Results 1 to 5 of 5

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

11-08-2010, 05:09 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Fed Crosses the Rubicon and Ignites Powerful Parabolic Gold

Fed Crosses the Rubicon and Ignites Powerful Parabolic Gold Bull Market

Commodities / Gold and Silver 2010

Nov 08, 2010 - 02:27 AM

By: Clive_Maund

The Fed crossed the Rubicon last week with its announcement of another massive tranche of QE (Quantitative Easing or in common parlance money printing), known as QE2. It is thus clear that what is now known as QE1, which was portrayed at the time as "one off rescue of the financial system" was nothing of the kind, but represented instead the bursting of a dam that can never be put back together again. The junkie has graduated to another level, from that of being merely a chronic debtor, unable to live within its means and sponging on the rest of the world, to selling its own future down the river in order to maintain its voracious consumption habits in the present.

One thing we can be sure of is that the rest of the world is "not going to take this lying down" - what is sauce for the goose is sauce for the gander, so we can expect this new fashion for massively ballooning the money supply to catch on increasingly around the world, as various countries seek to maintain adequate liquidity and remain competitive in global trade by taking the same proactive hands on approach to manipulating their currencies in a downward direction as the US.

So let's now be crystal clear about what we are talking about and looking at here - we face the prospect of massive global across the board currency debasement and inflation resulting from same. Where does hot money go in such circumstances? - it goes into tangibles, commodities, collectibles and the like - and especially into the Precious Metals - anything which provides a bulwark against the ravages of inflation. Sure - there are massive deflationary forces out there, but since politicians and business leaders like to make money and be popular for as long as possible, they are going to keep these forces at bay for as long as possible, regardless of the future consequences. A deflationary collapse means riots and politicians being chased through the streets and being strung up from lamp posts etc. That collapse must come, and come it will but hard on the heels of a massive hyperinflationary episode that leave the broad swath of the middle and working classes destitute and ruined.

The upper classes and elites will by then have fled to their tax havens where they can sell the gold bars they have stashed away and continue to live lives of ease and comfort, far from the madding crowd, who will set about cannibalising each other in conditions of anarchy and mayhem. This will be the time of "the great global reset" when the absurdly astronomic debts and derivative pyramids etc will be completely wiped clean by the simple expedient of being rendered totally worthless. If you are a creditor at this time tough luck - you won't get enough back to buy yourself a pretzel. This will also be the time when a new generation of leaders will rise up who have galvanised and harnessed the energy of the mob and go on to become future politicians who will reinstate some kind of gold standard and a new order will rise up from the ashes of the old. At this point former political leaders who may be getting bored with island life, however comfortable, would be well advised to avoid a premature attempt to go back and do a Mrs Gandhi or Mrs Aquino, as they might come to an untimely and sticky end.

Even without the benefit of hyperinflation, most major bullmarkets end with a parabolic blowoff move, so it is clear that if we do end up with hyperinflation - and all the signs are pointing to that - the parabolic acceleration in gold, which our long-term chart shows has not even started yet is going to be that much more pronounced and it could rise to levels which would seem to many now to be insane. Here we should note that while gold's rise will of course be real money, which is what gold is, simply moving to compensate for the loss in value of fiat, it should actually be gaining in real value as gold becomes a magnet for hot money seeking speculative gains, which will be an important driver for the final vertical ramp that is expected to mark the end of the bullmarket.

What would such a parabolic blowoff move look like? To get an idea we need look no further than the parabolic blowoff that ended the tech bubble 10 years ago. While the acceleration is dramatic and pronounced on an arithmetic chart, it is obvious even on a log chart, which tends to squash down higher values, and referring back to the long-term gold chart and comparing it with this Nasdaq chart, it is quite clear that gold hasn't even begun the parabolic acceleration phase yet, which fits with the fact that even after 10 years of a strong steady bullmarket, the broad investing public are only now starting to sniff around and get interested in gold.

We haven't looked at a long-term chart for the dollar index for a long time so it is worth doing so now. Our chart going back 11 years shows that overall the dollar index has not lost all that much ground since its late 2004 low, which is rather surprising given the abuse that the dollar has been subjected to in recent years. However, the key point to focus on here is that if all currencies have been "going down the gurgler" more or less together, then gold should have been rising against most or all of them, which it has, and referring back to our 11-year chart for gold in dollars, we can readily see that the relentless advance is a symptom of the general malaise of fiat. So even if the dollar index stages a technical bounce here from the support shown on the chart, it is unlikely to stop gold.

There is good news for the many PM stock investors who have been perplexed by the refusal of many PM stocks, especially the larger ones, to perform well given the continued ascent of gold and silver. Last week's surge in gold saw the large gold and silver stock Philadelphia XAU index break out to clear new highs for the 1st time. This was the last piece missing in our jigsaw - now everything is in place for a thumping great rally in PM stocks across the board. You can see this breakout on our 4-year chart for this index below.

