Results 1 to 9 of 9

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

11-16-2011, 04:19 PM #1

60 Minutes Catches Nancy Pelosi with Her Dress Down

60 Minutes Catches Nancy Pelosi with Her Dress Down

This past Sunday night, Steve Croft of “60 Minutesâ€

-

11-16-2011, 04:20 PM #2

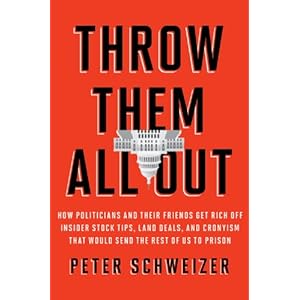

BOOK REVIEW : THROW THEM ALL OUT

Book Description

Publication Date: November 15, 2011

One of the biggest scandals in American politics is waiting to explode: the full story of the inside game in Washington shows how the permanent political class enriches itself at the expense of the rest of us. Insider trading is illegal on Wall Street, yet it is routine among members of Congress. Normal individuals cannot get in on IPOs at the asking price, but politicians do so routinely. The Obama administration has been able to funnel hundreds of millions of dollars to its supporters, ensuring yet more campaign donations. An entire class of investors now makes all of its profits based on influence and access in Washington. Peter Schweizer has doggedly researched through mountains of financial records, tracking complicated deals and stock trades back to the timing of briefings, votes on bills, and every other point of leverage for politicians in Washington.

The result is a manifesto for revolution: the Permanent Political Class must go.

-

11-16-2011, 04:26 PM #3

Pelosi aide calls '60 Minutes' report a 'smear'

Carolyn Lochhead, Chronicle Washington Bureau

Tuesday, November 15, 2011

Washington -- House Minority Leader Nancy Pelosi's office accused the news program "60 Minutes" of omitting key information from its report Sunday on how members of Congress use privileged information to profit from stock trades.

Pelosi spokesman Drew Hammill also called the report "a right-wing smear" based on a new book by conservative author Peter Schweizer of the Hoover Institution, a think tank based at Stanford University. The book is titled: "Throw Them All Out: How Politicians and Their Friends Get Rich Off Insider Stock Tips, Land Deals, and Cronyism That Would Send the Rest of Us to Jail."

Pelosi, a San Francisco Democrat, was highlighted in the report along with House Speaker John Boehner, R-Ohio, and House Financial Services Committee Chairman Spencer Bachus, R-Ala., among others.

In an interview Monday, Schweizer said the "most egregious" allegations of insider trading concerned Bachus. At the height of the 2008 financial panic, Bachus participated in private briefings by Federal Reserve Chairman Ben Bernanke and then-Treasury Secretary Henry Paulson warning that the financial system was about to collapse.

The next day, "60 Minutes" reported Sunday, Bachus bought a stock fund designed to rise in value when the market sank.

Studies led by Georgia State University Professor Alan Ziobrowski found that stock portfolios of senators beat the market by 12 percent annually, while those of House members by about 6 percent, returns he called abnormal.

"There is no law that says a congressman can't go into the cloakroom, hear some information that is about to have an important impact on a company and then, before it becomes public, go right to his stockbroker and trade," Ziobrowski said. "It is a tremendous temptation."

The "60 Minutes" segment suggested Pelosi had a conflict of interest because she and her investor husband, Paul Pelosi, bought stock in Visa, the credit card company based in San Francisco, in March 2008 while a bill that would limit the fees credit card companies could charge merchants was pending in the House.

Three purchases

The Pelosis bought Visa stock three times in 2008: 5,000 shares at $44 each in an initial public offering March 18; 10,000 shares after the IPO at $64 on March 25; and 5,000 shares at $86 on June 4.

The credit card fees bill, by then-House Judiciary Committee Chairman John Conyers, D-Mich., passed his committee on Oct. 3, 2008, but did not reach the full House. Pelosi was speaker at the time and controlled which legislation came to the floor.

Pelosi's office said Monday that "60 Minutes" should have reported that Oct. 3, 2008, was the same day the House was voting on the bank bailout known as the Troubled Assets Relief Program, amid a crisis atmosphere on the last regular day the House was in session. Its leaders were trying to round up votes for the bank rescue, and no other bills had much chance of reaching the floor.

The month before, Pelosi led House passage of the Credit Cardholders Bill of Rights, a bill also considered hostile to the industry. It was opposed by the Bush administration and died in the Senate, but was enacted in 2009.

