when investment banks in conjunction with government backed guarantees co-opted the market and turned it into just another commodity to speculate and destroy. Keep in mind many of these investment banks and government cronies sought to increase home ownership across the nation and have only done the opposite. Glass-Steagall was repealed back in 1999 and here we are with a home ownership rate now back to 1997 levels and an economy that is still in disarray for working and middle class Americans.

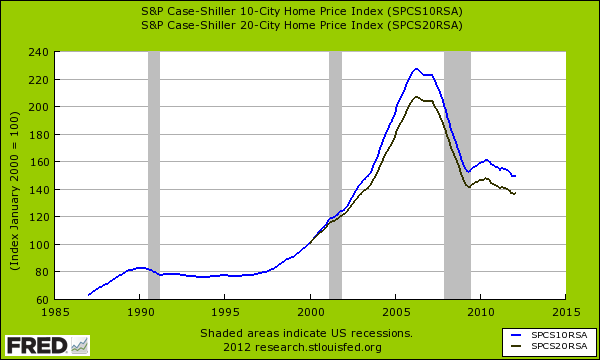

The Case Shiller Index reveals a lost decade in home values:

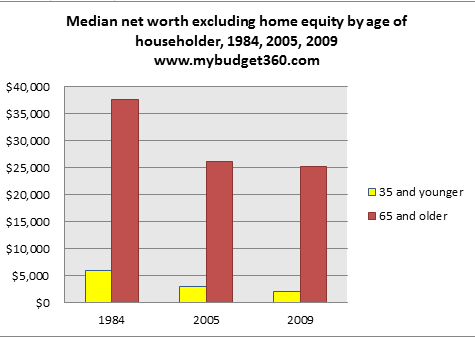

Yet this destruction in illusory and real wealth in real estate has impacted the net worth of most Americans. The biggest asset most Americans have is in their property and it has been one of the worst performing items in the last decade. Keep in mind that many Americans already had a small net worth to begin with:

So here you have a two prong attack to a symbolic item of the American Dream:

-1. Younger Americans now have a much more skeptical view of housing. The low wages and big student debt already make them a harder sell for current housing.The student debt bubble

-2. Older Americans had most of their wealth in housing and have seen their biggest asset class pop only a few years before many enter into full retirement mode.

The blue collar power that built a big middle class after World War II is no longer an option for many in this country. Many of the viable careers that are available today require specified training through education. Yet many are led into for-profits with the notion that all degrees are created equal and are saddled with back breaking levels of debt. Put yourself in the shoes of a young person today. You are 18, you realize that there are little options for making it into the shrinking middle class without a solid education. So many take the big plunge into for-profits or subpar schools and simply come out with a giant level of debt. State schools and local community colleges cannot compete with marketing budgets of for-profits. How many at 18 really have a solid understanding of macroeconomics and future trends?

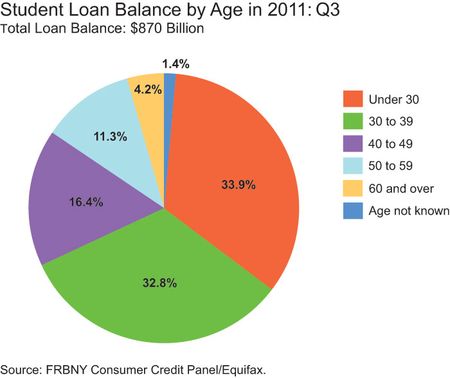

Most of the nearly $1 trillion in outstanding student loan debt is held by younger Americans:

Over 66 percent of all student debt is held by those 39 and younger. If you remember that first net worth chart, most of these people already have a terribly low net worth. This is going to be a big issue moving forward especially given the structure of student loan debt. Almost every form of debt including mortgages, auto, and credit card debt can be discharged through the bankruptcy process. This makes sense in any balanced economy with a responsible financial system. For example, a bank does a careful analysis of a home and requires a down payment that is meaningful. For whatever reason, the current owners are unable to meet their mortgage payment (a very common issue). The bank will start foreclosure proceedings and take the home back. The owner is not responsible for the mortgage once the bank takes over the house and gets a clean start and if the bank was diligent, the home can be sold for market value. Of course the financial system did not exercise due diligence and that is why we are in the mess we are in.

However with student loans, there is no formal discharge process. So now you have many young Americans either underemployed or unemployed yet they need to pay back that student loan debt. Do you think these people are eager to take on another giant debt load with a mortgages? The middle class dysphoria is causing this recovery to feel more like a shadow recession because in reality, it is for most Americans. The stock market is up over 100 percent from the lows in 2009 but look at how Americans feel in poll after poll. Why? Most Americans derive their wealth from housing and solid employment and those two items are in the doldrums. The stock market largely benefits those in the top one percent who derive a sizeable income from dividends or stock gains. Weve seen banking executives making millions of dollars in bonuses for what? Breaking apart the middle class? Taking out trillions of dollars in bailout funds? No wonder why most Americans are questioning what it means to be middle class.

Middle class dysphoriaJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Twitter just suspended Ad account on X

04-19-2024, 05:54 PM in illegal immigration Announcements