Results 1 to 4 of 4

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-04-2010, 08:48 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Corporate Hiring No Longer Improving; American Less Optimist

Tuesday, August 03, 2010

Corporate Hiring No Longer Improving; American Less Optimistic

Corporate hiring has been in a weak but generally improving condition from January through June according to a Gallup Poll. That positive trend is now broken as noted in U.S. Job Creation Remains Level in July http://www.gallup.com/poll/141719/Job-C ... -July.aspx

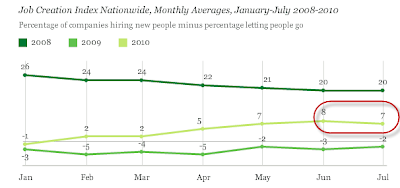

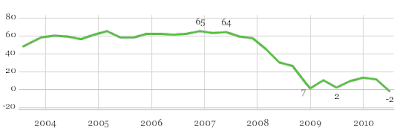

Gallup's Job Creation Index finds job growth essentially unchanged for the third consecutive month, with a score of +7 in July -- about on par with +8 in June and +7 in May. Job market conditions are better now than they were during the financial crisis at this time a year ago (-2), but remain far below the already-recessionary levels found at this point in 2008 (+20).

Job Creation Index

click on the link for a sharper image: http://3.bp.blogspot.com/_nSTO-vZpSgc/T ... Jobs+1.png

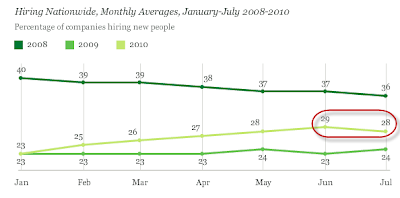

Hiring No Longer Improving

In July, 28% of U.S. workers reported that their companies were hiring, halting the consistent upward trend found from February to June. From a longer-term perspective, hiring reports are up substantially from the same period in 2009, but still below hiring levels at this time in 2008.

Percentage of Companies Hiring Workers

click on the link for a sharper image: http://2.bp.blogspot.com/_nSTO-vZpSgc/T ... Jobs+2.png

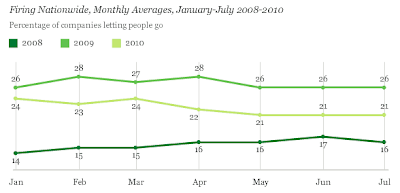

Firing Also Levels Off

Twenty-one percent of U.S. employees report that their companies are letting people go -- unchanged during the past four months. Workers' reports of people being let go in July are down five points from July 2009 but remain five points above July 2008 levels.

Percentage of Companies Firing Workers

click on the link for a sharper image: http://4.bp.blogspot.com/_nSTO-vZpSgc/T ... Jobs+3.png

What the Charts Don't Say

Unfortunately, Gallup does not say actual numbers of people hired or fired, only that a company is hiring or firing. A company firing one worker is as significant as another company hiring 200 workers.

Gallup also fails to incorporate new business creation as well as death of new businesses. Of course the BLS "birth-death" model is one of the things many like to complain about, including me.

I bring these points up because it is important to understand the potential flaws in the data being reviewed. It would have helped if Gallup broke out results by company size, as well as some order of magnitude as to hiring and firing.

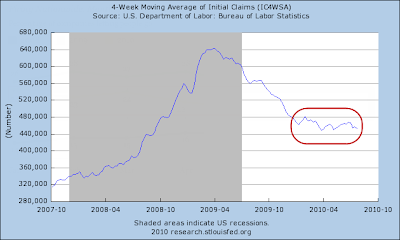

We do have an alternate handle on firing however, simply by looking at Weekly Unemployment Claims.

Weekly Unemployment Claims

click on the link for a sharper image: http://1.bp.blogspot.com/_nSTO-vZpSgc/T ... -07-29.png

The above chart shows no improvement in weekly claims for going on 8 months, dating back to mid-December.

That chart is roughly in agreement with the relatively flat Gallup line on the percentage of companies firing workers.

Small Business Job Creation

A recent Gallup poll on small business conditions strongly suggests small businesses are not going to ramp up hiring plans anytime soon.

Record Pessimism in Future Expectations

The Future Expectations Dimension of the index, which measures small-business owners' expectations for their companies' revenues, cash flows, capital spending, number of new jobs, and ease of obtaining credit fell 13 points in July to -2 -- the first time in the index's history that future expectations of small-business owners have turned negative, suggesting owners have become slightly pessimistic as a group about their operating environment in the next 12 months.

Small Business Index Future Expectations

click on the link for a sharper image: http://1.bp.blogspot.com/_nSTO-vZpSgc/T ... 08-02B.png

For more charts, details and discussion please see Wells Fargo/Gallup Small Business Index Hits Record Low, Future Expectations Dip Below Zero First Time Ever http://globaleconomicanalysis.blogspot. ... index.html

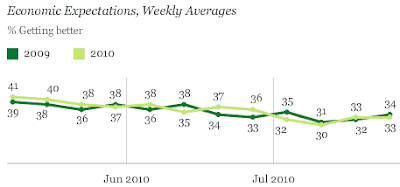

Americans Less Optimistic About the Economy in July

Wrapping up a trio of Gallup surveys, please consider Americans Less Optimistic About the Economy in July http://www.gallup.com/poll/141626/Ameri ... -July.aspx

Americans' economic optimism declined from 41% at the beginning of May to 30% in mid-July before ticking up to 33% over the past couple of weeks.

