Results 1 to 5 of 5

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-04-2010, 09:03 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Fed Is Selling Paper Gold And Buying Physical Gold

The Fed Is Selling Paper Gold And Buying Physical Gold

Commodities / Gold and Silver 2010

Oct 04, 2010 - 07:19 PM

By: Rob_Kirby

[the good ole âAmerican wayâ â through proxies] A couple of weeks ago, I pitched an idea to some associates of mine who are involved in SERIOUS [tonnage] PRECIOUS METALS procurement â physical metal only â letâs just say HUGE money. I asked them if they would be interested in purchasing an âoptionâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-04-2010, 09:07 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold's Big Countdown Vs. the Big Four Fiat Currencies

Commodities / Gold and Silver 2010

Oct 04, 2010 - 01:06 PM

By: Adrian_Ash

Over the last four quarters, the stand-out losers against gold have been the world's top four reserve currencies...

The UPSHOT from last week's London Bullion Market Association conference in Berlin, at least for gold prices, was that there's more sound and fury about bullion in the financial pages than in the dealing rooms right now.

Several dealers I spoke to said business was quiet, if not boring. Gold's current rally, said one speaker, "punches above its weight in terms of significance." Another noted that at the start of September, when Dollar-gold surpassed its June high, volatility was at a 5-year low. (It still is. Silver price volatility has fallen to a 3-year low as it broke three-decade highs.)

You can see this lack of frenzy in prices alone, in fact â but only if you don't focus on the Dollar alone...

BullionVault's Global Gold Index shows the price of gold against the world's top 10 currencies, weighted by GDP.

Latest forecasts for economic growth from the IMF are applied for 2010, putting the US Dollar top, with the Euro next...then the Chinese Yuan...Japanese Yen...British Pound....Russian Rouble...Brazilian Real...Canadian Dollar...Indian Rupee...and Mexican Peso.

And just in case you were wondering, three points stand out from the last 3 months' action:

Gold's bull-market pattern against all the world's money continued in Q3 (July's low was higher than the previous bottom in March);

Q3 marked the 33rd positive quarter of the 43 since Jan. 2000, but only just. The GGI rose to 422 from 421 (New Year 2000 = 100);

Most notably, gold's 5% gain vs. the Dollar was its strongest rise against any currency.

That third point is only to be expected, perhaps. Because the Dollar's decline made headlines across the summer/start of fall. But crunching the numbers further again, two truly remarkable points jump out from there...

#1. July-Sept this year was only the third quarter since the start of 2000 when the Dollar was the weakest major currency against gold. (The currency most commonly bottom-of-the-heap has been the Brazilian Real, but it's not been worst-in-show since 2005.) The USD was previously in the dog-house during Q4 2004 and Q3 2007 â periods when, just as over the last 3 months, US central-bank policy stood out as deliberately weakening the Dollar compared with its paper alternatives;

#2. Over the last four quarters (starting Oct. 2009), the stand-out losers against gold have been the world's top four reserve currencies:

Q4 2009 â gold rose 13.5% versus the Yen (which accounts for 3.3% of central-bank reserves, by Dollar value, worldwide);

Q1 2010 â gold rose 9.3% against the British Pound (4.2% of world reserves);

Q2 2010 â gold rose more than 23% in terms of the Euro (26.5%);

Q3 2010 â as we just saw, gold rose fastest against the US Dollar (62.1%).

Yes, the world's most reservable currencies have topped the bottom of the league-table against gold for the last four quarters running â and in reverse order of reservability, too!

Again, this countdown shouldn't surprise us, perhaps. Because while the US, Eurozone, UK and Japan now account for 97.9% of officially reported FX reserves worldwide, they've seen little reason not to abuse that demand, slashing interest rates further than any lesser currency-issuer could dare (0%, 1.0%, 0.5% and 0.1% respectively). And oddly enough, emerging-market central banks have been reducing the Big Four's weighting in their reported reserves right alongside, actually nudging it below the "advanced economies" weighting of USD, EUR, GBP and JPY since the start of last year.

Gold bullion, of course, pays nothing in interest. But that zero-yield is no longer a handicap against the world's most heavily-owned paper money. Little wonder it's getting a strong bid in the market, most of all against those same, heavily-owned paper currencies.

