Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-31-2011, 04:45 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Chicago PMI Plummets From 67.6 To 56.6, Biggest Monthly Drop

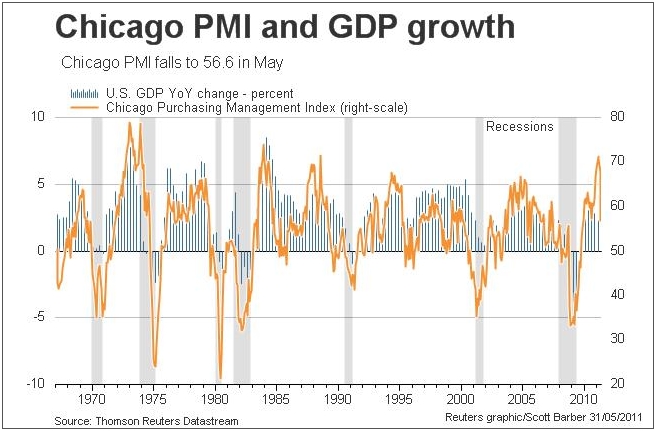

Chicago PMI Plummets From 67.6 To 56.6, Biggest Monthly Drop Since Lehman Bankruptcy

Submitted by Tyler Durden

05/31/2011 09:43 -0400

80 comments

The May Chicago PMI is out https://www.ism-chicago.org/chapters/is ... ay2011.pdf and contrary to the herd of clueless Wall Street idiots, better known in polite circles as economists, it came at 56.6 on expectations of 62.0, a collapse drop from the 67.6 before. This is the worst monthly drop since the economy imploded back in October 2008, and the second largest two month drop since 1980! A quick look at the New Orders index indicates it was the lowest since September 2009. But the good news: the economy is still in expansion... for about 1 more month. The release says it all: "NEW ORDERS and PRODUCTION posted their largest declines in several years...but remained positive" and "INVENTORIES accelerated buildup" - thank god for artificial economic expansion. And from the respondents: "Fuel cost are going to have a major impact on business activity in a negative way that will slow recovery to a crawl." Uh, what recovery? Just you wait until QE3 is announced in 3 months. And elsewhere, the May consumer confidence completed the trifecta of bad news, coming at 60.8 on expectations of 65.4, and down from 66.6.

And the two month change:

And from Reuters, a comparison of PMI and GDP:

The survey respondents confirm everything we have been saying since the Japanese earthquake struck in March, and really since December 2010, when we had the nerve to mock Goldman's December 1 call for an economic resurgence.

1 Incoming orders have definitely slowed down, but we needed that. We do continue with a high level of quote activity.

2. Prices continue to increase eating into margins which will inevitably impact the long term organic growth outlook for the US. Oil markets continue to rise, primarily on speculation, which could have short-term impacts on economic and job recovery. Increases on food costs could foster continued economic and political instability in third world countries. Strengthening of foreign currencies against the dollar are cause for concerns relative to continued inflationary pressures.

3. High oil prices are driving up pricing on plastics, and most chemical items. High commodity prices such as corn (>7% increase in April) continue to escalate industrial ethanol pricing. High Fuel prices are also driving up costs. At some point demand will drop because there will be less in the spending pool for consumers, which will cause business to decline. Weakness of the dollar vs foreign currency is also causing issues with increased costs for imported goods. Rough times ahead if oil & commodities do not ease up.

4. Aluminum pricing, like other commodities I suspect, has really eaten into our margin. Mills and Fabricators alike are increasing their cost, besides the actual commodity. Paper Roll and Film suppliers are adding a temporary surcharge to their goods to cover costs they are incurring. Seems to be getting popular among the bigger players.

5. Our prices are up (asphalt/oil), and the weather is hurting the construction industry right now.

6. Fuel cost are going to have a major impact on business activity in a negative way that will slow recovery to a crawl.

7. Commodity prices need a break. Hopefully the new planting season has good weather and produces good harvest yields.

8. Business keeps increasing but pricing pressures continue to rise as well. Often we see no valid reason for some of the increases other than trying to improve margins.

9. Inventory increase to cover any fall out from Japan crisis. Commodities are still pushing up our cost.

10. Slowdown from Japan automakers.

11. Finally seeing a slow down in the request for price increases.

12. Local economic environment beginning to show signs of gaining steam BUT financial quality of certain borrowers remains poor.Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Illegal immigration is costing American hospitals billions of...

04-27-2024, 07:55 PM in General Discussion