Results 1 to 5 of 5

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-28-2019, 01:07 AM #1

Elizabeth Warren Is Not Proposing a Tax. She’s Proposing Asset Forfeiture.

LOL, she's gone full commie! "The Kulaks Must Be Liquidated as a Class"

nationalreview.com

Elizabeth Warren Is Not Proposing a Tax. She’s Proposing Asset Forfeiture. | National Review

The Kulaks Must Be Liquidated as a Class

By Kevin D. Williamson

January 25, 2019 6:30 AM

Sen. Elizabeth Warren speaks at an event in Claremont, N.H., January 18, 2019. (Brian Snyder/Reuters) Elizabeth Warren is not proposing a tax; she’s proposing asset forfeiture.

History is very short, if you look at it the right way.

The American Revolution seems like it was a very long time ago, but looked at with the right kind of eyes, it was the day before yesterday: The revolution of Washington and Jefferson inspired the French Revolution, which unhappily perverted the classical-liberal principles of the American Founders and created instead an ersatz religion purporting to be a cult of pure reason — le Culte de la Raison — which culminated in fanaticism, terror, and dictatorship. The French Revolution inspired the Russian Revolution, which created its own cult of pure reason — “scientific socialism” — and modeled its “enemies of the people” purges on French revolutionary practice, culminating in fanaticism, terror, and dictatorship. The Russian Revolution in turn inspired the Iranian one, which had intellectual roots in the Bolshevik experience in the Caucasus and culminated in fanaticism, terror, and dictatorship. The Iranians exported many of their revolutionary principles to Hugo Chávez, his United Socialist party, and their so-called Bolivarian Revolution (whose colectiovos gangs were modeled on Iran’s basji militias) which culminated in fanaticism, terror, and dictatorship, currently on particularly dramatic display.

In most cases, the revolution begins with a peasant prelude and reaches its crescendo with some variation on the theme of Napoleon; socialist revolutions in particular have a peculiar habit of beginning with a man in a work shirt and ending up with a man dressed like Cap’n Crunch. Venezuelan President Nicolás Maduro does look a sight in his beauty-pageant sash and Mr. T-worthy gold chains. The people who endure his socialist government are eating zoo animals and pets in what was the richest country in South America.

Elizabeth Warren is going to look terrific in those mirrored aviator sunglasses and peaked captain’s hat. She’s spent half her life playing dress-up, morally — pretending to be an Indian — so she may as well dress the part of her aspirations. “Who are you wearing to the state dinner? Oscar de la Renta? Prada? Pinochet?”

Revolutions do not set out to be awful. Not usually. They just end up that way. When the Bolsheviks came to power in Russia, many of them wanted to prohibit capital punishment, which they saw as a high-handed czarist institution. V. I. Lenin overruled them. “How can you make a revolution without executions?” he asked. The key to revolution in his mind — and in those of his revolutionary antecedents and descendants — was terror. “We shall return to terror and to economic terror,” he promised, in a revolution of “unrestricted power based on force, not law.”

Senator Warren apparently has found her guiding spirit and has announced along with her presidential campaign a campaign of economic terror based on force, not law. Specifically, she has proposed to begin seizing a portion of the assets of some wealthy Americans, a course of action that the federal government has no constitutional power to undertake. The seizure of assets is a fundamentally different thing from the taxation of income, which itself took a constitutional amendment to implement. What Warren is proposing is essentially a federal version of the hated asset-forfeiture programs that have been so much abused by law-enforcement agencies — minus the allegation of criminal misconduct and made universal and annual.

The senator is in a bit of a panic: She hadn’t expected to face a challenge from her left in her quest for the Democratic nomination, but as her entire party lurches in a chávista direction, she has been forced to go one step farther lest she fall into the “moderate” class, whose members almost certainly will be slaughtered in the 2020 Democratic primary. And so she proposes this ridiculous and illegal course of action.

She may not be the radical she pretends to be, but Senator Warren has pretended to be a lot of things. A Cherokee, for one, which is good for a laugh, but perhaps not the worst of it. Her longing for fame — and money and power — is impossible to miss. She spent a period trying to launch a career as a writer of dopey self-help books (The Ultimate Lifetime Money Plan!) and then tried on the costume of a Lou Dobbs-style populist China hawk, and even in her scourge-of-Wall-Street incarnation, she couldn’t help cribbing from Margaret Thatcher in pandering to Dobbs, then at CNN: “One of the problems with spending money in this way is that at some point we really do run out of money.” She boasted that her little bureaucratic fiefdom — the Congressional Oversight Panel — was called “COP.” Her “professor of color” act got her a couple of cushy academic postings and a net worth of a few million dollars. I covered her Senate race against Scott Brown and watched her doing a pretty poor impersonation of an Irish-American ward-heeler in Boston, clapping along awkwardly to “Charlie on the M.T.A.” like some animatronic Muldoon. If she has to pretend to be Hugo Chávez, it won’t be her first act of cultural appropriation. And the recipe book should be a hoot.

