Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-07-2010, 09:33 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Currency Tensions Build; China Tells EU to Stuff It

Wednesday, October 06, 2010

Trichet's Exit Strategy Trapped by PIIGS; Currency Tensions Continue to Build; China Tells EU to Stuff It

In the midst of the crisis with sovereign debt of Greece, Spain, and Portugal, Trichet and the ECB acted by offering as much cash as the countries needed. This stabilized things for a while and Trichet was supposed to drop this support.

However, yield spreads between Germany and the PIIGS is once again soaring, and if unlimited lending is withdrawn now, it is a near-certainty that spreads will widen further.

Thus Trichet is âTrappedâ by Banksâ Addiction to ECB Cash. http://noir.bloomberg.com/apps/news?pid ... hNjhNlOGUY

Near-record borrowing costs for nations across the euro regionâs periphery are making it harder for the ECB to wean commercial banks off the lifeline it introduced two years. The extra yield that investors demand to hold Irish and Portuguese debt over Germanyâs rose last week to 454 basis points and 441 basis points respectively. Spainâs spread hit a two-month high.

The risk for the ECB is that it gets pulled deeper into helping the banking systems of the most indebted nations in the 16-member euro bloc. Governing Council member Ewald Nowotny said Sept. 6 that addiction to ECB liquidity is âa problemâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-07-2010, 10:50 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Pressures Mount on Bank of England (BOE) to Devalue Pound

Currencies / British Pound Oct 07, 2010 - 01:00 PM

By: Chris_Ciovacco

The Bank of England (BOE) is due to make a statement today at noon in London (7:00 a.m. ET U.S.). The BOEâs actions in the next 45 days may be important to investors in the U.S. and global commodity markets. All things being equal, a weak U.S. dollar tends to provide favorable headwinds to both U.S. stocks and commodities, such as oil (USL), copper (JJC), gold (GLD), and silver (SLV). With the BOE facing more bad news on the housing front today, political pressures to join the money-printing parties in the United States and Japan are mounting.

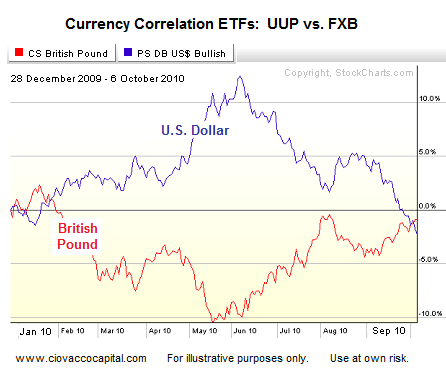

As shown below, the U.S. Dollar (UUP) and British Pound (FXB) tend to be negatively correlated. Should the Bank of England decide to stimulate further in the coming weeks and months, in the form of more quantitative easing, it could impact investors in the S&P 500, Dow, and NASDAQ, as well as those using commodities as a hedge against a weak dollar.

With exports impacted by stronger currencies, Japan (FXY), the U.S., and England are all looking to prevent their medium of exchange from appreciating too much. Japan recently announced additional plans for asset purchases and the U.S. Fed is hinting strongly at following along at their November 3, 2010 meeting. The BOE has a decision to make over the next few weeks. It is widely expected no significant changes to BOE policy will be announced this morning, but it is something investors should keep on their radar.

The daily CCM 80-20 Correction Index closed Wednesday at 604, which keeps us at a point of relatively low-risk for a major market correction. Roughly 80% of the corrections we studied occurred from points when the 80-20 values were greater than 604. The CCM Bull Market Sustainability Index (BMSI) closed Wednesday at 2,807. Markets Downside Risk Mitigated By Fed, Economy, and Technicals contains a BMSI table which shows historical risk-reward ratios for BMSI values.

By Chris Ciovacco

Ciovacco Capital Management

http://www.marketoracle.co.uk/Article23320.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Man with alleged ties to ISIS lived in US for two years prior to...

05-03-2024, 07:47 AM in illegal immigration News Stories & Reports