Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-30-2010, 01:57 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

3 Million Foreclosures Forecast For 2010

3 Million Foreclosures Forecast For 2010

By Chuck Butler

Jan 29 2010 12:13PM

www.caseyresearch.com

Good day... And a Happy Friday to one and all! A Fabulous Friday in my book so far... The wind is blowing so hard outside that the door to the building wouldn't open for it was opening against the wind! Have I told you all recently how much I dislike cold weather? I gotta go where it's warm! And... Hopefully I will next week, when I head to Orlando for the Money Show... Last year, it was cold there too, so I was very disappointed! But back in the day when Alex was young, we used to go early, and spend a few days at Disney World, we always had warm weather then...

OK... Another day, another day of listening to dolts talk about rate hikes coming in the near future for the U.S. I'm going to go into the reasons, and please notice, I have an "s" at the end of reason, in a bit, for why I think these people are showing their doltness...

The Currencies, which had rallied during the European session yesterday morning, got sold during the U.S. session, VS the dollar the rest of the day... The data in the U.S. was nowhere near what was expected, thus showing that the economy wasn't as strong as suspected, which brought about that same old tired trading theme that's really beginning to give me a rash!

So... We start this Fabulous Friday on the downside with the non-dollar currencies... The euro continues to get dragged through the mud and muck of Greece's debt problems... I did a short interview with Reuters yesterday, and told them that I truly believe that this smashing the euro is getting completely overdone, and blown out of proportion... Sooner or later love is gonna get ya', Oh, really Chuck, was that necessary? Sooner or later, the European Union and the IMF are going to step in, and fix Greece's debt problem... And this will be just a bad memory...

I told the Reuters reporter that I didn't understand why, if the euro was getting sold because of Greece, why the dollar wasn't getting sold because of California, and California is the world's 8th largest economy... I don't think you'll find Greece anywhere near that size! I also told the reporter that I believed that traders and investors were forgetting about all the skeletons in the dollar's closet... At least for now they are!

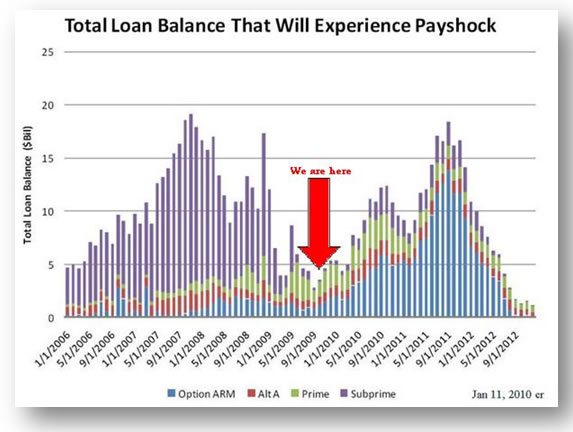

Here's a skeleton that's a BIGGIE in my book... According to RealtyTrac Inc. foreclosures here in the U.S. will probably reach 3 million this year, surpassing the record of 2.82 million foreclosures in 2009...

And that brings me to the reason(s) why the Fed can not entertain raising interest rates any time in the near term...

1. The Fed has been buying mortgage backed securities, read toxic waste bonds, from financial institutions for almost a year now... The Fed Heads stated when they first began this program that their intention was to sell these bonds back to the market once the sky cleared... Well... Should the Fed raise rates, these mortgage backed bonds would lose value... I've explained this before, but for those new to class, when dealing with bonds, yield and price have an inverse relationship. When yield goes up, price goes down, and vice-versa... And... When you have a bond with a stated yield, and interest rates go up, then the new higher yielding bond has more value, and thus the "old bond" is worth less...

So... The Fed Heads can either raise rates and take HUGE losses on their books, or continue to hold these toxic waste bonds, and eventually have to take losses on mark to market moves...

2. See above regarding the 3 million foreclosures forecast for this year... Raising interest rates would sink whatever life the housing market has in it!

3. Unemployment... I saw John Williams latest report on Unemployment yesterday... For those of your new to class, John Williams is a former Gov't accountant that started a website called "Shadow Stats" and John goes through Gov't reports and gets down and dirty with them, taking out all the hedonic adjustments, and cooked books, and reports "real data"... Well, John's latest report on Unemployment shows the unemployment rate to be 20%, not the 10% the Gov't claims... OMG!

There's no way on earth, the Fed Heads are THAT stupid to raise rates when unemployment is 20% in this country!

4. When... Have the Fed Heads ever been "pro-active"? They'll hold on to these near zero interest rates until the cows come home, and then it will be too late to begin to fight inflation...

I'm sure I could think of a few more, but I think that's enough for today!

