Results 1 to 4 of 4

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-23-2013, 11:21 PM #1

US targets major drug cartel: Hezbollah

US targets major drug cartel: Hezbollah

April 24, 2013 ⋅ 4:12 am

By Jay Solomon

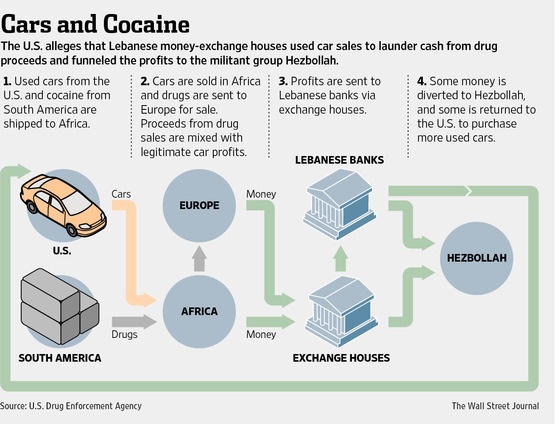

The Obama administration charged Hezbollah with operating like an international drug cartel and blacklisted two Lebanese money-exchange houses for allegedly moving tens of millions of dollars of drug profit through the U.S. financial system on behalf of the militant group.

The Treasury Department’s action Tuesday marked the latest salvo in a two-year U.S. government campaign against Hezbollah’s alleged drug-trafficking activities.

U.S. officials alleged that Hezbollah is using proceeds from this narcotics trade to fund international terrorist activities and to bolster the forces of Syrian President Bashar al-Assad in their fight against a widening political rebellion.

U.S. officials also said Hezbollah is increasingly reverting to illicit trade to offset diminished funding coming from Iran, the organization’s closest ally.

“Hezbollah is operating like a major drug cartel,” said Derek Maltz, a special agent for the Drug Enforcement Administration, who is overseeing the U.S. probe into Hezbollah. “These proceeds are funding violence against Americans.”

Bulgaria’s Interior Ministry concluded that Hezbollah operatives conducted last year’s bombing of a tourism bus at a Black Sea resort that killed five Israeli nationals. The European Union is considering imposing broadsanctions on Hezbollah as a result.

Hezbollah has repeatedly denied any involvement in narcotics trafficking or terrorism. It has accused the U.S. of spreading propaganda to discredit the Lebanese organization.

The Treasury Department in 2011 named the Beirut-based Lebanese Canadian Bank as a major facilitator for a drug-trafficking scheme it said originated in Latin America and West Africa but involved laundering proceeds through the U.S. financial system via the purchases of used cars.

Hezbollah received much of the profit from this illicit business, U.S. officials charged.

In response to the U.S. charges, the Lebanese Canadian Bank was shut by Beirut’s financial regulators. But Treasury and DEA officials said Tuesday that two money-exchange houses replaced the bank in conducting illegal wire payments through the U.S. financial system on behalf of Hezbollah and a Lebanese drug trafficker who U.S. officials allege to be coordinating with the militant group.

The alleged trafficker, Ayman Joumaa, is a joint Lebanese and Colombian national who the U.S. charges with trafficking tens of thousands of kilograms of cocaine from Colombia to Europe, West Africa and Latin America. The U.S. believes he works with both Hezbollah and the Mexican drug cartel, Los Zetas. Attempts to reach him in recent years have been unsuccessful.

U.S. officials are particularly worried about the operations of money exchange houses in Lebanon and the broader Middle East because of their focus on moving bulk cash and the fact they are less regulated than banks.

One of the exchange houses, Kassem Rmeiti & Co. for Exchange, moved nearly $30 million in drug proceeds through the U.S. since 2008, according to Treasury and DEA officials. The company’s owner, Haitham Rmeiti, has also emerged as “a key facilitator for wiring money and transferring Hezbollah funds,” the Treasury and DEA said.

The second exchange, Halawi Exchange Co., meanwhile, was facilitating the shipment of more than $220 million of used cars, which originated in the U.S., into the West African country of Benin last year as part of the same drug-trafficking operation, U.S. officials alleged.

“Following Treasury’s action against the Lebanese Canadian Bank, the Joumaa narcotics network turned to Rmeiti Exchange and Halawi Exchange to handle its money-laundering needs,” said David Cohen, the Treasury Department’s top counter-terrorism official.

Attempts to reach officials at the Halawi and Rmeiti exchange houses Tuesday in Beirut were unsuccessful.

The U.S. Treasury named both exchange houses as “primary money laundering concerns” under the U.S. Patriot Act. This determination could result in both firms being banned from the U.S. financial system, and their dollar-based assets frozen, unless they provide evidence to Treasury over the next 120 days to reverse the decision.

Lebanon’s central bank governor, Riad Salameh, said in an interview Tuesday that Beirut’s financial regulators had independently been scrutinizing the businesses of both exchange houses.

Rmeiti’s case is being handled by Lebanon’s general prosecutor, Mr. Salameh said, while Halawi’s business is being monitored by the central bank’s Special Investigation Commission.