By Adrian Ash

BullionVault.com

http://www.marketoracle.co.uk/Article23228.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-05-2010, 09:27 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Connecting the Dots of Chinese Gold and Currency Reserves

Commodities / Gold and Silver 2010

Oct 05, 2010 - 03:17 PM

By: Richard_Daughty

Bill Bonner here at The Daily Reckoning is one of those guys who, for some reason, figures that we (represented, apparently, by me) are smart enough to "connect the dots," when some of us (again, me as "everyman") are obviously not smart enough to engage in such mental gymnastics.

For example, as the gold-bug, Austrian school of economics, gun nut, paranoid, lunatic, greedy lowlife that I am, I am instantly alerted to buy more gold when he writes, "Gold makes up only 1.7% of China's foreign exchange reserves. Many analysts believe China is targeting a 10% figure. If so, it would have to buy every ounce the world produces for two and a half years. Or, if it relies on only its own production - China is the world's largest producer - it would take nearly 20 years of steady accumulation to reach the 10% level."

"Wow!" I said to myself!

The problem for me is that China's annual production of gold is, obviously, relatively fixed in the short run and, due to depletion of a finite resource, bound to hit something like Peak Chinese Gold, especially since gold and gold mining are not new to China!

So this "20 years of buying all internally produced gold" figure also supposes that China's foreign exchange reserves will not grow at all - zero growth! - for 20 years.

Watch carefully here, as I note this inevitability of China accumulating more foreign reserves, which is, I figure, a dot to be connected! A dot!

I was so happy to have discovered a "dot" that I quit work early and went out to have a few congratulatory drinks to celebrate, and thus only needed one more dot to have something to connect! Wow! This is the kind of thing of which careers are made!

Sadly, I never did discover another dot, no matter how much I drank and/or thought about it, and I ended up getting really smashed, which is, admittedly, how I would have ended up if I had celebrated actually discovering another dot, and actually connected something.

So, either way, I ended up the same! It's a win-win situation! Hahaha!

But it was still a rewarding experience, as towards the end of the night I noticed, as I "relaxed" on the floor of the bar, that the old wooden floor was tilted. Because of this slope in the floor, and my unique perspective of lying face-down on the ground in a puddle of what I hope was only beer, I could see by the light of some neon beer signs and a jukebox that two puddles of some unidentified liquid were slowly draining downhill, and the trails of them both curved down and around in big arcs. Arcs! Of course!

"Eureka!" I shouted, which caused the rest of the patrons to shout out, almost as one, "Alaska!" and then, apparently, argue about whether or not Eureka was the capital of Alaska, and if it wasn't the capital of Alaska, then what is the capital, you loudmouth, which evolved into a discussion of who is calling who a loudmouth and who is going to do something about it, with or without the help of some alluded-to army.

"No, you morons!" I shouted from where I lay on the filthy floor, prostrate and stinking of beer, "I emulate the excited exclamation of Archimedes upon discovering the principle of specific gravity to indicate that I see, glinting in the glaring neon of the beer signs of this dreary little bar, the curving, upward-sloping line of China's foreign reserves rising exponentially faster than the upward-sloping line of their internal production of gold, meaning that China cannot ever have enough internally-produced gold to equal 10% of their reserves if foreign reserves keep rising unless gold goes up a lot - a lot! - in price when priced in the currencies of those reserves, one of them being the dollar!

In that case, gold will go up wonderfully up in price!

Otherwise the Chinese are going to need to buy a lot - a lot! - of gold from the rest of the world, which will also drive up the price a lot - a lot! - to the point where today's gold-bug people are going to be rich, rich, rich, and who will be a happy band of people who abruptly disappear from one town and mysteriously appear in another, fabulously wealthy, sporting nice clothes and snazzy new convertibles, and about whom lurid, wickedly delicious stories are told in whispers.

Fortunately, the Austrian school of economics and the Mogambo Lazy Bum Portfolio Plan (MLBPP) both figured that this was going to happen, and while I can't speak for an entire school of economics, the MLBPP dictated that one should buy gold, silver and oil when the Federal Reserve is creating so outrageously, so unbelievably, so insanely much new money.