Speaking of Fed Heads... I see where Big Ben Bernanke was finally confirmed to a second term, as Fed Chairman, yesterday... But not before some senators took some deep cutting shots at the Fed Chairman! Jim Bunning, who I had to explain to all the youngsters on the desk here was a former major league baseball pitcher, led the charge against Bernanke... Everything the senator said was absolutely true... Of which, one of the quotes went like this, "you (Bernanke) has turned the Fed into an arm of the Treasury." The vote was interesting in that, no Fed Chairman confirmation has ever had as many "no" votes as Bernanke received yesterday! I would have voted no, but then I probably didn't have to say that, as long time readers know that I am not fond of "Time Magazine's Man of the Year"...

I still say that the American public have the right to know what goes on at the Fed, and who received funds from the Fed during the financial crisis... We would know all this if the lawmakers would get off their duffs and pass Ron Paul's "audit the Fed Bill"...

Watch the major dumbed down media drool all over themselves today, when they announce that the U.S. 4th QTR, annualized GDP was the strongest growth in 4 years, at +4.7%... These dolts will conveniently forget to mention that the growth was mainly Government stimulus, but don't let that get in the way of a "feel good story"... Someone with a little intestinal fortitude should stand up and ask the question... "How can we have 4.7% growth when 2/3rds of our economy is consumer spending, and we have 20% unemployment?"

Don't get me wrong here... I live here, and would love to see "full employment, and 4.7% growth"... But, we don't have full employment, and in reality, we don't have 4.7% growth either!

A couple of weeks ago, I did a video on our deficits... One of those deficits was the "leadership deficit"... This isn't just the Gov't... It's the Central Bank and Treasury... And Credibility is a big thing when it comes to leadership... This latest fiasco involving the Fed and Treasury, regarding the payments made by AIG, with Gov't bailout money, to financial institutions... You see, these financial institutions weren't figuring on receiving 100% of their contract amount... They figured they would be happy to get 1/2 the money... But... The Treasury instructed AIG payments to be 100% of the contract, thus causing Billions on Billions of taxpayer money to be spent when it didn't have to be!

Don't worry, the guys in charge at that time were our old friend, NOT! Henry Paulson, and NY Fed Chief, and now Treasury Sec. Tim Geithner... They'll have some sweet, fat, jobs waiting for them once they leave the Gov't... (Paulson already has one!) (and rumors are going around that Geithner has finally figured out Turbo Tax! HA!)

So... Going down the list of reasons why foreigners would shy away from U.S. assets, would be a long list, but it would include, Corporate scandals, ponzi schemes, lack of regulation being carried out, the age of ignorance at the Federal Reserve, lack of yield, lack of credibility, and a lack of leadership... That's not all, but I was getting upset typing those...

Then there was this... Remember last spring, when I tried to explain to the dolts at CNBC of how I suspected there was "outside forces" pushing stocks higher, and they mocked me, and told me to take the story to Hollywood? A couple of weeks ago I told you about a guy named Charles Biderman, had discovered proof that the Government was involved in the stock moves?

Well, a reader was kind enough to send me this... If this stuff is of interest, then you might want to watch this fascinating television clip: http://watch.bnn.ca/trading-day/january ... clip253604. Unfortunately, this was not seen on American television. Again... Our dumbed down major media would never look into this kind of stuff...

Currencies today 1/29/10: American Style: A$.8955, kiwi .7080, C$ .9395, euro 1.3965, sterling 1.6135, Swiss .9530, European Style: rand 7.5575, krone 5.8850, SEK 7.3325, forint 193.85, zloty 2.8985, koruna 18.7355, RUB 30.36, yen 90.25, sing 1.4035, HKD 7.7675, INR 46.17, China 6.8268, pesos 13.01, BRL 1.86, dollar index 78.99, Oil $73.79, 10-year 3.65%, Silver $16.30, and Gold... $1,084.40

That's it for today... Tomorrow is BIG DAY! For it's our Little Christine's Birthday! Yeah for Christine! Our Little Christine was born the same year that I got married! Uh-Oh, she won't be happy that I said that, for some people with math skills will be able to figure out her age! HA! Christine began working for me when we barely had 10 people in the office... She's gotten married, had two adorable boys, and is still the same fun loving, hard working person after all this time of working for me! HA! (My beautiful bride can't believe anyone would work for me 1 year, much less multiple years!) One of our customers call her "Super Chris" So... Happy Birthday, Christine... I hope your day is grand! I'm taking Chris Gaffney to lunch today to celebrate his birthday... We never leave for lunch, so both of us leaving for lunch at the same time is uncharted waters! Mike Meyer will have the conn! I hope you have a Fabulous Friday, stay warm, and raise a glass to our little Christine tomorrow!

Chuck Butler

Senior Market Strategist

http://www.kitco.com/ind/Butler/jan292010.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-30-2010, 02:10 AM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-30-2010, 02:22 AM #3

I just found out my old house I sold for $380,000 was foreclosed on last year, the bank now has it on the market for $180,000. Since the buyer only put $40,000 down the bank (ie. taxpayers via bailout) took a $160,000+ bath. Yep the government demanding increased home ownership among "underrepresented" groups was such a great idea.

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

ALIEN INVASION: Hundreds of illegal immigrants enter San Diego...

04-27-2024, 05:54 PM in General Discussion