Results 1 to 10 of 10

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

12-03-2007, 03:19 AM #1

VICTIMS OF UNINSURED DRIVERS: SUE D.M.V.

This is a real eye-opener!

~~

VICTIMS OF UNINSURED DRIVERS: SUE D.M.V.

PART 1 of 2

By: Devvy

December 3, 2007

© 2007 - NewsWithViews.com

On May 28, 2002, my beautiful daughter, my only child, was rear ended on the freeway in LA. Since she was stopped because of another accident right next to her lane, the police were right there. Brandy was wearing a seat belt and took the entire brunt of the forceful impact. The driver who hit her car turned out to be an uninsured Mexican, who I later found out is an illegal alien. This illegal was attending UCLA on your federal income tax dollars.

My daughter required months of medical attention and on the way to her final appointment for specialized treatment, November 8, 2002, she was rear ended again at a stop sign. This driver is insured, but her mini van striking the car, causes my Brandy to be re-injured.

My daughter, still requiring physical therapy, trying to recover from this battering to her body is again struck on February 21, 2003. This time she is broad sided by an illegal Mexican with no insurance who runs a red light at approximately 40 mph. Thankfully, this uninsured illegal hit the passenger side of the vehicle or she would have killed my daughter. The damage is extensive this time. This illegal driver with no insurance skipped back across the border, leaving behind the carnage of a battered body that is in constant pain. This illegal alien had phony Michigan plates on the mini van and was using a phony Michigan drivers license.

Brandy has uninsured motorist coverage, but our insurance company, realizing they are going to be on the hook for settlement money as provided for in Brandy's policy put us through Hell. Because this illegal alien skipped back across the border, they couldn't interview her so they charged my daughter with the accident and raised her premium! Brandy was backing out of a lot. The street was clear. She could have no way of knowing this mini van would come flying through a red light and hit her, but that didn't matter to our insurance company even though there were witnesses. In the end, Brandy got nothing for all her pain and suffering.

Between the first accident and 2006, it cost my husband and I, $92,000 in cold, hard cash for Brandy's living expenses until she could get back on her feet, the bills from private investigators to track down these illegals, specialized treatment our insurance company would not pay for and lawyers bills. There is no retirement nest egg for my husband and I, but my Brandy is still alive and for that, I thank God everyday. She will suffer the rest of her life with the lingering problems from the accidents, i.e., constant back aches, clinical migraines that knock her out. The illegal alien from UCLA has gone about her business and the illegal alien who skipped back across the border could care less and neither does George Bush, Nancy Pelosi, Hillary Clinton or your state legislature.

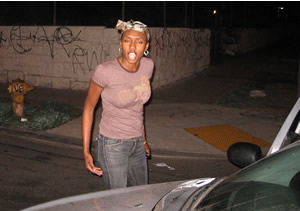

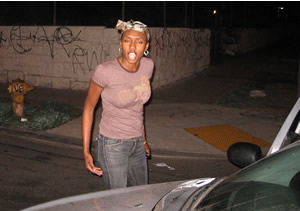

On October 31, 2007, she was hit again by this woman:

This female was driving with no insurance. She ran a stop sign and plowed into Brandy's two month old SUV hybrid. I asked my daughter several months ago to get an SUV for better protection because I was afraid of this happening again and thank God, she took my advice. Another car with four young men were stopped at the other stop sign and saw the whole thing. Also, thankfully, they stayed with my daughter because this uninsured driver actually got on her cell phone and told her "homies" (her words) to get on down and help her "kick my daughter's ass." Yes, she intended to beat up my daughter. These four young men prevented that and bless them for staying the whole time until the police showed up. Fortunately, Brandy had her camera and took pictures, not just of the accident,

but this uninsured driver and her friends keyed Brandy's vehicle! They took car keys and destroyed the driver's side while waiting for the police to arrive.

