Results 1 to 7 of 7

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-18-2014, 01:29 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

State in the Worst Fiscal Condition Is: study on the fiscal condition of the 50 State

State in the Worst Fiscal Condition Is…

Jan. 17, 2014 6:45pm Guest Post

[Editor’s note: The following is a cross post that originally appeared on CNBC.com]:

A new study on the fiscal condition of the 50 states ranks New Jersey dead last, citing revenue shortfalls, budget practices and high levels of debt .

The healthiest states, on the other hand, are those benefiting from the domestic energy boom, including Alaska and the Dakotas.

The Mercatus Center at George Mason University released the study earlier this week. The center counts among its key backers the Koch family, and conservative financier Charles Koch sits on the center’s board.

The author, Sarah Arnett, is an analyst at the Government Accountability Office (though the study was produced outside of her GAO work, the center said).

New Jersey ranked last in both budget solvency and long-run solvency, and in the bottom 15 in the other categories.

Alaska was first or second in three of four metrics, though it came dead last in service-level solvency.

For a download of the full report click here.

–

Other Must-Read Stories

- Here Are the 10 Freest States in the U.S. (And the Least)

- Here Are the Most 'Conservative' & 'Liberal' States

- Ex-Reagan Economist and Ron Paul Staffer: Deregulation Does Not Spur Job Growth

- Betting on the National Debt - LA Times Gets it Wrong (op-ed)

- 15 NFL Cheerleaders Who Should Put on More Clothes (rantsports.com)

RELATED:

- Top States for Business 2013

- Top states ranked

- France: We’re not a failed socialist experiment

- He Was Fired: Here’s Marissa Mayer’s De Castro Buh-Bye Memo to Yahoo Staff

- American Airlines cuts flights from Reagan, LaGuardia airports

©2014 CNBC LLC. All Rights Reserved.

http://www.theblaze.com/stories/2014...-condition-is/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-18-2014, 02:15 PM #2Junior Member

- Join Date

- Nov 2013

- Posts

- 4

This is really good information you can see the trends California and Illinois are on the bottom. Both of these states have very high numbers of illegal aliens with democratic administrations.

-

01-18-2014, 02:21 PM #3

Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

-

01-18-2014, 02:23 PM #4Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

-

01-22-2014, 01:36 AM #5Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Bottom 5 States in (Liberal) Fiscal Condition: New Jersey, Connecticut, Illinois, Massachusetts, California

Mike Shedlock | Jan 20, 2014

Mike Shedlock | Jan 20, 2014

Inquiring minds are digging into a George Washington University paper on State Fiscal Conditions, a ranking of 50 states, by Sarah Arnett.

PolicyMic Produced this Chart of State Fiscal Conditions based on the working paper.

Highlights and Lowlights

Let's return to the original working paper for some highlights and lowlights.At the bottom of the rankings are New Jersey and Illinois. New Jersey faces long-run solvency problems due in part to nearly 15 years of underfunding its state and local pensions. It has an estimated unfunded pension liability of around $25.6 billion as well as $59.3 billion in unfunded liabilities for the health benefits of retired teachers, police, firefighters, and other government workers (State Budget Crisis Task Force 2012).

Illinois has also underfunded its public pensions, resulting in an estimated state retirement system combined unfunded liability of $ 96.8 billion as of 2012 (Illinois Commission on Government Forecasting and Accountability 22 2013). To cover the costs of its pension obligations, Illinois has also sold bonds to cover its annual contributions — 60 percent of Illinois’ total outstanding debt is in pension bonds (State Budget Crisis Task Force 2012). In essence, Illinois is using long-term debt instruments to meet current year pension obligations.

[In Contrast] Nebraska is constitutionally prohibited from incurring debt. As such, the long-term liabilities reflected in Nebraska’s long-run solvency score are mainly due to claims payable for worker’s compensation, Medicaid claims, and other employee-related items. With no significant bond debt, Nebraska has a much lower long-term liability per capita and a much lower long-term liability ratio than most other states.

Bottom 5 in Long-Term Solvency

In terms of long-term solvency (the most critical issue), New Jersey and Illinois are at the bottom of the heap. Pension plans and union activism are to blame.

All five states at the bottom of the list have one thing in common: they got that way via "progressive" extreme-liberal politics, fueled by union activism, and promises that cannot possibly be met.