We will close with a word about tactics with regards to PM stocks. There are few things worse than watching an entire sector take off higher, and finding yourself stuck with a bunch of lemons that hardly do anything. The way to avoid this is to go for, or redeploy into, stocks that are in established steady uptrends, or look like they are just entering into such uptrends, provided that they have not gone up a lot already or are otherwise showing signs of topping out, like very heavy volume.

By Clive Maund

CliveMaund.com

http://www.marketoracle.co.uk/Article24107.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-08-2010, 05:11 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold Hits New Record High, Breaks â¬1000/Oz, on "Gold Standard" Call from World Bank

Commodities / Gold and Silver 2010

Nov 08, 2010 - 07:38 AM

By: Adrian_Ash

THE PRICE OF PHYSICAL gold bullion touched a new Dollar-record on Monday â just $1.25 shy of $1400 per ounce at the start of Asian trade â before easing back as global stock markets slipped and the US currency rose on the forex market.

Japanese, Swiss and Canadian investors saw the gold price continue to rise, however, while the Euro price broke above â¬1000 per ounce for the time in 14 weeks.

Indian Rupee prices rose to further all-time highs, but consumer demand for gold at Diwali this weekend was "robust", according to local dealers and international suppliers.

London's AM Gold Fix â where the very largest bullion banks agree a price to settle their clients' outstanding orders â today set the price in British Pounds above £860 an ounce for only the fourth day ever.

Silver prices meantime held near last week's 30-year Dollar highs, briefly trading above $27 per ounce.

"The [Dollar] buoyancy of precious metals lasted a few minutes," says one Hong Kong dealer in a note, "before the metals decided to follow the Euro instead."

"November is likely to see gold prices trade above $1400 but also to experience a correction," says the latest Precious Metals Monthly from Walter de Wet's team at Standard Bank.

"Any dips in price, especially if they are extended in local currencies by Dollar weakness, are expected to generate physical buying and fresh investor interest. This is compounded by the fact that more central banks are appearing as gold buyers."

Central-bank gold sales, in contrast, are "currently non-existent" says Standard, while the International Monetary Fund's 403-tonne sale â begun with the 200 tonnes sold a year ago to the Reserve Bank of India â may have "already been completed" after Sept.'s sale of 32 tonnes.

"The [world's monetary] system should consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values," writes Robert Zoellick â president of development lender the World Bank â calling for some element of a return to the Gold Standard in today's Financial Times.

Setting out a 5-step package "to address the fundamentals of growth" worldwide, Zoellick says that "Although textbooks may view gold as the old money, markets are using gold as an alternative monetary asset today."

"That is not true," counters Berkeley professor Brad DeLong on his blog, claiming that "markets are using gold as a speculative asset and a hedge" and calling Zoellick "the stupidest man alive."

New data released on Friday showed speculative traders in New York gold futures and options actually cut their "net long" position (of bullish minus bearish bets) for the third week running in the week-ending last Tuesday, even as gold prices rose 1.6%.

Speculative interest in gold typically grows when the price rises. But as the gold price reached a new record-high for the CFTC's Commitment of Traders report â hitting $1351 per ounce the day before the US Federal Reserve unveiled its $800 billion QEII program â the "net long" held by non-industry speculators shrank by 1%, slipping to a 10-week low equivalent to 937 tonnes.

Known to analysts as "speculative length", that figure peaked at 1021 tonnes in Oct. 2009. Back then, the total number of all open gold futures and options contracts outstanding was one-quarter smaller than today.

"After last week, this week looks very quiet on the data front," says Investec Bank's capital markets note today, with "very little on the docket ahead of Thursday's G20 meetings London," as a Bullion dealer notes.

Following Friday's factory-gate inflation data in the UK â which showed a surprise jump to 8.7% for output prices â this week brings German and Chinese consumer-price figures, plus import-price and consumer sentiment from the United States.

UK debt led a dip in government bond prices on Monday, nudging the 10-year gilt yield up towards 3.0%.

Commodity prices also fell back, with US crude oil contracts retreating from a two-year high near $87.50 per barrel as the Dollar rose.

