Results 1 to 3 of 3

Thread: The Strong US Dollar Illusion

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-16-2008, 07:07 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Strong US Dollar Illusion

The Strong US Dollar Illusion

Currencies / US Dollar

Aug 15, 2008 - 11:40 AM

By: Peter_Schiff

Economists who now see American troubles spreading around the world are predicting that foreign central banks will ignore the gathering inflation threat and follow the Fed down the rate cutting path. Similarly, they argue that since the downturn began here, the U.S. recovery will likely be underway while the rest of world is still decelerating. These assumptions have prompted a rally in the dollar, a sell-off in gold, commodities and foreign stocks, and have cast doubts on the ability of foreign economies to ‚Äúdecouple‚ÄJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-16-2008, 07:17 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Economic Decoupling Fails as World Follows US into Recession

Economic Decoupling Fails as World Follows US into Recession

Economics / Global Economy

Aug 16, 2008 - 09:11 AM

By: John_Mauldin

A Mid-Year Correction

Whatever Happened to Decoupling?

The UK Starts to Slow

A Recession by Any Other Name

What's a Central Banker to Do?

The old mantra was that if the United States sneezed, the rest of the world would catch a cold, as the US was seen as the main driver of world growth. That was then. Economists and analysts began to argue that China and the developing markets were starting to provide a consumer base for the world. And Europe's new and growing markets would be able to stave off problems from abroad and stay on their own growth path. The world, we were assured last year, would not suffer from problems in the US economy.

Today, we look at evidence that this might not quite be the case. And if it is not, those who look for diversification in global markets may be disappointed. Also, I quickly look back at my January forecasts and feel it may be time for a mid-course correction. It seems I may have been a little too optimistic. It should make for an interesting letter.

But first, a quick commercial. I spent two days at the Caves Valley Golf Club outside of Baltimore with good friend and business partner Steve Blumenthal, the president of CGM. He has developed a platform of money managers who can take direct accounts, and I recommend that readers interested in outside money management take a look at them. Normally, to take a look at the managers, we have you sign up to get a "pass" to take a peek behind the curtain. We decided we would change that policy, at least for this week. If you would like to look at a manager I think quite highly of, you can click on this link to see a few details about him. http://www.cmgfunds.net (Remember, past performance is not indicative of future results.) If you would like to talk with Steve or his team about this manager or the others that are on the platform, simply click on the following link, fill out the form, and they will call you. http://www.cmgfunds.net/ public/mauldin_questionnaire. asp

And as always, if you have a net worth of $1.5 million or more and are interested in hedge funds, commodity funds, and other alternative investments, you can go to www.accreditedinvestor.ws and one of partners from around the world will show you what is available on their platforms. (In this regard, I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.) And now to the letter.

A Mid-Year Correction

I wrote in my January 4 letter the following predictions:

"So let's get to the predictions. I think that we are in a recession for most of the first half of this year, and that we begin a slow recovery in the second half. It will be a Muddle Through Economy for at least another year after that. That would suggest that most companies will come under serious earnings pressure. If history is any indicator, that means we should see a bear market in the first half of this year. How deep will depend on how fast the Fed cuts, but I don't think we are looking at anything close to the bear market of 2000-2001. Still, I wouldn't want to stand in front of a bear market train.

"Consumer spending is going to slow, and it will be slower to rebound, for reasons outlined above. That will also make the recovery in the stock market a little slower. But I expect to become bullish on the market sometime this summer, if not before. I'm looking forward to it."

To be blunt, that optimism now seems misplaced. I think we are likely to stay in recession for perhaps the rest of the year and well into 2009 before we start a very slow recovery. It is not time to get bullish on stocks, as I have been writing for the past few months. Earnings are going to continue to come under pressure, and earnings are what drive the stock market over the long term. We could see total S&P 500 as-reported earnings drop below $50. You do the math. Even with a 20 multiple, that does not yield a pretty picture.

I think we are going to test the recent lows and then watch the market go lower as the market gets disappointed in the earnings from the third quarter, and re-test those lows again. We are in for an extended period of Muddle Through, while we wait for the housing market to find a bottom and the credit crisis to abate. Banks and other institutions have written off about $500 billion. There is at least another $500 billion to go. The amount of capital that is going to need to be raised is astronomical, and it is going to be very dilutive to current shareholders.

I did predict that the euro would top out against the dollar this summer, and that looks to be the case, although the dollar went lower against the euro than I thought it would when I forecast $1.50 about 4-5 years ago.

Whatever Happened to Decoupling?

