Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-14-2012, 12:47 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Economic Collapse Is Not A Single Event

The Economic Collapse Is Not A Single Event

June 11th, 2012

126 comments

Many people hype "the coming economic collapse" as if it is some kind of big summer Hollywood blockbuster. Many people out there write about it as if it is something that will happen in a single day or over a few weeks and that it will suddenly change how the entire world functions.

Many people hype "the coming economic collapse" as if it is some kind of big summer Hollywood blockbuster. Many people out there write about it as if it is something that will happen in a single day or over a few weeks and that it will suddenly change how the entire world functions.

But that is not how the financial world works.

The financial world is like a game of chess - very slow and methodical.

Yes, there are times when things happen very quickly (like back in 200 , but even that crisis played out over a number of months.

, but even that crisis played out over a number of months.

Sadly, most Americans are not used to thinking in terms of months or years.

These days, most Americans have the attention span of a goldfish and most Americans have been trained to expect instant gratification.

They are simply not accustomed to being patient and to wait for things. Well, despite what you may have read, the economic collapse is not going to be a single event. It is going to play out over quite a few years. In some ways we are experiencing an economic collapse right now. When the next major financial crisis occurs, many will be calling that "an economic collapse". But if you really want to grasp what is happening to us, you need to think long-term. We are heading for a complete and total nightmare, but it is going to take some time to get to the end of the story.

Yes, there will certainly be times of great chaos. The financial crisis of 2008 was one of those moments.

But the financial crisis of 2008 did not completely destroy us.

Neither will the next crisis.

I think it is helpful to think of what is happening to us as a series of waves.

When you build a beautiful sand castle on the beach, the first wave that comes in does not totally destroy it.

Rather, the first wave weakens the castle and it is destroyed by subsequent waves.

Well, that is what is happening to us.

The financial crisis of 2008 was a wave.

The epicenter of the next great financial crisis will be in Europe and that will be another wave.

For many, the next financial crisis will feel like "the end of the world" but it won't be.

There will be waves after that one that will be even worse.

Yes, the waves are going to start coming more rapidly and will start becoming more intense.

In that way, they will kind of be like birth pains.

But these problems did not build up overnight and they are not going to disappear overnight either.

A lot of people that write about the coming economic collapse seem to suggest that we should just let it happen so that the "recovery" can begin.

Unfortunately, it is not going to be so simple.

It took decades to build up a national debt of almost 16 trillion dollars.

It took decades for American consumers to build up the greatest consumer debt bubble in the history of the world.

It took decades to gut the economic infrastructure of the United States and ship millions of our jobs overseas.

These problems are going to plague us for a very long time.

Sadly, a lot of people out there seem to wish for an economic apocalypse. They seem to think that if the global financial system crashes that the government is going to disappear and we are going to start fighting with each other using sharp pointed sticks.

Well, it simply is not going to happen.

The U.S. government is not going to help you survive when things hit the fan, but it is not going to disappear either.

In fact, the federal government will probably try to grab more power than ever in an attempt to "restore order".

The governments of Europe are not going to disappear either. In fact, in the long run Europe is probably going to end up more "federalized" than ever even if the euro breaks up in the short run.

A lot of people out there seem to think that when the old system collapses that it will give them an opportunity to help put in a new system.

Sorry, but that is not going to happen either.

The powers that be are going to have their own ideas about what needs to happen.

They never like to let a good crisis go to waste, and they will certainly try to use every crisis to shape the world even more in their own image.

The coming economic collapse is going to play out over a number of years and it is going to be absolutely horrible.

Billions of people will deeply suffer because of it.

It will be unlike anything any of us have ever seen.

Personally, I believe that it will eventually be much worse than the Great Depression of the 1930s.

The United States is going to get hit particularly hard. The United States is going to lose its position as the leading economic power on the globe and the U.S. dollar is going to lose its position as the default reserve currency of the world.

If you thought that the unemployment crisis during the last recession was bad, just wait until you see what is coming.

We are heading for a complete and total unemployment nightmare in the United States. Unemployment is eventually going to soar well up into the double digits.

