Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-27-2010, 01:57 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Marc Faber and Peter Schiff on the U.S. Treasury Bond Bubble

Marc Faber and Peter Schiff on the U.S. Treasury Bond Bubble

Interest-Rates / US Bonds

Aug 26, 2010 - 07:57 AM

By: Dian_L_Chu

As I've been saying for some time that the bond market is screaming for an imminent burst, now Dr. Marc Faber and Mr. Peter Schiff also spoke with CNBC on Aug. 23 warning of a bond bubble trouble.

Video at the Link: Marc Faber and Peter Schiff on the U.S. Treasury Bond Bubble

26th August 2010 - 8 minutes

http://www.marketoracle.co.uk/financial ... 9.htm#vid4

Faber - Stay Away from a 19-year Rally

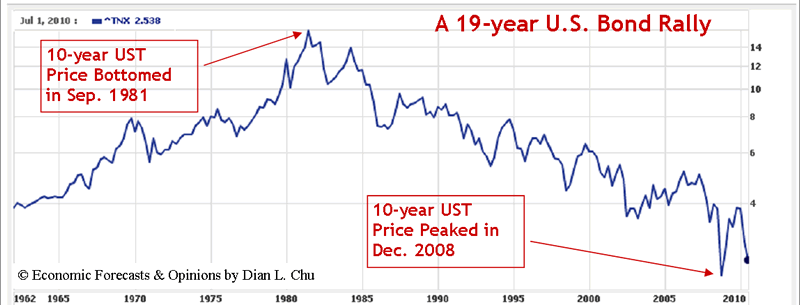

Faber advises investors "stay away from Treasurys as theyâve been rallying since 1981--equivalent to a 19-year bull run,"--when the 10-year bottomed out on Sep. 21, 1981. Faber says Dec. 18, 2008 was the peak of the bond bubble with yield of 2.08% and 2.53% on 10-year and 30-year respectively. (See 10-year chart)

âI think that there isnât much upside potential in Treasurys unless itâs for the short term. Even the short term is uncertain. But if I look 10 years ahead, where do I want to have my money, then certainly not in US Treasuries.âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

500,000 Illegals Caught on Arizona Ranch

05-02-2024, 09:08 AM in illegal immigration News Stories & Reports