Funny thing about Senator Warren’s asset-forfeiture scheme. Like many similar proposals, it probably would not raise much revenue and might in fact leave the country as a whole economically worse off. And the people advising Senator Warren on that are perfectly content with that outcome, because, as Emmanuel Saez and Gabriel Zucman argue in the case of Representative Alexandria Ocasio-Cortez’s proposal to radically increase income taxes, this is to be understood not as an economic question but as a moral one: It is simply morally obligatory to hurt wealthy people. “The point of high top marginal income tax rates is to constrain the immoderate, and especially unmerited, accumulation of riches,” they write.

And who gets to decide what’s merited and what’s unmerited? What are the chances that, say, Senator Warren’s modest millions or her multimillion-dollar home are deemed “unmerited”? What decides, of course, is “unrestricted power based on force, not law,” because the law cannot substantially answer that kind of question but can only instead encode the desires of people with power, which is what Senator Warren is seeking more of.

Again, we have been here before.

When the socialist schemes of Joseph Stalin et al. foundered, they blamed the “kulaks,” i.e. those who had enjoyed the “unmerited accumulation of riches.” There was never any real definition of a “kulak.” Basically, if you had one cow and your neighbor had two, he was a kulak. Stalin announced the “liquidation of the kulaks as a class” as a necessary precondition for the progress of his program, which was, like Kamala Harris, “for the people.” Dekulakization (раскулачивание) was responsible for the deaths of about 5 million subjects of the workers’ paradise. This was necessary, the socialists argued, because the kulaks dominated the political party system (“for the rich, wealth begets power,” Zucman writes), because expropriating their wealth was necessary to fund benefits for the people (“The affluent,” Saez and Zucman write, “can contribute more to the public coffers. And given the revenue needs of the country, it is necessary”), because the kulaks were hoarders (under the headline “Elizabeth Warren is trying to save capitalism from itself,” David Atkins of Washington Monthly decries the “artificial lack of resources caused by the looting and hoarding of the obscenely wealthy”), etc.

But do our modern progressives really propose to liquidate these “hoarders” as a class?

Saez and Zucman write hopefully of the prospect that high tax rates would make the class of people with larger incomes “largely disappear.” Representative Ocasio-Cortez declares it “immoral” that we have a “system that allows billionaires to exist.” Marshall Steinbaum, the research director of the progressive Roosevelt Institute, wrote: “It’s increasingly clear that having wealthy people around is a luxury our society can no longer afford.”

And, so, here we are again: The kulaks must be liquidated as a class. But who is a kulak?

We might glean some insight into that from the progressives’ thinking in the recent free-speech debates, which goes something like this: “We’re all in favor of free speech, but Nazis should be chased from the public square, by violence if necessary, and we should harass their employers in order to ruin them financially. Also, everybody who disagrees with me is a Nazi, including children wearing hats that I don’t like.”

176

You may not feel like a kulak. You may take comfort in hearing that only the “tippy-top” wealthiest people are to be expropriated in the name of social justice. Those children at Covington Catholic probably didn’t think they were Nazis a week ago, either.

History is short, if you look at it with the right kind of eyes. Some of you might want to consider looking from Zurich or Singapore.

https://www.nationalreview.com/2019/...ocoJSdX1mPtAsYIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-28-2019, 06:28 PM #2

Martin Armstrong Warns Warren's Wealth Tax Will Destroy America In Less Than 10 Years

"Warren’s proposal is not only going to be the final nail in the coffin of capitalism and the United States but indeed, investors will migrate to China. The danger is clear... it would absolutely destroy the Right to Privacy."

Mon, 01/28/2019 - 17:21

1 SHARES

Authored by Martin Armstrong via ArmstrongEconomics.com,

QUESTION:Mr. Armstrong; I have been reading your blog for years now. It is obvious that you are well connected behind the curtain. It did not take but perhaps a day or two after you explain the difference between wealth and income to suddenly see Elizabeth Warren adopting the position to impose a wealth tax of two percent on people with assets of 50 million or more. Will this not cause the rich to leave as they did in France?

Thank you for the enlightenment

HT

ANSWER:

Warren’s proposal is not only going to be the final nail in the coffin of capitalism and the United States but indeed, investors will migrate to China. The danger is clear...

The famous legal case that led to the Supreme Court’s Right to Privacy was Griswold v Connecticut. It involved a doctor who was criminally convicted for giving married persons information and medical advice on how to prevent conception with a condom. The religious extremist took the view that the Bible said go forth and propagate and thus they imposed their religious beliefs upon the majority by criminal law. The Supreme Court correctly created the Right to Privacy out of a simple logical conclusion. How would the state outlaw the use of a condom in marriage? How could it be enforced? Would a state policeman have to inspect before you had intercourse? Would you then have to apply for a license to have intercourse so the state would then know to send the policeman into your bedroom?