The police, after three 911 calls, finally showed up an hour later. They cited this uninsured driver with several citations including malicious destruction. The tab to repair Brandy's vehicle was $9,000.00; she just got it back three days ago. My baby girl (I know, she's 32, but she will always be my baby) was re-injured and is back in physical therapy. How can one person be hit by three uninsured motorists in five years? Because in LA you're talking about an astronomical number of drivers with no insurance who simply don't give a damn. God only knows how many of them are illegal aliens since LA is a haven for these criminals who smuggle themselves into our country like thieves in the night.

I did a column about this back in 2003 and received a half dozen emails from libertarians who said it's unconstitutional to force people to pay for car insurance and that everyone should just make nice and take care of the expenses. All 50 states require insurance and until you are the victim, it's easy to say you don't want to pay car insurance and actually believe these uninsured motorists are going to come up with tens of thousands of dollars to repair your vehicle and body. A few states have mentally ill people serving in their state legislatures who have voted to give illegals drivers licenses. Think these illegals have insurance? Think again. These criminals have NO reason to stick around and "make it right" for you and your family and they don't. Let me give you the numbers from my aforementioned column:

"Here in California the numbers are astronomical. Statewide, over one third of drivers lack insurance--about 33 percent, according the California Department of Insurance. The figures skyrocket in low-income and minority city neighborhoods: nearly 50%. In San Jose, California, 55% of all drivers on the road have no insurance. Statewide, the problem is worst in the Los Angeles, Imperial, San Diego and Alameda counties. With the exception of Alameda, the uninsured rates in those counties reaches a whopping 90 percent range. Alameda County's worst neighborhood, Oakland, is 63 percent uninsured. Just to put things in perspective: Statewide, every third car that goes by you - the driver has no insurance. In LA, one of the two cars involved in an accident, one has no insurance."

The time has come to hold the states responsible and since the legislatures have made themselves immune, the next logical place is the DMV. After the third accident in February 2003, I had a face to face meeting with California State Senator Pete Knight at the state capitol; one of the good guys who unfortunately passed away, May 7, 2004. I gave Pete all my research and he told me this: The legislature would do nothing because of the bleeding heart liberals holding power in Sacramento. The Democrats continue to control the legislature in California with a flaming butch dyke liberal controlling their senate. Pete told me the only way he thought change would happen is to sue the California Department of Motor Vehicles. They are mandated by law to make sure no person is issued a driver's license without proof of insurance. If they were hit for a five or ten million dollar pay out in a lawsuit, they would immediately figure out how to verify a person has valid insurance before issuing a license and if the insurance is dropped for non payment, their license is immediately yanked.

Let me tell you the loophole. People buy insurance on the monthly payment plan which I have no problem with except that they sign up, get the certificate, get a four year license and never make another payment until it's time to renew their license. The way the process works now, anyone walks into a DMV with a piece of paper claiming to be valid insurance, the clerk slogs through the process and without verifying the authenticity of these insurance documents, gives the individual a license. No "proof" of insurance, just a piece of paper anyone can create on a home computer and printer. The DMV doesn't bother to verify if the certificate is real or phony and I know for a fact that illegals are using phony insurance documents printed up off home computers to acquire a driver's license. They buy stolen identities off the street corner to get a license and present these phony documents with a phony insurance certificate.

Let me tell you something else: the insurance companies DO NOT CARE or they would have done something about this mess decades ago. All of these insurance companies have powerful lobby groups and they could put the pressure on these state houses big time, but they don't. They just continue to raise our premiums to pay for all these accidents by people who pay nothing. We're all paying through the nose for insurance because others want a free ride and that includes walking away from your accident without it costing them a penny. We would all see lower premiums if everyone were insured. For low income families, the states offer special discount insurance you and I can't apply for, but refuse to get because they don't want to pay even the lowest rates; see my column here.

What needs to be done?

Victims of uninsured drivers need to come together and file class action lawsuits in every state. My daughter will be suing the California DMV soon because we've had enough. The law mandates the DMV makes sure no one is issued a driver's license without valid insurance and since they have failed to do their lawfully required job, they are at fault and must be held accountable. The only time these bureaucracies react is when it costs them money. Fine.

