Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

03-28-2010, 03:47 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Stock Market S&P Index Readying For a Crash

Stock Market S&P Index Readying For a Crash

Stock-Markets / Financial Crash

Mar 28, 2010 - 06:24 AM

By: Shaily

This week COT data was quite illustrative of what the big boys are doing. Infact it was deja vu for me as it gave me taste of what the big boys aim to do when they need to get off their positions. I was part of all this as we used to unload huge and massive speculative postions and leaving the small guys holding the batter.

For the first time in the last 6 months, we have the small traders (even retail) becoming hopeful of the rally to go on. And guess what? The big boys including the commercials and large funds and traders have gone short. This is bearish. Very!

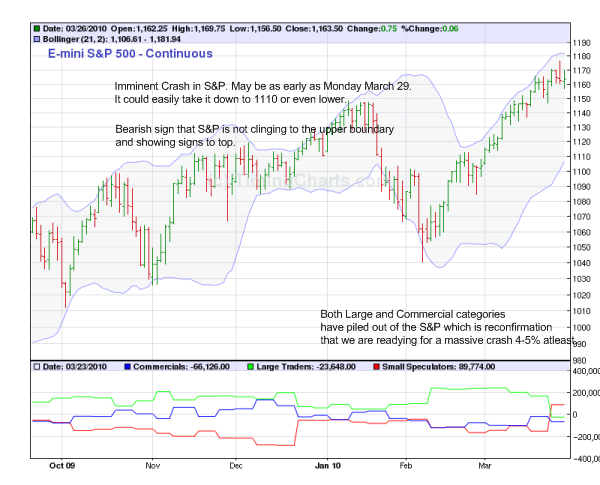

S&P Charts

S&P is just shy of kissing the upper boundary of bollinger band but seems to be now topping out into another vertical fall. The Committment of Trader reports indicate that both Large and Commercial guys have loaded out of the S&P. Take a guess is on the counter party to their shorts? Correct. Retail guys. It is unbelievable how these guys egts drawn in time and again and again. How dumb can you be?

Even a simple math of P/E should tell you that S&P is right now trading at forward 16x on Goldman’s prediction for S&P EPS. That is near to pre crash levels when unemployment were closer 6%. And yet the retail guys found a reason to buy this crap out of the big boys.

We have suggested to our clients to books profits and stay in cash. Once S&P crashes below 1160 go short to a target of 1120/30.

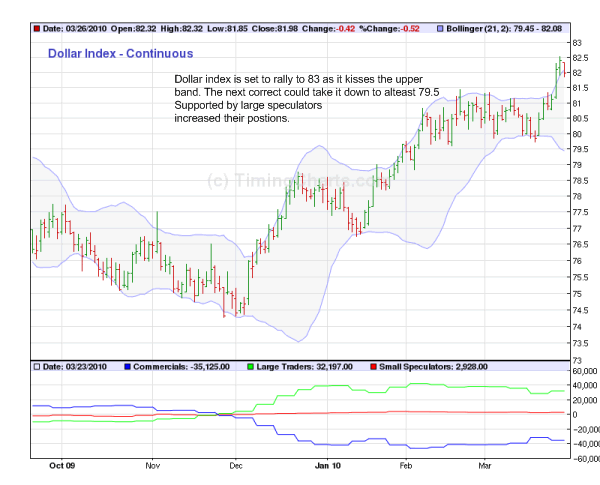

Dollar Index:

Unlike the S&P , dollar index looks well set to rally. Any fall will be picked up by the large traders who increased their bet that dollar will rally. Dollar index has been rising kissing the upper band and sometimes even going over it, showing the strength left in the bear rally of dollar. My own target for this is 83 which could happen as early as Friday when the Jobs report will be released.

It is no coincidence that we have a 30 Year auction this week and there is no way the FED will allow the dollar to weaken given that 30 year auctions have been disappointment all through 2010.

EURO

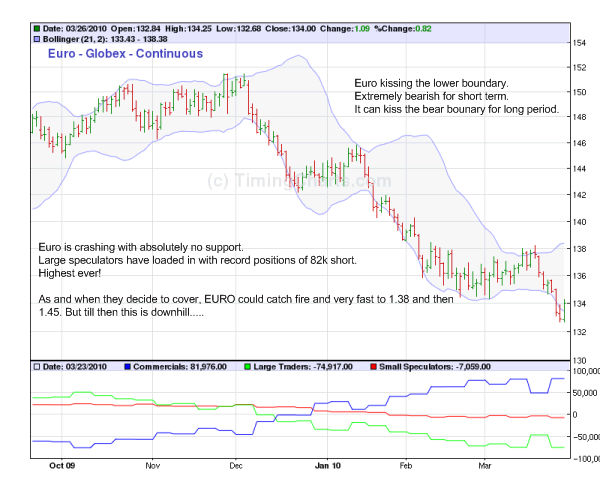

And that brings to my favorit currency: Euro. Well the outlook is bleak for short term traders.

Large traders increased their bet to the largest every >80k short contracts.

A definite target of 1.31 is on. But the momentum could take it into 1.29 territory where it can form a doji.

There was a time when everyone hated dollar and dollar bounced so fast that lots of people have been left naked. Zerohedge used a great term to describe the dollar rally to the EURO: “Bernanke was sodomizedâ€Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

JOE BIDEN WANTS TO BRING IN GAZA RESIDENTS AND GIVE THEM...

05-02-2024, 01:19 PM in Videos about Illegal Immigration, refugee programs, globalism, & socialism