In order to impose a Wealth Tax, that means the absolutely EVERYONE would then by law be compelled to list everything they own right down to your wedding rings so the state could them calculate your wealth to impose a tax.

This type of tax would absolutely destroy the Right to Privacy.

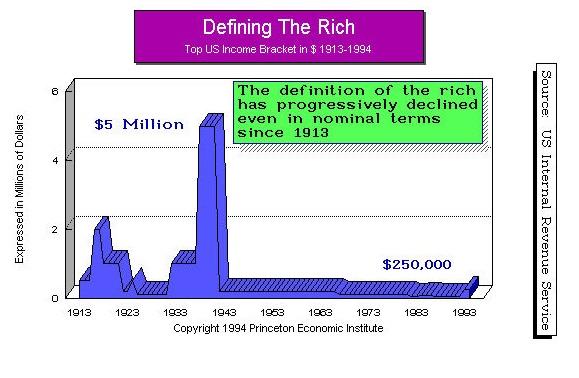

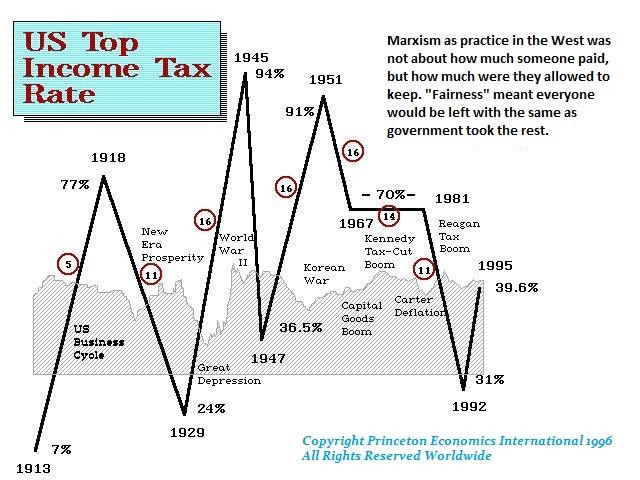

Putting the Right to Privacy aside, the government can NEVER be held to whatever it promises today. The government will always introduce a tax and claim it will only apply to the “super-rich” as she is doing – $50 million will pay 2% annually on the value government claims your assets are worth and $1 billion+ will pay 3% annually. At 8%, you will confiscate all of a person’s assets in less than 10 years. Elizabeth Warren is the new Karl Marx advocating communism in slow motion. To sell the income tax in 1913, it was to be just 1% and only on the rich. Ever since it rose to 94% and now the Democrats want to raise it to 70%. No matter what rate they say today, they will always change it.

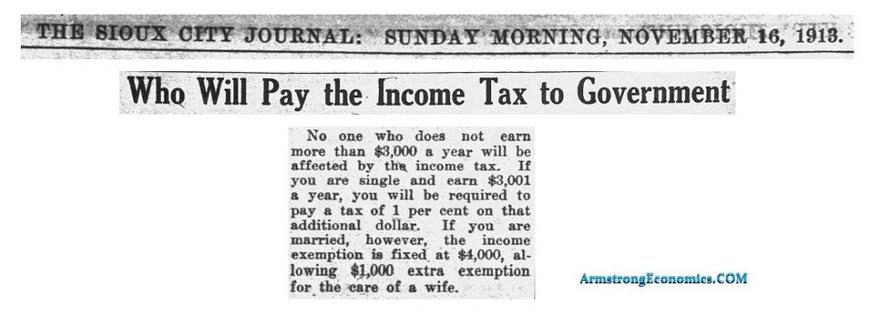

Those below that $50 million thresholds will cheer – go get em. They did precisely that in 1913. To sell the introduction of the income tax, they drew the line at $3,000 when a good job paid $0.30 per hour or $18 a week which was just under $1,000 a year. So to get a new tax in, they will ALWAYS place it above the majority of people and pretend they will never be impacted. This is the luxury tax I saw in Australia pitching they would tax their Ferraris, Fur Coats & French Wines. They cheered. When the tax was imposed, it included all electrical products.

Once they create a new tax under false promises, they ALWAYS change the specifics. Just as ONLYthe rich would pay income tax, then comes Roosevelt’s New Deal and morally the same claims were made but suddenly they introduce the Payroll Tax and not everyone pays income tax. They will do the very same thing with a Wealth Tax. You cannot hold the government to whatever it promises. They will constantly change the rates and to whom it applies based upon they need money. They have constantly changed the DEFINITION of the “rich” and now it begins at $500,000. As the pension crisis explodes, they will need money for their own pensions like California, Illinois, and New Jersey, just to name a few. They will drop the Wealth Tax to the same level of income tax. Regardless, EVERYONE will have to report their total wealth in order to make sure you are paying your Wealth Tax.