“We are doing, first of all, the oversight on our own initiative because there are rules and laws and regulations that the money-exchange houses need to abide with,” Mr. Salameh said. “We are cooperating and will continue to cooperate in a sincere and firm way with the U.S. Treasury.”

Lebanon has emerged as a key, and complicated, front in the U.S.’s financial war against Iran, Syria and Hezbollah—allies who refer to themselves as being part of a “resistance axis” against the U.S.

Hezbollah have served in recent Lebanese governments and is the most powerful military actor in Lebanon. But the U.S. has also worked closely with Lebanon’s army, police and financial regulators to try to contain Hezbollah’s influence in Beirut and to curtail Iranian and Syrian clout in Lebanon.

U.S. officials have pressed Mr. Salameh in recent years to move aggressively against Hezbollah, but they have also been wary about upsetting Lebanon’s banking system, which has historically been one of the Arab world’s most important.

Mr. Cohen on Tuesday stressed that the Treasury’s action against the exchange houses “wasn’t an indictment of the Lebanese financial system as a whole.”

Still, he stressed that the Treasury had “concerns about the adequacy of the supervision” of Lebanon’s money-change houses.

Mr. Salameh said Lebanon has roughly 400 such exchange houses that conducted $1.5 billion in transactions last year. Lebanon’s central bank governor said his government has increased the capital requirement for these firms in recent years and required new training guidelines for their staff.

“We are always following up on exchange houses,” he said.

Wall Street Journal

http://www.yalibnan.com/2013/04/24/us-targets-major-drug-cartel-hezbollah/NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

04-24-2013, 01:05 AM #2

DEA Investigations Lead to Treasury 311 Patriot Act Designation Against Hizballah-

DEA Investigations Lead to Treasury 311 Patriot Act Designation Against Hizballah-Backed Financial Institutions

April 23, 2013

WASHINGTON (RPRN) 04/23/13 — The U.S. Department of the Treasury today named two Lebanese exchange houses, Kassem Rmeiti & Co. For Exchange (Rmeiti Exchange) and Halawi Exchange Co. (Halawi Exchange), as foreign financial institutions of primary money laundering concern under Section 311 of the USA PATRIOT Act (Section 311) – the first time the Department has used Section 311 against a non-bank financial institution. Today’s action reflects the Treasury Department’s continuing commitment to target illicit financial networks that launder millions of dollars in funds for narcotics traffickers and that, in the process, provide substantial financial benefits to the terrorist organization Hizballah. This action will protect the U.S. financial system from these activities and expose entities supporting the network of designated drug kingpin Ayman Joumaa.

“Following Treasury’s action against the Lebanese Canadian Bank, the Joumaa narcotics network turned to Rmeiti Exchange and Halawi Exchange to handle its money laundering needs,” said Under Secretary for Terrorism and Financial Intelligence David S. Cohen. “As our actions against the Lebanese Canadian Bank, Joumaa and the two exchange houses today make clear, the Treasury Department, working with our partners across the Federal government, will aggressively expose and disrupt sophisticated multi-national money laundering organizations that handle drug proceeds for criminal enterprises including the terrorist group Hizballah.”

“Drugs and terrorism co-exist across the globe in a marriage of mutual convenience," said DEA Special Operations Division Special Agent in-Charge Derek Maltz. "As State-sponsored terrorism has declined, these dangerous organizations have looked far and wide for sources of revenue to recruit, corrupt, train, and strengthen their regime. Many drug trafficking groups have stepped in to fill that revenue void, as have the financial facilitators such as Halawi and Rmeity.”

The Treasury Department’s 311 action against Lebanese Canadian Bank in February 2011, as well as designations in January 2011 of Ayman Joumaa and two exchange houses, Hassan Ayash Exchange and Elissa Exchange, exposed the Joumaa network’s money laundering scheme and forced these financial institutions out of the U.S. and international financial systems.

Rmeiti Exchange and Halawi Exchange subsequently picked up the network’s money laundering work, including the trade-based money laundering schemes involving used car dealerships in the United States and consumer goods from Asia. Rmeiti Exchange and Halawi Exchange used their foreign money transmitter businesses to process millions of dollars on behalf of narcotics traffickers and money launderers, and attempted to obfuscate the source of illicit funds by comingling or splitting transactions across a variety of businesses, financial institutions, and continents, including in the United States.

In conjunction with today’s findings that Rmeiti Exchange and Halawi Exchange are foreign financial institutions of primary money laundering concerns, Treasury’s Financial Crimes Enforcement Network (FinCEN) also issued an order, effective immediately and with a 120-day duration, that requires U.S. financial institutions to report information on any new or attempted transactions by Rmeiti Exchange and Halawi Exchange. Treasury also today issued a notice of proposed rulemaking that, if adopted as a final rule, would continue the reporting requirement imposed by the order and prohibit any U.S. financial institution from opening or maintaining a correspondent or payable-through account that is used to process a transaction that involves Rmeiti Exchange and Halawi Exchange, effectively cutting off these exchanges from the U.S. financial system.

