Results 21 to 30 of 31

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

07-22-2013, 10:23 PM #21

It may sound cruel but in a way I hope that many of these pensions and retirement plans from public sector workers go up in smoke or take huge hits with hopefully protecting firemen and police. The reason is simple enough which is to alert people to the dangers of overspending and not budgeting. If its your house, your city, your county, your state, your country YOU should take a part in these things and not be passive and placid as long as it hasn't hurt you directly yet. Maybe with enough bad hitting all those thinking they sit pretty on public cush jobs we could get some real reform including privitizing most government jobs put out to contractors who could do it far cheaper.

-

07-23-2013, 01:15 PM #22NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

07-24-2013, 02:57 PM #23

Judge stops lawsuits against Detroit bankruptcy

Published July 24, 2013Associated Press

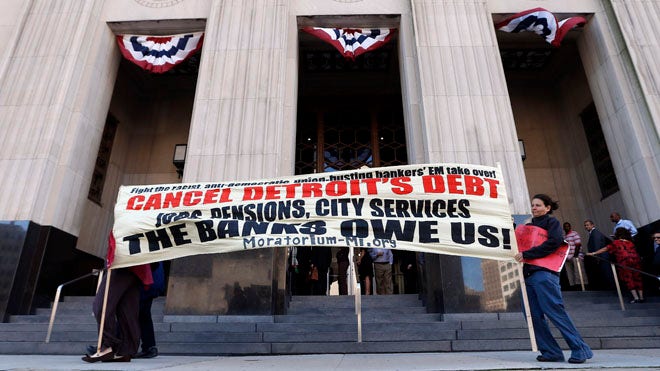

Protesters carry a sign outside the Levin Federal Courthouse in Detroit, Wednesday, July 24, 2013. (AP)

A federal judge in Michigan has put the brakes on lawsuits threatening to derail Detroit's bankruptcy and declared that he will handle any challenges.

The decision Wednesday after two hours of arguments is a victory for Detroit.

A county judge last week said Gov. Rick Snyder ignored the Michigan Constitution and acted illegally in approving the Chapter 9 filing, the largest ever U.S. municipal bankruptcy.

Retirees sued, claiming their pensions are protected by the constitution and are at risk in a bankruptcy.

U.S. Bankruptcy Judge Steven Rhodes suspended any pending lawsuits and barred new ones. He says his court will be the exclusive venue for any legal action regarding the bankruptcy.

http://www.foxnews.com/politics/2013/07/24/judge-begins-first-hearing-on-detroit-bankruptcy/

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

07-26-2013, 11:57 AM #24

New $444 million hockey arena is still a go in Detroit

By Chris Isidore @CNNMoney July 26, 2013: 9:16 AM ET

A Detroit Red Wings game at Joe Louis Arena, the team's current home.

A Detroit Red Wings game at Joe Louis Arena, the team's current home.

NEW YORK (CNNMoney)

Detroit's financial crisis hasn't derailed the city's plans to spend more than $400 million in Michigan taxpayer funds on a new hockey arena for the Red Wings.

Advocates of the arena say it's the kind of economic development needed to attract both people and private investment dollars into downtown Detroit. It's an argument that has convinced Michigan Gov. Rick Snyder and Kevyn Orr, the emergency manager he appointed to oversee the city's finances, to stick with the plan. Orr said Detroit's bankruptcy filing won't halt the arena plans.

"I know there's a lot of emotional concern about should we be spending the money," said Orr. "But frankly that's part of the economic development. We need jobs. If it is as productive as it's supposed to be, that's going to be a boon to the city."

But critics say the project won't have enough economic impact to justify the cost, and that it's the wrong spending priority for a city facing dire economic conditions.

Detroit city services are already stretched extremely thin. On average, police take about an hour to respond to calls for help, and 40% of street lights are shut off to save money.

"If you want people to live in the city, and not just visit to go to games, you have to invest in schools, in having the police to respond to calls," said Gretchen Whitmer, the Democratic leader in the state senate. "There are so many investments that should trump a sports stadium."

Additionally, Orr wants to make deep cuts to both the pensions and health care coverage promised to city employees and retirees.

The state legislature approved the taxpayer funding for the arena in December. The controversial vote split Detroit's own legislative delegation. Whitmer argues that the matter should be reconsidered given the city's worsening finances.

"If the vote was held today, since the bankruptcy, I wouldn't put my money on it passing," she said.