A version of the Conyers fee limit became law in 2009 as part of a larger regulatory overhaul.

Pelosi spokesman Hammill said "60 Minutes" relied heavily on a "discredited conservative author who has made a career out of attacking Democrats," citing Schweizer books such as "Do as I Say (Not as I Do): Profiles in Liberal Hypocrisy."

Schweizer accused Pelosi of trying to shoot the messenger rather than address stock trading by members of Congress and their staffs.

"The issue is what the facts say and whether people think there's a problem with a senior member of Congress, whoever they are, taking IPO shares of corporations that have legislation sitting in front of them," Schweizer said.

Stopping trading

A bill by Rep. Louise Slaughter, D-N.Y., called the Stop Trading on Congressional Knowledge Act, or STOCK, would ban congressional insider trading. It had just nine sponsors until Monday, when nine more joined, none from California.

Donna Nagy, an Indiana University law professor, said members of Congress could be prosecuted under current Securities and Exchange Commission rules if they commit fraud involving violation of a fiduciary trust or silence about relevant non-public information.

"I would argue, and I would hope the government would argue, that the federal government and its citizens are defrauded and deceived if a member of Congress trades securities on the basis of material non-public congressional knowledge," Nagy said.

E-mail Carolyn Lochhead at clochhead@sfchronicle.com.

Read more: http://www.sfgate.com/cgi-bin/article.c ... z1dtzBlsNE

-

11-16-2011, 04:29 PM #4Pelosi aide calls '60 Minutes' report a 'smear'

SOMEONE CORRECT ME IF I AM WRONG BUT ISN'T CBS A LiBERAL NEWS ORGANIZATION?

-

11-16-2011, 04:35 PM #5

INSIDER TRADING

Stewart convicted on all charges

Jury finds style maven, ex-broker guilty of obstructing justice and lying to investigators.

March 10, 2004: 1:51 PM EST

NEW YORK (CNN/Money) - A jury found Martha Stewart guilty Friday on all four counts of obstructing justice and lying to investigators about a well-timed stock sale, and the former stockbroker turned style-setter could face years in jail.

Her ex-broker, Peter Bacanovic, was found guilty on four of the five charges against him. Each of them faces up to five years in prison and $250,000 in fines for each count. Sentencing is set for June 17.

Stewart leaves the courthouse with her attorney, Robert Morvillo (right), after the verdict.

Neither defendant appeared to show any emotion as the verdict was read, while the lead prosecutor seemed to be holding back tears of joy.

"The word is -- beware -- and don't engage in this type of conduct because it will not be tolerated," David Kelley, U.S. attorney for the Southern District of New York, said outside the courthouse.

One of the jurors said, "This is a victory for the little guys. No one is above the law."

About an hour after the verdict was read, Stewart -- wearing a fur around her neck and a black overcoat and carrying a brown leather bag -- strode poker-faced down the stairs of the courthouse, accompanied by her lawyers, and left. She did not respond to questions shouted at her by reporters.

As she came within sight of a crowd in the street, some people began chanting, "We want Martha!"

Eyewitnesses said Stewart's daughter Alexis was crying.

In a statement posted on her Web site, Stewart said, "Dear Friends: I am obviously distressed by the jury's verdict but I take comfort in knowing that I have done nothing wrong and that I have the enduring support of my family and friends.

"I believe in the fairness of the judicial system and remain confident that I will ultimately prevail." (For more on Stewart's statement, click here).

Stewart's lead attorney said his client would appeal.

"It was a difficult process for all of us," Robert Morvillo said outside the courthouse, adding that he was disappointed in the verdict but confident about an appeal.

A lawyer for Bacanovic said he also will appeal. The ex-Merrill Lynch broker made no comment as he left the courthouse not long after Stewart.

Neither Stewart, 62, nor Bacanovic testified at the trial, which began Jan. 27 and ran for five weeks. Attorneys for Bacanovic called just a handful of witnesses while Morvillo called only one witness.

"Unless this is somehow undone on appeal, she's a felon and she's going to prison," legal analyst Kendall Coffey said.

"This was a total rout," said CNN legal analyst Jeffrey Toobin, who sat through the trial. "The story she told investigators after she made the stock trade simply didn't add up."

The panel of eight women and four men began deliberating Wednesday on whether Stewart and Bacanovic, 41, obstructed justice and lied to the government about her sale of ImClone Systems Inc. stock in December 2001.