The U.S. government will try a wide variety of measures to try to "fix" things, and some will likely have some limited success.

But the debt-fueled prosperity that we are all enjoying now is going to come to an end.

Many communities all over America will degenerate into rotting cesspools.

There are going to be riots in our major cities, crime and looting will be absolutely rampant and it will seem like society is coming apart at the seams.

The U.S. government will likely respond by becoming more authoritarian than ever, and that will truly be frightening.

But all of this is going to play out over time.

Right now, things are not as good as they were five years ago.

A couple of years from now, things will be even worse. Many of us will look back and wish that we could return to the "good old days" of 2011 and 2012.

We are on a decline that is not going to stop. There will be little false bubbles of hope like we are in now, but they won't last long.

But just because the economy is falling apart does not mean that your life is over. Many that are busy preparing right now will be greatly blessed even in the middle of all the chaos.

And it is when things are the darkest that the greatest lights are needed.

Make the decision right now to be a light during the times ahead.

You can choose to let the times that are coming destroy you, or you can choose to make them the greatest adventure of your life.

The choice is up to you.

The Economic Collapse Is Not A Single Event

Last edited by AirborneSapper7; 06-14-2012 at 12:49 AM.

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-14-2012, 12:51 AM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-14-2012, 01:20 AM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Protect Yourself From Economic Crisis

June 13, 2012 by John Myers

The global economy is imploding.

The Occupy Wall Street leftists may have a lot less square footage to trespass on, given the way the global economy is imploding. Stock indexes around the world are down and commodity prices are in their worst slump since 2008. If the trend continues, the Dow Jones industrial average could be valued at half its current price in 24 months.

That will mean that Wall Street fat cats could soon look more like feral felines. That wouldn’t be a heartbreaker except for the fact that the destruction of Wall Street would bring suffering to tens of millions of Americans.

Global markets took it on the chin this month in the wake of unemployment numbers that underscore the weakest U.S. economic recovery in decades.

The Four Horsemen Of Deflation

Not once in the 30 years that I have been researching the markets have I witnessed the troubles that the world now faces: a stock market slide, falling gross domestic product, rising unemployment and waning confidence.

In just the past few weeks, Big Board U.S. stocks have erased most of the gains they made during the first five months of this year. Only because of a 287 point rally last Wednesday — its strongest single day performance this year — the Dow is now comfortably over 12,000. But the Dow Jones Industrial Average is not immune from Europe’s problems, and a break below 12,000 could soon push the index below 10,700. The next support for the Dow would be 9,000.

Big Board stocks have been responding to the likelihood of a double-dip recession. U.S. GDP has been slashed from 2.2 percent to 1.9 percent. The U.S. economy is not adding jobs. As stagnation has spread into manufacturing, consumer confidence is beginning to tank.

American payrolls increased by just 69,000 last month, far below the 150,000 that analysts had expected. The unemployment rate rose to 8.2 percent from 8.1 percent, while revised estimates show that fewer jobs were created in the past three months than originally expected. The Obama economic recovery has run out of steam.

Then there is Europe. Crises in Spain and Greece have sparked a bank run that has pushed yields on relatively risk-free assets like U.S. Treasuries and German Bunds to record lows. The two-year German Bund has even dipped into negative territory. Yields on the 10-year U.S. Treasury have fallen to 1.40 percent. Those are yields not seen since the Great Depression. (See Treasury chart further below.)

Nervous investors are throwing money into the U.S. and German government bonds knowing they’ll get back a negative return when adjusted for inflation. This is becoming a panic — and for good reason. Europe’s wholesale funding market is broken at a time when Spain’s banking system is teetering toward bankruptcy.

Worse Than 2008

My old friend and Personal Liberty Digest™ columnist Chip Wood signs off each Friday with this phrase: “Keep some power dry.” Unfortunately, the people who run the Federal government don’t read Wood’s columns.

When the economic calamity hit four years ago, governments around the world began injecting money into the economy. The Administration of President George W. Bush and a complacent Congress immediately shot $700 billion with the Troubled Asset Relief Program. That plus other bailouts left the United States with a Federal budget deficit of $1.17 trillion in fiscal 2012.

