Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-14-2011, 02:29 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Greek 10 Year Yield Surges Over 13.2% - Euro Falls Against Gold And Particularly Silver

Submitted by Tyler Durden

04/14/2011 07:18 -0400

34 comments

From Gold Core

Greek 10 Year Yield Surges Over 13.2% - Euro Falls Against Gold and Particularly Silver

Gold is tentatively higher against the euro but mixed against other currencies while silver is again higher against most currencies. Both probed higher this morning and are exhibiting signs that they may push higher prior to a much anticipated correction.

The Greek 10 year yield has just surged over 13.2% and this is leading to falls in the euro and risk aversion with equities, commodities and oil falling.

Both gold and silver are less than 2% from their record nominal highs seen Monday (gold all time and silver 31 year) and are remaining firm due to concerns about the U.S. dollar, the euro and sovereign debt issues in Europe.

While markets are not focusing on geopolitical risk in Africa and the Middle East and the Japanese natural and nuclear disasters, these problems remain and will lead to continuing safe haven demand.

Resistance in gold is at Mondayâs record nominal high at $1,478.20/oz and the psychological level of $1,500/oz.

Silverâs resistance is at Mondayâs multiyear nominal high at $41.95/oz. In normal circumstances profit taking would be expected near $42/oz but this is anything but a normal market due to the existence of massive concentrated short positions being investigated by the CFTC.

A short squeeze may be underway with longs buying all dips in order to punish the shorts and force them to buy back their short positions thereby propelling the price much higher.

The dollarâs fall suggests that markets are skeptical of Obamaâs latest budget proposal to cut $4 trillion off the massive US budget deficit. The US fiscal situation continues to deteriorate week on week and month on month which could potentially lead to sharp falls in the dollar in the coming weeks.

Eurozone debt markets are under pressure again this morning with Greek 10 year bonds surging to a life time record high of 13.2%. Greece appears to be heading towards sovereign default despite the usual denials. Greeceâs debt has become unsustainable, only a year after it was granted the biggest bailout in history. Debt levels in Ireland, Portugal and Spain also look increasingly unsustainable.

GFMSâ prediction of gold rising to $1,600 and an average price of $1,455/oz in 2011 (todayâs current price) was reported in much of the financial press but as usual ignored by most of the non specialist financial media.

GFMS are bullish on gold in 2011 and into 2012 particularly due to investment and monetary demand. This demand looks set to continue and they identify rising inflation and U.S. sovereign debt risk as a threat with America's AAA status more likely than not to be questioned in H2 2011.

GFMS say that global mining supply has increased primarily due to another significant jump in Chinese gold production â up 8% to 350.9 tonnes from 324 tonnes.

The increase in Chinese gold production in recent years has been very large, to the degree, that some analysts have questioned their production figures. Mine supply from other major producers continues to be flat or fall as seen in South Africa and Russia production figures.

NEWS

(Bloomberg) -- Portuguese, Greek Bonds Fall as Dollar Weakens, Silver Rallies

Bonds of Europeâs most-indebted nations fell, driving Portuguese and Greek yields to records, on concern countries will reschedule debt. The Dollar Index sank to a 16-month low, silver rose and European stocks retreated.

Portugalâs five-year yields climbed to 10.43 percent as of 10:20 a.m. in London, while the Greek 10-year yield rose above 13 percent for the first time since at least 1998. Credit swaps on Greece signaled a 60 percent chance of a default within five years. The Dollar Index slid 0.3 percent, and the yen gained against its 16 major peers. Silver jumped 1.2 percent and copper lost 0.5 percent. The Stoxx Europe 600 Index sank 0.3 percent and Standard & Poorâs 500 Index futures declined 0.2 percent.

Bondholders may see a 50 percent to 70 percent âhaircutâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

04-14-2011, 02:33 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Thursday, April 14, 2011 12:53 PM

Greek 10-Year Government Bond Yield Exceeds 13% First Time, Portuguese Yield Approaches 9%; Credit Default Swaps US vs. Europe

Greek and Portuguese Euro-based sovereign debt yields hit new highs today with the Greek 10-Year sovereign bond yield topping 13% for the first time in the history of the Euro and the Portuguese yield

Greece 10-Year Yield 13.27%

Portugal 10-Year Yield 8.88%

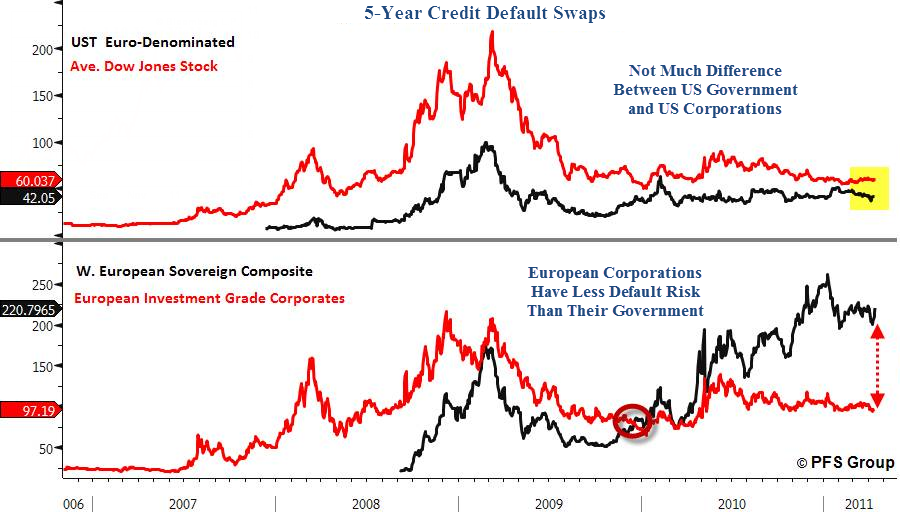

5-Year Credit Default Swaps US vs. Europe

Here is an interesting chart from Chris Puplava at PFS Group (Financial Sense) comparing default risk in the US vs Europe.

Note that government default risk is higher than corporate risk in Europe. The opposite is true in the US.

The market clearly believes there is risk of default on Portuguese and Greek government bonds and so do I.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

http://globaleconomicanalysis.blogspot. ... -time.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

72 Hours Till Deadline: Durbin moves on Amnesty

04-28-2024, 02:18 PM in illegal immigration Announcements