Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-26-2008, 01:58 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

US Banking System in Crisis- Why banks are Not lending?

US Banking System in Crisis- Why banks are Not lending?

Stock-Markets / Financial Markets

May 24, 2008 - 11:38 AM

By: Anthony_Cherniawski

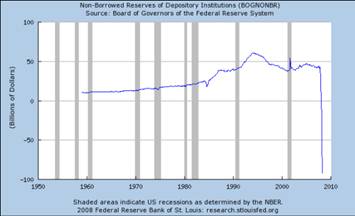

Here's an eye opener. The attached report http://research.stlouisfed.org/fred2/series/BOGNONBR from the St. Louis Fed on banks' non-borrowed reserves shows that it has just gone down in flames. According to the chart, the amount of money that banks have in reserve that is non-borrowed is not only at a 50-year low, but has entered negative territory for the first time since these statistics have been kept. Does this mean our banks are now insolvent?

Frankly, I don't have an answer, but this information is very disturbing, to say the least. The FDIC is gearing up for it, too.

Mr. William M. Isaac, former chairman of he FDIC, has written an article that also reflects what I have been commenting about in the past weeks. Here are a couple of his observations http://www.ronpaulforums.com/showthread.php?t=138977 , “ Do we want the Fed underwriting takeovers of failing firms? Are we willing to allow that to happen without a competitive bidding process, which is routinely used when insured banks fail? Would we want the Fed to rescue an insurance company? How about an auto company? In short, what are the rules going forward?

I'm delighted the liquidity crisis has eased (Has it?) , and I believe the Fed had a big hand in that. But I'm deeply troubled by the precedent that has been set and the implications for our financial system.â€Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

72 Hours Till Deadline: Durbin moves on Amnesty

04-28-2024, 02:18 PM in illegal immigration Announcements