Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

03-09-2011, 02:48 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Economic Death Spiral Into the Second Great Depression

U.S. Economic Death Spiral Into the Second Great Depression

Economics / Great Depression II

Mar 03, 2011 - 03:12 PM

By: D_Sherman_Okst

Bernanke’s Unstoppable, Self Reinforcing, Negative-Feedback-Loop

Our economic death spiral into the Second Great Depression

Wracked up by both parties over many decades our debt has evolved into a yearly deficit that can no longer be serviced with tax revenue and borrowing.

To avoid default Ben Bernanke chose to monetize the un-payable portion of our deficit. Each month about 100 billion dollars are created out of thin air to cover our government’s bills.

This has set forth an unstoppable, self reinforcing, negative-feedback-loop whereby:

1. Debt monetization (printing money out of thin air to cover the portion of governments spending not satisfied by tax revenue and borrowing) reduces the value of the dollar.

2. The debt monetization triggers dollars to flow out of bonds and into commodities.

3. This increases demand, commodity prices rise.

4. As commodities make their way into the supply chains businesses and consumers realize higher prices.

5. Since globalization has caused wages to stagnate at 1970 levels, and with 23% unemployment, businesses try to eat increases, this in turn reduces hiring, causes layoffs and kills expansion.

6. Consumers reduce their purchases, case in point: Wal-Mart is losing market share to the Dollar Store - that right there spells retail health (read: it’s terminal).

7. Nations whose citizens spend 32%-52% of their entire budget on food are especially affected.

8. In those nations where citizens spend 32%-52% of total their income on food; food riots erupt, social unrest breaks out, governments topple.

9. Geographically speaking, many of these nations are in the Middle East where about a third of the world's oil supply comes from - so oil production is adversely affected, the price of oil increases. Drastically increases. The empire must then send in troops and warships to protect oil assets from being wiped off the map.

10. Oil is an integral part of everything from farming to manufacturing to transportation, therfore the prices of all goods and services rise.

11. This of course creates more stress on our economy, which drives tax revenues down, whic creates a greater deficit, which causes idtiot Ben to lean on the print button and monetize even more debt.

12. Like an infinite loop in some errant computer code we go back to #1 above and iterate back through this unstoppable, self reinforcing, negatively-insane-Ben Bernanke-code that we call a negative self reinforcing feedback loop.

Bernanke's Crimes Against Humanity

Exporting Higher Food Prices to Poor Nations:

The price of grain and many other foor comodities are set in US Dollars. Creating more dollars reduces the dollars purchasing power. Creating more dollars makes investors flee securities and rush to hard assets, like grain, corn, soy, oil, cotton, coffee, sugar and so on.

In Tunisia on December 17, 2010 a 26-year-old man who tried to supported his family by selling fruits and vegetables doused himself in paint thinner and set himself on fire in front of a local municipal office.

Police had confiscated his produce cart, the cart he needed to earn a living in order to feed his family. With rising prices he coldn't afford a permit. They also beat him when he objected. Local officials then refused listen to him.

His desperation highlighted the public's frustration over living standards and increasingly higher food prices which accounted for 32.4% of their entire earnings.

A month later the ruler of Tunisia was gone, its government collapsed.

Now it is Libya’s turn.

In Lybia 37.2% of a families budget goes to food.

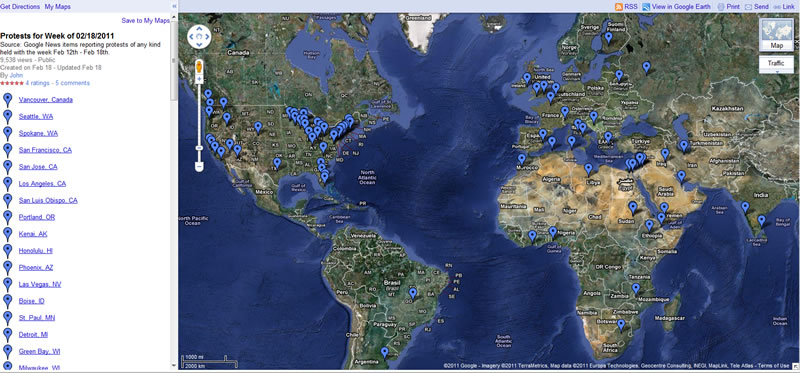

Many other oil producing nations have citizens who face the same income to food budget ratios. Map of many of the countries that are experiencing protests. http://maps.google.com/maps/ms?hl=en&ie ... 527344&z=3

Organic bond sales have been anemic. Money is flowing out of securities and into commodities. Bernanke’s plan to have Quantitative Easing reduce interest rates has so far been a failure because of these outflows. That was Bernanke's first mistake.

Rising commodity prices, which for the most part peg global food prices was his second misstake.

Actually, if you count: Bear Stearns, the housing bubble, subprime contageon, unemployment contageon and recesion contageon they are respectively Bernanke's 6th and 7th blunders. Add to that the fact that he is following the steps that Greenspan used to explain how Great Depression One was created http://www.321gold.com/fed/greenspan/1966.html and it soon becomes apparant that Ben Bernanke is, without a doubt, the worlds biggest economic imbicile and shouldn't be allowed to balance a checkbook - let alone run the world's (now thanks to him and Greenspan) third largest economy.

Bernanke couldn't find cause and effect in a dictionary. He is an economic moron, and a master of global disaster. The only bigger fools are our leaders who:

1. Haven't fired him.

2. Still listen to him.

Now we have 2008 redux. Commodity prices and oil prices are headed up. Will they crash or will the dollar crash? If commodity prices and oil prices crash again this time I’ll be surprised if money flows into securities again. The dollar is no longer looked at as secure now that Bernanke is monetizing the debt.

The gig is up, the game is almost over.

When High Frequency Algorithmic Trading (insider trading) became responsible for 70% of stock trades I tossed the term “stock market�Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Listen to William Gheen on Rense Apr 17, 2024 talking NEW Tool...

04-18-2024, 06:17 PM in ALIPAC In The News