Related: Why Obama won't bailout Detroit

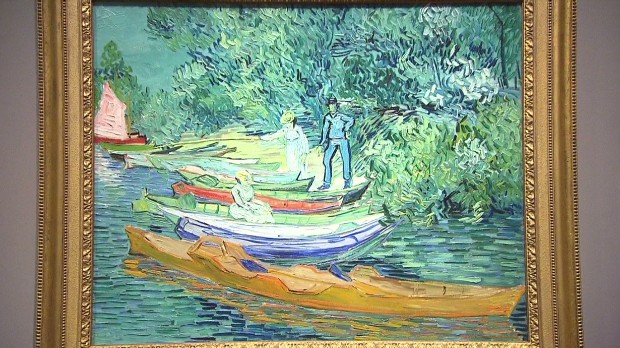

Detroit may sell its art treasures

The arena will be paid for with a $450 million bond issue that will be repaid over the next 30 years. Taxpayers will be paying almost two-thirds of the cost of the arena -- $283 million -- and private developers will cover the rest. Including interest, it's projected that there will be a total of $444 million in taxpayer funds spent on the project.

Additionally, the developer has committed to spending another $200 million to build retail, office, residential and hotel space as part of the project.The construction is expected to create about 8,000 construction jobs with work due to start next year.

Most of the tax money going into the project would otherwise be going into Detroit schools,which are also under state control due to their dire finances. But the lost money is slated to be made up for by the state government according to Michigan's school-funding formula.

"The schools won't lose a dollar," said Robert Rossbach, spokesman for the Detroit Economic Growth Corp., the non-profit agency overseeing the project. "It was designed to have minimal impact on city of Detroit operations."

Mark Rosentraub, a University of Michigan professor and an expert on the economic impact of sports teams, did a study for the arena developers, and estimates that it would create more than $1 billion of direct spending in Detroit during the next 30 years. He said many stadium and arena projects have minimal impact on local economies because they're already thriving or because of poor location.

But he argues that this one -- in a depressed city next to football and baseball stadiums -- will encourage a lot of private investment in restaurants, bars and other entertainment venues.

Related: Detroit entrepreneurs make case for their bankrupt city

The Joe Louis Arena where the Red Wings now play is antiquated by modern arena standards, and is relatively isolated from the downtown area where the new arena is to be built.

"The problem behind the financial issues of Detroit has been a flight of capital to the suburban areas," he said. "We have to bring foot traffic and investment back to Detroit. This is exactly what it needs."

Typically, a team threatens to move out of a city in order to get government officials to agree to a publicly financed new home, but the Red Wings have not made that threat.

Andrew Zimbalist, a Smith College economics professor and a sports business expert, said the Red Wings are one of the few profitable teams in the National Hockey League, and there is no chance they would want to leave Detroit, even for the suburbs.

-- CNN's Poppy Harlow contributed to this story

http://money.cnn.com/2013/07/26/news/economy/detroit-bankruptcy-arena/index.html?eref=googletoolbarNO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

07-27-2013, 07:28 PM #25

Detroit bankruptcy another setback for unions

FILE - In this July 24, 2013 file photo protesters carry a sign outside the Levin Federal Courthouse in Detroit. Detroit's historic bankruptcy filing is a major setback for public sector unions that have spent years trying to ward off cuts to the pensions and benefits of government workers. If the city succeeds, it could put into jeopardy a key bargaining tool for unions that have often deferred higher wages in favor of more generous pension benefits. And it could embolden other financially troubled cities dealing with pension shortfalls to consider bankruptcy, or at least take a harder line with their unions in negotiating cuts. (AP Photo/Paul Sancya)

Sam Hananel, Associated Press 6 hours ago Detroit

Sam Hananel, Associated Press 6 hours ago Detroit

WASHINGTON (AP) -- Detroit's historic bankruptcy filing is a major setback for public employee unions that have spent years trying to ward off cuts to the pensions of millions of government workers around the country.

If the city's gambit succeeds, it could jeopardize an important bargaining tool for unions, which often have deferred higher wages in favor of more generous pensions and health benefits.

It also could embolden other financially troubled cities dealing with pension shortfalls to consider bankruptcy, or at least take a harder line with their unions in negotiating cuts.

"This is essentially the union's worst nightmare, said Gary Chaison, professor of industrial relations at Clark University in Worcester, Mass. "It means that the most sacred of sacred things they've negotiated for, the pensions of their retired members, are going to be severely cut."

Detroit's bankruptcy filing comes on the heels of some public unions losing most of their collective bargaining rights in Wisconsin. At the same time, the unions have shed thousands of members as state and local governments shrink public payrolls. The crisis of underfunded public pensions could further erode union clout.

From Chicago to Cincinnati to Santa Fe, N.M., dozens of cities and counties are struggling with massive debt linked to pension liabilities. Critics say state and city employees won generous defined benefit pensions and lifetime health care from elected officials trying to curry favor with public sector unions.