How do you find others in your state who are victims? Do we have one person out there who can volunteer to slap up a simple web site like www.victimsmotorvehiclelawsuit.com and send the link to me? I'll make sure it gets displayed on my web site and in my columns. This simple web site should have fifty states with a page where victims can list their name and contact info. Contact each other and find an attorney to represent you in a class action lawsuit. I feel confident there are good, decent attorneys out there who would represent a group of victims. This is the only way to force this issue and stop this insanity. I doubt the jury is going to be sympathetic to the DMV in my daughter's lawsuit when they see how out of control this mess really is and that they and their loved ones are also at huge risk.

Motor Vehicle Departments in all 50 states need to verify insurance at the time a license is applied for and this can be done with a simple phone call. Individual comes into the DMV with proof of insurance that contains a direct phone number to the insurance company. The clerk at the DMV picks up the phone and dials that number, speaks to a rep at USAA, AAA, Geico or State Farm and gives the person's name, policy number and verifies that this individual is indeed an insured and that the insurance is paid up. I am fully aware of the misery of the lines at DMVs. I lived in California for 40 years. However, what is more important - another five minutes or getting hit like my daughter over and over and over by uninsured drivers?

The insurance companies can also make this information available to the DMVs through a simple data base restricted to use only by the DMV. The clerk at the DMV could then type in the insured's name, policy number and verify on line in one minute whether or not the person at the counter has insurance and that it's paid up, but this won't happen unless they're forced by a law. Additionally, insurance companies should be required by law to immediately pump out a simple document to the state DMV when an insured has missed a payment and is no longer covered. This way the DMV can put it in their data base within 24 hours and stop another uninsured driver from obtaining a license and then going out and maiming or killing another American and simply walking away with a slap on the wrist. Cross verification is a good thing.

This may sound like hard ball to you, but thousands of Americans are being slaughtered or seriously injured and maimed every year on roads and highways by those who refuse to pay for insurance and illegals who have obtained phony documents to get a license. I have cried a million tears over my daughter's accidents. It hurts so bad to see your child hurt so bad. These uninsured drivers get a slap on the hand or skip across the border while you and your loved one try to pick up the pieces or grieve the rest of your life because your loved one is dead and you barely have enough for the funeral and burial. I get quite a bit of mail each year on this one issue from people reading my 2003 column and the stories will break your heart. If you think you and your loved ones won't be victims, you're playing Russian Roulette. Look at those numbers above. Check your state. I'm confident they will be in the double digits.

http://www.newswithviews.com/Devvy/kidd324.htmSupport our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

12-03-2007, 03:34 AM #2

Nevada already has a verification system set up....if you don't have insurance for even 1 day and you get major fines and your Drivers License is put on hold....When I moved from Ca. to NV they said I did not have insurance for 3 days....impossible cause I went from Farmers in Ca to Farmers in NV...The paperwork involved was horrible and they put the burden of guilt on you and YOU have to clear it up...

Good luck in setting this up......(that's why I left Ca......)The difference between an immigrant and an illegal alien is the equivalent of the difference between a burglar and a houseguest. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-03-2007, 09:53 AM #3

On October 31, 2007, she was hit again by this woman:

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-03-2007, 09:55 AM #4

THE CARNAGE OF UNINSURED MOTORISTS

By Devvy Kidd

April 28, 2003

NewsWithViews.com

Imagine being 27 years old, beautiful, gainfully employed making good money, and then one day your whole world gets turned upside down because you live in a state that refuses to enforce the law. You lose your job and life changes dramatically.

On May 28, 2002, the aforementioned young woman was rear ended on the freeway in LA. Since she was stopped because of another accident right next to her lane, this victim took the entire brunt of the forceful impact. The driver who hit her car turned out to be an uninsured Mexican, possibly an illegal, who attends UCLA and continues to drive the streets. Specialized medical treatment for this victim ran $375.00 per hour - up front.