Compare to the top five.

Top 5 in Long-Term Solvency

The top five states all have something in common as well: none of them are the hotbed of "progressive" activism and unions.

Although there are other issues, I strongly suggest the performance of the top five and bottom five is directly related to "progressive" politics.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Read more at http://globaleconomicanalysis.blogsp...ZgLpe1O5meB.99

http://finance.townhall.com/columnis...1414/page/fullJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-22-2014, 02:02 AM #6

---------------------------------------

Examining this poverty map closely factually demonstrates how just only ten or fifteen years ago the states that are now in the bottom five were (at least some) in the TOP FIVE.

LoL. Everywhere illegal aliens permeate and saturate, the quality of life and economy goes straight to $hit.Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

-

01-22-2014, 07:29 AM #7Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

New Mercatus Fiscal Ranking Shows the Real New Jersey Scandal

Daniel J. Mitchell | Jan 21, 2014

Daniel J. Mitchell | Jan 21, 2014

If you’re a libertarian, you generally don’t act and think like other people. Most folks, when they heard about Governor Christie’s bridge-closing scandal, focused on the potential political ramifications.

But not me. My immediate reaction was to think that the problem could have been avoided if the bridge and its various entry points were privately owned. Sort of like the Ambassador Bridge between Canada and Michigan, which is the busiest border crossing in North America. Or the Progreso International Bridge, a major transportation link between Mexico and Texas.

If the George Washington Bridge also had private owners, they would want to maximize the flow of traffic, not arbitrarily close lanes for petty political purposes. So while others may speculate about Chris Christie and the 2016 presidential race, I daydreamed about how privatized bridges would improve transportation (just as I couldn’t stop myself from pontificating about private fire departments when sharing some libertarian humor).

If the George Washington Bridge also had private owners, they would want to maximize the flow of traffic, not arbitrarily close lanes for petty political purposes. So while others may speculate about Chris Christie and the 2016 presidential race, I daydreamed about how privatized bridges would improve transportation (just as I couldn’t stop myself from pontificating about private fire departments when sharing some libertarian humor).

All that being said, I’m digressing before I even get started. The purpose of today’s column is to focus on the real scandal in New Jersey.

New research from the Mercatus Center looks at cash solvency, budget solvency, long-run solvency, and service-level solvency to show which states are fiscally responsible and which states face serious long-run problems.

And while Chris Christie may have taken a few steps to rein in excessive compensation for state bureaucrats (causing me to become giddy with infatuation), he still has a long way to go because the Garden State is in last place in this comprehensive new ranking of fiscal responsibility.

And that means New Jersey is even behind fiscal hell holes such as California, New York, and Illinois.

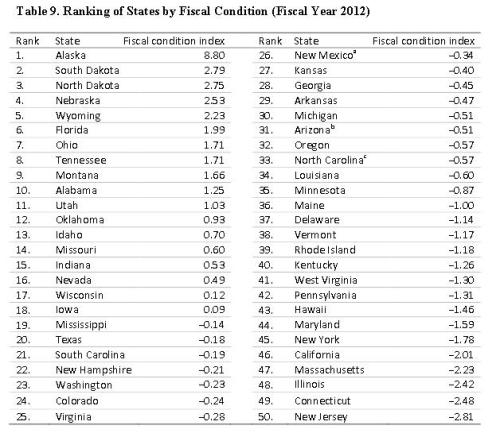

Here are the key takeaways from the study, which ranks all 50 states.This paper contributes to that stream of research by applying models of fiscal condition to create indices measuring cash, budget, long-run, and service-level solvency as well as overall fiscal condition at the state level. It also discusses the relative strengths and weaknesses of each solvency index and provides a ranking — based on these indices and using fiscal year 2012 data — of the 50 US states. …Table 9…shows the state rankings based on fiscal condition with all four dimensions taken into account. …the states at the bottom are there due to years of poor financial management decisions, bad economic conditions, or a combination of both. New Jersey and Illinois face similar problems of tax revenues that have not kept up with expenditures, use of budget practices that only appeared to balance their annual budgets, and significant debt levels as a result of decades of using bonds without being able to pay for them. In addition, both states have underfunded their pension systems, resulting in billions in unfunded liabilities.Now let’s take a look at the main chart from the study, showing the ranking for all 50 states.