And because merely buying gold, silver and oil is so easy, one can only say, "Whee! This investing stuff is easy!"

Richard Daughty (Mogambo Guru) is general partner and COO for Smith Consultant Group, serving the financial and medical communities, and the writer/publisher of the Mogambo Guru economic newsletter, an avocational exercise to better heap disrespect on those who desperately deserve it. The Mogambo Guru is quoted frequently in Barronâs, The Daily Reckoning, and other fine publications.

http://www.marketoracle.co.uk/Article23263.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-05-2010, 09:35 PM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

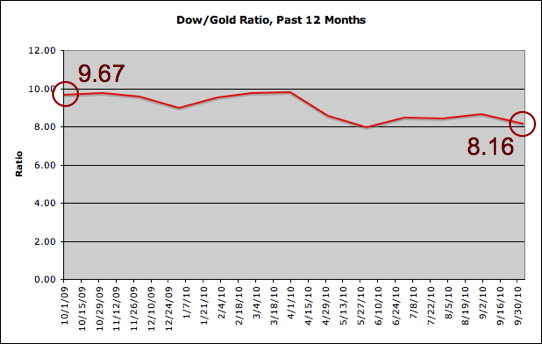

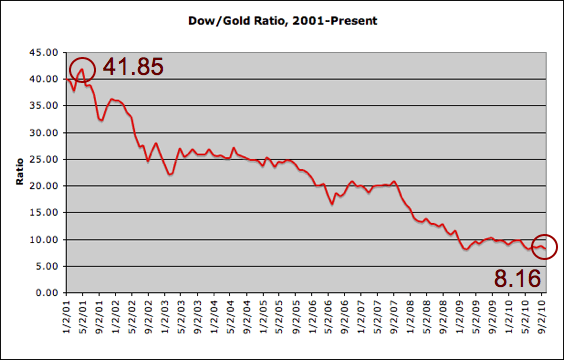

The Silent Stock Market Crash, Dow Continues Slide vs. Gold

Commodities / Gold and Silver 2010

Oct 05, 2010 - 03:15 PM

By: Tarek_Saab

Rise in equities got ya bullish? Be cautious. Amidst the October push to 11,000, the Dow Jones Industrial Average has continued its calamitous descent against gold which began in 2001 and shows no signs of abating. The silent market crash is real, and the fall of this paper tiger is surreptitiously ferocious.

As I wrote earlier this year, gold is not an investment. Gold is money - real money (See: Aristotle). Today, the rise in the Dow is being shown for what it really is - a crash - by that golden bedrock of monetary stability.

In the past 10 years, gold has fallen in nominal value sharply at times. In 2008, it plummeted over 20% in six months. It may happen again. But the real statistic worth measuring is purchasing power.

Gold's real value is determined not in the price of a fiat currency, but as a ratio to other assets. The Dow/Gold ratio simply determines how many ounces of gold it takes to purchase one Dow Jones Industrial Index. Whether the economy suffers through deflation or hyperinflation, it's the purchasing power that matters.

Dow/Gold Ratio

I follow the Dow/Gold ratio closely as a measure of equity strength. It is worth noting that, in the two most difficult economic periods in the past one hundred years, the Dow/Gold Ratio approached 1. As of today it sits at 8.16.

July 1932 - Deflationary Depression

Dow 41.22, Gold $20.67

Ratio: 1.99

January 1980 - Inflation

Dow 872, Gold $850

Ratio: 1.03

Will the gold price catch the Dow to the upside as a result of hyperinflation, or will the Dow plummet towards the gold price in a deflationary vacuum? There are well-qualified arguments for each scenario. Regardless of direction, what we do know is that the ratio is narrowing - and fast!

'Til next time, that's my Saab Story.

By Tarek Saab

http://www.marketoracle.co.uk/Article23262.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-06-2010, 12:40 AM #5Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Welcome back to the Worldwide Fiat Currency Race to Debase!

Currencies / Fiat Currency Oct 05, 2010 - 04:56 AM

By: GoldCore

At the close of third quarter 2010, it is clear for the world to see that all fiat currencies around the globe have been getting their paperback-sides kicked in by true hard monies, silver and gold.

