Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

12-16-2010, 11:03 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Bankers Secret Meeting to Control the World?

Bankers Secret Meeting to Control the World?

Stock-Markets / Market Manipulation

Dec 16, 2010 - 03:26 AM

By: PhilStockWorld

Revisiting the massive global oil scam... Last year, Phil calculated that this $2.5 Trillion dollar operation was 50 times the size of the Bernie Madoff ponzi scheme. "It's a number so large that, to put it in perspective, we will now begin measuring the damage done to the global economy in "Madoff Units" ($50Bn rip-offs). That's right - $2.5Tn is 50 TIMES the amount of money that Bernie Madoff scammed from investors in his lifetime, yet it is also LESS than the MONTHLY EXCESS price the global population has to pay for a barrel of oil..."

If you want to know why the powers that be hate the New York Times â read this!

"The Paper of Record," one of the few remaining news entities not controlled by Rupert Murdoch or some other Billionaire or major corporation, still has the guts to tell it like it is as they are actually pointing a finger right at the Gang of 12 (well 9 of them) and those not-so-secret meetings they have been having for years where they sit down and think of new and exciting ways to control the World. It takes a lot of guts to write an article like this, especially one which actually names ICE (I got my ass handed to me with legal BS when I dared mention them in conjunction with the word "manipulation." http://www.philstockworld.com/2009/11/1 ... doff-mark/ Fortunately they straightened me out and we now know that clearly there is no manipulation in the energy markets â can I have my Grandma back now?).

Anyway, those fools at the NY Times have thrown caution to the wind without naming specific names using the phrase "giants LIKE JPM, GS and MS" â something I have learned to do as well because, if you donât â THEY WILL GET YOU! And what are they saying about our friendly Banksters?: http://www.nytimes.com/2010/12/12/busin ... .html?_r=1

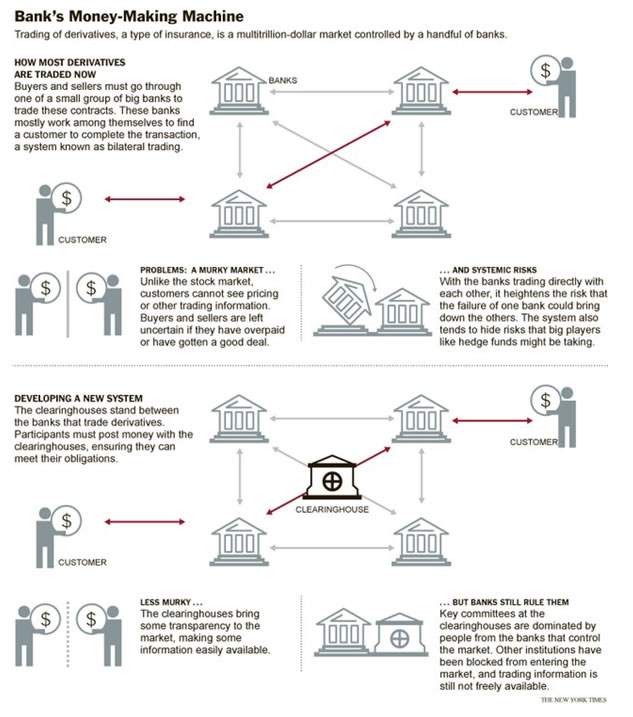

In theory, this group exists to safeguard the integrity of the multitrillion-dollar market. In practice, it also defends the dominance of the big banks. The banks in this group, which is affiliated with a new derivatives clearinghouse, have fought to block other banks from entering the market, and they are also trying to thwart efforts to make full information on prices and fees freely available. Banksâ influence over this market, and over clearinghouses like the one this select group advises, has costly implications for businesses large and small,

According to the Times, the marketplace as it functions now âadds up to higher costs to all Americans,âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Nightmarish MS-13 Gangbanger Caught In New Orleans After Prior...

05-03-2024, 12:21 PM in illegal immigration News Stories & Reports