The Treasury Department will continue to work with the Lebanese Central Bank and other relevant Lebanese authorities to address concerns highlighted by today’s action.

These actions would not have been possible without considerable support from the Drug Enforcement Administration, Customs and Border Protection, the Federal Bureau of Investigation, and the New Jersey State Police.

Kassem Rmeiti and Co. For Exchange

Rmeiti Exchange, its ownership, management, and associates facilitate extensive transactions for money launderers and drug traffickers. Between 2008 and March 2011, Rmeiti Exchange and its owner provided at least $25 million in payments to U.S.-based car dealers and exporters associated with the Joumaa narcotics and money laundering network. Some of these car dealers and exporters have been named in a civil money laundering and forfeiture action against the Lebanese Canadian Bank, drug kingpins Ayman Joumaa and Ali Mohamed Kharroubi, and Elissa Exchange and Hassan Ayash Exchange, brought by the U.S. Attorney’s Office for the Southern District of New York.

Rmeiti Exchange and its management have also conducted financial activities for other money laundering and drug trafficking organizations operating in both Europe and Africa. Between March 2011 and October 2012, Rmeiti Exchange facilitated the movement of at least $1.7 million for Beninoise and Lebanese money launderers and drug traffickers. This included Rmeiti Exchange and Kassem Rmeiti taking on large cash deposits, collecting bulk cash currency, issuing cashier’s checks, and facilitating cross-border wire transfers on behalf of known and suspected money launderers, drug traffickers, and Hizballah affiliates.

As of December 2011, we believe that Hizballah had replaced U.S.-designated Elissa Exchange owner Ali Kharroubi with Haitham Rmeiti – the manager/owner of STE Rmeiti – as a key facilitator for wiring money and transferring Hizballah funds. Rmeiti Exchange, through its owner, Kassem Rmeiti, owns STE Rmeiti. Treasury believes that this activity demonstrates Hizballah’s efforts to adapt after U.S. Government disruptive actions, and illustrates the need for continued action against its financial facilitators.

Halawi Exchange Co. (“Halawi Exchange”)

Halawi Exchange represents a substantial threat to the U.S. and international financial systems, given its extensive illicit financial activity on behalf of a variety of international narcotics trafficking and money laundering networks. Halawi Exchange often employs deceptive practices to disguise this illicit financial activity to mislead U.S. and international banking institutions.

Halawi Exchange facilitates transactions for a network of individuals and companies which launder money through the purchase and sale of used cars in the United States for export to West Africa. In support of this network, management, ownership, and key employees of Halawi Exchange coordinate transactions – processed within and outside of Halawi Exchange – on behalf of Benin-based money launderers and their associates. For example, in early 2012, Halawi Exchange, including its management, ownership, and key employees were involved in arranging multiple wire transfers totaling over $4 million on behalf of one such money laundering network. As of mid-2012, central figures in this scheme planned to move $224 million worth of vehicle shipping contracts through this same network via a Halawi-owned Benin-based car lot, which receives vehicle shipments from the United States.

As of late 2012, Benin-based money launderers continued to use Halawi Exchange to wire transfer money to U.S. car suppliers in support of their money laundering operations. The proceeds of car sales were hand-transported in the form of bulk cash U.S. dollars from Cotonou, Benin to Beirut, Lebanon via air travel and deposited directly into one of the Halawi Exchange offices, which allowed bulk cash deposits to be made without requiring documentation of where the money originated. Halawi Exchange, through its network of established international exchange houses, initiated wire transfers from its bank accounts to the United States without using the Lebanese banking system in order to avoid scrutiny associated with Treasury’s designations of Hassan Ayash Exchange, Elissa Exchange, and its Lebanese Canadian Bank Section 311 Action. Money was then wire transferred via Halawi’s banking relationships indirectly to the United States through countries that included China, Singapore, and the UAE, which were perceived to receive less scrutiny by the U.S. Government.

Additionally, Halawi Exchange is known to have laundered profits from drug trafficking and cocaine-related money laundering networks for a leading Hizballah official and narcotics trafficker. Halawi Exchange has also been routinely used by other Hizballah associates as a means to transfer illicit funds.

http://rushprnews.com/2013/04/23/dea-investigations-lead-to-treasury-311-patriot-act-designation-against-hizballah-backed-financial-institutionsNO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

04-24-2013, 09:59 AM #3working4changeGuest

NEED YOUR HELP HERE TO MAKE CALLS PLEASE !

http://www.alipac.us/f8/today-we-ins...4/#post1340465

-

01-10-2020, 01:31 PM #4

Terrorists inbound: Iran conflict & illegal immigration

Share & Discuss this Alert at (ALIPAC HERE) .. (FACEBOOK HERE) .. (TWITTER HERE) .. (GAB HERE)

https://www.alipac.us/f8/terrorists-...ration-376507/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Watch: Paul, Hawley Torch Mayorkas To His Face On Laken Riley's...

04-19-2024, 02:32 PM in illegal immigration News Stories & Reports