Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

02-22-2012, 09:24 PM #1

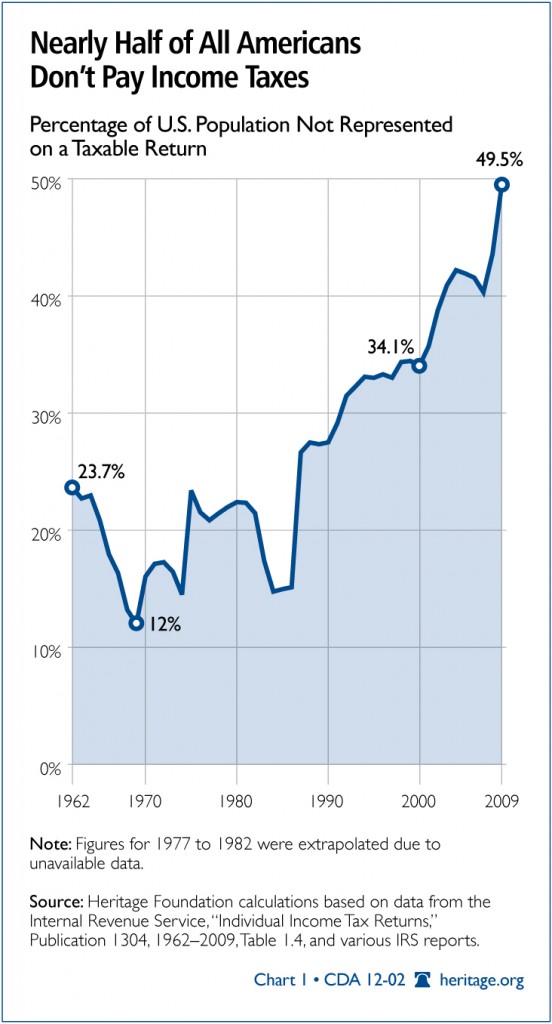

Nearly Half Of All Americans Don't Pay Income Taxes

It's jumped even higher under Obama's administration.

Chart: Nearly Half of All Americans Don't Pay Income Taxes

Chart of the Week: Nearly Half of All Americans Don’t Pay Income Taxes

Rob Bluey

February 19, 2012 at 9:32 am

(331)

This year’s Index of Dependence on Government presented startling findings about the sharp increase of Americans who rely on the federal government for housing, food, income, student aid or other assistance. (See last week’s chart.)

Another eye-popping number was the percentage of Americans who don’t pay income taxes, which now accounts for nearly half of the U.S. population. Meanwhile, most of that population receives generous federal benefits.

“One of the most worrying trends in the Index is the coinciding growth in the non-taxpaying public,” wrote Heritage authors Bill Beach and Patrick Tyrrell. “The percentage of people who do not pay federal income taxes, and who are not claimed as dependents by someone who does pay them, jumped from 14.8 percent in 1984 to 49.5 percent in 2009.”

That means 151.7 million Americans paid nothing in 2009. By comparison, 34.8 million tax filers paid no taxes in 1984.

The rapid growth of Americans who don’t pay income taxes is particularly alarming for the fate of the American form of government, Beach and Tyrrell warned. Coupled with higher spending on government programs, it is already proving to be a major fiscal challenge.

“This trend should concern everyone who supports America’s republican form of government,” Beach and Tyrrell wrote. “If the citizens’ representatives are elected by an increasing percentage of voters who pay no income tax, how long will it be before these representatives respond more to demands for yet more entitlements and subsidies from non-payers than to the pleas of taxpayers to exercise greater spending prudence?”Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

02-22-2012, 10:19 PM #2

What I want to know is how can someone receiving ss disability payments, food stamps, and medicaid, one child under 17 manage to get a $4500 dollar tax refund? SS disability is not taxable. No one in the house works. No federal taxes are paid by this person. HOW is she allowed a more than 4 thousand dollar 'refund'? Anybody?

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

72 Hours Till Deadline: Durbin moves on Amnesty

04-28-2024, 02:18 PM in illegal immigration Announcements