Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-17-2019, 07:49 PM #1

"It's A Reunion For People Who Broke The World": Author Explains Why Davos Should Be

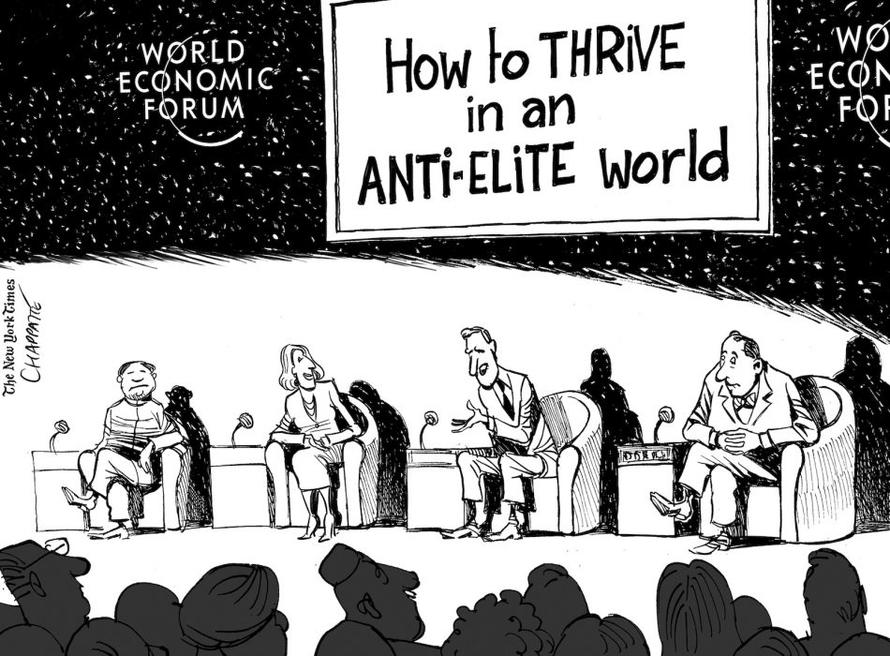

"It's A Reunion For People Who Broke The World": Author Explains Why Davos Should Be Cancelled

#CancelDavos

Thu, 01/17/2019 - 15:34

94 SHARES

Paris is burning, a large chunk of the US federal government is shut down and Britain is careening toward a delay of Article 50 - or possibly a second referendum - as the Brexit process descends into chaos, calls for the World Economic Forum to cancel its annual conference in Davos, a notorious rendezvous for the world's financial and political elite, are growing louder. Particularly after Donald Trump, Emmanuel Macron and now Theresa May have all decided to skip the conference this year to attend to their respective crises.

While these demands from a frustrated public might seem baffling to the global elites who see Davos as an opportunity for less-fortunate emerging economies to "pitch" themselves in an effort to attract more FDI, one former New York Times columnist and the author of a new book that explores the causes of the surge in populism sweeping the Western world offered a surprisingly articulate and trenchant explanation for why people across the west are "mad as hell", and, furthermore, what role the average Davos attendee played in bringing our society to this point.

In an interview with Bloomberg TV, Anand Giridharadas placed the blame on plutocrats like Facebook's Mark Zuckerberg and Amazon's Jeff Bezos for helping to "break the world" with ruthless corporate agendas that helped monopolize political power in the hands of the elite...leaving the rest of the population with deep-seated feelings of frustration as the usual avenues of social mobility have been closed, and people feel more powerless to change their future.

By building a product that has helped undermine the American Democratic process, Zuckerberg has helped steal the future from the average American, Giridharadas said.

"The story of our time is that the people who have monopolized progress and stolen the future from the people...are the change agents. Mark Zuckerberg, who is one of the great change agents of our time, has compromised American democracy...and has stolen the future...the financial industry...which caused the crisis...has rebranded itself with CSR...and little programs to empower some people here and empower some people here...Amazon another monopoly..."

His hosts interrupted him. Are you advocating anarchy, they asked?"No", he replied. "'m advocating the restoration of Democracy in the US and elsewhere where you actually have leaders who reflect the aspirations of regular people."And this can be accomplished, he said, if voters embrace populist policies and stop "believing the BS" propagated by the elites - BS like the notion that Silicon Valley tech firms are working "for the greater good" or that the financial services industry has somehow fundamentally reformed its behavior since the crisis, or that special interests don't exercise unfettered power over the political system.

"I think it ends when people stop believing the BS. Every age of savage unequal distribution has its own BS...if you watch Downton Abbey, there was a set of feudal beliefs that held the whole society together."But...but...but...how can one argue that the world is getting less equal and, ultimately, worse for the everyday person when average life expectancy has been increasing? Well, Giridharadas explains, he's not arguing that. While global life expectancy has risen, largely because of progress in India and China, in the US, life expectancy rates are actually declining. And Giridharadas's criticisms primarily focus on what's happening in Western developed economies, and how people are responding to them.