Last week the Congressional Budget Office (CBO) released a report showing that the national debt will soar over the coming years.

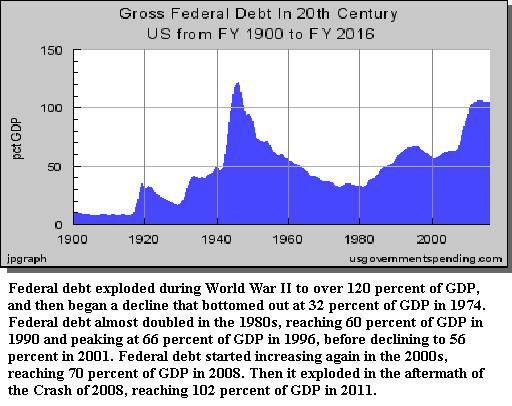

“The growing imbalance between revenues and spending, combined with spiralling interest payments, would swiftly push debt to higher and higher levels,” the CBO said in its 2012 Long-term Budget Outlook. “Debt as a share of GDP would exceed its historical peak of 109 percent by 2026, and it would approach 200 percent in 2037.”

The Federal government has not the means to inject another trillion dollars or more into the economy because they have burned all their powder. If Washington were to try another rescue like they mounted four years ago, the U.S. Treasury market would implode.

The result of that would be higher interest rates. The bulk of bidders at U.S. Treasury auctions these days are foreign powers, particularly China. However, if China and other nations begin to think the United States is another Argentina, they simply won’t throw good money after bad into U.S. Treasury bills, notes and bonds. The result is that America would have to go begging to get buyers of its debt. That would mean higher interest rates because if the marketing of U.S. debt securities slowed, the U.S. government would cease to operate.

Higher rates forced on Treasury auctions would send interest rates across the board higher. Higher rates for mortgages, car loans, credit cards, you name it. And that, my friends, would be a death knell for an economy that is struggling with interest rates at their lowest levels since the 1930s.

Crude Is Crashing

The price of oil is in its worst retreat since 2008. Crude fell 18 percent in May. In fact, oil prices traded down in 17 of the 22 trading days last month, the worst single monthly performance for oil since 1997. Given the poor prospects for the U.S. economy, China’s economic woes and the debt disaster in Europe, oil could give up 50 percent of its value. That would put crude around the $40 per barrel mark. This would throw petroleum stocks into a devastating bear market.

Keep Only Your Core Gold And Silver Holdings

Gold is off its highs, but it is one of the few real assets that has held its value. I wouldn’t recommend the purchase of additional gold just yet, because I think the bullion bull has stalled. But it is impossible to predict what crisis might erupt, including the collapse of the greenback. If you can put a few dollars away — something that is getting tougher to do these days — you should keep at least 20 percent of savings in physical bullion. More than 25 percent of your savings in gold is not wise, because I think it will correct further downward. Long term, however, gold will rise well above $2,000 because of the bleak prospects for the U.S. dollar.

What to do? I think anybody holding from a small nest egg to a fortune should get heavily into cash.

If you have $10,000 or less, and given the poor rate of bond returns, I think you should find a good safe and lock it up along with your gold and some survival silver. A safety deposit box is another alternative. Even if your bank fails, I think you will have access to your box.

If you have more than $10,000 saved in a safe or a bank safety deposit box. I recommend you buy three-month to six-month U.S. Treasury bills. Most banks will sell you U.S. Treasury securities. You can also buy U.S. Treasuries in paperless electronic form from TreasuryDirect. You can go online and research more about them and more about U.S. Treasuries by clicking here.

Don’t buy Treasury instruments that have maturity longer than six months. Interest rates cannot stay at these historic lows and once they rise, longer maturity debt instruments such as notes and bonds will lose a significant amount of their value.

Yours in good times and bad,

–John Myers

Editor, Myers Energy & Gold Report

Protect Yourself From Economic Crisis : Personal Liberty Alerts

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Durbin pushes voting rights for illegal aliens without public...

04-25-2024, 09:10 PM in Non-Citizen & illegal migrant voters