I was reminded of an article by Desmond Lachman of the American Enterprise Institute (by Leo Kolivakis of www.pensionpulse.blogspsot.com ). Lachman wrote these very prescient words last January in a paper called "The Myth of Decoupling." Quoting:

"Sadly, the 'decoupling' thesis has little support in theory or in practice. Its proponents overlook the fact that during the past five years the U.S. economy grew faster than all the other G-7 economies. During that time, America's economy remained the principal generator of global aggregate demand, accounting for around one-fifth of global imports and 25 percent of global production. This evidence suggests that, as in the past, if the U.S. economy sneezes the rest of the world will catch a cold.

"... A number of the shocks presently affecting the U.S. economy are global in nature, and are already slowing European and Japanese growth. The credit crunch flowing from America's subprime woes is causing a global increase in market interest rate spreads and a global tightening of bank lending standards. This is hardly surprising: almost half of all U.S. asset-backed subprime mortgage securities were distributed abroad.

"... The 'decoupling' optimists are ever hopeful that China's rapid growth, together with the rest of Asia's emerging market economies, will offset any U.S. economic downturn. But they tend to forget that Asia is filled with export-dependent economies: in some countries, exports to the United States alone [emphasis mine] account for more than 10 percent of annual GDP. The "decouplers" also forget how relatively small these Asian economies still are, at least in relation to the G-7 industrialized economies. Even the vaunted Chinese economy is barely 15 percent the size of the U.S. economy."

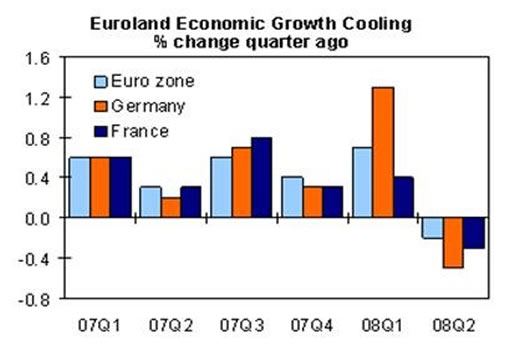

We are now seeing the major economies of the world go into simultaneous recessions and in many of them elevated inflation as well, giving way to stagflation. Let's first take Europe. Today we learned that "GDP growth is easing in a number of European economies as highlighted by national accounts figures out during the week. The flash second quarter GDP data for the euro zone noted a 0.2% q/q contraction, following a 0.7% expansion in the first three months of the year. This was primarily the result of a 0.5% downturn in the region's largest economy, Germany, and a 0.3% contraction in second biggest, France." ( www.economy.com ) The chart below shows the latest data results.

And it's not just Germany and France. "Preliminary data suggest the Italian economy also contracted 0.3% during the quarter, the Netherlands reported no growth, and Spain grew at its slowest pace since the 1993 recession, with a minimal 0.1% expansion. The Spanish government fears recession in the second half of the year and called for emergency discussions on Thursday to deal with the situation. Latvia and Estonia also contracted in the second quarter, with Estonia reporting a technical recession after also shrinking in the first three months of the year. While no flash estimate is available for Ireland, the economy is on the brink of recession."

Inflation in Europe is running at 3.6%. Since the European Central Bank has just one mandate, and that is to provide for a stable currency, it will be difficult for them to ease this year.

The UK Starts to Slow

The Bank of England is forecasting a flat (0%) GDP over the next year. The United Kingdom is probably already in recession, but the problem is that the central bank is going to have difficulty cutting rates, with inflation at 4.4%; and that problem may get worse, as major energy suppliers like British Gas are announcing price increases of as much as 35%. Producer prices in the UK rose by 10.2% in July. The head of the British central bank, Mervyn King, is forecasting an inflation of 5%.

And in Asia? Real GDP declined 0.6% in the second quarter in Japan. Chinese stocks are forecasting trouble, as stocks are down more than 54% this year and 60% since the peak last year. And it is not just China. Stock markets all over Asia are in serious decline, although my friends at GaveKal note that Chinese stocks may be seriously oversold and a buy from here. I think I would wait until we see just how much a prolonged US slowdown will affect Asian economies and exporters. And inflation pressures are evident all over Asia. Producer prices in China are rising more than 10%. Inflation is at 12.4% in India, a 16-year high.

Inflation in the US? Data came in this week that was rather shocking. July CPI rose by 0.8% in July and 5.5% year over year, and core inflation on a three-month basis (less food and energy) rose by 3.4%.

A Recession by Any Other Name

Remember the comfort the bulls took in the fact that GDP when first reported was a positive 0.6% in the fourth quarter of 2007? Now is has been revised to a negative 0.2%. As I have repeatedly said, GDP numbers will be revised downward in this part of the cycle, but maybe a few years after the fact when real data and not estimates are available.

Let's look at this piece from David Rosenberg, the North American Economist for Merrill Lynch. He does a good job of telling us why GDP estimates that suggest the economy is not on recession may not reflect the facts on the ground.

