Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-07-2010, 11:16 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Consumer Credit Drops $11.5 Billion, 5.6% annualized, 12th d

Wednesday, April 07, 2010

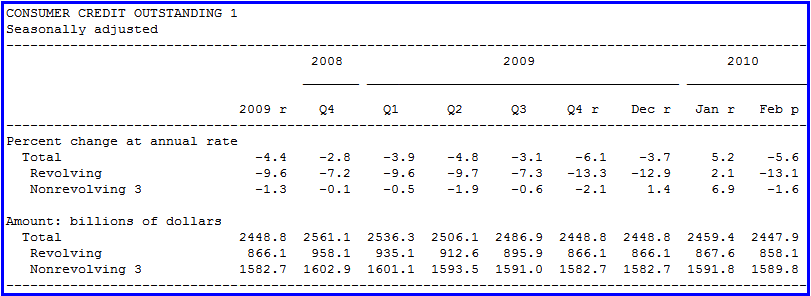

Consumer Credit Drops $11.5 Billion, 5.6% annualized, 12th drop in 13 Months; Increase In January was a Mirage related to Student Loans

Take away January's rise in consumer loans related to government buying up more student loans from private lenders, and consumer credit would have fallen 13 consecutive months.

Please consider Consumer credit drop resumes http://money.cnn.com/2010/04/07/news/ec ... er_credit/

Total consumer credit fell a seasonally adjusted $11.5 billion, at an annual rate of 5.6%, to $2.448 trillion in February, the Federal Reserve reported. Economists predicted a decline in total borrowing of $0.7 billion in February, according to a consensus estimate from Briefing.com.

"February's decline reflects on the still dire state of the economy," said Yasmine Kamaruddin, an economic analyst at Wells Fargo.

"Even if we have seen retail sales and personal expenditure increase in past months, we haven't seen these gains translate into the use of credit because consumers faced with unemployment and slow wage and salary growth are still shying away from taking on credit," she added.

The decline was led by a 13% annual rate drop in revolving credit, which includes credit card debt.

"The pop last month didn't really reflect the consumer," said Kamaruddin. "It was really due to the federal government's holding of nonrevolving credit, since they were buying up more student loans from private lenders."

G.19 Federal Reserve Report http://www.federalreserve.gov/releases/g19/Current/

Inquiring minds may be interested in the raw data from the G.19 Federal Reserve Release

Consumer credit decreased at an annual rate of 5-1/2 percent in February 2010. Revolving credit decreased at an annual rate of 13 percent, and nonrevolving credit decreased at an annual rate of 1-1/2 percent.

Some of that decrease is writeoffs. Regardless, this was a very weak report.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot. ... on-56.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

72 Hours Till Deadline: Durbin moves on Amnesty

04-28-2024, 02:18 PM in illegal immigration Announcements