To all the paper-bug fiat currency fools out there, we have this to say to you. Scoreboard.

RACE TO DEBASE

Year 2010 GOLD vs. Fiat Currency + 19.9%

Quarter 3 SILVER vs. Fiat Currency + 29.8%

Fiat money has no place to go but gold. If all currencies are moving up or down together, the question is: relative to what? Gold is the canary in the coal mine. It signals problems with respect to currency markets. Central banks should pay attention to it. - Alan Greenspan

Many people, like the aforementioned bubble maestro Alan Greenspan, mistakenly refer to fiat currency as fiat money. In order for a currency to also be money it must by definition be a store of value over a long period of time. Only two currencies are money, gold and silver.

Lets delve further into the numbers.

Here is a look at how real monies, gold and silver, have performed against 74 various fiat paper currencies thus far in 2010.

Fiat Currency vs. One Gold Ounce 1-Jan-10 30-Sep-10 % Gold Gain

Afghanistan Afghanis 53,343 57,162 7.2%

Albania Leke 104,997 132,216 25.9%

Algeria Dinars 78,965 95,891 21.4%

Argentina Pesos 4,171 5,161 23.7%

Australia Dollars 1,223 1,352 10.5%

Bahamas Dollars 1,097 1,303 18.8%

Bahrain Dinars 414 491 18.7%

Bangladesh Taka 75,662 90,340 19.4%

Barbados Dollars 2,195 2,606 18.7%

Bermuda Dollars 1,097 1,303 18.8%

Brazil Reais 1,914 2,212 15.6%

Bulgaria Leva 1,497 1,874 25.2%

CFA BCEAO Francs 502,190 628,614 25.2%

CFA BEAC Francs 502,190 628,614 25.2%

Canada Dollars 1,154 1,342 16.3%

Chile Pesos 556,850 631,042 13.3%

China Yuan Renminbi 7,493 8,722 16.4%

Colombia Pesos 2,244,898 2,347,464 4.6%

Comptoirs Français Francs 91,358 114,358 25.2%

Fiat Currency vs. One Gold Ounce 1-Jan-10 30-Sep-10 % Gold Gain

Costa Rica Colones 618,358 652,479 5.5%

Croatia Kuna 5,594 7,001 25.1%

Czech Republic Koruny 20,134 23,558 17.0%

Denmark Kroner 5,701 7,142 25.3%

Dominican Republic Pesos 39,642 47,760 20.5%

East Caribbean Dollars 2,853 3,499 22.6%

Egypt Pounds 6,018 7,420 23.3%

Estonia Krooni 11,979 14,994 25.2%

Euro 766 958 25.1%

Fiji Dollars 2,116 2,459 16.2%

Hong Kong Dollars 8,509 10,113 18.8%

Hungary Forint 207,032 265,249 28.1%

IMF Special Drawing Rights 700 837 19.6%

Iceland Kronur 136,181 147,371 8.2%

India Rupees 51,147 58,608 14.6%

Indonesia Rupiahs 10,315,100 11,630,461 12.8%

Iran Rials 10,869,251 13,347,991 22.8%

Iraq Dinars 1,265,793 1,524,275 20.4%

Israel New Shekels 4,136 4,754 14.9%

Jamaica Dollars 98,024 112,069 14.3%

Fiat Currency vs. One Gold Ounce 1-Jan-10 30-Sep-10 % Gold Gain

Japan Yen 102,084 108,834 6.6%

Jordan Dinars 779 925 18.7%

Kenya Shillings 83,234 105,293 26.5%

Kuwait Dinars 315 371 17.9%

Lebanon Pounds 1,650,963 1,967,079 19.1%

Malaysia Ringgits 3,758 4,025 7.1%

Mauritius Rupees 33,812 39,224 16.0%

Mexico Pesos 14,371 16,459 14.5%

Morocco Dirhams 8,666 10,744 24.0%

