Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

09-03-2010, 08:31 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

FDIC holding banking system by a thread

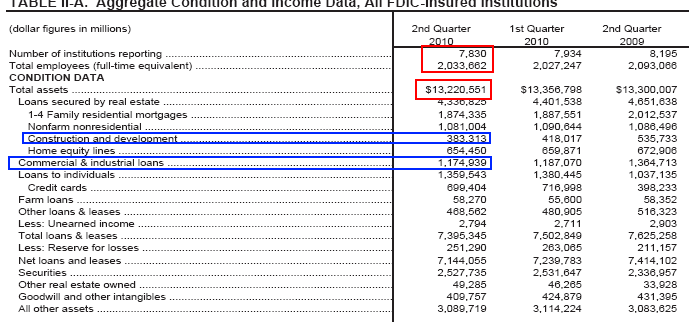

FDIC holding banking system by a thread â $13.2 trillion in assets backed by -$15.2 billion Deposit Insurance Fund. 19 Banks hold 50 percent of all banking assets out of 7,830 institutions. What needs to be done to restore the banking system for the American public.

It was interesting to see the spin regarding the FDIC quarterly report http://www.mybudget360.com/fdic-flashes ... und-empty/ this week. The report was largely a reflection of the way we now categorize profits in the banking system. Banks made a nice amount of profit through trading securities (on bailout leverage) while at the same time cutting back the amount of capital available to the American public. The number of institutions decreased by 104 but interestingly enough, the number of employees grew in this sector. Why? The too big to fail banks are simply getting bigger and stepping in where other smaller banks have failed. The amount of assets held at the 7,830 institutions is a stunning $13.2 trillion and who really knows if it is even that amount. To a bank, a loan is an asset and with mark to market suspended they can value these things at absurd bubble level prices. http://www.mybudget360.com/top-1-percen ... ga-wealth/

Let us look at some key details in the report:

Source: FDIC

First, youâll notice that the amount of assets backed did decrease by over $100 billion. If the economy is supposedly growing, you would expect this number to increase as well. Next, you will see the incredible amount of commercial real estate and industrial loans http://www.mybudget360.com/the-trillion ... al-estate/ (this is the bailout that is currently occurring but the government and banks donât want you to know about). http://www.mybudget360.com/the-trillion ... al-estate/ How can an industry that has lost 104 institutions add employees? Simple, when you have the U.S. Treasury and Federal Reserve bankrolling your finances you have more capital. http://www.mybudget360.com/us-treasury- ... -collapse/ Over 95 percent of all mortgages made this year are backed by the Federal government so why do we even need banks serving as middlemen here to skim additional profits? Why not let the public borrow directly from the government for say a 30 year fixed mortgage? The underwriting is already computerized and IRS data is already in the governmentâs hands (heck, at least youâll know the government will check this as opposed to the no-doc fraud of the too big to fail banks). http://www.mybudget360.com/fdic-flashes ... und-empty/ Either way, the report is more of a reflection of banks not realizing losses and pretending all is well.

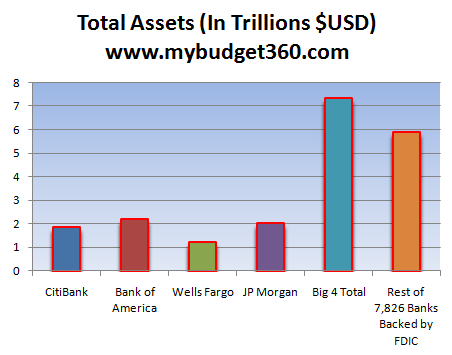

The big 4 banks control a large amount of banking assets in the system:

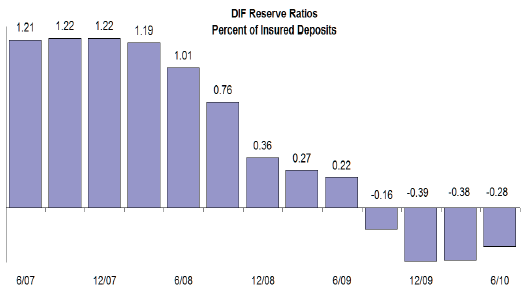

So even though we have nearly 8,000 banks, the bulk of the assets sit with a small number of banks. Iâm not sure why the report was spun as being good especially when the Deposit Insurance Fund (DIF), the fund that backs the assets of the banks is actually in the red for $15 billion:

This is the fourth consecutive quarter of it being in the red yet it is perceived as being good. Keep in mind that this also has to do with programs like HAMP and also CRE delays because banks are basically ignoring bad loans with these stop-gap measures so this helped here. After all, if you didnât have to recognize the actual value of an asset then you can still claim the inflated price and boost your assets. For those that were pushed into HAMP, banks were able to shift toxic loans onto the taxpayer bill. As we now know, over 50 percent of these loans re-default so instead of them going bad on the bankâs books, they will now go bad and the taxpayer will have to cover the entire bill. The FDIC report title should have included âshell gameâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Hotel Quietly Converted Into Migrant Shelter In Up-And-Coming...

04-29-2024, 08:52 PM in illegal immigration News Stories & Reports