Percentage of Consumers Saying Economic Conditions are "Getting Better"

click on the link for a sharper image: http://2.bp.blogspot.com/_nSTO-vZpSgc/T ... ions+2.png

Weekly trends in economic optimism that Gallup has measured over the past three months are surprisingly similar to those of a year ago. That is, consumers are no more optimistic now about the future course of the economy than they were when the economy was just beginning to recover from its late 2008 and early 2009 plunge and as companies were aggressively shedding jobs.

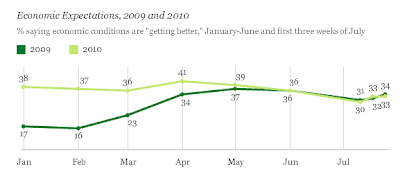

A slightly longer view shows the difference in year-over-year consumer expectations: 38% of Americans in January 2010 said the economy was "getting better," compared with 17% in January 2009, for a difference of 21 percentage points. This year-over-year difference fell to zero in June 2010 and has been essentially maintained during three weeks of July.

click on the link for a sharper image: http://1.bp.blogspot.com/_nSTO-vZpSgc/T ... ions+3.png

Bottom Line

The Conference Board on Tuesday reported a decline in consumer confidence in July, something Gallup has been reporting for weeks. Reuters/University of Michigan also reported a sharp decline in consumer sentiment in its preliminary report for July. While these monthly measures are belatedly catching up with the Gallup weekly trend, they have not reflected the steady erosion in consumer expectations over the past 12 weeks, or the uptick of the past two weeks that most likely came in response to the surge on Wall Street.

The most troubling finding in the Gallup data, however, is that today's consumer expectations are no better than those of a year ago. Americans' views may reflect the prospect of a jobless recovery; the unemployment rate is expected to remain near double digits for the rest of the year. American consumers might also be taking to heart Federal Reserve Chairman Ben Bernanke's assertion that this is a period of "unusual uncertainty" as something that applies to them just as much as businesses and policymakers.

Unusual Uncertainty

I commented at length on Bernanke's assertion in Bernanke Says Economic Outlook is "Unusually Uncertain", Fed Prepared for "Actions as Needed" http://globaleconomicanalysis.blogspot. ... ok-is.html

In my opinion the Fed is enormously and erroneously overoptimistic about its assessment of the economy, especially unemployment. The odds we get back to 5% unemployment anytime soon are close to zero. And unless the participation rate collapses, we are far more likely to see higher highs, possibly above 12% before we start to see the rate drop.

Be Prepared for "Unusual Actions"

The Fed seems to be sensing it may be wrong in its optimistic assessment judging from Bernanke's "Unusually Uncertain" statements.

Risks are not just "skewed" to the downside, they are enormously skewed to the downside.

Bernanke Has Met His Match

Hyperinflationists will be coming out of the woodwork on the Fed's statements today. However, I calmly note that Bernanke has met his match: consumer attitudes.

We have reached a Consumption Inflection Point - No One Wants Credit and consumer spending plans have plunged. There is nothing Bernanke can do to "fix" that. http://globaleconomicanalysis.blogspot. ... o-one.html

Besides, there is nothing to "fix" anyway. Boomers headed towards retirement better be saving more and spending less. The same applies to kids out of college without a job.

Finally, I note that Bernanke thinks consumer spending is on the rise. It's not. Bernanke needs to get out in the real world and see what's happening. He can start by reading Rockefeller Institute Confirms Rising Retail Sales a Mirage. http://globaleconomicanalysis.blogspot. ... ising.html

The Gallup Poll suggests consumers are not about to go on a spending spree. This is a matter of common sense.

Economic Models vs. Common Sense

Repeating a portion of Wells Fargo/Gallup Small Business Index Hits Record Low, Future Expectations Dip Below Zero First Time Ever .... http://globaleconomicanalysis.blogspot. ... index.html

Bernanke no doubt is adhering to his models as to what a recovery from a typical recession looks like. Those models no doubt suggest that the steep yield curve will spur economic growth.

The problem is this is not the typical recession. This is a credit bust recession and consumers are still deleveraging. Moreover, with savings deposits yielding close to 0% and with credit card rates over 20%, common sense dictates consumers pay down bills. Indeed, given all the economic uncertainties, consumers are reacting in a rational manner by not spending.

Bernanke needs to throw his silly formulas out the window and use some common sense. Unfortunately, he cannot do that because he does not have any common sense.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot. ... oving.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-04-2010, 09:10 AM #2

Airborne, I don't have to read that lengthy article to know that corporations are either 1) Sitting on the sidelines with their money trying to decide what to do or 2) They're fed up and given up and moved their operations offshore.

Either way, our manufacturing sector has been decimated and we are no longer a manufacturing power in the world. We can thank our gubment for establishing such a hostile environment for such businesses to make a buck....I call on you in the name of Liberty, of patriotism & everything dear to the American character, to come to our aid...

William Barret Travis

Letter From The Alamo Feb 24, 1836

-

08-04-2010, 09:12 AM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

yep ... there is no doubt in my mind who not only caused this mess; but made it far worse by the actions they took Originally Posted by TexasBorn

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Originally Posted by TexasBorn

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-17-2010, 11:28 AM #4

- Join Date

- Jan 1970

- Posts

- 1

hi

Things are showing no signs of improvement which has made the situation worse

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

San Diego Sector of Southern Border Reaches Top Spot for Illegal...

05-11-2024, 02:51 PM in illegal immigration News Stories & Reports