By Adrian Ash

BullionVault.com

http://www.marketoracle.co.uk/Article24117.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-08-2010, 05:13 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

QE2 to Dilute the U.S. Dollar and Boost Gold and Silver

Commodities / Gold and Silver 2010

Nov 08, 2010 - 06:02 AM

By: Bob_Kirtley

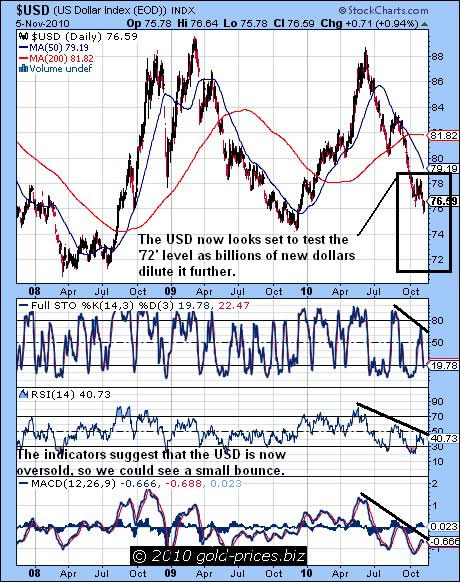

We kick off with a quick look at the chart for the USD which now looks set to test the â72â² level of support as billions of new dollars dilute it further. However, the indicators suggest that the USD is now oversold, so we could see a small bounce from this point. Any upward move we believe would be short lived as those holdings dollars at the moment must surely be considering their options and making plans to limit their exposure to any further devaluation of the dollar.

Should the â72â² level be breached then there are a number of possible staging posts on the way down that could provide a floor on which the dollar could stabilize. But we all know that once the rot sets in it is very hard to reverse as more and more investors lose their patience and withdraw their support. Its not off the radar that the dollar could lose another 30% of its value from here taking it down the â50â² level on the USD index. Other nations, who are currently involved in a race to the bottom with their own fiat money will try and keep pace, however, their mantra is austerity and not stimulus so we expect the dollar to win the race to the bottom, as silly as this sounds.

Overall the world of paper money appears to have little going for it and the world of hard assets appears to be the place to be. The choice of just which hard asset offers the best protection is for you to make, we have made this choice and are firmly entrenched in the gold and silver camp. Owning physical metal and actually having it in your own hands is probably the ultimate form of protection as it cannot be diluted and is not at the mercy of third parties, who may or may not use your gold for other purposes.

The gold and silver mining stocks are also getting some recognition as profitable businesses, thus attracting more investors. Over the last year or two gold and silver have taken the lead and the mining stocks have tended to follow, however, the unhedged gold stocks, as represented by the HUI index have recently picked up the pace somewhat and moved higher with some gusto, as we can see on the chart below.

The HUI Index of gold miners has added 50 points over the last few weeks for a gain of 10% on the back of some good results from mining companies and rising gold prices. The competition for investment funds remains intense as the various gold funds offer an attractive, liquid and easy way to participate in this market. The rapid rise of these funds and shear magnitude of their holdings offers the larger investor the freedom to trade in and out of these funds with ease, whereas a large stake in one mining company can be difficult to exit due to the companies lack of liquidity.

Even so, as the producers begin to offer more in terms of leverage to gold and silver, investors will be tempted into spreading their investment dollars accordingly.

This new influx of capital could soon propel the stocks into an environment where they react to gold prices on a much higher ratio of say 3:1 or 4:1. Should this occur and gold prices continue to rise we will see stocks make gains in one day equivalent to the price that you could have acquired them for just few short years ago. The next move could be truly electric so ensure that you have finalized your strategy and are now executing those plans.

Donât be one those people who thought about investing in this sector but didnât get around to taking some form of action. This is it, its here, right now, your ball!

Stay on your toes and have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

http://www.marketoracle.co.uk/Article24114.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-08-2010, 05:16 PM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Fed Debases the Imperial Dollar, Inflation, Stagnation and Higher Interest Rates Ahead

Economics / Inflation

Nov 08, 2010 - 02:18 AM

By: Prof_Rodrigue_Trembl

"Under a paper money system, a determined government can always generate higher spending and hence positive inflation."Ben Bernanke, future Fed Chairman (in 2002)

âMy thesis here is that cooperation between the monetary and fiscal authorities in Japan could help solve the problems that each policymaker faces on its own. Consider for example a tax cut for households and businesses that is explicitly coupled with incremental BOJ purchases of government debt â so that the tax cut is in effect financed by money creation. Moreover, assume that the Bank of Japan has made a commitment, by announcing a price-level target, to reflate the economy, so that much or all of the increase in the money stock is viewed as permanent.âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-08-2010, 05:53 PM #5

Excellent Charting!!

Excellent Charting!!

They all add up to a Death Spiral.....

But all those things are out of our reach.

Grab all the silver - physical only- you can afford.

BUT MORE THAN ANYTHING - get... FOOD FOOD FOOD...

while you can still afford it...........

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

The Food is No Good at All African Illegals at NYC City...

04-17-2024, 09:12 PM in illegal immigration News Stories & Reports