Our victim then receives months of medical attention and on the way to her final appointment of specialized treatment, November 8, 2002, she is rear ended again at a stop sign. This driver is insured, but her mini van striking the car, reinjures the young woman. This driver's insurance company balks at paying any medical to the person their insured rear ended.

Our victim is still getting physical therapy, trying to recover from this battering to her body. On February 21, 2003, she is then broad sided by an illegal Mexican with no insurance who runs a red light. Thankfully, this uninsured illegal hit the passenger side of the vehicle. The damage is extensive this time. This illegal driver with no insurance has skipped back across the border, leaving behind the carnage of a battered body that is in constant pain.

Our victim has uninsured motorist coverage, but the insurance company, realizing they are going to be on the hook for settlement money as provided for in our victim's policy, is not cooperating. The parents of our battered victim then cough up five grand to retain legal counsel to protect her rights regarding settlements for these accidents; none have been settled yet.

How do I know so much about this case? Because the victim is my only child.

Is this an isolated case of an uninsured driver in California? Certainly not. Another case I have verified: Stay at home 29-year old mother of two. Husband works at a decent paying job. Unaware of how out of control the uninsured motorist problem is in California and living like so many today, paycheck to paycheck, they have no uninsured motorist coverage, just the minimum required.

Mother is driving on I-880 in Fremont, CA (SF Bay Area) with the two minor children. Wham! She is hit by an uninsured motorist who loses control of his truck, killing the mother and the daughter. The toddler son goes into a coma; after coming out of it, the brain damage is so severe, he will require specialized care the rest of his life. The father is devastated. He buries his wife and daughter and faces bankruptcy for costs ranging from the funerals to his son's future care. The driver of the vehicle who destroyed this family had no insurance. His justification was he couldn't afford it and feed his family, too. Instead, he's now on trial with a public defender for involuntary manslaughter. More lives destroyed.

Those who oppose mandatory auto insurance

There are many in the âpatriot' movement who are vehemently against mandatory automobile insurance. They maintain it's unconstitutional to force them to pay insurance in exchange for their God-given right to drive the roadways.

I fully understand their sentiments. However, then there is reality.

The 50 states of the Union have state legislatures that make the laws. The citizenry of those states elect representatives to their state house to pass laws that conform to their state constitutions for the benefit of the people. If enough of the citizens stand up to the legislatures and demand repeal or passage of certain laws, change occurs. That's how the process works. It doesn't work perfectly, how well we all know. But, the reason is because most people no longer involve themselves with what these scalawags and scoundrels are doing over at the state house. They just continue to line up like sheep and pay and pay and pay.

If people believe mandatory automobile insurance is unconstitutional, then they have to work to get the law overturned either legislatively or through the courts. It's not easy, but it can and does happen. Part of the problem with getting in an accident is lawsuits and the high cost of medical treatment, but those are arguments for another day.

The reality of the situation regarding automobile insurance, especially if one doesn't carry the uninsured motorist coverage, is without it, you and your family face not only bankruptcy, but there may be no money available to get the needed medical treatment after the accident. My daughter's uninsured motorist coverage contains a clause whereby she has a hefty medical account. Still, some of the treatment had to be paid for in advance and then the insurance company reimburses. How many people have $5,000 or $15,000 sitting around in their checking account to pay for this kind of unexpected emergency medical expense?

What are the odds of you being a victim of an uninsured motorist?

Here in California the numbers are astronomical. Statewide, over one third of drivers lack insurance--about 33 percent, according the California Department of Insurance. The figures skyrocket in low-income and minority city neighborhoods: nearly 50%. In San Jose, California, 55% of all drivers on the road have no insurance. Statewide, the problem is worst in the Los Angeles, Imperial, San Diego and Alameda counties. With the exception of Alameda, the uninsured rates in those counties reaches a whopping 90 percent range. Alameda County's worst neighborhood, Oakland, is 63 percent uninsured.