"The aggregate number is largely because of what's happening in India and China over the last 40 years...getting past their experiments and getting to some semblance of capitalism...my focus is many of the advanced countries of the west...which have left most of their people feeling that the world is rigged against them...that there is no correlation between the efforts they make the things they study and their ability to live a good life.:."Asked if he has a message for the "elites" at Davos, Giridharadas offers a surprisingly stern warning...

"What is the core belief of the US? Social mobility the American dream. That belief is least true in the US among the rich countries."

"Time is running out for them to get on the right side of history..."...Before explaining that he believes Davos should be cancelled, adding that it's "a family reunion of all the people who broke the world..." and that maybe those people should show a little respect for the people they have hurt and the chaos they have caused by foregoing their annual party for one year.

"...First of all I believe that it should be cancelled this year...because the US government is shut down, because of Brexit chaos...because of what's happening in France...it's all the more reason to have something different which is the anti-Davos."Watch a clip from the segment below:

"Davos is a family reunion of the people who broke the world...the world we live in had worked for a narrow slice of people...that didn't just happen...these were outcomes designed through policy...that engineered a winner-take-all outcome."

162 people are talking about this Bloomberg TV ✔ @BloombergTV

Bloomberg TV ✔ @BloombergTV

Video at the tweet

"Davos is a family reunion for the people who broke the world," says @AnandWrites on @bsurveillance https://bloom.bg/2FCLM4u

254

7:41 AM - Jan 17, 2019

https://www.zerohedge.com/news/2019-...d-be-cancelledIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-17-2019, 07:50 PM #2

May To Skip Davos, No-Deal Brexit Odds Greater Than Many Think

" There may be an extension and an extension is needed, not to prevent Brexit but rather to better manage a WTO-Brexit..."If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-27-2019, 11:48 PM #3

Prins: The Three Concerns Hanging Over The Davos Elite

"... even though the various leaders promoted their achievements, what’s lurking behind the pristine snowcapped Alps, is a dark foreboding of a less secure world."

Sun, 01/27/2019 - 15:15

36 SHARES

Authored by Nomi Prions via The Daily Reckoning,

This week, the global elite descended private jets to their version of winter ski-camp – the lifestyles of the rich and powerful version. The World Economic Forum’s (WEF) five-day annual networking extravaganza kicked off in the upscale ski resort town of Davos, Switzerland.

Every year, the powers-that-be join the WEF, select a theme, uniting some 3000 participants ranging from public office holders to private company executives to the few organizations that truly do help fix the world that they mess up. This year’s theme is “Globalization 4.0”, or the digital revolution. The idea being, the potential tech take-over of jobs, and what wealthier countries are doing to lesser developed ones in the process.

While the topic might be focused on the future, the present is just as troubling, if not more so, than the future. Such is the disconnect between real people and corporations. That’s what the estimated 600,000 Swiss Franc membership to be a part of the WEF constellation gets you as a CEO at the Davos table.

Government leaders like German Chancellor Angela Merkel, Brazil’s president, Jair Bolsonaro and Chinese Vice President, Wang Qishan are in attendance this week. Business leaders like Microsoft co-founder Bill Gates and JPMorgan Chase CEO, Jamie Dimon will also take part in the festivities.

Yet, even though the various leaders promoted their achievements, what’s lurking behind the pristine snowcapped Alps, is a dark foreboding of a less secure world. Nearly every major forecast from around the world is projecting an economic slowdown. As one Bloomberg article reports, “companies are the most bearish since 2016 as economic data falls short of expectations and political risks mount amid an international trade war, U.S. government shutdown and Brexit.”

The list of non-attendees includes U.S. President Donald Trump, UK Prime Minister Theresa May and French President, Emmanuel Macron. They are too busy dealing with complex political problems in their own government institutions and domestic home fronts to make the trek.

Below is a breakdown of the three flashpoints that the Davos crowd should be watching in 2019:

Economic Growth Will Slow

Signs of slowing global economic growth are increasing. We’re seeing that in both smaller emerging market countries and larger, more complex ones. Weaker-than-anticipated data from the U.S., China, Japan and Europe are stoking worries about the worldwide outlook for 2019.

Many mainstream outlets are beginning to understand the turmoil ahead. Goldman Sachs, my old firm, is predicting an economic slowdown in the U.S. And the International Monetary Fund (IMF) has revised downward its 2019 U.S. growth prediction to 2.5% from 2.7% from 2018. It believes that the U.S. will be negatively impacted by the economic slowdowns of American trade partners and that the 2020 slowdown could be even “sharper” as a result.

The IMF also points to pressure from ongoing trade tensions between the U.S. and China and growing dysfunction between the U.S. and other major trading partners, such as Europe.

Because the world’s economies have become increasingly interdependent, problems in one economy can have widespread consequences. We learned this once before: the collapse of U.S.-based investment bank, Lehman Brothers, triggered a greater international banking crisis in 2008. That sort of connectivity has only grown. The reality is that we may now face even greater threats than forecast so far, which could lead to another financial or credit crisis.

It is likely that China could be ground zero for a global economic slowdown. Recent dataout of China indicates that much global GDP and trade activity that should normally be in the first quarter (Q1) of 2019 was pulled forward into Q4 2018 to “beat” the tariff increase.

