Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

11-17-2011, 08:37 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Debt Situation Worse Than Italy

U.S. Debt Situation Worse Than Italy

November 17, 2011 by Daniel Zurbrügg

The European debt crisis has been in the spotlight for a couple of months already.

In recent weeks, the situation has gotten worse and is causing enormous volatility in global financial markets. After Ireland and Greece, two very small countries within the Eurozone, larger countries like Italy and Spain are now also struggling.

Italy has recently issued new government bonds with a five-year lifetime. The price for those new bonds is 6.29 percent. This is the yield that investors demand to get compensated for the investment risk they are taking. Back in October, Italy could still borrow at a rate of 5.3 percent. This represents an increase of almost 20 percent.

The departure of Prime Minister Silvio Berlusconi will not change much for now. It will take years to correct the mistakes of his administration, and structural reforms are desperately needed in many areas. New Prime Minister Mario Monti will have a very challenging job of turning the Italian situation around. Difficult? Very difficult. Impossible? No, but quick action is needed since financial markets are getting very impatient.

The situation in Italy is similar to the one in Greece, but probably not quite as bad. However, the fact that Italy is so much bigger makes the situation a real threat.

Italy has a debt burden of about 1,900 billion (euros) and it looks like they will need about 300 billion more next year. The help from the European Central Bank and the new European Financial Stability Facility (EFSF) will not be enough to save Italy. The country needs to take swift action in order to avoid insolvency.

The Italian parliament has recently accepted a new savings plan, but it will also require further spending cuts and privatization of state-owned enterprises to keep going. The situation looks scary, but it is possible it can be controlled for now and improved in the long run.

Italy is, for the European Union, too big to fail, and therefore a very different situation compared to Greece. Also, most of Italy’s debt is held by domestic investors and a comparably low portion of debt is held by foreign investors. In that sense, Italy’s debt situation is bad but manageable.

The situation with the United State’s sovereign debt is different. Although the U.S. situation has not captured much attention lately due to the European debt crisis, it has not improved at all. And what’s worse, no measures have yet been taken to address the situation. So while there are a lot of discussions in Europe about how to solve the debt problem, nothing has been done in the U.S. It is only a matter of time until world financial markets focus on the U.S. situation again.

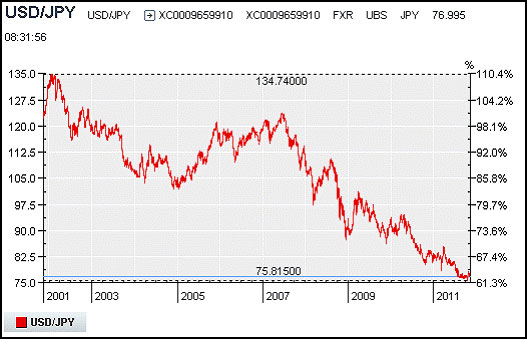

How can it be that despite all these problems in Europe, the U.S. Dollar has not been able to gain ground versus the euro? It is still trading at around 1.37 (see chart below), and despite the headlines about the Greek and Italian debt problems, the European currency has not crashed. Actually, it has been able to appreciate against various major currencies of late. Are we missing a point here, or can we blame speculators for this obvious mispricing of currency values?

First of all, I don’t think that the market is mispricing the value of the euro. I also don’t think that the yen is as highly overvalued as many market participants believe.

The euro clearly takes some strength from the fact that countries like Germany and France are still doing relatively well. Germany is, right now, the star economy in Europe, hugely successful in exports despite some structural problems. But looking at debt ratios in most European countries should send an alarming signal and, in combination with the severe structural problems in many countries, one would expect the euro to be much more vulnerable.

Let’s take simplistic look at the sovereign debt problem for a moment.

Sovereign debt is public debt or borrowings that a country has. Simply put, the governments in the past have spent more money than they took in. Governments make their money from taxes, and use tax money to provide public goods and services. A government needs to manage its money in a way that taxes can be kept at moderate levels. However, if a country spends more money than it has available, it has to borrow money in capital markets to finance the shortfall.

This is exactly what the U.S. and many European countries have been doing for many years. For as long as a country’s total wealth is sufficient to cover these borrowings, the country should remain solvent. It might be difficult to raise taxes quickly, but what is important is that any shortfall in the finances of government is sufficiently covered by savings in the private sector.

Also, a government might have a lot of assets that it can liquidate over time to free up cash. This is typically called privatization. Countries like Greece and Italy, for example, still have a lot of government-owned assets that, over time, need to be sold as the countries restructure their economies.

European countries, as well as Japan (or Asian countries in general), are places where people tend to save a lot of money. This is in sharp contrast to the U.S., where the savings rate has been in a long-term downtrend for most of the last 60 years and has only recently started to move back up. This is a clear indication that people in the U.S. are deleveraging by paying down loans and mortgages in the face of uncertain times.

However, the overall wealth of American households is significantly lower than one or even two decades ago. This is mainly driven by stagnant incomes and a crash in housing prices. What makes the situation even worse is the fact that the government is running record levels of debt, which means that the overall wealth of America (private and public wealth) is significantly reduced to the levels seen back in the 1980s.

According to official statistics, Americans’ average household net worth fell by 23 percent between 2007 and 2009 and has not really recovered since. This hasn’t been the case in Europe and Japan, where the public debt levels look even more alarming (as a percentage of gross domestic product).

Compared to the overall wealth of those nations, their debt levels look much more moderate. For example more than 50 percent of Italy’s government debt is financed domestically. In Japan the number is even higher.

How public debt is financed therefore becomes the main question. Preferably, as much as possible should be financed by the country and its citizens. The higher the share of a country’s debt financed by foreigners, the worse the situation becomes. This is, in my opinion, the reason the euro and Japanese yen have outperformed the U.S. dollar recently.

From that point of view, the U.S. debt problem looks even more alarming than the situation in most European countries. When will the focus of financial markets switch back to the U.S. debt crisis?

http://www.personalliberty.com/asset-an ... 1_17_PLAa_[P11227021]&rrid=238434262Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Mike Johnson betrays border security for more foreign aid

04-18-2024, 10:31 PM in illegal immigration News Stories & Reports