Just to put things in perspective: Statewide, every third car that goes by you - the driver has no insurance. In LA, one of the two cars involved in an accident, one has no insurance.

Additionally, in the LA basin, you can't even get an accident report by the police unless there's a bloody body or death. That's right. You can call the coppers, but they won't come unless a meat wagon has been called. In the case of my daughter's three accidents, they just told her to exchange information and go on her way; in their eyes she wasn't injured seriously enough to bother. If there is some dispute over responsibility for the accident, you're on your own with only your word against the other driver.

Equal protection under the law

The Fourteenth Amendment to the U.S. Constitution guarantees that everyone receives equal protection under the law. Now, either we all pay insurance or no one should pay insurance.

The California Department of Motor Vehicles is allowing this cancer to grow without taking any steps to enforce the law already on the books.

California actually has special automobile insurance programs for those folks who live on very fixed, low incomes. But, guess how many of those who can quality for reduction even bother to acquire coverage?

Associated Press Nov 30, 2000 by John Howard

Few taking advantage of new low-cost auto insurance program

"Five months after California launched its landmark program to provide auto insurance to low-income drivers, hardly anyone is taking advantage of it.

"The experimental low-cost policy, the first of its type in the nation, first was offered July 1 in Los Angeles and San Francisco counties. The three-year pilot project was approved by the Legislature and Gov. Gray Davis to reduce the number of uninsured drivers.

"But as of Oct. 31, the most recent period for which figures are available, 434 people have obtained the low-cost policies, almost all of them in Los Angeles, according to figures compiled by the state Insurance Department. In San Francisco, 12 people signed up."

This is why those of us who abide by the law are being fleeced in exorbitant rates. Our roadways are filled with illegals driving around and those who refuse to even take advantage of low cost insurance that the rest of us can't get because our incomes are "too high." It's not up to the Governor to reduce the number of uninsured motorists. It is the sole responsibility of the Department of Motor Vehicles to enforce existing laws.

Why the system doesn't work

There is no enforcement of existing laws. California's lawmakers and our Governor coddle and protect illegal aliens coming across the border from Mexico. Our Governor and legislature not only do nothing to stop this invasion, they go to extraordinary lengths to protect illegals. That's a fact.

Illegals running freely in this state purchase social security numbers off the street corners as well as driver's licenses. They drive around with phony documents and then when they cause accidents, they simply skip back across the border and wait for another opportunity to re-enter the U.S. and wreck more lives without fear of being prosecuted.

Illegals using counterfeit documents, and those who willfully choose to break the law, buy insurance using the pay-by-the-month plan to get away with driving without insurance. They buy an insurance policy with the promise to pay the monthly premium. They need this insurance to get a valid driver's license. I have absolutely no problem with this monthly payment plan as long as the individual follows through with their responsibility to maintain the policy.

However, this payment program is exactly how the uninsured drivers are getting away with sticking it to the rest of us: They go buy an insurance policy, make one payment, go to the DMV and get a four year license. Then, they never make another payment on the insurance policy and DMV here in California does nothing to follow up on individuals who no longer pay on their policy.

Back in 1992, the State of California stopped routinely checking drivers for insurance. Because of this lax policy, people simply choose to drive around with no insurance, hoping they won't get caught and can save a few bucks. The consequences of such choices have been described above.

Last August I had a sit down with Sen. Pete Knight over at the California State Legislature. He's one of the really good guys in office. While he agreed he could introduce a bill to close the loop hole in the law, he said it wouldn't get past senators like Sheila Kuehl. You see, here in California, the bleeding heart socialists (Democrats) run the State Legislature. Kuehl is a flaming lesbian who promotes every filthy, deviant behavior in the world. Isn't that just grand?