Unlike private employers that must fund such defined benefit pensions under the Employee Retirement Security Act, government employers are not covered by that statute. As a result, many elected officials approved such plans, leaving the financial consequences for future leaders to handle.

If cities such as Detroit can use bankruptcy or other tactics to reduce pension obligations, government employees could become less interested in union membership, said Charles Craver, a George Washington University law professor specializing in labor relations. That would be another dose of bad news for the steadily shrinking labor movement, especially because public employees now make up over half of all union members.

"Union leaders should go to the bargaining table and try to address this issue through negotiations, but they fear being thrown out of office if they agree to any cutbacks," Craver said, referring to pensions.

Detroit's financial woes were aggravated by widespread corruption, financial mismanagement, the auto industry collapse and a dramatically shrunken tax base as people moved out. The city has long-term debts of at least $18 billion, including $3.5 billion in unfunded pensions and $5.7 billion in underfunded health benefits for about 21,000 retired workers. The rest is owed to bondholders and other unsecured creditors.

About 7.3 million government workers belong to a union. The union membership rate for public sector workers is about 40 percent, much higher than the 6.6 percent rate in the private sector.

The fallout from Detroit could lead to more acrimonious contract negotiations between cities and union, said John Beck, a professor of labor relations at Michigan State University.

"If I'm a union and bargaining, where I used to be willing to defer wages in form of pensions, I'm going to bargain for what I can get right now because I can't be sure whether those future wages are going to be protected," Beck said.

Unions, led by the American Federation of State, County and Municipal Employees, have launched a furious legal challenge to the Detroit's bankruptcy petition, arguing that Michigan's constitution law does not allow public pension obligations to be diminished. But a federal bankruptcy judge dealt a blow to that tactic last week, halting any state lawsuits that would interfere with the bankruptcy proceeding.

"Government entities declaring bankruptcy, it's really a government going to war with its own people," said Steven Kreisberg, director of collective bargaining for AFSCME. He said trying to reduce pensions is unfair to those who worked for years in good faith and expected to depend on those benefits in old age.

The average pension for retired city employees other than firefighters and police officers is quite modest, Kreisberg said, at about $19,000 annually. Retired fire and police get about $30,000 in pension benefits, higher since they are not part of the Social Security system.

While other cities in financial trouble might be willing to follow Detroit's lead, Kreisberg said the stigma of bankruptcy and its long-term damage to a city's financial future make that unlikely. But if there is a national epidemic of pension defaults, it could change what unions would demand in terms of funding levels.

"We may seek legislation to guarantee that employers are making their payments," Kreisberg said.

The AFL-CIO has called on President Barack Obama and Congress to offer immediate financial aid to Detroit. The labor federation also wants any federal aid to be matched by the state of Michigan.

"As the nation emerges from the worst of the Great Recession, it is time for Congress and the White House to make it clear they will not turn their backs on our urban centers," said Lee Saunders, president of AFSCME and chairman of the AFL-CIO's political committee.

But the White House appears reluctant to intervene. White House spokesman Jay Carney has said the city's insolvency should be resolved by local leaders and creditors and that the Obama administration has no plans to provide a federal bailout. Carney said the administration was ready to provide other forms of assistance, such as investment opportunities or help for blighted neighborhoods hit hard by the recession.

http://news.yahoo.com/detroit-bankruptcy-another-setback-unions-152833123.htmlNO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

07-28-2013, 04:38 PM #26NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

07-28-2013, 05:56 PM #27NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

08-07-2013, 05:15 PM #28NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

08-08-2013, 08:35 PM #29

Legal/Regulatory | Wall Street August 8, 2013, 7:55 pm

Detroit Blocks Other Cities From Bond Market

By MARY WILLIAMS WALSH

Clay Lomneth/The Saginaw News, via Associated PressSaginaw County, Mich., pulled a bond sale that was planned to put $60 million into a pension fund for county employees, like police officers.

Clay Lomneth/The Saginaw News, via Associated PressSaginaw County, Mich., pulled a bond sale that was planned to put $60 million into a pension fund for county employees, like police officers.

The Detroit Effect has rippled all the way To Wall Street.

Two weeks after Detroit declared bankruptcy, cities, counties and other local governments in Michigan are getting a cold shoulder in the municipal bond market.

The judgment has been swift and brutal. Borrowing costs are up around the state, in some cases drastically. On Thursday, Saginaw County became the latest casualty when it said it was delaying a $60 million bond sale planned for Friday. It had hoped to put the proceeds into its pension fund.

It was the third postponed bond sale in Michigan since Detroit dropped its bombshell on July 18. Earlier this week, the city of Battle Creek said it would postpone a $16 million deal scheduled for August because of concerns that investors would demand interest rates that were too high. And the previous week, Genesee County pulled a $54 million bond sale off the market for the same reason.