And I want to focus on the bottom 10, which are a rogue’s gallery of big-government basket cases. New Jersey, as already noted, is in last place, but the next-worst state is Connecticut, which has become a fiscal mess ever sincemaking the horrible mistake of adopting an income tax more than two decades ago.

Illinois is in 48th place, which is not surprising since the state is infamous for tax-and-spend fiscal policy. Massachusetts is number 47, making it the fourth-worst state…just as it is the fourth-worst state in the Tax Freedom Day rankings.

California is number 46, and I was surprised (given Jerry Brown’s attempts todrive successful people from the state) to read in the study that its fiscal condition actually has gotten better in recent years. And no rating of fiscal irresponsibility is complete without New York, which is in 45th place.

Indeed, you’ll notice that there’s a good bit of overlap between the states at the bottom of the Mercatus studyand the “death spiral” states that I shared last year. No wonder taxpayers are fleeing these oppressive jurisdictions.

Indeed, you’ll notice that there’s a good bit of overlap between the states at the bottom of the Mercatus studyand the “death spiral” states that I shared last year. No wonder taxpayers are fleeing these oppressive jurisdictions.

Likewise, you’ll see that there’s also overlap between the highest-ranking states and the states that have avoided the mistake of imposing an income tax.

And since we’re on the topic of top-ranked states, it is worth noting that five of the top 10 don’t have an income tax, but we should issue a caveat. Both Alaska and Wyoming have a lot of natural resources, so politicians in those states have lots of revenue to spend. Indeed, too much if we believe these numbersshowing state debt in Alaska.

And the same is true for North Dakota, which makes the mistake of maintaining an income tax while also collecting a flood of severance tax revenue.

P.S. If you want to further explore state fiscal performance, here are four additional rankings.

- The state business tax climate index.

- State spending growth between 2001-2011.

- A comprehensive measure of overall freedom by state.

- The famous “moocher index” of state dependency ratios.

P.P.S. I have a confession to make. I’m currently on vacation in Nevis with the PotL. Sounds like an idyllic (albeit very temporary) lifestyle, particularly since it’s cold back in Washington. But every night has been a battle because I can’t figure out how to operate the bloody thermostat. It’s automatically set for 64 degrees, which is far too cold for my tastes, but I don’t know how to change the temperature. It’s a digital device and when I move the temperature up or down, the word “set” starts blinking on the screen, but with no indication of how to actually implement that command.

P.P.S. I have a confession to make. I’m currently on vacation in Nevis with the PotL. Sounds like an idyllic (albeit very temporary) lifestyle, particularly since it’s cold back in Washington. But every night has been a battle because I can’t figure out how to operate the bloody thermostat. It’s automatically set for 64 degrees, which is far too cold for my tastes, but I don’t know how to change the temperature. It’s a digital device and when I move the temperature up or down, the word “set” starts blinking on the screen, but with no indication of how to actually implement that command.

So I have to get up in the middle of the night and turn the device to “on” or “off” depending on whether I’m too cold or too hot. You may be asking yourself why I don’t inquire with the hotel staff, but that’s not an option. A friend on the island arranged for me to rent a private condo, so there’s nobody I can contact. Sort of reminds me of the time in Slovakia when I couldn’t figure out how to operate a shower, or the time in Switzerland when I was baffled by a toilet. And if I can’t figure out how to operate household fixtures, how on earth will I ever figure out how to shrink the size and scope of the federal government.

So I have to get up in the middle of the night and turn the device to “on” or “off” depending on whether I’m too cold or too hot. You may be asking yourself why I don’t inquire with the hotel staff, but that’s not an option. A friend on the island arranged for me to rent a private condo, so there’s nobody I can contact. Sort of reminds me of the time in Slovakia when I couldn’t figure out how to operate a shower, or the time in Switzerland when I was baffled by a toilet. And if I can’t figure out how to operate household fixtures, how on earth will I ever figure out how to shrink the size and scope of the federal government.

http://finance.townhall.com/columnis...2050/page/fullJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Oklahoma House passes bill making illegal immigration a state...

04-19-2024, 05:14 AM in illegal immigration News Stories & Reports