Once any new form of taxation is introduced, then politicians will ALWAYSraise the rates and lower thresholds as they continually need a never-ending source of other people’s money. The $50 million thresholds will crash to normal levels and the criteria will change for everyone. Every person will have to report their entire wealth right down to inheritance or else the government will be unable to confirm you are under the $50 million entry level. There are a lot of “super-rich” kids who inherited companies rather than cash. If your father’s company was worth $1 billion, how do you get $30 million in cash to pay taxes without liquidating at least part of the company? Then you have to pay that EVERY year!

Warren’s tax will cause a collapse in investment which means that unemployment will only rise. When people appear to make a fortune because their company goes public, they have restrictions that prevent them from selling for a period. A wealth tax will be applied simply based upon values of shares they cannot sell. This would certainly lead to a mass exit of the upper-class the very same as what took place in France – they just left!

Like the income tax, Warren’s Wealth Tax will move to 100% application to everyone because of some new event or war. Since we are already in a collapsing state of socialism, they will argue to raise this new Wealth Tax to save government pensions. Effectively, we will have a NATIONAL property tax that will include your home and then you will have to pay income tax on top of that. The pension funds will become a national emergency and the shift to increasing taxes will take place exactly as we are witnessing in California – if it moves, tax it; it fails to move tax it; and if it has any use whatsoever (like water) tax it.

Back in the ’90s, I was working to trying to Privatize Social Security to invest in equities rather than 100% government bonds and reform taxes by moving to a national retail sales tax (indirect) and eliminating the income tax. I was shuttling back and forth between the Speaker of the House Dick Armey and Bill Archer who was Chairman of the House Ways & Means Committee. Dick served in Congress between January 3, 1995 – January 3, 2003. I was sitting in Dick’s office. He had his feet up on the desk with his cowboy boots while smoking a cigar. He said to me that he could not support a retail sales tax because he did not believe he would be able to terminate the income tax. He then said to me that when the political cycle would change, as I told him our computer was projecting, then the Democrats would have both taxes. It was at that moment when I gave up. I told Dick he was absolutely correct. Without restoring the Constitution to prohibit direct taxation, it was hopeless to save the future no less Social Security. I made my decision to stop the nonsense of thinking I could prevent the future economic disaster. All I could do was advise my clients to help them survive not the nation.

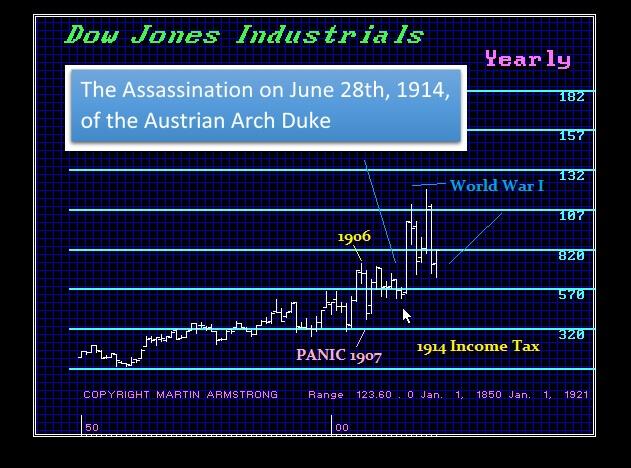

War is a great excuse, which is why politicians like war for it justifies raising taxes and introducing new powers like the Patriot Act. Make no mistake about it, when they introduced the income tax, the economy plunged into a steep recession in the face of the income tax. INVESTMENT dried up and the stock market shifted buyers. Americans were sellers and Europeans were the buyers as SMARTmoney began to move out of Europe. It had been the assassination on June 28th, 1914, in Sarajevo, Bosnia and Herzegovina of the Austrian Arch Duke which began to increase the tensions.

But a 43-month economic boom ensued from February 1915 to 1918, first as Europeans began purchasing U.S. goods for the war and later as the United States itself joined the battle. It was February 1915 is when the Ottoman forces attacked the Suez Canal and Germany defeated a Russian army in Poland. Eventually, the long period of U.S. neutrality made the ultimate conversion of the economy to a wartime base. The economic boom led to real plant and equipment expansion in response to the increased demand from both Europe and the United States.

Those who are in the “rich” category earn their money from INVESTMENT not wages. This is what Elizabeth Warren is addressing for she wants a tax on wealth – not income. So if you owned $100 million of a stock that was valued at that level because of a bull market, you will then have to pay 2% – $2 million. The stock crashes by 50%. You now pay 2% again every year of the current value of $1 million even though you lost $50 million. This type of Wealth Tax will unquestionably destroy INVESTMENT. You can lose and get no credit for a loss.