Detroit’s bankruptcy, the largest ever by a municipality, has raised fundamental concerns about the safety and security of municipal bonds, certainly in Michigan but potentially elsewhere in the country, too. The municipal bond market appears to be sending Michigan’s cities a message that no matter how well rated they are, they are going to have to put their plans and projects on hold or pay more for them.

When Jefferson County, Ala., declared bankruptcy in 2011, there were warnings it had tainted the credit of all other municipalities in the state, but the expected fallout never materialized. After Orange County, Calif., came through its bankruptcy in the 1990s, its borrowing costs actually fell. But Michigan appears to have something new — a bankruptcy that makes it harder for others in the state to borrow.

Detroit’s state-appointed emergency manager, Kevyn Orr, has proposed imposing deep cuts on some bondholders — treating them the same, in effect, as retired Detroit workers who have been receiving city-paid health insurance that will now end. Mr. Orr’s bankruptcy plan would put them all at the back of the line for whatever money is available, as unsecured creditors.

And because the city’s bankruptcy filing was approved by the governor, Rick Snyder, it is seen as the best distillation of how Michigan will treat certain bondholders in times of trouble.

Putting a city’s “full faith, credit and taxing power” behind a bond no longer means what it did in the past, anywhere in the state, critics say. The governor and Mr. Orr have said they are not concerned about the effect of the bankruptcy plan on the municipal bond market as a whole. But other participants find their treatment of indebtedness profoundly disturbing, and their anxiety has spilled over to other Michigan municipalities.

“A lot of the people I talk to are investors who are just very angry about this,” said Matt Fabian, a managing director at Municipal Market Advisors. “Bonds are so cheap everywhere across the whole market, there’s no reason to put anyone in Michigan bonds right now.”

Sara Wurfel, a spokeswoman for Governor Snyder, acknowledged the concerns, but said they were overblown. She called Detroit’s financial breakdown “an incredibly unique situation,” and said the bond rating agencies would continue to rate Michigan’s other municipalities individually, each on its own strengths and weaknesses no matter what went on in Detroit.

“Michigan is home to hundreds of local communities across our state, rated by the credit agencies,” she said. According to a recent analysis by Standard & Poor’s, she said, “only two of those aren’t investment grade. There continue to be an abundance of sound, smart investments to make in Michigan and our local communities. Michigan’s fiscal house is in order and sound.”

Mr. Fabian and others who work with municipal bonds cited two main concerns coming out of Detroit. First was the city’s plan to put several different kinds of bonds, plus the retirees, into one big category — unsecured creditors — even though bonds were issued with many different ratings and promised investors different interest rates accordingly.

If Detroit succeeds in lumping them all together in a single bankruptcy class, then by logic, the bonds of other Michigan cities should have their ratings changed accordingly. The ratings would go down, and the investors holding the bonds would take losses.

Creditors recalled that Michigan’s state treasurer helped to market some of Detroit’s debt, encouraging investors to buy it as very safe.

“Now they’re saying that the investors are getting what they deserve, and they should have known better,” Mr. Fabian said. “So you can’t really trust the statements of the state government.”

The other concern was that the federal bankruptcy court might ultimately approve Detroit’s treatment of bondholders, setting a precedent that distressed cities in other states might be tempted to follow. Their borrowing costs would then also rise, and that would undercut the way most of the country’s roads, bridges and schoolhouses are built — planned and financed at the local level.

Local officials in Michigan were putting on brave faces Thursday, saying the chill in the market might prove to be temporary, or to have been caused by broad credit conditions unrelated to Detroit. As the Federal Reserve has signaled a coming end to its easy-money policies, interest rates have been rising, making it more expensive for almost everyone to borrow.

“There’s been a lot of things going on in the market,” said Linda Morrison, the city finance manager in Battle Creek. Her city had been planning since last spring to raise $16 million, to pay for a new roof and better seating for the Kellogg Arena, among other improvements. She said that none of the projects were needed urgently and that Battle Creek could afford to wait for more favorable market conditions.

She said she was aware that Detroit’s bankruptcy plan had dealt a blow to longstanding beliefs about a city’s “full faith, credit and taxing power.” But, she added, maybe the judge would decide things in the bondholders’ favor, and the markets would come back.

“Who’s to say that the court won’t decide it that way?” she said.

http://dealbook.nytimes.com/2013/08/08/detroit-blocks-other-cities-from-bond-market/NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

12-10-2014, 01:06 PM #30NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Congressman Eli Crane says Biden administration is stonewalling...

04-24-2024, 05:07 AM in illegal immigration News Stories & Reports