"You'll miss a lot of action waiting for GDP to go negative. More to the point, if you're waiting as an investor for GDP to actually turn negative, you're going to miss a lot of action along the way. I think the best example is to just go back to Japan. They had a real estate bubble that turned bust and they had their own credit contraction back in the early 1990s. Guess what; Japan didn't post its first back-to-back contraction of real GDP until the second half of 1993. By the time the back-to-back negative that people seem to be waiting for happened, the Nikkei had already plunged 50%, the 10-year JGB yield rallied 300 basis points, and the Bank of Japan had cut the overnight rate 500 basis points, which said a thing or two about the efficacy of using the traditional monetary policy response of cutting interest rates into a credit contraction (as we're now finding out here in the US)."

Dating the recession is a very scientific process:

"The point is we can't make the assumption that we've avoided a recessionary condition in the economy, just because we have so far managed to avoid back-to-back quarters of negative GDP. I'm just telling you as the economist that it is basically irrelevant. The only body that officially makes the call on the broad contours - when the recession started, when it ends, when the expansion starts, when it ends - is the National Bureau of Economic Research, the NBER. It's a very scientific process. It's not a gut check or a judgment call.

"We should actually be welcoming the recession call. When they make the determination - it's very interesting, by the way - when they make the announcement that the recession began, when they actually date it for us, traditionally we're a month away from the recession actually ending. The announcement, in fact, is going to be a rather cathartic event, something we should actually welcome happening, but so far they are still taking their sweet time in making the proclamation.

"Four factors used to determine recession:

1) Employment - "The NBER relies on four different variables. The first is employment. Now I've told you before; employment is down seven months in a row. Does employment go in the GDP? The answer is no. Is it correlated? Yes. Does it help grow the business cycle? Of course.

2) Industrial production - "The next variable is industrial production. Does that go into GDP? The answer is no. Does it help grow the business cycle? The answer is yes. This is a number that comes from the Fed. The GDP comes from the Commerce Department. It's a very important variable.

3) Real personal income net government transfers - "The next variable, the third one, is real personal income excluding government transfers. This metric is now down four months in a row. Does personal income go into GDP? The answer is no; of course, it doesn't. GDP is all about spending. Personal income goes into gross domestic income, which is another chart of the national accounts.

4) Real sales activity - "The fourth variable and the only variable that actually feeds into GDP is real sales activity in manufacturing, retail and wholesale sectors.

"A Recession probably started in January. When I take a look at these four key indicators that define the broad contours of the business cycle, they all peaked and began to roll over sometime between October of last year and February of this year. I am convinced that when the NBER does make the final proclamation, it will tell us that a recession officially began in January. Of course, to any market person, this would make perfect sense, because of when the S&P 500 peaked. It did a double top into October, right when it usually does, before a recession begins.

"This recession won't end before mid-2009, in our view. Now I'm just giving you the rearview mirror. What's most important to you folks is let's look through the front window and see when this recession is going to end. The tea leaves that I'm reading at this point in time show that this recession is not ending any time before the mid part of 2009, which would mean that, if you're looking for, not the Mary Ann Bartels intermediate bottoms, but the fundamental bottom, I don't think you can expect to see it before February or March of next year, if I'm correct on when this recession ends. Historically the S&P 500 troughs four months before the economy actually hits its bottom point."

I agree with Rosenberg. And if we see a recession lasting into 2009, then earnings are going to be under a lot of pressure. Buying index funds today could be very risky to your portfolio.

What's a Central Banker to Do?

Central bankers everywhere are faced with a serious dilemma. Do they raise rates to fight inflation, cut rates to stimulate their economies, or sit tight and hope that prices moderate as the world economy slows? Hope is an interesting strategy for a central bank, but it may have come to that.

In short, the world has not decoupled, but is more closely intertwined because of the global financial community. Housing problems and excesses in California (and the rest of the US, the UK, Spain, etc.) affect banks in Europe and Asia and the US simultaneously.

You cannot have a worldwide recovery until the financial crisis in the major lending institutions is dealt with. A functioning banking system is the lubricant for a world economy, and the banking industry is cutting back on loans and tightening the standards by which they do make loans. Look at these survey results from Northern Trust:

In reality, it is not just mortgage lending that is getting tighter. Every survey done on any type of lending worldwide shows bankers are setting tougher standards; and most are simply lending less, partially as a result of shrinking capital ratios. Until lenders have adequate capital to be able to make loans, it will be hard to see anything other than a very tepid recovery sometime next year.

