Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-13-2009, 03:01 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Disappearing Middle Class Dream

The Disappearing Middle Class Dream - How the Average American is coping with the Recession:

Savings, Banking, Housing, and Investing.

Over 50 Million Households Living on $52,000 or less a year.

Last month the American Community Survey detailed the painful 2008 year for American households. This is a comprehensive survey looking at multiple financial, economic, and social characteristics of Americans. What we find is that the average American is having a tougher time maintaining a hold on the middle class dream. This isn’t a revelation but it does help us determine what to expect in the next few years. The American family in fact over the past decade has maintained the illusion of middle class living by going deeper into debt because of stagnant wages. The U.S. Treasury and Federal Reserve allowed this to occur by injecting liquidity and creating a credit market that had no brakes.

In the latest data, the median American household brings in $52,000 per year. Let us break down this data:

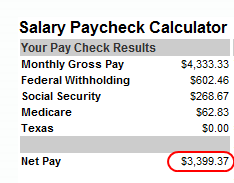

Using Texas or any state with no income tax is a good starting point because it puts us at the higher end of the take home pay bracket. Some states like California have state income taxes reaching up to 10 percent. However, this allows us to see how much actual take home pay the average American family is working with. By looking at the above it looks like people have roughly $3,400 a month for all additional expenses. Keep in mind that we are also not putting money away in any retirement accounts or paying for health insurance and that can add a large line item.

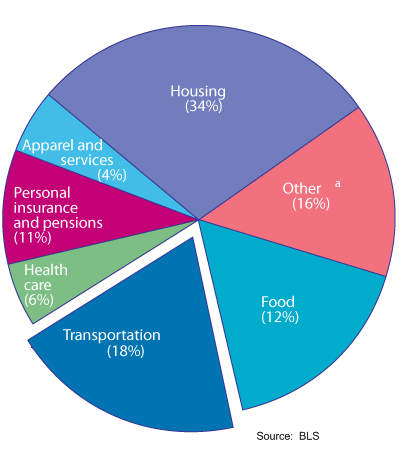

Let us see how the average family spends money:

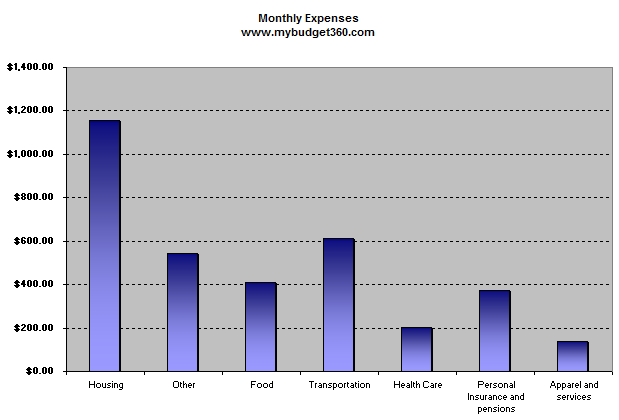

So let us use these estimates with the monthly take home to get an idea of what people are working with:

From here you can understand why the current recession is hurting so deeply. Take for example the housing expense. The current median home price in the U.S. is $174,000. So if the family above with the median income went to purchase this median priced home, how much are they looking to spend? Let us assume they buy the home via a FHA insured loan requiring only 3.5 percent down:

Down payment: $6,009

Mortgage: $167,910 (at 5.5 percent 30 year fixed)

PI: $953

On the surface this may seem okay. But we are not including taxes and insurance above. If you include taxes and insurance, let us assume this family buys in Texas, the taxes with insurance can range from 2.5 to 3 percent of the purchase price of the home:

Insurance and Taxes: $362 per month

Total monthly housing payment: $1,315

The median family in the U.S. spends $1,165 per month on housing. This may not seem like a big difference but we are looking at an 11 percent difference for the biggest line item here. That is why housing in many parts of the country is still having trouble. Americans have become more price conscious in a time with 17 percent unemployment and underemployment.