I spoke with several lawyers before I chose one to represent my daughter. A couple of them used to represent insurance companies as staff counsel. When I brought up the subject of going after the legislature and the DMV, their advice to me was to buy the maximum uninsured motorist policy available. Isn't that just grand? What a solution.

My daughter and I both have insurance through USAA which provides auto and home insurance for retired military officers and their families. I have written to the CEO of USAA asking him to help me file a lawsuit against the California Department of Motor Vehicles for negligence in performance of mandatory duties as stated by the law. The only way to get the DMV to enforce the law is to sue them. All I got back was a letter telling me they're sorry I'm not happy with the treatment of my daughter. However, they don't seem to mind taking $3,000 a year from me in premiums. Very disappointing.

The insurance companies appear to have no real interest in cleaning up this mess. On March 18, 2003, while sitting in a meeting with my daughter and the senior claims analyst at USAA, she stated that USAA would do "little to nothing" to go after the illegals who plowed into Brandy. How reassuring for the criminals who break the law. But, just look at things from the standpoint of the insurance carriers: If everyone buys the maximum coverage for uninsured motorists under their existing policy, the insurance companies make more money!

This reminds me of an incident back in 1998. Someone broke into my car parked in our driveway; it had to have occurred during the night. Thieves punched a hole in the door lock and rummaged through the glove box. The police said the object was to find auto insurance documents, car registration, a checkbook and hopefully, something with a social security number on it. You see, this is a multi-billion dollar a year industry. Fortunately, neither our registration nor our insurance policy (which were stolen) carried our SSNs.

The police also refused to come over and finger print my vehicle (the crime scene). They said they didn't have time. How reassuring for the criminals. Why should they worry about getting caught if they leave fingerprints? The police are too busy to dust for them. Isn't that just grand?

Is it any wonder so many productive individuals are moving out of California? People are sick to death of supporting illegals and being the victims of broken systems that the State refuses to fix. However, the number of illegals and people who refuse to obtain mandatory auto insurance is growing in other states. Texas: Approximately 27% of drivers are uninsured. Florida: 15-25%. Colorado: 32%. Check your state and see what you find and then go out and buy the maximum uninsured motorist policy you can find to protect your family and assets. Your insurance company appreciates the extra business!

Pressure the lawmakers and the insurance carriers

Nothing will change until the people of California get on talk radio and put the pressure on the California State Legislature to close the loop holes in the law and boot out the illegal aliens flooding across our border at will. In the meantime, insurance rates will continue to get higher and higher as the wave of uninsured motorists continues to grow. So will the carnage left behind by these uninsured motorists.

We all see the wrecks along the freeways. Here in California your chances of getting hit by an uninsured driver are better than one in three. In LA, it's one in two. Think the tragedy described earlier can't happen to you and your family while motoring over to Disneyland or the gas station? Think again. Lives are forever changed in a heart beat.

My greatest fear is the thought that the next uninsured driver (legal resident or illegal alien) driving around LA will kill my daughter, while the biggest concern for a California State Senator is how many new laws she can introduce to protect the "rights" of Sodomites.

http://www.newswithviews.com/Devvy/kidd14.htmJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-03-2007, 01:12 PM #5Senior Member

- Join Date

- Mar 2006

- Location

- Santa Clarita Ca

- Posts

- 9,714

To bad this doen't happen to Washingtons' OBL

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-03-2007, 02:29 PM #6

- Join Date

- Jan 1970

- Location

- Farmers Branch, Texas

- Posts

- 385

Glad I left L.A. when I did. I was involved in 3 accidents in 4 years. 2 of them not my fault. The one that was was lightly bumping the back of a car while stuck in stand-still traffic (less than 5mph), then the lady doesn't want the cops or insurance, and then sics a lawyer on her for "massive neck injuries." The worst one involved a multiple accident repeat offender who lived in a mansion in Beverly Hills, who hit me hard enough that her bumper was stuck under the front wheel of my car. Of course, the insurance company said it was equally our fault and no money for car repairs or medical. So frustrating, and lawyers showed up out of nowhere every time it happened. Vultures!