What this will do is far worse than the proposed 70% income tax for the new “Green New Deal” of Alexandria Ocasio-Cortez. This dynamic-duo of Warren and Ocasio-Cortez will absolutely complete what our model is forecasting – the end of the United States. Both are completely ignorant of how the economy even functions. They lick their lips at other people’s wealth and just want to get their hands on it to fund their wild ideas of some Green New Deal.“The Green New Deal we are proposing will be similar in scale to the mobilization efforts seen in World War II or the Marshall Plan… Half measures will not work… The time for slow and incremental efforts has long past [sic].” – Alexandria Ocasio-Cortez, then-candidate for the U.S. House of Representatives, Huffington Post, June 26, 2018This manifesto is very serious for they reject gradual change but are demanding immediate change to the economy. What has taken place among the Democrats is a band of newly elected members of Congress is accepting the leadership of Alexandria Ocasio-Cortez to push forward for this Green New Deal by sheer force. She is calling her proposal the most significant blueprint for system change in 100 years.

The core idea demands the mass conversion to renewable energy and zero emissions of greenhouse gases in the U.S. by 2030. Yes – Global Warming is a great excuse to raise taxes. They argue that a transition is not acceptable for it must be immediate action by the elimination of greenhouse gas emissions from our multi-trillion-dollar food and farming system they claim is long overdue because farming and cows represent a degenerative food system generates that accounts for 44-57% of all global greenhouse gases.

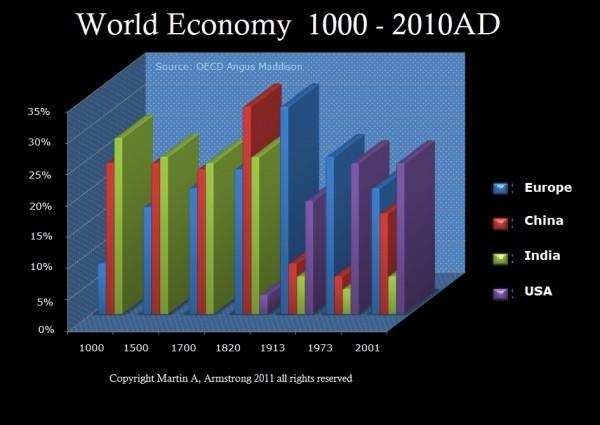

Warren’s proposal will destroy the economy and lower economic growth providing the strongest incentive for capital to migrate to China. As Europe and the United States spiral downward economically, this is how our model will be correct in the shift from the United States to China of the title – Financial Capital of the World. India and China were where all the wealth was which peaked during the early 19th century. After the fall of Rome and them Byzantium, the Financial Capital of the World began to migrate to India. That peaked by about the 14th century as India gradually declined and it moved to China.

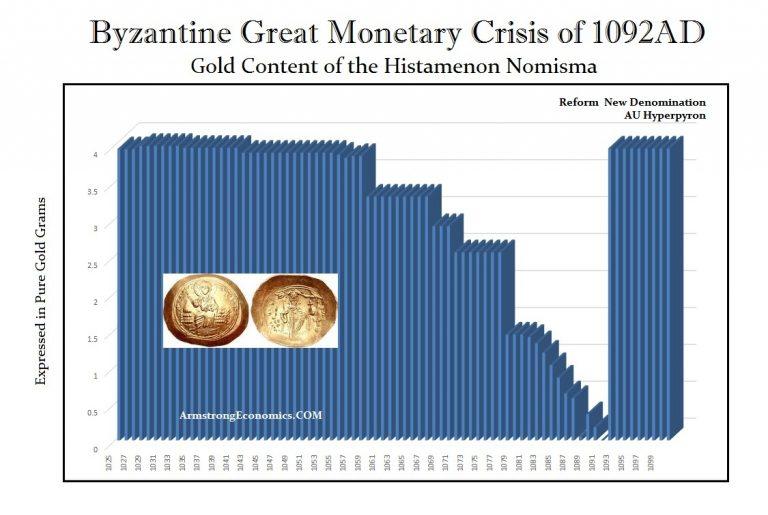

Following the Great Monetary Crisis of 1092, the Financial Capital of the World migrated to India – the land of the Spice Trade. Southern India has long imitated Roman gold coins to facilitate the local economy. We begin to see actual India coins but only under the Kushan Empire. Southern India continued to mint Roman imitations until the mid 3rd century AD. After that period, we begin to see actual India gold coins being struck showing that governments began to win the confidence of the people.

India’s economic boom period lasted about two Pi Cycles of approximately 630 years. The time period that it had captured the title of the Financial Capital of the World appears to be only about 224 years. China’s rise also lasted about 224 years. The rise of the United States has come into play for also about 224 years.

It’s just time. So thank you Warren and Ocasio-Cortez for ensuring our model will be correct once again. What these people refuse to ever look at is that the government is incapable of ever managing anything. Economic growth declines with rising taxation and regulation. No matter how many examples there are of how socialism destroys economies right down to present day Venezuela, they just cannot help themselves trying to change the very nature of human behavior. Any one who believes this tax will stay at $50 million+ is an absolute fool. History would beg to differ.