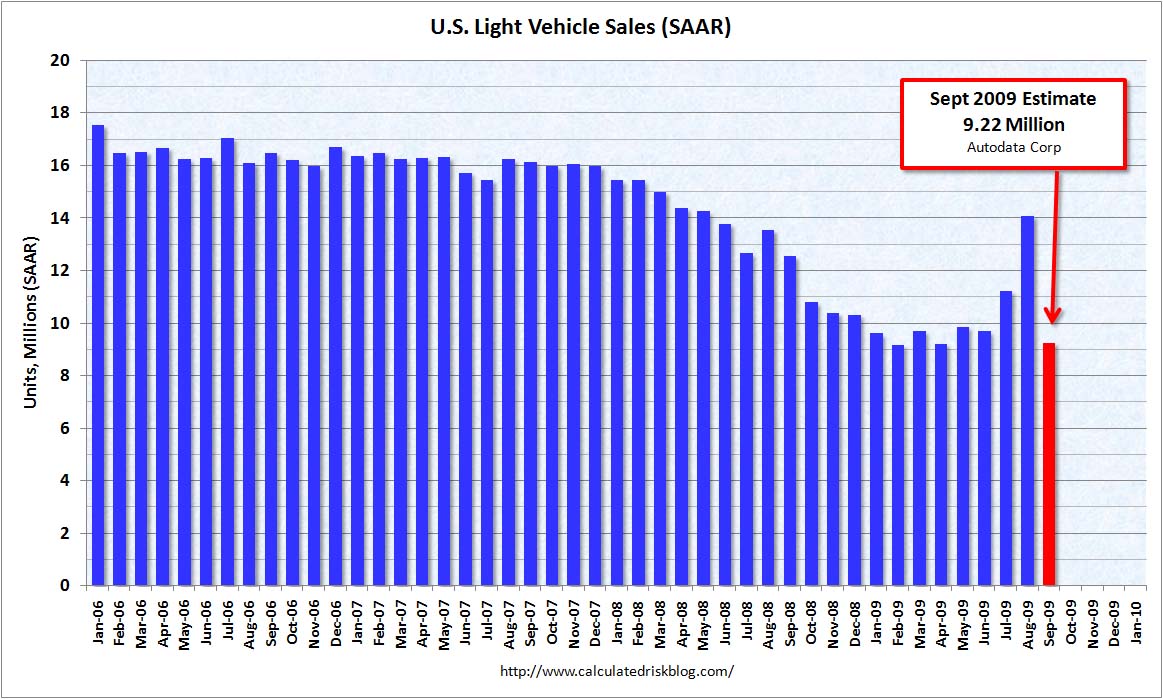

The transportation item in the budget above is also high. Spending nearly $600 a month Americans have become more reluctant to buy expensive autos. This number looks to include one car payment and fuel cost for the average family with two cars. Assuming a $300 car payment and $300 in insurance and fuel cost per month, many families are now unable to purchase a new car that averages close to $30,000. That is why the government found it necessary to offer a program like cash for clunkers to get people buying. But that program has run out of steam:

Source: Calculated Risk

It is obvious what occurred above. Sales for autos were front loaded into August and fell off when the cash for clunkers program wore off. We can expect a similar thing to happen for home sales that have benefited from the $8,000 tax credit. What is largely missed in all of this is the actual money Americans have in their wallet. That money comes from working and with unemployment rising, more and more people are having less and less money to spend.

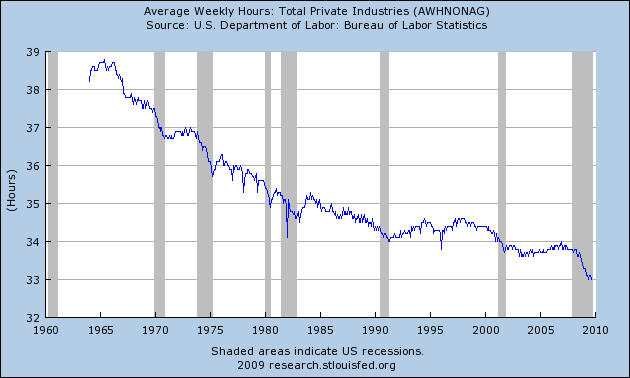

With no job or hours being cut, Americans are all feeling this recession including those who are working:

The above gives a better perspective on the new consumption era. Even those that are working are having shorter work weeks. This is happening from less overtime and also employees who are furloughed. These people are still considered fully employed yet their wages do not reflect a fully employed work schedule.

So when we break down the above budget and see what is happening it is clear that Americans are going to permanently shift their spending habits short of us going back to the bubble peak days. Not by choice this change is occurring, but by economic force. The U.S. Treasury and Federal Reserve are targeting the dollar so we can expect imported good prices to increase in the next few years (short of the dollar becoming strong again). It is a new era for the middle class dream.

http://www.mybudget360.com/the-disappea ... ss-a-year/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-13-2009, 08:56 AM #2

The middle class is dying in America and I believe many in government think this is a good thing because a rich/poor society wiill provide the socialist utopia they long for,it would appear they fear the middle class, America haters around the world cheer at our demise.

Simply America is failing,our society is fragmenting,loss of manufacturing, the belief that a consumer based society will work long term is false and our continuing open border policy is the added nail in the coffin.

I paint a bleak picture but I still believe we can turn it around if done now but remain on this path we will soon reach that point of no return.I'm old with many opinions few solutions.

-

10-13-2009, 01:42 PM #3I think we can turn it around too. But that requires changing the balance of power in Congress and the White House. Current policies will continue to make the problems worse. Health Care reform needs to be killed before it kills us and the economy. If it does pass, then a major issue for 2010 and 2012 is voting in people who will rescind the bill just as the ill-conceived medical reform bill for the elderly was rescinded in 1988. Cap and Trade, Card Check and Illegal Alien Amnesty bills must also be killed. There are sensible solutions for every one of the issues that spawned these bills, but the current crop of politicians in Washington do not want sense and sensibility. They want political power and money. Step One: Throw the rascals out!paint a bleak picture but I still believe we can turn it around if done now but remain on this path we will soon reach that point of no return."We have met the enemy, and they is us." - POGO

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Arizona GOP pushing tough, new border policies, but faces strong...

05-05-2024, 10:24 AM in illegal immigration News Stories & Reports