Anyway, this was just discussed in the Dallas Morning News this morning:

http://www.dallasnews.com/sharedcontent ... 68bf0.html

Dallas judge grows frustrated with uninsured drivers

Fines no deterrent, he says; defendants say they can't afford rates

07:39 AM CST on Monday, December 3, 2007

By STEVE THOMPSON / The Dallas Morning News

stevethompson@dallasnews.com

It is 10 a.m. at the Dallas Municipal Courthouse. From his faded wooden dais, Judge Jay Robinson faces yet another defendant accused of driving without insurance.

"You haven't done one hour of community service?" he asks 33-year-old Latonya Polk. She has a batch of violations for speeding and two for driving without insurance.

She asks for more time.

"This is ridiculous," Judge Robinson says, his generally mild-mannered voice rising in irritation. "I have no sympathy for you whatsoever."

The judge denies her request. Ms. Polk turns on her heel, rolls her eyes and takes her seat to wait for the paperwork.

"That judge really did me in," she says afterward.

Each day, dozens of people file into Magistrate Court 10 to take care of a variety of misdemeanor violations â speeding, code violations, public intoxication.

But as many as half of them, Judge Robinson estimates, have one violation in common: They've been caught driving without insurance.

They are among the more than 3 million uninsured motorists in Texas. They arrive one after the other, in T-shirts, in sports jackets, in blouses, in reflective road-worker vests.

So many that Judge Robinson seems exhausted by them all.

"It just does not seem to be a deterrent in many cases to impose a fine only," the judge said recently. "It's frustrating in that so many of them, when I ask them, are still driving without insurance."

The law allows fines from $175 to $350 against those caught driving without insurance. Those low on cash, like Ms. Polk, may perform community service instead.

Such penalties can seem paltry next to what Texas motorists pay to protect against those without coverage â nearly $900 million a year, the insurance industry estimates.

Two years ago, lawmakers authorized a system to crack down on Texans who drive without valid insurance. They're still waiting.

Although a contractor has been selected to operate the new auto insurance verification program, officials said the database needs more work and won't be ready until early 2008 â more than a year after it was supposed to launch.

Many people assume illegal Mexican immigrants, who have difficulty getting insurance, are at the root of the uninsured-motorist problem.

"That is a problem among several, but it is not the predominant problem," said Dallas' chief municipal prosecutor, Johnanna Greiner.

Other reasons

Some can't get it because they've had too many accidents or tickets, Ms. Greiner said. But the most common reason: Many people just can't afford it. The cost for auto liability coverage in Texas averages about $500 per year.

Ms. Polk, with a tear falling down her cheek after court, spoke of how hard it can be as a single mom â raising five kids, holding down a job, paying for gas and groceries, and making an insurance payment on top of everything else.

No money for insurance one month, and what is she supposed to do? Quit driving to work? Not go pick up the kids?

But tell that to someone involved in a crash with a driver who carries no insurance.

"They shouldn't be on the road if they don't have insurance," said 36-year-old Maria Guzman of Dallas, who says she has been hit several times by uninsured drivers. The authorities "should go ahead and have that vehicle towed. I mean, really, that's what makes everybody else's rates go up," she said.

Up the fines

Ms. Guzman, like many, also suggests raising the fines.

But the prosecutor, Ms. Greiner, doubts that would really deter people.

"If these people can't afford insurance right now," Ms. Greiner said, "upping the fines is not going to make it less common."

Last year, the Dallas City Council ordered police to impound uninsured vehicles involved in crashes. Several other area cities have done the same.

At least one council member, Mitchell Rasansky, argued that the ordinance didn't go far enough.

"We're waiting for an accident â smack! â to happen." he said, slapping his hands together at a council meeting. "I'd confiscate the car when they're stopped for a traffic violation."

But more severe penalties come with their own sets of problems.