Will this end up causing a mass exodus of Americans? Yes! It will simply be time to turn out the lights and leave. This is how the United States will be destroyed like every other empire. Far too often there ends up more people in government living off the tax collections disprotionately to the living standards of the people paying taxes.

https://www.zerohedge.com/news/2019-...-less-10-yearsIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-28-2019, 08:31 PM #3

Be Careful What You Wish For - Warren's Unconstitutional Wealth Tax Is Just The Beginning

"...in addition to the wealth tax being unconstitutional, it will soon have to pay for all sorts of crazy ideas that will go far beyond confiscating ALL the wealth of anyone who has anything..."

Mon, 01/28/2019 - 13:51

55 SHARES

Authored by Mike Shedlock via MishTalk,

If you thought the Native American story was a whopper, check out Warren's new plan to expand government.

Tax the rich. Tax the rich. Just take it. That is the message from progressives.

Here is Warren's Press Release.

United States Senator Elizabeth Warren (D-Mass.) today unveiled the Ultra-Millionaire Tax, a bold proposal to tax the wealth of the richest 0.1% of Americans. The legislation, which applies only to households with a net worth of $50 million or more, is estimated by leading economists to raise $2.75 trillion in tax revenue over a ten-year period.Sound good?

For decades, a small group of families has raked in a massive amount of the wealth American workers have produced, while America’s middle class has been hollowed out. The result is an extreme concentration of wealth not seen in any other leading economy.

The Ultra-Millionaire Tax taxes the wealth of the richest Americans. It applies only to households with a net worth of $50 million or more-roughly the wealthiest 75,000 households, or the top 0.1%. Households would pay an annual 2% tax on every dollar of net worth above $50 million and a 3% tax on every dollar of net worth above $1 billion. Because wealth is so concentrated, Saez and Zucman project that this small tax on roughly 75,000 households will bring in $2.75 trillion in revenue over a ten-year period.

Think again. Please consider Elizabeth Warren’s Unconstitutional Wealth Tax.As she seeks the 2020 presidential nomination of the Democratic party, Sen. Elizabeth Warren is giving voters fair warning that she does not accept the Constitution’s limits on federal power. On Thursday the former Harvard law professor unveiled a plan to extract wealth from the country’s wealthiest citizens.Just a Start

The “leading economists” cited by Team Warren are Emmanuel Saez and Gabriel Zucman from the University of California-Berkeley.

No doubt many economists will also explain in the days to come why the Warren tax would not raise as much as Messrs. Saez and Zucman expect and how it would distort investment and encourage capital flight from the United States. Ms. Warren implicitly acknowledges this last problem. Her plan includes “a significant increase in the IRS enforcement budget” and “a 40% ‘exit tax’ on the net worth above $50 million of any U.S. citizen who renounces their citizenship.”

There are excellent economic arguments against this new tax plan. But today this column would like to focus on the illegality of the Warren scheme. Ms. Warren seems to understand this problem as well. Typically lawmakers announcing new legislation don’t feel the need to simultaneously try to rebut anticipated claims that the bill is unconstitutional. But the Warren press release links to two letters on the subject, each signed by various law professors at famous universities.

No matter how many academics she persuades to sign on to this ideological project, the plain fact is that the founders specifically prohibited such a tax. A well-informed reader notes: The 16th Amendment authorizes Congress to tax “incomes, from whatever source derived.” It does not give Congress the power to tax balance sheets as well.

Voters can choose to believe that Ms. Warren’s wealth tax would only hit those with enormous wealth. But given the damage she intends to wreak on constitutional limited government, why should they?

These ideas are just a start. Please note that Democrat Presidential Hopeful Wants to Give Everyone $1,000 a Month Free Money.

I estimated the cost of that to be about $2.4 trillion a year.

Wealth in Wrong Hands

Also note New York Mayor Says "Wealth in Wrong Hands", So, We'll Take It

New Green Deal

Finally, please ponder ponder the Green New Deal and Medicare for All Proposal by newly elected progressive illiterate wonderkind Alexandria Ocasio-Cortez.

She proposes spending $1 trillion to save the planet. Others more realistically estimate the cost of her plan at $40 trillion.

Medicare for all will cost on the order of $32 trillion.

So in addition to the wealth tax being unconstitutional, it will soon have to pay for all sorts of crazy ideas that will go far beyond confiscating ALL the wealth of anyone who has anything.

https://www.zerohedge.com/news/2019-...just-beginningIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-28-2019, 08:39 PM #4

Elizabeth Warren's proposed 'ultra-millionaire tax' would be the rape of the Constitution

Warren, a Harvard Law School professor, knows this. It's a feature, not a bug.

January 28, 2019

By William Sullivan

Elizabeth Warren has unleashed her bold new presidential campaign promise, which she cleverly calls "The Ultra-Millionaire Tax." After all, none of us is an "ultra-millionaire," so why should we care? This new tax won't hurt you; it would just impose a 2% annual tax on all household net worth over $50M, with an additional 1% surtax kicking in for assets held over $1B. In her plan, wealth is defined as "all household assets ... including residences, closely held businesses, assets held in trusts, retirement assets, assets held by minor children and personal property with a value of $50,000 or more."

