Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Threaded View

-

10-13-2010, 02:18 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Treasury's Drive to Devalue Dollar, Takes Aim at China

U.S. Treasury's Drive to Devalue the Dollar, Fed Takes Aim at Chinese Yuan

Currencies / Fiat Currency Oct 12, 2010 - 02:40 PM

By: Gary_Dorsch

Although the United States is still the worldâs #1 economy, itâs increasingly feeling the heat of the Chinese dragon, breathing down its neck. At the beginning of the twenty-first century, the US-economy was eight-times larger than Chinaâs - a decade later the figure was down to three-times. Chinaâs $5-trillion economy has eclipsed Japan, Germany, France and Britain, to become the second-biggest, after three decades of blistering growth, and is now within reach of overtaking the US within 10-years. With Chinaâs economic growth rate at 10% and the US-economy struggling at +1.5% growth, - this long-term prediction doesnât sound that far-fetched.

China, with 10-times Japanâs population, has long been expected to catch up with its neighbor. But the global crisis and Japanâs sluggish growth brought that point forward by many years. China has emerged to become the worldâs largest exporter, overtaking Germany, which held the title since 2002. Factories employing low-paid workers to assemble iPods, computers, shoes, and toys are leading the boom. China has also passed the US as the worldâs largest auto market and producer. Two decades ago, a car industry barely existed in China.

In the midst of the global banking crisis, stimulus-driven Chinese growth helped to propel the worldâs economy out of recession. Chinese demand for raw materials and other imports buoyed economies from Australia to Brazil to South Korea. China uses more than half the worldâs iron ore and more than 40% of its steel, aluminum, and coal, lifting commodity prices. China is the biggest player in the copper market, buying 35% of the global supply, and is the second biggest importer of crude oil. State-owned Chinese companies are pouring billions of dollars into base metal mines and oil fields from Canada to Latin America to Iraq.

A free trade agreement between China and South East Asian nations came into effect on January 1st, creating the worldâs third-largest free trade bloc. The combined population of the trade bloc is 1.9-billion people with a combined GDP of $6-trillion. Already, the ASEAN countries are providing the raw materials and manufacturing parts for assembly hubs operating in China. About 60% of China-ASEAN made goods end up in European, Japanese, and US consumer markets.

China is at the epicenter of the fast growing Asian sphere, with satellites such as South Korea, Hong Kong, Taiwan, India, and Australia, hitching a ride to the Chinese juggernaut. The shift of economic gravity to China didnât happen by chance. Beijingâs massive intervention transformed its economy into the worldâs locomotive. The state-run mouthpiece, the Peopleâs Daily newspaper has hailed Chinaâs economic superiority over Western-style capitalism, boasting about its authoritarian rulersâ ability to make quick decisions and their will to carry them out.

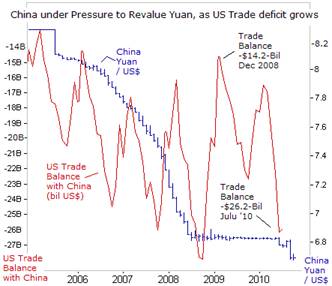

Washington is becoming increasingly alarmed at the rapid rise of Chinaâs economic might, and also worries that Beijing might eventually challenge the US for military superiority in the decades ahead. US Congressional lawmakers have long cited Beijingâs policy of undervaluing its currency, - the yuan, to give its exporters an unfair advantage in world markets, and making China a more affordable place to attract foreign direct investment in new manufacturing plants. In July and August, the US ran a combined trade deficit of about $52-billion with China, with the massive imbalance highlighting the hollowing out of Americaâs industrial base.

After holding the yuan steady against the US-dollar through the financial crisis, Beijing signaled on July 19th, that it would begin to allow for the yuan to drift higher, but at a gradual pace. Since then, the yuan has gained about +2.2%, - far short of what US lawmakers want. US Treasury chief Timothy Geithner told Congress on Sept 16th, âthe pace of appreciation has been too slow and the extent of the yuanâs appreciation too limited. We are examining the important question of what mix of tools, those available to the United States and multilateral approaches, might help encourage the Chinese authorities to move more quickly,âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

2 foreign nationals in ICE custody after alleged attempted...

05-18-2024, 07:35 AM in General Discussion