Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-26-2010, 06:33 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Euro Crisis Could Trigger Stocks, Dollar, Bond Market Drop

Euro Crisis Could Trigger Stocks, Dollar, Commodity and Bond Markets Drop

Stock-Markets / Financial Markets 2010 Apr 25, 2010 - 01:32 AM

By: Anthony_Cherniawski

FDIC Friday is open for business. The FDIC Failed Bank List announced seven new bank closures for the week thus far. FDIC Friday lives! http://www.fdic.gov/bank/individual/fai ... klist.html

U.S. Stocks Advance on Growth in Home Sales, Earnings Outlook

U.S. stocks advanced, wiping out losses spurred by the governmentâs lawsuit against Goldman Sachs Group Inc., as the biggest jump in new home sales in almost five decades bolstered optimism the economy is improving.

The Standard & Poorâs 500 Index rose 0.3 percent to 1,212.46 at 2:28 p.m. in New York, heading for its seventh weekly advance in the past eight. The index fell as much as 0.3 percent earlier today. The Dow Jones Industrial Average gained 28.65 points, or 0.3 percent, to 11,162.94.

Weakness Begets Weakness

As we write this, the European Union has recently announced new lending terms to support the Greek government, with great efforts made to assure the markets that these new terms do not constitute a âbailoutâ. The problem with the Greek situation is that an actual bailout would involve an almost impossible coordination among all the major powers within the EU. It would require the unanimous pre-approval of all the EU heads of state. It would involve the European Commission, the European Central Bank and the International Monetary Fund (IMF) all visiting

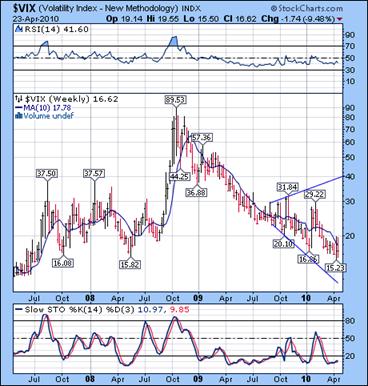

The VIX has an inside week while stocks rally higher.

--The VIX attempted again to stay above its 10-week moving average but closed short of its goal.

A weekly close above the 10-week moving average confirms a change in trend. The fact that it did not make new lows is a non-confirmation of the (final) move in stocks. The NYSE (weekly) Hi-Lo index has made a new high in April. This may be an indication of yet another climax week in stocks.

The SPX is only 7 points away from its 200-day moving average.

--The SPX has made a throw-over of its wedge formation towards its 200-day moving average. In all likelihood, it may make a final surge on Monday to hit its 200 d.m.a. at 1224.58 or its 61.8% retracement at 1228.74. The wave pattern appears complete, but extensions may appear when common retracements are nearby. On the other hand, it could reverse in the Pre-market and be on its way down at the open. Be prepared for either event.

The NDX closes at a new high.

--The climactic surge in the NDX continued through the close on Friday. Friday also happened to be a pivot day. The window for the pivot remains open until Monday. The NDX had three buying climaxes in four weeks, which are rare and a bit disconcerting. The three climax weeks in the NDX occurred in the last week of March, last week and this week. This is typical of a broadening top formation, which shows an increase of bullish sentiment at each new daily peak.

Goldâs consolidates for a third week.

-- Gold has been teasing traders by staying essentially in place for two weeks. Since it works from the same pivots as equities, it may be waiting for the turn in stocks to join the decline. It has made a corrective rally on Friday and appears ready to resume its decline shortly.

Oil spends a second week at its broadening top.

West Texas Light Crude has declined to its 10-week moving average, then partially retraced to the trendline of its Orthodox Broadening Top. Despite the fact that it reversed at the April 6th pivot, it too appears to be waiting for the equities to turn.

The commodities complex seems to have the ability to turn at the pivot tops just before equities make their turn. Since they are on the same cycle path as equities, it may be possible to continue to use them as an early warning for equities. That is, until they stop leading the market.

The Bank Index remains âcorneredâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Arizona GOP pushing tough, new border policies, but faces strong...

05-05-2024, 10:24 AM in illegal immigration News Stories & Reports