"I'm in," she says, "on the notion that we have to rewrite the tax code." And a policy like the one she proposes, say two UC Berkeley economists, "would shrink the wealth of the superrich by $2.75 trillion over a 10-year period, while only affecting around 75,000 U.S. households."

"Ultra-millionaire." "Superrich." As you can see, this is all very scientific and measured stuff.

In truth, Alexandria Ocasio-Cortez's proposed 70% tax on the "tippy tops" of income-earners looks downright sober and rational compared to Warren's proposed policy. And for all Ocasio-Cortez's ignorance about how government works (the three branches of government are not, in fact, "the presidency, the Senate, and the House," as she recently proclaimed), at least her proposed tax plan appears constitutional. Yet Warren, a Harvard law professor, has proposed a tax plan that is not potentially, but certainly unconstitutional.

This can be proven quite simply to anyone who cares to learn.

The Sixteenth Amendment of 1913 gave the federal government an additional right to tax income, and only income. Most federal revenue currently derives from this method of taxation. Individual income tax, business income tax (corporate tax), payroll taxes for Social Security and Medicare – all are collected as a percentage of income earned, and the government is deemed within its right to collect these revenues only because the Sixteenth Amendment exists.

The Sixteenth Amendment of 1913 gave the federal government an additional right to tax income, and only income. Most federal revenue currently derives from this method of taxation. Individual income tax, business income tax (corporate tax), payroll taxes for Social Security and Medicare – all are collected as a percentage of income earned, and the government is deemed within its right to collect these revenues only because the Sixteenth Amendment exists.

Now, you don't have to be an economist or a Harvard law professor to know that "net worth" is not "income," and that the Sixteenth Amendment could not uphold the constitutionality of Warren's proposal.

So, what are the other means of taxation allowed by the Constitution?

Article I, Section 8 declares that "Congress shall have the power to lay and collect Taxes, Duties, Imposts, and Excises[.]"

Throughout our history, we've seen a bevy of "duties, imposts, and excises," but we did not see much in the way of "direct taxes" until 1913.

That is because the Constitution includes caveats as to how direct taxes can be applied, most notably in Article I, Section 9, Clause 4, which reads, "No Capitation or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration hereinbefore directed to be taken."

According to Roy Ulrich of U.C. Berkeley, this is the specific clause which any new "net worth tax" would unequivocally violate. Warren's would most certainly qualify as violating this clause, as it's a direct tax that is uniform based upon a taxpayer's asset value, and without apportionment in relation to "Census or Enumeration" among the individual states.

There can be no argument that this clause was the reason for the necessity of the Sixteenth Amendment and that it remains troublesome to progressives today.

"A direct tax," Ulrich writes, "is a tax on real or personal property imposed solely by reason of its being owned by the taxpayer. In contrast, indirect taxes are levied upon the happening of an event, such as the transmission of property. Thus defined, the income tax is plainly a direct tax. So, for that matter, is a tax on any asset."

It's really quite simple. Income tax is a direct tax, but taxation of income is specifically protected by a constitutional amendment. A direct tax on assets held without any "transmission" of property having taken place is the arbitrary confiscation of property by a federal government which clearly has no right enumerated in the Constitution to do so.

I personally do not think Elizabeth Warren has a shot at the presidency. But as the current crop of Democrats seem to be doing perpetual end-arounds to continually stay to the left of one another, I don't think the fact that this policy proposal is insanely unconstitutional means that it has any less value in terms of its rhetorical legs.

And I personally do not think that Warren is so stupid as to not know that her proposal is clearly unconstitutional. There's an endgame here, and it's a page torn right out of Franklin Delano Roosevelt's playbook.

Let's break it down.

First, it's popular with the Democrat base, who sees the Constitution as an obstruction to progress and not the safeguard against tyranny that it's designed to be. In short, the contention is, as it was with FDR, that we need to be experimenting with new ideas to have progress, and if giving the federal government more power than the constitutional tether allows facilitates these experiments, then so be it.

Second, let's say Democrats are able to secure both chambers of Congress and the presidency in 2020. They will then have a choice. They could push for a constitutional amendment allowing for some sort of direct tax on net worth because, as that gaggle of lawyers in D.C. should damn well know, nothing in the Constitution currently allows it.

But setting the precedent, and enshrining in stone, that the federal government has a right to go diving into Americans' retirement accounts like Scrooge McDuck in his money bin, or requisitioning their securities, their real estate, or hell, even their collectible antique cars, is not something that will sit well with Americans. Such an amendment would be dead on arrival. Rather, they'll take the more sinister path of least resistance.

They'll just try to jam through a bill to "rewrite the tax code," as Warren says. And let's say they are able to pass something to this effect, God forbid. It should go without saying that if all members of the Court cared about the nature of the individual's rights in relation to the government as defined by the Constitution, it would be crushed unanimously. But while it may not be shot down with extreme prejudice, it will be shot down by this Supreme Court.

