Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Threaded View

-

05-21-2009, 08:14 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

24,700,000 Unemployed or Underemployed Americans: Job Losses

May 10, 2009...2:39 pm

24,700,000 Unemployed or Underemployed Americans: Job Losses Accelerate with 6 million unemployed over last year. Real Unemployment rate now at 15.8 Percent.

By mybudget360.com

It is hard to believe what is taken as good news. 539,000 jobs were lost in April yet this was taken as a positive because it wasnât 600,000. Forget about the fact that the revised number for March was moved upward to 699,000 from an initial 663,000. So it may be the case when the final number for April is calculated in June, we might have another 600,000 job loss month. The market is continuing on its upward surge with the S&P 500 now nearing a 40% gain in 2 months. This market volatility and surge is indicative of an unstable market. The fact of the matter is, when we total up all of the unemployed and underemployed we find that close to 24,700,000 Americans fall in this category.

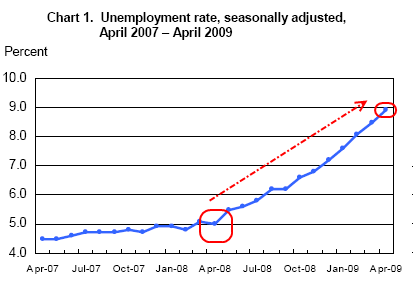

Over the past 12 months the number of unemployed has risen by 6 million. Also, if you look at the above chart, the rate has shot up by 3.9% from 5% last April of 2008 to the current 8.9%. Yet that rate is for those that are unemployed. When we start looking at the broader measure of U-6 we see that 15.8% of people are unemployed or underemployed. Let us break down the numbers:

Unemployed: 13,700,000

Part-time but looking for full-time: 8,900,000

Marginally Attached and Discouraged Workers: 2,100,000

This brings our total to 24,700,000. That is why when we go back to the 1982 unemployment rate of 10.8%, we are even in worse shape today because how the employment numbers are calculated. Part-time workers looking for full-time work are such a big group but are considered employed by the U-3 headline number and they should not be. I think most people would say that someone working part-time at a Wal-Mart because they are trying to make ends meet does not constitute being fully employed. This is why we are seeing deflationary pressure hitting the market.

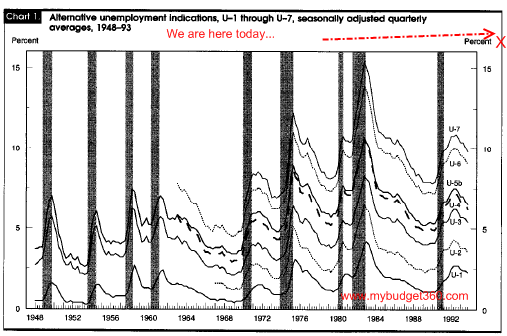

In October of 1995 the BLS revised their way of collecting data for unemployment. So if we are at 15.8% with the U-6 data, does that make our current employment situation worse than the 1980s recession? Absolutely. Take a look at this chart I found in an old article from the 1995 BLS revision report:

In fact, looking at U-6 data back to the early 1960s which is the best I have been able to find, we are having the worst economic recession since World War II. That is why even though the headline rate of 8.9% is much lower than the 10.8% peak of 1982, our overall unemployed and underemployed is much higher at 15.8% and that is why this recession feels a lot worse. It is a lot worse it is just the method of measuring the data has changed.

And the rise in part-time employment is somewhat troubling because of the actions taken by the Federal Reserve and U.S. Treasury. With the recent stress tests, it is becoming abundantly clear that the U.S. Treasury is going to pump as much taxpayer money into banks no matter what the long-term consequences. Essentially, we are going to follow the Japan approach. Now Tim Geithner would like to believe that the mistake Japan did was they stopped too soon or didnât do enough. Yet Japan has the highest percentage of national debt load of any industrial country in the world. They spent plenty. They zombified banks and injected trillions in fiscal stimulus and the market moved lower and lower for 20 years. Yet some point to the low employment rate. Well, the problem with this is nearly 1 out 3 people in Japan work as part-time workersâ¦that is, they would be considered part of that U-6 data point which of course isnât the headline number. How would you feel about being a part-time worker for the rest of your life?

Donât believe this? The BLS had 5.2 million part-time workers categorized in April of 2008 as being part-time for economic reasons. Last month, that number surged to 8.9 million. A jump of 70 percent in one year. We almost doubled the amount of part-time workers in 12 months which is such an unsupportable pace and that is why the U-6 rate is now up to 15.8%.

I do agree that things slightly improved yet it is no reason to think the worst is behind us. We still have the FDIC gearing up to take over banks each and every Friday while their deposit insurance fund gets depleted. Be cautious for what is considered positive news.

http://pakalert.wordpress.com/2009/05/1 ... 8-percent/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

2 foreign nationals in ICE custody after alleged attempted...

05-18-2024, 07:35 AM in General Discussion