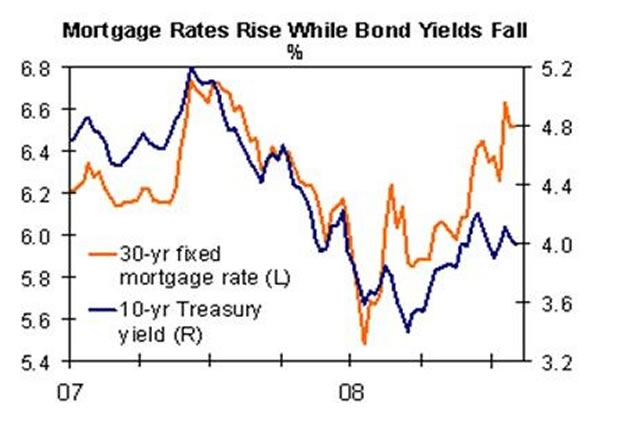

Look at the graph below. The spread of the difference between US 10-year treasuries and a 30-year mortgage is the highest in over 22 years. In May of 2007 it was 1.37%. Today it is 2.53%. The historical average is 1.68%. That means a mortgage costs almost 1% a year more than it would under a normally functioning market. That reflects that lenders are having trouble finding investors who will buy their mortgages, and of course it makes housing less affordable and puts off the day when inventories will again be reasonable.

Bottom line is that there is a long way to go before either the world economy or markets will be seen as functional. I continue to believe the data suggests we are still in a secular bear market and that valuations are not anywhere close to signaling a new bull market. Paying attention to daily market movements to confirm your bias one way or another is pointless. Daily market moves are random noise.

Pay attention to the fundamentals like earnings and valuation. In this type of market, you should be looking for absolute-return types of investing rather than relative-value index funds. And absolutely avoid anything linked to the US consumer or financial stocks unless you have some special knowledge of a specific situation. There are more write-downs and earnings disappointments to come.

John F. Mauldin

johnmauldin@investorsinsight

http://www.marketoracle.co.uk/Article5894.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-16-2008, 07:55 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Bank is powerless to rescue housing, King warns

Bank is powerless to rescue housing, King warns

By Sean O'Grady, Economics Editor

Thursday, 14 August 2008

After six months of falling prices, a rising tide of repossessions and the prospect of millions of families slipping into negative equity, the Governor of the Bank of England, Mervyn King, said yesterday that there was little the authorities could do to prevent a housing crash, if that is what the market demanded.

During a press conference to launch the bank's Inflation Report, Mr King said: "It's hard to judge where prices may go... We are in a period where prices are adjusting to new levels. Buyers and sellers are struggling to find out what that new level is. The market will determine it, not us or the Government. Once we have reached that level then prices should normalise. But that does not mean back to levels seen early last year that were clearly excessive."

His remarks stand in stark contrast to ministers who say they are searching for ways to "rescue" the housing market, most notably through measures such as a "holiday" for stamp duty and an extension of the Bank of England's special liquidity scheme.

Reports yesterday suggested that the Chancellor, Alistair Darling, is considering ordering the Bank to extend the scheme, making it easier for the high-street banks to lend. While the Bank is committed to what might be called a "son of SLS", officials have always made it publicly clear that the SLS was never intended to "kick-start" the mortgage market.

Yesterday, Mr King reiterated that stance, voicing considerable opposition to any move that would in effect result in the state funding the mortgage market. "Funding is not something the central bank can supply ... It would be a very dangerous move to move to a situation where the Government saw its major role as guaranteeing lending," Mr King said.

"Why should the taxpayer take on the risk of borrowing by individual borrowers, some of whom are risky? It's the lenders who should take on the risk. Pretending there's a magic solution is not the answer."

Mr King stressed that it was no longer liquidity in the banking system that was the major issue in mortgage funding and other lending, but the capital adequacy and lending policies of individual institutions.

He said: "The Bank can't provide funding to finance investment. That has to come from mobilising savings in the economy at home or abroad to fund investment: that's what the financial sector is there to do." Mr King's scepticism echoes that in the recent interim review of the mortgage market by the banker Sir James Crosby for the Treasury.

Sir James, a former HBOS chairman, wrote to Mr Darling: "I may yet recommend that the Government should not intervene in the market, on the grounds that such intervention would create more problems than it would solve."

The Bank also painted a gloomy picture for the construction industry as a result of the correction in the housing market and the general slowdown in the economy, predicting that, if housing starts remain at their present depressed level, that could reduce economic growth by between a quarter and a half percentage point.

But the Governor also highlighted the way the credit crunch has left some people relatively unscathed in terms of the cost of borrowing.

"It's the riskier borrowers who are finding it more expensive," he said. "That's where the credit crunch is hitting. It hasn't had an enormous impact on those people who are much safer borrowers. That's what you would expect.

"We are moving from the imprudent period of excessive lending back to a period now of much more cautious lending."

http://www.independent.co.uk/news/busin ... 94703.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Treasonous Congress Funds Billions For Middle East Invasion...

05-02-2024, 01:28 AM in Videos about Illegal Immigration, refugee programs, globalism, & socialism