"Arresting everybody who doesn't have insurance, or impounding their cars, is going to max out the [auto] pounds and the jails very quickly," Ms. Greiner said. "It's very frustrating."

Staff writer Terrence Stutz contributed to this story.

ADDING IT UP

16 million

Number of drivers in Texas

More than 3 million

Number of uninsured drivers in Texas

About 40

Number of people who walk into Judge Jay Robinson's court each day with violations for driving without insurance

$175 to $350

Fine for driving without insurance

$475.95*

Average annual cost of liability insurance in Texas

*In 2005, the most recent year for which numbers are available from the Texas Department of Insurance

GETTING HELP

What should you do if you're hit by an uninsured motorist?

Not much more than you'd do if you are hit by someone with insurance, state insurance officials say.

"You might just be even more diligent about getting good contact information for them. And the police report would be really helpful," said Jerry Hagins, a spokesman for the Texas Department of Insurance. "If you could get more than one form of identification that would probably be a good thing to do, and get it directly from their driver's license if you can, rather than having them tell it to you. I would be a little more careful because you're not going to have those insurance companies that you can contact. You're kind of on your own with a person without any insurance."

For more information about what to do in case you are involved in a car accident, visit http://www.tdi.state.tx.us/pubs/consumer/cb020.html

-

12-03-2007, 03:00 PM #7Senior Member

- Join Date

- Mar 2006

- Posts

- 7,377

I'm tired of hearing 'there's nothing we can do about it'.

This woman has 5 kids - WHERE'S THE FATHER???

The judge is correct, there were already a huge number of uninsured driver's on Texas highways. It was a an issue - but accidents didn't seem to be as prevelant and while it costs everyone - it is nothing like what has happened to insurance since the illegals.

I realize the judge doesn't want to say it, but illegals don't just 'have problems getting insurance' - most of them simply don't get insurance.

They have accidents. They have accidents at alarming rates.

What do you do with someone who has 5 kids - find that father - or fathers - make them support those children - and impound that car, let her find alternative transportation - bus, car pool, walk, bicycle, whatever.

We cannot afford to continue to care for everyone in this country and the world that simply 'want a better life'.

Insurance is high, we used to just write a check when our insurance came due for the full amount - now we pay it out, making payments every 2 months.

Is anyone crying for us?Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-03-2007, 04:10 PM #8

- Join Date

- Jan 1970

- Location

- Farmers Branch, Texas

- Posts

- 385

Trixie,

I thought the same thing! A single mom with 5 kids who can't afford car insurance? Who put THEMSELVES into this situation? Where was your birth control? Can't the father(s) help out some? If not, sic the court after them for child support!!!

This is why I'm sooo for giving out free birth control to lower-income, low-educated communities, because these women keep having child after child, when they can't afford them (and I'm not only stating this for the children of illegals, this goes towards a bunch of American's, too).

As the film "Idocracy" stated, most of the intelligent, responsible people think for a long time before having kids, and then only have one or two. While the uneducated, poor people have kids like rabbits. The film addressed a world where, 500 years in the future, the dumb people had so many kids that there were no intelligent people left (they'd been wiped out of the gene pool entirely). Very eye-opening movie, and why I want to have 3 kids, to get more smart legal Americans into the gene pool!

TexasGal

-

12-03-2007, 11:56 PM #9

Start by confisticating their cars. No insurance? Sorry, you just lost your car!

Harsh? Maybe so, but it might be a more effective incentive to make sure they have insurance if they risk losing a car.Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

"

-

12-04-2007, 12:32 AM #10

- Join Date

- Jan 1970

- Location

- The occupied territory of LA

- Posts

- 521

What in the world is a young women doing driving in that neighborhood alone after dark? Not to blame the victim but it's time this young woman used better judgment and stop going into those neighborhoods. She's luck that even worse things didn't happen to her... South central LA is dangerous after dark....

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

72 Hours Till Deadline: Durbin moves on Amnesty

04-28-2024, 02:18 PM in illegal immigration Announcements