New Zealand Dollars 1,512 1,779 17.6%

Norway Kroner 6,332 7,685 21.4%

Oman Rials 423 502 18.6%

Pakistan Rupees 92,518 112,539 21.6%

Peru Nuevos Soles 3,168 3,635 14.7%

Philippines Pesos 50,741 57,240 12.8%

Poland Zlotych 3,128 3,808 21.7%

Qatar Riyals 3,997 4,744 18.7%

Romania New Lei 3,227 4,091 26.8%

Russia Rubles 33,265 39,881 19.9%

Fiat Currency vs. One Gold Ounce 1-Jan-10 30-Sep-10 % Gold Gain

Saudi Arabia Riyals 4,116 4,887 18.7%

Singapore Dollars 1,542 1,715 11.3%

South Africa Rand 8,108 9,121 12.5%

South Korea Won 1,277,096 1,486,002 16.4%

Sri Lanka Rupees 125,504 145,586 16.0%

Sudan Pounds 2,452 3,092 26.1%

Sweden Kronor 7,848 8,819 12.4%

Switzerland Francs 1,137 1,278 12.4%

Taiwan New Dollars 35,063 40,755 16.2%

Thailand Baht 36,597 39,531 8.0%

Trinidad and Tobago Dollars 6,949 8,301 19.5%

Tunisia Dinars 1,453 1,851 27.4%

Turkey Lira 1,646 1,891 14.9%

United Arab Emirates Dirhams 4,030 4,787 18.8%

United Kingdom Pounds 679 828 22.0%

United States Dollars 1,097 1,303 18.8%

Venezuela Bolivares Fuertes 2,359 5,603 137.5%

Vietnam Dong 20,278,046 25,352,451 25.0%

Zambia Kwacha 5,092,801 6,317,655 24.1%

Why do central banks and governments around the world continue to overprint and weaken the values of their respective fiat currencies?

Countries need to export their products and trade. By having a weaker currency, a country can more easily sell and trade their products throughout the world.

The quandary is not every country can have a weak currency at the same time. Remember, fiat currencies trade in relative terms. Paper currencies are simply valued against one another therefore dollars are always priced in euros, yen, pesos, pounds, and so on. If one fiat currency weakens, one or more of the other fiat currencies strengthens.

When nations battle to faster debasement of their respective currency in the hope to bolster export demand (to perhaps maintain an economic status quo) this is what is called competitive debasement. In the 1930âs the term for this was "beggar thy neighbor."

Wall Street Journal - 9/24/2010

Beggar-thy-neighbor currency devaluations proved ruinous for the global economy in the 1930s. Is the world setting off down the same slippery slope again?

Japan's decision to intervene in the currency market to drive down the value of the yen blew a hole in the developed world's united effort to persuade China and other Asian countries to stop artificially holding down their currencies. Meanwhile, speculation that the U.S. and U.K. could soon resume quantitative easing has hit the value of the dollar and sterling.

Longer term, the biggest gainer is likely to be gold, already pushed to nearly $1,300 an ounce this week, the traditional refuge of those unwilling to put their faith in politicians.

Is the biggest gainer likely to be gold? What about silver?