It’s likely that the same phenomenon could happen in the U.S. If this trend does snowball, you should expect to see rapidly deteriorating economic numbers arriving in the months ahead.

Debt Burdens Will Worsen

No matter how you slice it, public, corporate and individual debt levels around the world are at historical extremes. Household debt figures from the New York Federal Reserve noted that U.S. household debt (which includes mortgage debt, auto debt and credit card debt) was hovering at around $13.5 trillion. That debt has risen for 17 straight quarters.

What is different this time is that current levels are higher than just before the 2008 financial crisis hit.

In addition, global debt reached $247 trillion in the first quarter of 2018. By mid-year, the global debt-to-GDP ratio had exceeded 318%. That means every dollar of growth cost more than three dollars of debt to produce.

After a decade of low interest rates, courtesy of the Fed and other central banks, the total value of non-financial global debt, both public and private, rose by 60% to hit a record high of $182 trillion.

In addition, the quality of that debt has continued to deteriorate. That sets the scene for a riskier environment. Over on Wall Street they are already disguising debt by stuffing smaller riskier, or “leveraged” loans into more complex securities. It’s the same disastrous formula that was applied in the 2008 subprime crisis.

Now, landmark institutions like Moody’s Investors Service and S&P Global are finally sounding the alarm on these leveraged loans and the Collateralized Loan Obligations (CLOs) that Wall Street is creating from them.

CLO issuance in the U.S. has risen by more than 60% since 2016. Unfortunately, it should come as no surprise that Wall Street is now proposing even looser standards on these risky securities. The idea is that the biggest banks on Wall Street can actively repackage risky leveraged loans into dodgy securities while the music is still playing.

If rates do rise, or economic growth deteriorates, so will these loans and the CLOs that contain them, potentially causing a new credit crisis this year. If the music stops, (or investors no longer want to buy the CLOs that Wall Street is selling) look out below.

Corporate Earnings Will Be Lower

With earnings season now underway, we can expect a lot of gaming of results in contrast to earlier reports and projections. What I learned from my time on Wall Street is that this is a standard dance that happens between financial analysts and corporations.

What you should know is that companies will always want to maximize share prices. There are several ways to do that. One way is for companies to buy their own shares, which we saw happen in record numbers recently. This process was aided by the savings from the Trump corporate tax cuts, as well as the artificial stimulus that was provided by the Fed through its easy money strategy.

Another way is to reduce earnings expectations, or fake out the markets. That way, even if earnings do fall, they look better than forecast, which gives shares a pop in response. However, that pop can be followed by a fall because of the lower earnings.

The third way is to simply do well as a business. In a slowing economic environment, however, that becomes harder to do. Plus, it’s even more difficult in today’s environment of geopolitical uncertainty, as a multitude of key elections take place around the world in the coming months.

* * *

These three concerns were central in conversation in Davos. Expect global markets to be alert to the comments coming from the Swiss mountain town. Severe dips and further volatility could be ahead as the gloomy rhetoric streams from the Davos gathering.

How Will the Fed React?

Ready to help, is the answer. This month, yet another top Federal Reserve official noted that economic growth could be slowing down. That would mean the Fed should, as Powell indicated, switch from its prior fixed plan of “gradually” raising interest rates to a more “ad-hoc approach.”

Indeed, Federal Reserve Bank of New York President John Williams, used Chairman Powell’s new buzz phrase, “data dependence,” to indicate that the Fed would be watching the economy more. While he didn’t say it explicitly, it has become largely clear that the markets are determining Fed policy.

Based on my own analysis, along with high-level meetings in DC, I see growing reasons to believe the Fed will back off its hawkish policy stance. As we continue to sound the alarm, there are now a myriad of reasons including trade wars, slowing global economic conditions and market volatility.

Traders are now assigning only a 15% chance of another rate hike by June. Just three months ago, those odds were 45%.

Watch for even more market volatility with upward movements coming from increasingly dovish statements released by the Fed and other central banks. Expect added downward outcomes from state of the global economy along with geo-political pressures.

https://www.zerohedge.com/news/2019-...er-davos-eliteIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

Doug Casey On Alexandria Ocasio-Cortez: "Evil On A Basic Level" "The world would be

By Airbornesapper07 in forum Other Topics News and IssuesReplies: 0Last Post: 01-14-2019, 12:50 AM -

France In Free Fall | "yellow vests" revolt is the result of the "despair of people

By Airbornesapper07 in forum General DiscussionReplies: 2Last Post: 01-09-2019, 01:06 AM -

President Obama Explains Why He "Did Not Request Permission" To Invade Syria -

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 2Last Post: 09-23-2014, 06:54 PM -

These Are The Ten "People" Who Run The World (For The Last 20 Years) Corporations

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 2Last Post: 09-28-2013, 04:07 AM -

Tea Party protester explains white people's "racist gen

By OneNationUnderGod in forum illegal immigration News Stories & ReportsReplies: 11Last Post: 07-29-2011, 06:15 PM

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Congressman Eli Crane says Biden administration is stonewalling...

04-24-2024, 05:07 AM in illegal immigration News Stories & Reports