Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-19-2012, 05:42 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Will the FHA require a bailout? – 12,000,000 underwater mortgages 3,000,000 are FHA

Will the FHA require a bailout? – 12,000,000 underwater mortgages 3,000,000 are FHA insured loans

Submitted by drhousingbubble on 05/18/2012 14:10 -040

FHA insured loans have been a big booster for the current market. Historically FHA insured loans made up roughly 8 to 12 percent of all mortgage originations but in 2009 they hit 30 percent. For first time home buyers it was a stunning 50 percent showing that most people can only purchase a home today with a very small down payment. Yet small down payments create instant negative equity positions if the market moves sideways or pops lower (aka our current market). For example, the 3.5 percent standard FHA down payment is wiped away by the 5 to 6 percent selling costs. What is interesting with this is that the FHA insured loan market is fully backed by the government (i.e., you) so any losses will be completely shouldered by the public. The move to increase premiums recently was no fluke. One piece of data that stood out to me was of the number of homes in negative equity, how large the FHA numbers grew.

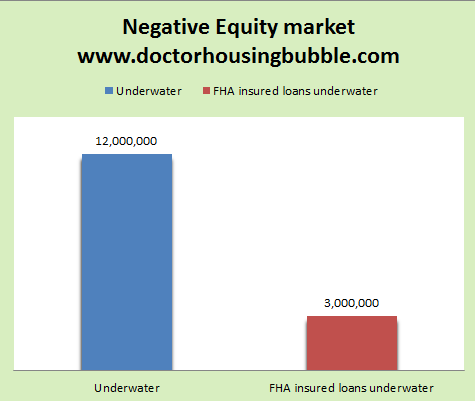

FHA insured loans 1 out of 4 underwater mortgages

A very troubling point showing a morphing of the current market is the number of underwater mortgages backed by FHA insured loans. As stated before, many of these loans were originated after the bubble popped in 2006 and 1 million originated only in the last two years:

Source: Federal Reserve, 2012 report to Congress

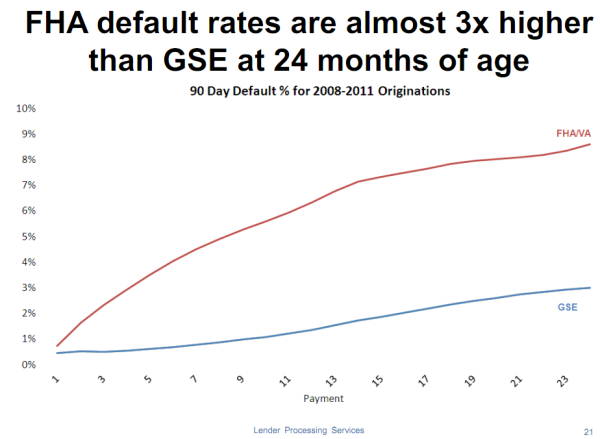

This data is coming straight from a Federal Reserve report given to Congress this year. The issues arise from the overall weak economy and the fact that employment growth has been weak across the nation. Take a look at this example:In this case, this borrower only had to go in with $3,000 to refinance his loan (1.5%). The home took on a new $192,278 loan but now two years later is valued at $80,000 less. Just one of the 3,000,000 FHA insured loans underwater. Do you think this borrower is in good shape? How motivated will they be to saddle up and keep making payments on a home that is underwater by $80,000? No wonder why default rates on FHA insured loans are soaring:

“(Business Financial Post) Opalka was refinancing another FHA-backed loan he had obtained in 2008, for $196,000, then at an interest rate of over 6%.

Under the refinancing, he borrowed $192,278 at an interest rate of 4.5%. Opalka, looking at the paperwork, is still surprised at the down payment he had to make in 2010, for a property valued at the time for little more than the loan was worth and in which he had almost no equity.

His down payment was just $3,000 – or about 1.5% of the total loan.

Less than two years later, local real estate estimates now value Opalka’s home at no more than $110,000.”

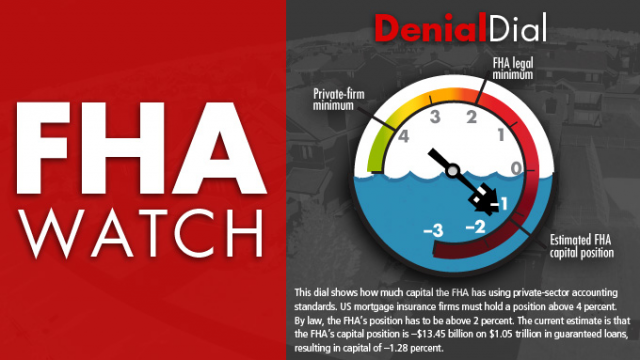

An expert that closely follows this market is Edward Pinto and he has a monthly “FHA Watch”:

Some key lending standards are provided:There is so much nonsense with FHA insured loans. First, most are using these as low down payment entry points. The median down payment is 4 percent contrary to the deception that was being preached years ago that most people were coming in with large money. Next, by rolling in the large insurance premiums you are basically financing the debt into the loan making it more expensive to supposedly “lower income” buyers who need more help. Any doubt why 3,000,000 FHA insured loans now are underwater? This has a little taste of the Alt-A and option ARM variety.

“1. Step back from markets that can be served by the private sector by taking steps to return to a traditional 10 percent home purchase market share.

2. Stop knowingly lending to people who cannot afford to repay their loans. 9

3. Help homeowners establish meaningful equity in their homes.

4. Concentrate on homebuyers who truly need help purchasing their first home.”

Finally, the average FHA borrower accumulates 7 percent in equity in their home during their first four years of owning the home. In other words they barely break even when they sell and this is assuming the market doesn’t shift even slightly lower which it has over the last few years. Ironically the FHA would be in full bailout mode right now if it weren’t for them squeezing the vice on new borrowers going in with bigger premiums.

The deception is strong in this market. I love the news that one of the GSEs turned a profit although the bailout costs are still in the hundreds of billions! Give me $200 billion and I’ll turn you a $2.7 billion profit tomorrow. With this kind of math, no wonder why we are going to face another bailout with FHA insured loans.

The deception is strong in this market. I love the news that one of the GSEs turned a profit although the bailout costs are still in the hundreds of billions! Give me $200 billion and I’ll turn you a $2.7 billion profit tomorrow. With this kind of math, no wonder why we are going to face another bailout with FHA insured loans.

Will the FHA require a bailout?

Last edited by AirborneSapper7; 05-19-2012 at 05:47 AM.

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

We must push through early Thurs at this critical moment

04-24-2024, 10:44 PM in illegal immigration Announcements