Base Currency vs. One Silver Ounce 1-Jan-10 30-Sep-10 % Silver Gain

Afghanistan Afghanis 821 952 16.0%

Albania Leke 1,616 2,203 36.3%

Algeria Dinars 1,215 1,598 31.5%

Argentina Pesos 64 86 34.0%

Australia Dollars 19 23 19.7%

Bahamas Dollars 17 22 28.6%

Bahrain Dinars 6 8 28.5%

Bangladesh Taka 1,165 1,505 29.3%

Barbados Dollars 34 43 28.6%

Bermuda Dollars 17 22 28.6%

Brazil Reais 29 37 25.1%

Bulgaria Leva 23 31 35.5%

CFA BCEAO Francs 7,730 10,474 35.5%

CFA BEAC Francs 7,730 10,474 35.5%

Canada Dollars 18 22 25.8%

Chile Pesos 8,571 10,515 22.7%

China Yuan Renminbi 115 145 26.0%

Colombia Pesos 34,553 39,115 13.2%

Comptoirs Français Francs 1,406 1,906 35.5%

Base Currency vs. One Silver Ounce 1-Jan-10 30-Sep-10 % Silver Gain

Costa Rica Colones 9,518 10,872 14.2%

Croatia Kuna 86 117 35.5%

Czech Republic Koruny 310 393 26.7%

Denmark Kroner 88 119 35.6%

Dominican Republic Pesos 610 796 30.4%

East Caribbean Dollars 44 58 32.8%

Egypt Pounds 93 124 33.5%

Estonia Krooni 184 250 35.5%

Euro 12 16 35.6%

Fiji Dollars 33 41 25.8%

Hong Kong Dollars 131 169 28.7%

Hungary Forint 3,187 4,420 38.7%

IMF Special Drawing Rights 11 14 29.6%

Iceland Kronur 2,096 2,456 17.2%

India Rupees 787 977 24.1%

Indonesia Rupiahs 158,766 193,796 22.1%

Iran Rials 167,295 222,415 32.9%

Iraq Dinars 19,484 25,399 30.4%

Israel New Shekels 64 79 24.4%

Jamaica Dollars 1,509 1,867 23.8%

Base Currency vs. One Silver Ounce 1-Jan-10 30-Sep-10 % Silver Gain

Japan Yen 1,571 1,813 15.4%

Jordan Dinars 12 15 28.6%

Kenya Shillings 1,281 1,754 37.0%

Kuwait Dinars 5 6 27.6%

Lebanon Pounds 25,411 32,777 29.0%

Malaysia Ringgits 58 67 15.9%

Mauritius Rupees 520 654 25.6%

Mexico Pesos 221 274 24.0%

Morocco Dirhams 133 179 34.2%

New Zealand Dollars 23 30 27.4%

Norway Kroner 97 128 31.4%

Oman Rials 7 8 28.6%

Pakistan Rupees 1,424 1,875 31.7%

Peru Nuevos Soles 49 61 24.2%

Philippines Pesos 781 954 22.1%

Poland Zlotych 48 63 31.8%

Qatar Riyals 62 79 28.5%

Romania New Lei 50 68 37.2%

Russia Rubles 512 665 29.8%

Base Currency vs. One Silver Ounce 1-Jan-10 30-Sep-10 % Silver Gain

Saudi Arabia Riyals 63 81 28.5%

Singapore Dollars 24 29 20.5%

South Africa Rand 125 152 21.8%

South Korea Won 19,657 24,761 26.0%

Sri Lanka Rupees 1,932 2,426 25.6%

Sudan Pounds 38 52 36.5%

Sweden Kronor 121 147 21.7%

Switzerland Francs 17 21 21.8%

Taiwan New Dollars 540 679 25.8%

Thailand Baht 563 659 16.9%

Trinidad and Tobago Dollars 107 138 29.3%

Tunisia Dinars 22 31 37.9%

Turkey Lira 25 32 24.4%

United Arab Emirates Dirhams 62 80 28.6%

United Kingdom Pounds 10 14 32.1%

United States Dollars 17 22 28.6%

Venezuela Bolivares Fuertes 36 93 157.1%

Vietnam Dong 312,112 422,443 35.3%

Zambia Kwacha 78,386 105,270 34.3%

We're in the midst of an international currency war. This threatens us because it takes away our competitiveness. Advanced countries are seeking to devalue their currencies. - Guido Mantega, Brazil's finance minister

The competing currency war is ramping up, with gross interventions, open disputes, notable desperation, friction among trade partners, and urgent need to take action. Nations are taking positions against each other increasingly. In defending their economies, they are pitting themselves against allies and foes alike. The number of bilateral squabbles has never been greater. The winner will be Gold, as all paper currencies will circle the toilet and lose. The Gold price acts as a meter; it will rise in spectacular fashion. It rises due to the profound debasement in a death process of the currency system. - Jim Willie CB, aka "The Golden Jackass"

Over the long haul, only money maintains its purchasing power. Gold and silver are money and they are destined to be the world champions of purchasing power.

The 74 different fiat paper currencies listed above are not money. They are poor stores of value for they donât and wonât maintain their purchasing power over the longterm. We forecast that their worth will continue to fall, that their face values will simply purchase less and less as we continue to witness this ongoing worldwide race to debase.

Yes! Physical silver and gold bullion coins and bars are for winners!

http://goldsilver.com

http://www.marketoracle.co.uk/Article23239.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Tenth List of Content Moved to Archive "Americans Killed by...

04-30-2024, 06:46 PM in Americans Killed By illegal immigrants / illegals