The conviction came exactly a week after U.S. District Judge Miriam Goldman Cedarbaum threw out the most serious charge against Stewart -- securities fraud -- which carried a maximum penalty of 10 years in prison and a $1 million fine.

The charge -- which the judge had called "novel" during the trial -- accused Stewart of using her own statements that she was innocent as a ploy to mislead investors in her company, Martha Stewart Living Omnimedia.

Martha Stewart has been found guilty on all four counts. CNNfn's Chris Huntington reports.

Martha Stewart Living (MSO: Research, Estimates) stock rallied early Friday on hopes for a favorable verdict but then plunged 22.6 percent afterward on the New York Stock Exchange, where Stewart once served as a director.

The company said it would survive but analysts said the verdict was a serious threat. Stewart quit as chairman and CEO of Martha Stewart Living after she was indicted last summer but stayed on as chief creative officer. (For more on the company's outlook, click here).

Despite the intense publicity surrounding the trial -- the most closely watched of the recent corporate fraud cases -- the stock trade at its center involved a relatively small amount of money.

Stewart avoided a loss of about $51,000 by selling nearly 4,000 shares of ImClone stock on Dec. 27, 2001, rather than the next trading day, when the stock tumbled after regulators rejected the company's application for a key cancer drug.

By contrast, Dennis Kozlowski and Mark Swartz are charged with looting Tyco of $600 million, John Rigas and his sons are charged with stealing millions from Adelphia, the cable company Rigas founded, and the collapse of Enron and WorldCom led to billions of dollars in losses for investors and costs thousands their jobs.

Ex-Enron CEO Jeff Skilling and former WorldCom CEO Bernard Ebbers were each recently indicted for their alleged roles in the collapse of those companies. (For more on the scandals, click here).

Ironically, Erbitux, the ImClone drug at the heart of the scandal, was approved by regulators last month to treat certain forms of cancer.

Prosecutors argued that Stewart sold her ImClone stock only after Bacanovic told his assistant to tip her off that ImClone founder Sam Waksal was trying to sell. Stewart and Bacanovic had told investigators they had an arrangement to sell once the stock fell to $60.

Bacanovic was broker to both Stewart and Waksal, who is serving a seven-year prison term after pleading guilty to securities fraud over his family's sale of ImClone shares.

The government's star witness in the case, Douglas Faneuil, Bacanovic's former assistant, testified that his boss ordered him to pass the inside tip about ImClone to Stewart.

Mark Powers, Faneuil's attorney, said his client "came forward because his conscience told him it was the right thing to do. He was solely a witness telling the truth."

Stewart told CNN's Larry King Live last December that she was not prepared for the trial.

"No one is ever prepared for such a thing," she said. "And no one is ever strong enough for such a thing. No one is -- you know, you have no idea how much worry and sadness and grief it causes."

-

11-16-2011, 04:39 PM #6

Is Martha Stewart A Conservative Republican?

What are Ms. Stewart's political affliations? What party does she belong to? Is this public knowledge? Thank you!

Best Answer - Chosen by Voters

No, she's a Democrat.

http://answers.yahoo.com/question/index ... 925AA0BcC5

-

11-16-2011, 04:43 PM #7

-

11-16-2011, 05:14 PM #8

RELATED

FLASHBACK: House Leader Joins Bush To Assist Illegal Aliens

http://www.alipac.us/ftopic-255374-0-da ... rasc-.html

PHILADELPHIA-January 26, 2003-(TomFlocco.com)-While receiving wide media coverage and criticism because she pressed for U.S. acceptance of the Mexican government's "Matriculas Consulares" identification cards [issued to illegal immigrants] to permit illegals to enter the San Francisco Federal Building which houses her district office, a number of legal, ethical, and constitutional questions remain unanswered regarding House Minority Leader Nancy Pelosi's curious actions and investments.

This, as her multi-million dollar wine industry investments are linked directly to the First Family, while her grape vineyards also stand to benefit from the cheap labor afforded by illegals from Mexico.Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

-

11-16-2011, 06:03 PM #9

I really hope she slipped up somewhere and spends many years in prison!

https://pelosi.house.gov/contact/email-me.shtml

4 digit zip code 94103-6700

http://www.facebook.com/NancyPelosi

http://twitter.com/NancyPelosiSupport our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at http://eepurl.com/cktGTn

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

JOE BIDEN WANTS TO BRING IN GAZA RESIDENTS AND GIVE THEM...

05-02-2024, 01:19 PM in Videos about Illegal Immigration, refugee programs, globalism, & socialism