Then a constitutional crisis will be declared, just as FDR did when the Supreme Court began laying waste to his reckless New Deal experiments. You should know what comes next. The left will cry that the Supreme Court is at odds with the people's desires and will call to pack the Court with new leftist justices. They've already begun calling for this. Knowing that they can't change the Constitution to allow what they desire to do, this is the only viable means to destroy the Constitution's safeguards that prohibit their radical and redistributive policy prescriptions.

It is the Democrats who are advocating this rape of the Constitution's protections, and not one single Republican is. You should remember that the next time you hear a conservative sanctimoniously suggests that the moral thing to do to protect our country's integrity is to sit out on the coming election because he doesn't like the personal demeanor of the Republican candidate.

William Sullivan blogs at Political Palaver and can be followed on Twitter.

Photo credit: Tim Pierce.

Follow us: @AmericanThinker on Twitter | AmericanThinker on Facebook

https://www.americanthinker.com/blog...stitution.htmlIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-30-2019, 09:02 PM #5

Elizabeth Warren wants the federal government to CONFISCATE your savings at gunpoint, all in the name of “redistribution”

(Natural News) As the 2020 Democratic presidential field expands, each candidate is attempting to out-liberal the others by pledging to hand out more freebies to more people, paid for by the U.S. Treasury. Some of the ideas floated so far: “Medicare-for-all,” free college, free housing allowances, and a dramatically higher mandated wage … [Read More...]

Wednesday, January 30, 2019 by: JD Heyes

Tags: 2020 election, Alt-Left, asset forfeiture, confiscate wealth, democrat, Democratic candidate, democrats, Elizabeth Warren, free stuff, insanity, left cult, personal property, presidential contender, redistribution, Robin Hood, steal, Taxes, theft

1,320 Views

(Natural News) As the 2020 Democratic presidential field expands, each candidate is attempting to out-liberal the others by pledging to hand out more freebies to more people, paid for by the U.S. Treasury.

Some of the ideas floated so far: “Medicare-for-all,” free college, free housing allowances, and a dramatically higher mandated wage businesses must pay employees.

One Democratic candidate, Sen. Elizabeth “Fauxcohontas” Warren, wants to play Robin Hood. Under the guise of a “tax” hike, she has proposed what many see as an unconstitutional “asset forfeiture” scheme that would allow the federal government to “seize” assets owned by “the wealthy” so she can redistribute it to other Americans in the hopes that she’ll hook them on government largess — and Democrat ‘generosity’ — for generations to come. (Related: Elizabeth Warren pushing for government-run health care system to “solve” the problem of government-run health care systems.)

Just plain theft

But there’s something even more sinister behind Warren’s bid to portray the fictional English folk hero. According to the American Left, which is fundamentally no different from the Nazi Left, or the Stalinist Left, or the Venezuelan Left, is that they believe it’s a sin to be smart enough or lucky enough or industrious enough to accumulate wealth. To the Warren Left, being rich is an unfair construct simply because not everyone can be.

Yet, stealing someone’s personal property because you despise the fact that they have it is not enshrined in American law, nor is it a constitutional construct. It’s just plain theft, and, as National Review’s Kevin Williamson notes, that’s the crux of Warren’s plan: She wants to federalize the hated state-level concept of “asset forfeiture” without the pretense of anyone having committed a crime.

Every other authoritarian Leftist in modern history ensures their own creature comfort by stealing it from the people. If she gets her way, a President Warren would enrich all-powerful government in exactly the same way.

Then, aside from elites like her, we’ll all be equal. Equally poor and equally miserable.

Video at the page link

Read more about Elizabeth Warren’s candidacy at LizWarren.news.

Sources include:

TheNationalSentinel.com

NationalReview.com

https://www.naturalnews.com/2019-01-...r-savings.htmlIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

Why Conservatives Are Proposing a DACA Deal

By GeorgiaPeach in forum illegal immigration News Stories & ReportsReplies: 0Last Post: 01-17-2018, 11:17 PM -

Utah A.G. proposing different kind of immigration reform

By FedUpinFarmersBranch in forum illegal immigration News Stories & ReportsReplies: 5Last Post: 06-29-2010, 12:23 AM -

Why isn't Colorado proposing a law similar to SB 1070?

By scar137 in forum General DiscussionReplies: 15Last Post: 05-25-2010, 12:30 AM -

TX Politician Proposing Immigration Law Similar to AZ

By MontereySherry in forum illegal immigration News Stories & ReportsReplies: 5Last Post: 04-26-2010, 04:44 AM -

Gil Keeps Proposing-We Keep Opposing

By CCUSA in forum illegal immigration News Stories & ReportsReplies: 4Last Post: 01-20-2007, 11:21 AM

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Listen to William Gheen on Rense Apr 17, 2024 talking NEW Tool...

04-18-2024, 06:17 PM in ALIPAC In The News