Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Hybrid View

-

08-15-2010, 04:17 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

NAFTA and Who Benefited from Globalization? NOT the U.S.

Stocks, Housing and Economy, Mass Delusion American Style

Stock-Markets / Liquidity Bubble

Aug 14, 2010 - 01:04 PM

By: James_Quinn

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one." - Charles Mackay- Extraordinary Popular Delusions and the Madness of Crowds http://tinyurl.com/2e9acnk

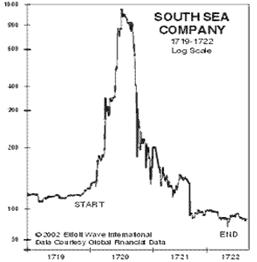

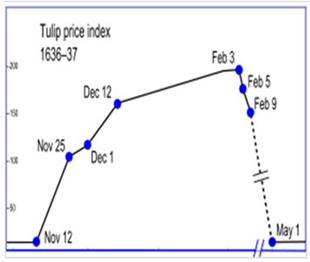

The American public thinks they are rugged individualists, who come to conclusions based upon sound reason and a rational thought process. The truth is that the vast majority of Americans act like a herd of cattle or a horde of lemmings. Throughout history there have been many instances of mass delusion. They include the South Sea Company bubble, Mississippi Company bubble, Dutch Tulip bubble, and Salem witch trials. It appears that mass delusion has replaced baseball as the national past-time in America. In the space of the last 15 years the American public have fallen for the three whopper delusions:

1. Buy stocks for the long run

2. Homes are always a great investment

3. Globalization will benefit all Americans

Bill Bonner and Lila Rajiva ponder why people have always acted in a herd like manner in their outstanding book Mobs, Messiahs and Markets: http://tinyurl.com/297ov89

"Of course, we doubt if many public prescriptions are really intended to solve problems. People certainly believe they are when they propose them. But, like so much of what goes on in a public spectacle, its favorite slogans, too, are delusional - more in the nature of placebos than propositions. People repeat them like Hail Marys because it makes them feel better. Most of our beliefs about the economy - and everything else - are of this nature. They are forms of self medication, superstitious lip service we pay to the powers of the dark, like touching wood....or throwing salt over your shoulder. "Stocks for the long run," "Globalization is good." We repeat slogans to ourselves, because everyone else does. It is not so much bad luck we want to avoid as being on our own. Why it is that losing your life savings should be less painful if you have lost it in the company of one million other losers, we don't know. But mankind is first of all a herd animal and fears nothing more than not being part of the herd."

Stocks for the Long Run

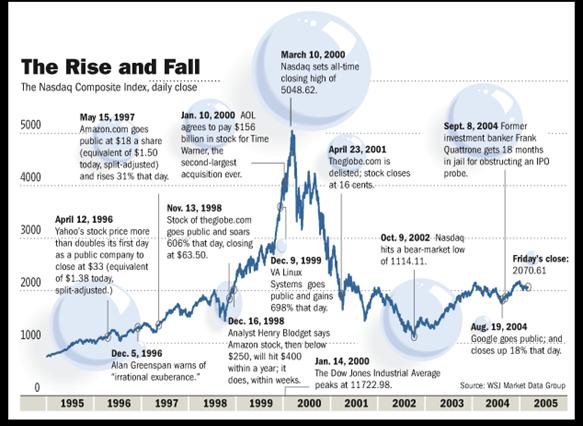

The book Stocks for the Long Run was written by Jeremy Siegel in the mid-1990's. The premise is that if you just buy and hold stocks over a 20 to 30 year period, you will always make money. This was exactly what the Wall Street witch doctors ordered. They pounded this message into the brains of every American incessantly in their advertising campaigns, literature and propaganda. It became an unquestioned truth. Just one problem. It isn't the truth. Valuations matter. The Dow Jones was at the same level in 1982 as it was in 1966. On an inflation adjusted basis, the Dow did not get back to the 1966 level until 1990. That is 24 years of no return in the stock market. The American public ignored the true facts and piled into equities during the late 1990s. The result was one of the greatest examples of mass delusion in history. The internet bubble drove the NASDAQ market to a peak of 5,048 in March 2000. Today it sits at 2,180. Ten years after the bubble burst, the NASDAQ is still down 57% from its peak.

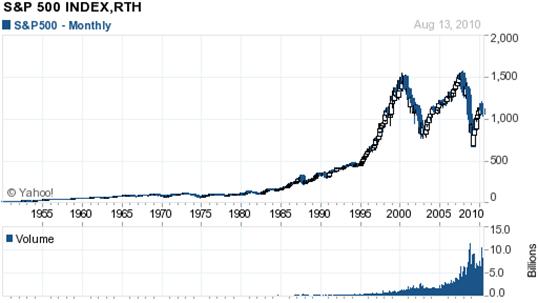

Delusional Americans all over the country believed in the new internet paradigm. Fools thought "bricks and mortar" retailers were dead. Morons quit their jobs so they could get rich day trading. Wall Street hucksters took advantage of this hysteria by attaching .COM to every ridiculous IPO they shilled to the American public. Wall Street knew these companies were pieces of crap, but they churned out the IPOs as quickly as possible while the getting was good. The Wall Street oligarchs made billions and the delusional American public got screwed. You would think that average Americans would have learned their lesson after this experience. They did not. They continued to buy into the Wall Street lies about stocks being a sure path to riches. The fact is that the S&P 500 is currently at the same level it was in March 1998. On an inflation adjusted basis, it is 25% below the level of 1998. You don't hear this information on CNBC because the oligarchs that control the media need the delusion to continue in order to harvest more riches from the ignorant masses.

Home Sweet Home

âThe continuing shortages of housing inventory are driving the price gains. There is no evidence of bubbles popping.âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

FREUDIAN SLIP: Dementia Joe Refers to Illegal Aliens as...

05-12-2024, 09:24 AM in illegal immigration News Stories & Reports